Key Highlights

- Owing to its numerous advantages, such as stability, rigidity, and high barrier qualities, metal cans are frequently used to store and transport commodities across great distances. Metal cans constructed of steel and aluminum are the most popular in Australia. These qualities, such as softer and lighter, enable the makers to reduce logistics-related expenses.

- Many regular consumers of canned foods choose the products due to the convenience offered and lower cost of the products. Canned foods are more convenient to consume and require less energy and time to cook. Most canned foods take 40% less time to prepare than regular meals. Due to the ease and reduced price of canned goods, many regular customers opt to buy them. Foods in cans are easier to prepare and cook, using less energy and time.

- Canned food products such as vegetables and fruits undergo a process that increases their shelf life. These cans of food can be stored for months or years and are readily available throughout the year, across all seasons, which makes them a continent option for people. In Australia, cans are made of tin-coated steel. Canned fruits and vegetables are as nutritious and healthy as fresh and frozen. The number of minerals, fat-soluble vitamins, protein, fat, and carbohydrate remains relatively unchanged by the canning process.

- The increasing demand for sustainability and the worldwide ban on single-use plastic is expected to propel the demand for sustainable packaging, such as Metal cans. Australia has a significant global standing in the metal mining industry and is also the 2nd largest exporter of Cans (HSN Code 020443 & 020443) worldwide. This is evident from the fact that Australia is rich in natural resources, and iron ore is no exception. For instance, according to the World Bureau of Metal Statistics, Australia produced 922 million metric tons of iron ore in 2021. The increased iron ore production in Australia compared to the previous year indicates the rising demand for metal packaging.

- However, the availability of alternative packaging solutions, such as glass, provides tough competition to metal packaging in the same segment. The other alternate packaging solutions include plastic and paper.

- In an attempt to combat the COVID-19 outbreak, the packaging material choices were affected significantly. Packaging designs and materials that address hygiene and consumer safety concerns and minimize the possibility of the survival of the virus on the packaging material are expected to be certain factors when deciding on the packaging material. Hence, the adoption of metal packaging is anticipated to be on the rise, owing to its chemical properties. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

Australia Metal Packaging Market Trends

Aluminum is Expected to Hold a Significant Share

- Cans made of aluminum are gaining significant growth in the food and beverage industry as the demand for canned food is growing. Also, canned food has a natural shelf life of up to three years with no need for chemical additives for preservation. The canning process locks in flavor and nutrients. Canned food's vitamin content has often been proven equal to that of fresh. This allows the producers to produce canned foods to serve non-seasonal food to their customers.

- Also, growing environmental concerns in the region have increased awareness about the type of packaging materials utilized. High energy consumption of packaging manufacturing is one of the factors pushing recycling. Diminishing natural reserves, global warming, and the impact of plastics on the environment are key trends influencing consumer demand.

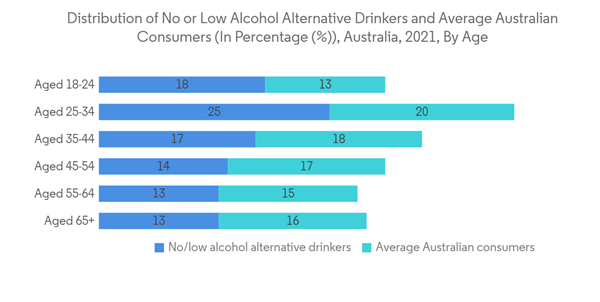

- Additionally, the growing demand for standard cocktails and mocktails and the willingness to spend on alcoholic beverages among Australian consumers are expected to support the market's growth. Also, Australian drinkers are expected to pay less for no- or low-alcohol alternatives than standard serves across all drink categories. This will promote growth for metal caps and closure in the projected time frame.

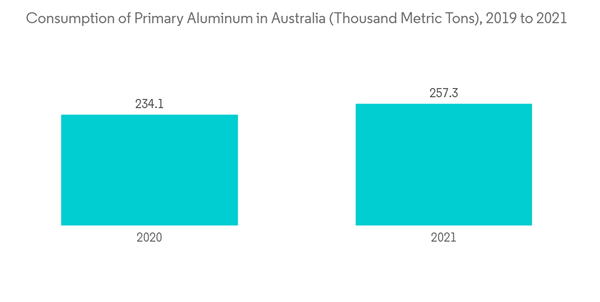

- Growing sustainability and environmental concerns and the ban on single-use plastics commenced in 2022. Banning plastic straws, stirrers, cutlery, plates, and bowls has boosted the demand for metal and paper packaging. This is evident from the growing consumption of primary aluminum in Australia. Also, the immediate aluminum consumption reached 257.3 thousand metric tons in 2021, a significant increase from 179.5 thousand metric tons in 2019, according to the World Bureau of Metal Statistics.

