Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

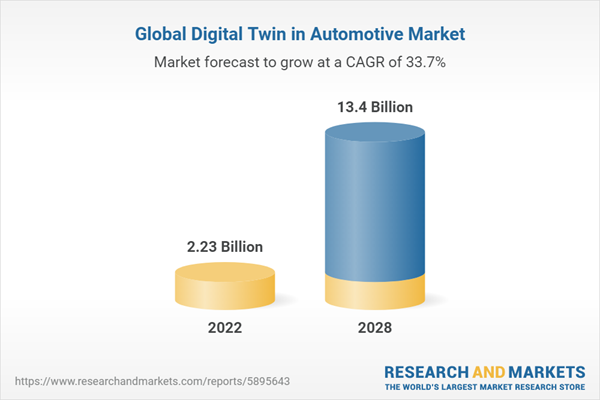

A standout feature in the market's evolution is the increasing demand for streamlined and interactive solutions. This demand is further catalyzed by the integration of Global Digital Twin in Automotive technologies, which play a pivotal role in propelling this growth forward. Innovations such as IoT-integrated operational platforms and interactive applications have augmented the capabilities of digital twins, adding new layers of sophistication to their utility. This transition towards technology-optimized solutions, harmonizing with operational enhancements, aligns seamlessly with the concept of transformative business strategies. Enterprises, industries, and logistics centers are strategically harnessing Global Digital Twin in Automotive technologies to enhance operational experiences and provide their teams with newfound dimensions of efficiency.

Nevertheless, it's crucial to acknowledge and address the challenges accompanying these technological advancements. Regulatory compliance and security considerations must be diligently managed to strike the right balance between innovation and operational effectiveness. This ensures that digital twin technology continues to deliver value while upholding data integrity and privacy.

In the ever-evolving landscape of industrial technology, the Global Digital Twin in Automotive market stands as a steadfast enabler, propelling the modernization of operational methodologies. Its influence extends beyond mere technological adoption; it fosters improved adaptability, streamlined processes, and ultimately, enhanced outcomes. As industries continue to evolve, this market consistently reshapes traditional paradigms, establishing a robust foundation for interconnected and innovative operations.

In conclusion, the remarkable growth and impact of the Global Digital Twin in Automotive market underscore its pivotal role in shaping the future of the automotive industry. With its ability to drive efficiency, productivity, and innovation, it is poised to remain a driving force in the ongoing transformation of automotive operations.

Key Market Drivers

Innovation Accelerates the Global Digital Twin in Automotive Market

The adoption of Industry 4.0 principles and the rapid evolution of smart manufacturing are major drivers behind the growth of the Global Digital Twin in Automotive Market. Automotive manufacturers are increasingly leveraging digital twin technology to create virtual replicas of their production processes, allowing for real-time monitoring and optimization. These digital replicas enable predictive maintenance, reduce downtime, and enhance overall operational efficiency.With the integration of IoT devices and sensors on the factory floor, automotive companies can collect vast amounts of data, which digital twin technology transforms into actionable insights. These insights enable proactive decision-making, quality control, and process optimization. As a result, companies can reduce costs, improve product quality, and meet the growing demand for customized and high-quality vehicles.

Furthermore, the automotive industry's commitment to sustainability aligns with digital twin technology's ability to optimize resource utilization and energy efficiency. by simulating and analyzing various manufacturing scenarios, companies can minimize waste, reduce energy consumption, and lower their carbon footprint, contributing to their environmental and social responsibility goals.

Driving Innovation: The Role of Digital Twins in Autonomous and Connected Vehicles

The development of autonomous and connected vehicles is another significant driver propelling the Global Digital Twin in Automotive Market. As the automotive industry transitions towards autonomous driving, digital twins play a crucial role in testing and validating complex autonomous vehicle algorithms and systems. Digital twins allow automotive manufacturers to create virtual environments where they can simulate various driving conditions, test sensor technologies, and refine self-driving algorithms. This accelerates the development timeline, reduces testing costs, and enhances safety, ultimately expediting the deployment of autonomous vehicles.In the realm of connected vehicles, digital twins enable real-time data exchange between vehicles, infrastructure, and the cloud. This connectivity enhances vehicle-to-everything (V2X) communication, leading to improved traffic management, enhanced driver experiences, and increased safety. Digital twins serve as the backbone of these systems, ensuring seamless integration and reliable data exchange.

