Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The rise of eco-conscious living, minimalist aesthetics, and smart technology integration - such as lighting or motion-enabled features - is influencing purchasing preferences. Additionally, space-efficient and customized furniture offerings are resonating with urban buyers, reflecting a desire for both functionality and style in compact living environments. This confluence of trends positions the luxury segment as a resilient and adaptive sector within Australia’s broader furniture market.

Key Market Drivers

Rising Affluence and Shifting Consumer Demographics

The Australia luxury furniture market is benefitting from a growing population of affluent consumers and evolving spending behaviors. Major urban centers like Sydney and Melbourne continue to lead luxury consumption, but regional cities including Brisbane, Perth, and Adelaide are seeing increased activity driven by high-net-worth individuals and affluent migrants. Younger consumers, motivated by digital influence and social media, are contributing to the growth of premium furniture sales, even in the face of economic uncertainty. The pandemic also gave rise to the "YOLO boom," where Australians redirected unspent travel budgets toward high-end domestic purchases, including luxury home furnishings. This shift revealed a broader and more diverse customer base for luxury products, underscoring the category’s resilience and continued appeal across age groups and income brackets.Key Market Challenges

Economic Pressures and Shifting Consumer Spending

The luxury furniture segment in Australia faces mounting pressure from economic volatility, including elevated interest rates and cost-of-living increases. These factors have led many consumers to reduce discretionary spending, impacting overall furniture sales. Companies like Nick Scali and Myer have reported declines in revenue and profits, attributing the downturn to higher logistics expenses and reduced consumer demand. The premium pricing associated with luxury furniture - due to superior materials and craftsmanship - can be a deterrent for middle-income buyers during economic slowdowns. Consequently, brands must navigate the balance between maintaining exclusivity and offering accessible options to attract a broader consumer base without diluting brand prestige.Key Market Trends

Customization and Personalization

Personalized and customizable luxury furniture has emerged as a prominent trend, reflecting consumers' desire for products tailored to their individual tastes and needs. Buyers increasingly seek options that allow them to select specific colors, materials, finishes, and modular configurations to suit their unique living spaces. This customization trend spans both high-end mass-market lines and exclusive artisanal pieces, offering versatility across pricing tiers. Furniture brands are responding with modular collections, bespoke design services, and digital tools that enhance customer engagement and reinforce brand loyalty. This approach not only aligns with evolving consumer expectations but also positions brands to deliver more meaningful, long-term value.Key Market Players

- IKEA Pty Limited

- Harvey Norman Holdings Limited

- Living Edge (Aust) Pty Ltd

- Nick Scali Limited

- Greenlit Brands Pty Limited

- Freedom Furniture Australia Pty Limited

- Amart Furniture Pty Limited

- King Furniture Australia Pty Ltd

- Saveba Pty Ltd trading (Coco Republic)

- Kogan Australia Pty Ltd

Report Scope:

In this report, the Australia Luxury Furniture Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Australia Luxury Furniture Market, By End User:

- Residential

- Commercial

- Australia Luxury Furniture Market, By Material Type

- Wood

- Plastic

- Metal

- Others

Australia Luxury Furniture Market, By Sales Channel:

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

Australia Luxury Furniture Market, By Region:

- Australia Capital Territory & New South Wales

- Northern Territory & Southern Australia

- Western Australia

- Queensland

- Victoria & Tasmania

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Australia Luxury Furniture Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- IKEA Pty Limited

- Harvey Norman Holdings Limited

- Living Edge (Aust) Pty Ltd

- Nick Scali Limited

- Greenlit Brands Pty Limited

- Freedom Furniture Australia Pty Limited

- Amart Furniture Pty Limited

- King Furniture Australia Pty Ltd

- Saveba Pty Ltd trading (Coco Republic)

- Kogan Australia Pty Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | June 2025 |

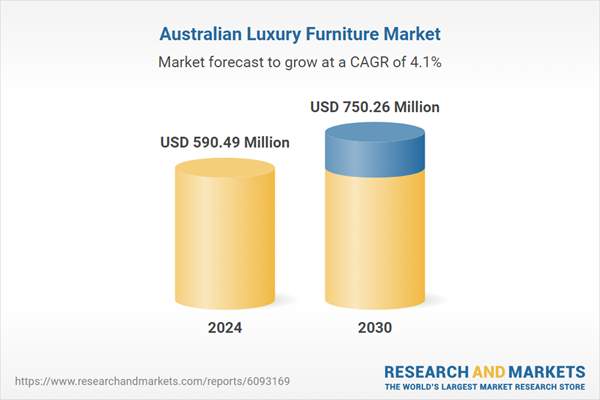

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 590.49 Million |

| Forecasted Market Value ( USD | $ 750.26 Million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 10 |