The Australia ready meals market comprises various products such as chilled pizza, canned preserved ready meals, dried ready meals, frozen pizza etc. The Australia ready meals market growth can be justified by the increase in the working population in the country along with the other benefits that these pre-prepared meals provide such as their easy-go nature.

The Australia ready meals market is enhanced by the increase in customisation benefits, convenient alternatives, health benefits and technological advancements.

Convenient Alternatives

The Australia ready meals market development is being guided by the increase in the working population leading to home-cooked meals being substituted by ready meals to save time.Health Benefits

Ready meals are rich in nutrients and are available in various options such as gluten-free, diabetes-free, vegetarian, dairy-free, etc.Customization Benefits

Ready meals offer ample customisation benefits thus helping individuals to customise what they would like to eat while excluding other ingredients from the meal.Technological Advancements

To make environment-friendly plastic packaging for packing ready meals, the company Dineamic adopted eco-cardboard packaging instead of plastic packaging.January 2024: To expand its ready meal portfolio and helping catering to broader consumers, the Australian plant-based meat maker v2food has acquired two ready meal brands MACROS and Soulara.

July 2023: Quorn, a UK meat-free brand has launched an Australian-made Frozen Ready Meals, which also includes vegetarian dishes Spaghetti Bolognese, Thai Style Green Curry & Rice, and Butter Chicken Style Curry & Rice.

June 2023: The Australia brand The Mad Foodies produced ready meals made with the CSIRO low-carb diet as an aid of adding nutritional value to the food.

May 2022: The Australian plant-based meat maker v2food introduced four new vegan-ready dishes to its menu. This includes lasagne, chilli con carne, bolognese and penne bake.

Australia Ready Meals Market Trends

As per the Australia ready meals market report, the demand for ready meals is increasing due to the increase in the working population in the country. To save time, working professionals prefer ready meals over home-cooked meals which further results in Australia ready meals market growth.Moreover, vegan-ready meals provide health benefits to individuals who are conscious about their physical health. The online food services also provide customization options to the individuals thus helping them to be more specific about what they want to eat.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Meal Type

- Non-vegetarian

- Vegetarian

Market Breakup by Product Type

- Dried Ready Meals

- Chilled Pizza

- Frozen Pizza

- Canned Preserved Ready Meals

- Chilled Ready Meals

- Frozen Ready Pizza

- Prepared Salads

Market Breakup by End Use

- Food Services

- Residential

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Channels

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Based on the meal type, the Australia ready meals market is led by non-vegetarians

These meals include non-vegetarian ingredients such as eggs, chicken etc. which are the most preferred meals by individuals as they are rich sources of protein and nutrients thus resulting in the Australia ready meals market growth. Vegan and vegetarian ready meals are those meals which are rich in plant-based proteins and are preferred by individuals who want to maintain a healthy lifestyle.The Australia ready meals market is driven by chilled ready meals

Chilled ready meals are the most preferred meals by individuals. They maintain the nutritional values longer as compared to the other meals and are also high in protein and fibres, thus resulting in holding a greater Australia ready meals market share. Dried ready meals, chilled pizza, frozen pizza, frozen ready pizza, canned preserved ready meals and prepared salads are those meals that are made with the nutritional values but are high in calories.Based on the end use, the Australia ready meals market share is led by residential users

The residential segment dominates the market due to the maximum usage by working individuals as they prefer packaged ready meals rather than cooking the food by themselves.The online channel is capturing an increasing share of the Australia ready meals market

Online channels are those places which help individuals get easy access to the ready meals that they want to have. They also provide discounts as well along with customisation benefits thus helping individuals to order ready meals. Supermarkets and hypermarkets are also convenient options for individuals to get easy access to ready meals.The Australia ready meals market competitiveness has increased due to customization benefits, convenient alternatives, health benefits and technological advancements.

Youfoodz Pty Ltd.

Youfoodz Pty Ltd. is involved in the delivery of ready-made meals which are tasty, healthy and fresh in characteristics. It mainly consists of three types of menus including low-calorie, flexitarian and everyday healthy meals.

Chefgood Pty Ltd.

Youfoodz Pty Ltd. is involved in the delivery of ready-made meals which are tasty, healthy and fresh in characteristics. It mainly consists of three types of menus including low-calorie, flexitarian and everyday healthy meals.

Soulara

Soulara is operating to provide ready-made meals which are plant-based and are rich in proteins, nutrients, fibres, natural flavours and low in saturated fats.My Muscle Chef Pty Ltd

My Muscle Chef Pty Ltd is involved in the production of ready meals that are incorporated with healthy ingredients which helps in weight reduction and works as a fitness goal.Other Australia ready meals market key players are MarleySpoon Pty Ltd., Grocery Delivery eServices Australia Pty Ltd., Macros, Oppenheimer Pty Ltd., and Lite n’ Easy, among others.

Australia Ready Meals Market Analysis by Region

According to the Australia Bureau of Statistics, the increase in the number of individuals employed per month which furthermore results in the market growth. For instance, the number of individuals employed in January 2024 in Queensland shows an increase of around 0.2% from the last month i.e. December 2023 which is further likely to supplement the market growth.Table of Contents

Companies Mentioned

- Youfoodz Pty Ltd.

- Chefgood Pty Ltd.

- Soulara

- My Muscle Chef Pty Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 112 |

| Published | October 2025 |

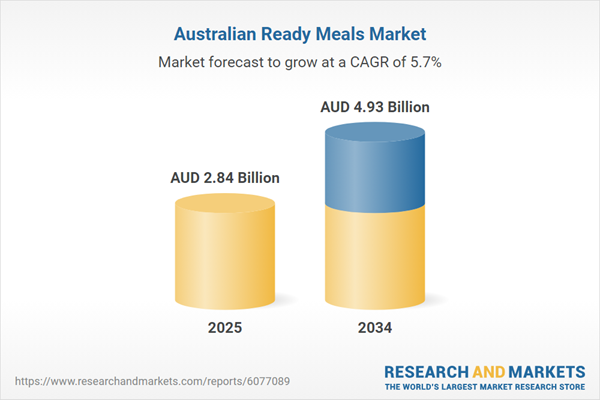

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 2.84 Billion |

| Forecasted Market Value ( AUD | $ 4.93 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 4 |