Enhancing Customer Engagement: Digital Twins in the Automotive Market

The desire for personalized customer experiences is driving the adoption of digital twins in the automotive market. Consumers increasingly expect vehicles that cater to their unique preferences and needs, and digital twin technology enables automakers to meet these demands.Through digital twins, automotive manufacturers can create a comprehensive profile of each vehicle's performance, usage patterns, and maintenance needs. This data empowers companies to offer personalized maintenance recommendations, upgrade options, and value-added services to individual vehicle owners.

Moreover, digital twins support the development of interactive and immersive in-car experiences. by continuously collecting and analyzing data from sensors and user interactions, automotive companies can refine infotainment systems, navigation, and other in-car features to provide a more intuitive and personalized driving experience. This, in turn, fosters brand loyalty and customer satisfaction, driving sales and revenue growth in the automotive market..

Key Market Challenges

Guarding the Digital Realm: Data Security Challenges in the Global Digital Twin in Automotive Market

The Global Digital Twin in Automotive Market has witnessed substantial growth, driven by its transformative capabilities in optimizing operations and enhancing vehicle development. However, amidst this technological advancement, one of the most critical challenges faced by the industry is ensuring robust data security and addressing privacy concerns. As the automotive industry embraces the era of connectivity, vehicles are becoming part of an intricate network. These vehicles continuously exchange data with each other, infrastructure, and the cloud, creating a vast ecosystem susceptible to cybersecurity threats. Hackers and malicious actors seek to exploit vulnerabilities in this ecosystem, putting vehicle safety and user privacy at risk.The regulatory landscape is evolving to address data protection and privacy concerns. Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose strict requirements on data collection, storage, and usage. Automakers and tech companies must navigate these complex regulations while developing and implementing digital twin solutions. The challenge lies in striking a delicate balance between connectivity and security. While connectivity enhances user experiences and enables innovative features, it also introduces potential entry points for cyberattacks. Ensuring data security involves implementing robust encryption, authentication mechanisms, and intrusion detection systems to safeguard data during transmission and storage.

Digital twins generate and rely on vast amounts of user data, which raises questions about ownership and consent. Users should have control over their data and be informed about how it is used. Obtaining clear and informed consent from vehicle owners for data collection and processing is essential. Moreover, defining data ownership responsibilities in complex ecosystems involving multiple stakeholders is a significant challenge. OTA updates have become commonplace in modern vehicles, enabling manufacturers to improve software and fix vulnerabilities remotely. However, these updates also present opportunities for attackers to compromise vehicle systems. Ensuring the security of OTA updates, from transmission to installation, is a critical challenge. The automotive industry relies on a vast supply chain network. Any vulnerability in this network, whether it's a component supplier or a software provider, can pose a significant threat to the security of digital twin systems. Implementing robust supplier cybersecurity standards and continuous monitoring is essential to mitigate these risks.

Human errors and social engineering attacks remain a considerable challenge. Phishing attacks and insider threats can compromise even the most secure systems. Comprehensive training and awareness programs are necessary to educate employees and users about the importance of cybersecurity and data privacy. Addressing data security and privacy challenges in the Global Digital Twin in Automotive Market requires a collaborative effort from all stakeholders. Manufacturers, regulators, and technology providers must work together to establish industry standards, guidelines, and best practices. Continuous innovation in cybersecurity technologies and practices is essential to stay ahead of evolving threats.

In conclusion, while the Global Digital Twin in Automotive Market offers tremendous potential for revolutionizing the industry, the challenges related to data security and privacy cannot be underestimated. Proactive measures, stringent regulations, and ongoing innovation are necessary to ensure that the benefits of digital twin technology can be harnessed safely and responsibly.

Interoperability and Integration Complexities

The Global Digital Twin in Automotive Market has witnessed remarkable growth, driven by its capacity to revolutionize vehicle development, manufacturing, and operations. However, amid this transformative journey, one of the most prominent challenges faced by the industry is achieving seamless interoperability and addressing the complexities of integrating digital twin systems.The automotive industry comprises a vast ecosystem of stakeholders, including vehicle manufacturers, suppliers, software developers, and service providers. Each of these entities may use different technologies, data formats, and communication protocols. Achieving interoperability among these diverse components is a formidable challenge. Many automotive companies have legacy systems and processes in place. Retrofitting digital twin technology into existing operations can be complex and costly. Integrating digital twins with legacy systems often requires custom solutions, posing challenges in terms of compatibility and data consistency. Data standardization is fundamental to achieving interoperability. Without standardized data formats and communication protocols, digital twin systems may struggle to exchange information accurately. Establishing industry-wide data standards is a critical step but can be met with resistance due to proprietary interests.

