Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Demand for Convenient Snacks

Convenience is a central driver of the Australia Biscuit Market’s growth. As busy lifestyles become the norm, Australians are increasingly seeking snacks that are quick, easy to consume, and portable. Biscuits are a perfect match for this need because they are ready-to-eat, require no preparation, and can be consumed on the go, whether during a busy workday, while commuting, or as a quick snack for children after school. In particular, the rise of single-serve packaging options has further driven biscuit consumption. These convenient pack sizes make biscuits an ideal snack to carry in a bag or lunchbox, catering to the needs of people with fast-paced lifestyles.Additionally, the growing popularity of e-commerce platforms has made biscuits even more accessible, allowing consumers to easily purchase their preferred brands online and have them delivered to their doorsteps, enhancing convenience. The preference for on-the-go snacks has extended beyond traditional biscuits, as consumers are increasingly demanding functional and healthier biscuit options that still meet their need for convenience. As a result, biscuit companies are innovating to create products that cater to various consumer preferences, including low-sugar, gluten-free, and protein-enriched biscuits. This trend highlights how convenience, paired with health-conscious demands, is shaping the Australia Biscuit Market.

Key Market Challenges

Rising Health Consciousness and Dietary Preferences

One of the major challenges faced by the Australia Biscuit Market is the increasing health consciousness among consumers. As Australians become more aware of the nutritional impact of their food choices, many are opting for healthier snack alternatives, which directly affects the demand for traditional biscuits that are often high in sugar, fat, and refined carbohydrates. Consumers are increasingly prioritizing products that align with specific dietary needs, such as low-sugar, low-fat, gluten-free, and high-protein options. The growing trend towards healthy eating has prompted many consumers to move away from traditional indulgent snacks, which could reduce the market for regular biscuits.As a result, biscuit manufacturers face pressure to reformulate their products to meet these new demands. Reformulating products to reduce sugar, fat, or gluten while still maintaining taste and texture presents a significant challenge. Moreover, creating healthier alternatives can be costly, as it often requires the use of specialized ingredients and innovation in product development. Furthermore, the rise of niche dietary trends, such as keto, paleo, veganism, and plant-based diets, has forced biscuit companies to adapt quickly. These specific diets require highly specialized products, and meeting the needs of each dietary group while ensuring product quality and taste can be a daunting task. Failure to adapt to these trends may result in losing market share to more innovative competitors offering healthier, diet-friendly biscuits.

Key Market Trends

Health-Conscious and Functional Biscuits

A significant trend in the Australia Biscuit Market is the growing demand for healthier, functional biscuits. With more Australians becoming aware of the health impacts of their food choices, there is a marked shift toward biscuits made with nutritious ingredients. Health-conscious consumers are increasingly seeking biscuits that offer more than just taste; they want snacks that align with their wellness goals. This trend is driven by a variety of factors, including rising concerns about obesity, diabetes, and other lifestyle-related health issues.In response, many biscuit manufacturers are reformulating their products to offer healthier options, such as biscuits that are lower in sugar, contain whole grains, or are made from plant-based ingredients. Gluten-free and dairy-free biscuits are becoming more popular as consumers with specific dietary restrictions seek alternatives that align with their needs.

Additionally, there is a growing interest in functional biscuits enriched with ingredients like protein, fiber, vitamins, or antioxidants, which provide extra health benefits beyond basic nutrition. The popularity of alternative diets like keto, paleo, and veganism also plays into this trend, prompting manufacturers to introduce new biscuits that cater to these specific dietary needs. For example, biscuits made with almond flour for keto diets or vegan-friendly biscuits made without animal-based ingredients are gaining traction. The desire for clean-label products, where ingredients are simple, recognizable, and free from artificial additives, also contributes to the rising demand for healthier biscuits.

Key Market Players

- Arnott’s Biscuits Holdings Pty Limited

- Green's Foods Holdings Pty Limited

- Unibic Australia Pty Ltd

- Waterwheel Premium Foods Pty Limited (Waterthins)

- Byron Bay Cookie Company

- Mondelez International

- Ausbic Pty Ltd

- Kez Kitchen

- Kin rise Pty Ltd

- Emmaline's Country Kitchen

Report Scope:

In this report, the Australia Biscuit Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Australia Biscuit Market, By Type:

- Crackers & Savory Biscuits

- Sweet Biscuits

- Wafers

- Functional/Energetic Biscuits

- Others

Australia Biscuit Market, By Packaging:

- Pouches/Packets

- Boxes

- Cans/Jars

- Others

Australia Biscuit Market, By Sales Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online

- Others

Australia Biscuit Market, By Region:

- New South Wales

- Victoria

- Queensland

- South Australia

- Western Australia

- Tasmania

- Northern Territory

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Australia Biscuit Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Arnott’s Biscuits Holdings Pty Limited

- Green's Foods Holdings Pty Limited

- Unibic Australia Pty Ltd

- Waterwheel Premium Foods Pty Limited (Waterthins)

- Byron Bay Cookie Company

- Mondelez International

- Ausbic Pty Ltd

- Kez Kitchen

- Kin rise Pty Ltd

- Emmaline's Country Kitchen

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | March 2025 |

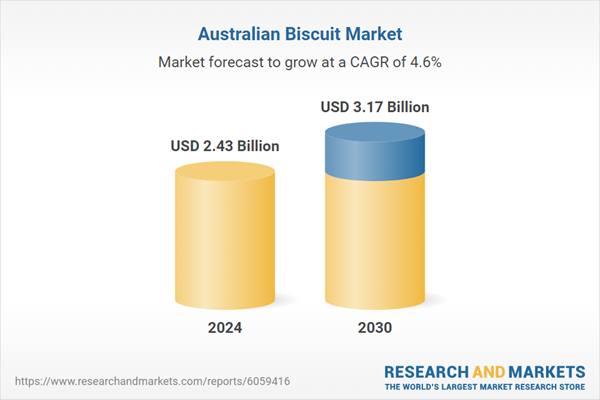

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.43 Billion |

| Forecasted Market Value ( USD | $ 3.17 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 10 |