Increasing Demand for Metal Packaging by the End-User Vertical

- From production to transport and storage, metal packaging offers greater protection, value, and performance throughout the supply chain. Australia's expanding distribution network for canned food items is expected to contribute to market growth. Dedicated niche online and offline shops for specialty food products are helping to build a significant demand for canned produce. The longevity of canned fruits and vegetables is an important factor supporting the canned vegetable market.

- Cans made of aluminum are gaining substantial growth in the food and beverage industry as the demand for canned food is growing. Also, canned food has a natural shelf life of up to three years with no need for chemical additives for preservation. The canning process locks in flavor and nutrients. Canned food's vitamin content has often been proven equal to that of fresh. This allows the producers to produce canned foods to serve non-seasonal food to their customers.

- Also, growing environmental concerns in the region have increased awareness about the type of packaging materials utilized. High energy consumption of packaging manufacturing is one of the factors pushing recycling. Diminishing natural reserves, global warming, and the impact of plastics on the environment are key trends influencing consumer demand.

- Additionally, the growing demand for standard cocktails and mocktails and the willingness to spend on alcoholic beverages among Australian consumers are expected to support the market's growth. Also, Australian drinkers are expected to pay less for no- or low-alcohol alternatives than standard serves across all drink categories. This will promote growth for metal caps and closure in the projected time frame.

- Growing sustainability and environmental concerns and the ban on single-use plastics commenced in 2022. Banning plastic straws, stirrers, cutlery, plates, and bowls has boosted the demand for metal and paper packaging. This is evident from the growing consumption of primary aluminum in Australia. Also, the immediate aluminum consumption reached 257.3 thousand metric tons in 2021, a significant increase from 179.5 thousand metric tons in 2019, according to the World Bureau of Metal Statistics.

- Demand from the food and beverage market has fueled the packaging industry's expansion. The need for canned food and beverages is driven by a need for more time and smaller family sizes, which forces the metal packaging market forward. Advances in packaging technology have also aided in the development of metal cans with increased functional and storage qualities, which has fueled market expansion in the beverages end-use sector.

- Metal can finds its uses in both alcoholic and non-alcoholic beverages. However, the market's growth is expected to be hindered by factors such as environment-related issues pertaining to steel mining, increased material cost, and a shortage of skilled workers.

- Additionally, according to CGA, in 2021, about 43 % of no/low alcohol alternative drinkers in Australia were between 18 and 34. In comparison, the 18-34-year-old average Australian consumers accounted for 36 % of surveyed adults in Australia. This is anticipated to boost the market for metal packaging in the forecast timeframe.

Australia Metal Packaging Market Competitor Analysis

The AustraliaMetal Packaging Market competitive landscape is consolidated, with selected packaging vendors having manufacturing facilities in the country. Moreover, the competition among vendors is high due to the investments and innovations made by the companies. Companies are also undergoing acquisitions or joint ventures to strengthen their product portfolios and increase their market shares. Some of the prominent vendors include Crown Holdings Inc., Perennial Packaging Group Pty Ltd., Glory Tins Australia Pty. Ltd., NCI Packaging, Jamestrong Packaging, Vic Cans Australia, and Irwin Packaging Pty Ltd., among others.In December 2022, Coca-Cola Europacific Partners (CCEP), with a new line at the production site in Moorabbin, will scale its local can production significantly and increase the flexibility around the packaging configurations it delivers to customers across Victoria, Tasmania, and South Australia. CCEP fills and pack cans into a range of pack formations, multipacks, cluster packs and slabs, across 37 different beverage varieties, including Coca-Cola No Sugar, Sprite, Mount Franklin Lightly Sparkling, Canadian Club & Dry, Monster, and Mother Energy. Equipments were provided by KHS Australia, a beverage packaging specialist. Processing capacity of the KHS Innofill Can DVD line is 1200 cans per minute for 500ml, 1500 cans per minute for 375ml and 1700 cans per minute for slimline 250ml cans. The line can handle a variety of formats and sizes, from mini 250ml cans to 375ml and 500ml packs. Cans are supplied by Orora Beverage.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Crown Holdings Inc.

- Perennial Packaging Group Pty Ltd

- Glory Tins Australia Pty

- NCI Packaging

- Jamestrong Packaging

- Vic Cans Australia

- Irwin Packaging Pty Ltd

- Pact Group

- Ekam Global

- Orora Packaging Australia Pty Ltd