Digital twin systems rely on data from various sources, including sensors, IoT devices, and databases. Integrating and synchronizing this data in real-time is a significant technical challenge. The accuracy and timeliness of data are crucial for digital twin systems to provide reliable insights. Automotive companies are increasingly adopting digital twins across multiple domains, such as product design, manufacturing, supply chain, and connected vehicles. Ensuring seamless integration between these domains is essential for achieving end-to-end visibility and efficiency. Determining data ownership and governance principles in a multi-stakeholder environment can be complex. Different entities may have varying rights and responsibilities regarding data access, sharing, and usage. Resolving data governance issues is essential for smooth interoperability.

Digital twins often involve complex simulations of physical systems. Ensuring that these simulations accurately represent real-world conditions requires sophisticated modeling and simulation capabilities. Achieving synchronization between physical systems and their digital counterparts can be challenging. Validating the interoperability of digital twin systems across the automotive ecosystem is a critical step. Rigorous testing is necessary to identify and resolve integration issues. However, comprehensive testing can be time-consuming and resource intensive. Addressing the challenges of interoperability and integration in the Global Digital Twin in Automotive Market requires collaborative efforts and the establishment of industry-wide standards. Automotive manufacturers, technology providers, and industry associations must work together to define interoperability guidelines and promote the adoption of standardized data formats and communication protocols.

In conclusion, while digital twin technology offers immense potential for revolutionizing the automotive industry, the complexities of achieving interoperability and seamless integration cannot be underestimated. Overcoming these challenges will require innovative solutions, industry collaboration, and a commitment to setting and adhering to common standards.

Key Market Trends

Unlocking Innovation: The Changing Landscape of Digital Twins in Automotive Design

One prominent trend shaping the Global Digital Twin in Automotive Market is the evolving role of digital twins in vehicle design and simulation. Traditionally used for product prototyping and validation, digital twins are now taking on a more central role in the automotive design process.Automakers are harnessing the power of digital twins to create highly detailed virtual replicas of vehicles, including their components, subsystems, and even entire manufacturing processes. These digital replicas enable engineers to perform intricate simulations, testing various design iterations, and assessing their performance under different conditions. This trend allows for rapid design optimization, reducing time-to-market and development costs.

Additionally, digital twins are aiding in the development of electric and autonomous vehicles. Simulations powered by digital twins help refine the complex algorithms that govern these vehicles' behaviour, contributing to their safety and reliability.

IoT Integration and Real-Time Monitoring for Enhanced Vehicle Maintenance

Connected Insights: IoT-Enabled Maintenance Trends in the Global Digital Twin in Automotive Market

Another noteworthy trend is the integration of the Internet of Things (IoT) and real-time monitoring capabilities in digital twin solutions for vehicle maintenance. Automakers and fleet operators are increasingly equipping vehicles with IoT sensors and data connectivity, allowing for continuous monitoring of vehicle health and performance. Digital twins are being leveraged to create virtual representations of vehicles in real-time, mirroring their physical counterparts. These digital twins receive data from IoT sensors installed in vehicles, capturing information on engine health, tire pressure, fluid levels, and more. This data is then processed to provide insights into maintenance needs and potential issues. This trend enables predictive maintenance, where automotive companies can proactively identify and address maintenance requirements before they lead to costly breakdowns. by reducing unplanned downtime and extending the lifespan of vehicle components, predictive maintenance contributes to improved operational efficiency and cost savings.Enhancing the Connected Driving Experience with In-Car Digital Twins

Next-Generation In-Car Experiences: The Rise of In-Car Digital Twins

The third key trend is the development and integration of in-car digital twins, revolutionizing the connected driving experience. As vehicles become increasingly connected and automated, the interior of the vehicle is evolving into a digital hub, offering advanced features and personalized experiences.In-car digital twins create virtual representations of the vehicle's interior, including the dashboard, entertainment systems, and cabin controls. These digital twins enable innovative features such as augmented reality (AR) navigation, personalized infotainment, and immersive in-cabin experiences. Passengers and drivers can interact with these digital twins through touchscreens, voice commands, or even gesture recognition. These digital twin-driven enhancements enhance the driving experience, making it more intuitive, entertaining, and productive.

Furthermore, in-car digital twins can adapt to individual preferences, learning user behaviors and adjusting settings accordingly. They can also provide valuable insights into vehicle diagnostics and suggest maintenance or service needs directly to the driver.

