Butter provides essential nutrients such as vitamins A, D, E, and K2, and healthy fats crucial for brain function, energy metabolism, and satiety, thus these benefits have increased the Australia butter market growth. It enhances culinary offerings with rich flavour and texture, delivers antioxidants for cell protection, and contributes to hormone production and skin health.

The butter market consists of various distribution channels including supermarkets and hypermarkets, convenience stores, online, and others. Online platforms offer consumers convenient access to a wide variety of butter products from different brands without the need to visit physical stores. This convenience appeals to busy consumers who prefer shopping from home or on the go. Supermarkets and hypermarkets leverage seasonal and promotional campaigns to boost butter sales in Australia. Special promotions during holidays, cooking events, or local food festivals drive consumer interest and increase sales volume, adding to the overall Australia butter market revenue.

According to USDA FAS, the milk production in 2022 was estimated to be 8.55 million metric tons. Further, the Australia butter market developments are guided by rising innovations in flavoured butter, such as garlic, herb-infused, or gourmet varieties, further catering to culinary enthusiasts seeking enhanced flavours for cooking and spreading. Moreover, consumers are increasingly drawn to butter brands that prioritise sustainable farming practices, animal welfare, and ethical sourcing. Brands that support fair trade principles or use environmentally friendly packaging resonate with eco-conscious consumers, leading to an increase in Australia butter demand growth.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Cultured Butter

- Whipped Butter

- Salted Butter

- Uncultured Butter

- Others

Market Breakup by Nature

- Organic

- Conventional

Market Breakup by Form

- Spreadable

- Non-Spreadable

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Butter Market Share

Organic butter holds a major share of the Australia butter market due to consumer preferences for health, sustainability, animal welfare, quality, certification assurance, packaging practices, market accessibility, regulatory support, educational campaigns, and lifestyle choices.Leading Companies in the Australia Butter Market

The growth of the butter market is fueled by trends towards health and wellness, flavoured and speciality products, dairy-free alternatives, sustainability, convenience, online retail growth, innovative packaging, functional ingredients, transparency, and culinary preferences.- Richmond Dairies Pty Ltd.

- Arla Foods amba (Lupak)

- Saputo Dairy Australia Pty Ltd.

- Ballantyne

- Fonterra Brands (Australia) Pty Ltd.

- Bega Cheese Limited

- Crumble Pty Ltd. (Pepe Saya)

- Others

Table of Contents

Companies Mentioned

- Richmond Dairies Pty Ltd.

- Arla Foods amba (Lupak)

- Saputo Dairy Australia Pty Ltd.

- Ballantyne

- Fonterra Brands (Australia) Pty Ltd.

- Bega Cheese Limited

- Crumble Pty Ltd. (Pepe Saya)

Table Information

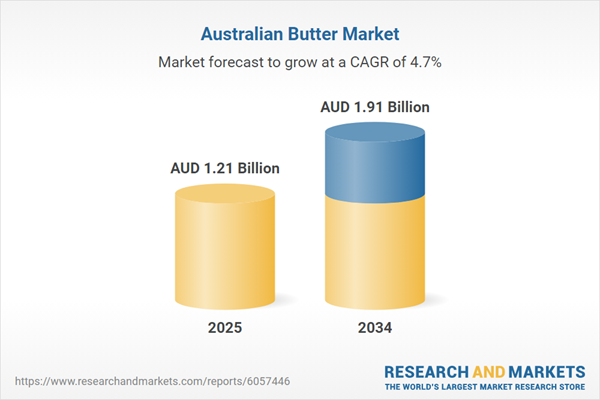

| Report Attribute | Details |

|---|---|

| No. of Pages | 108 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 1.21 Billion |

| Forecasted Market Value ( AUD | $ 1.91 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 7 |