In conclusion, the Global Digital Twin in Automotive Market is witnessing dynamic trends that are reshaping the automotive industry. From revolutionizing vehicle design and leveraging IoT for maintenance to enhancing the connected driving experience with in-car digital twins, these trends are driving innovation, efficiency, and improved user experiences across the automotive sector. As technology continues to advance, the role of digital twins in the automotive industry is expected to expand even further.

Segmental Insights

Component Type Insights

In 2022, the Global Digital Twin in Automotive Market was predominantly dominated by the"Software" segment. This dominance is anticipated to persist and even strengthen during the forecast period. The software segment encompasses digital twin modeling and simulation software, which plays a pivotal role in creating virtual replicas of automotive components, systems, and processes. It enables automotive manufacturers to simulate various scenarios, optimize designs, and enhance production processes. As the automotive industry increasingly embraces digital twin technology for vehicle design, manufacturing, and operational optimization, the demand for advanced software solutions is expected to continue to grow. These software platforms facilitate real-time monitoring, predictive maintenance, and data analytics, driving efficiency and innovation throughout the automotive value chain. Consequently, the software segment is poised to maintain its dominance as the central driving force behind the Global Digital Twin in Automotive Market's growth in the foreseeable future.End-Use Industry Insights

In 2022, the Global Digital Twin in Automotive Market was primarily dominated by the"Automotive Manufacturers" segment, and this dominance is expected to persist throughout the forecast period. Automotive manufacturers are at the forefront of adopting digital twin technology to enhance their product development and manufacturing processes. Digital twins enable automotive manufacturers to create virtual replicas of their vehicles, factories, and supply chain, allowing for real-time monitoring, simulation, and analysis of various parameters. This comprehensive insight enables manufacturers to optimize production efficiency, reduce downtime, and improve product quality. Furthermore, digital twins empower automotive OEMs to fine-tune vehicle designs, test prototypes virtually, and anticipate potential issues before they arise, ultimately speeding up time-to-market and reducing development costs. Given the significant advantages that digital twins offer to automotive manufacturers in terms of operational excellence and innovation, it is expected that this segment will continue to dominate the market in the coming years. Additionally, as the automotive industry undergoes a transformation towards electric and autonomous vehicles, the reliance on digital twins for advanced simulations, predictive maintenance, and real-time monitoring will likely increase, further cementing the dominance of the"Automotive Manufacturers" segment in the Global Digital Twin in Automotive Market.Regional Insights

In 2022, the regional segmentation of the Global Digital Twin in Automotive Market revealed that the"North America" region dominated the market and is poised to maintain its dominance during the forecast period. North America has been a frontrunner in the adoption of digital twin technology within the automotive industry due to several key factors. Firstly, the region is home to a significant concentration of prominent automotive manufacturers and technology companies, particularly in the United States, which have been quick to embrace digital twins for various applications, including product design, manufacturing, and vehicle testing.Secondly, North America has seen a growing focus on research and development in autonomous and electric vehicle technologies. Digital twins play a pivotal role in the development and testing of these innovative vehicle types, enabling companies to simulate complex scenarios and improve safety features. This has led to increased investments in digital twin solutions, further solidifying the region's dominance.Moreover, the regulatory environment in North America has encouraged the adoption of digital twins for compliance and safety purposes, with government agencies promoting advanced technologies in the automotive sector. This regulatory support has spurred automotive manufacturers and suppliers to invest heavily in digital twin solutions to meet stringent industry standards.

Additionally, the robust presence of automotive aftermarket services and fleet operators in North America has accelerated the adoption of digital twins for maintenance, predictive analytics, and performance optimization. As a result, the North American region not only dominated the Digital Twin in Automotive Market in 2022 but is expected to continue its dominance in the forecast period, given the ongoing commitment to technological advancements and the evolving automotive landscape in the region.

Key Market Players

- Siemens AG.

- SAP SE.

- IBM Corporation

- ANSYS, INC

- GENERAL ELECTRIC.

- GENERAL MICROSOFT CORPORATION

- PTC Inc

- Dassault Systemes SE

- Hitachi Ltd

- Altair Engineering Inc

Report Scope

In this report, the Global Digital Twin in Automotive market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Digital Twin in Automotive Market, by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

Global Digital Twin in Automotive Market, by Component Type:

- Hardware

- Software

- Services

Global Digital Twin in Automotive Market, by End-Use Industry:

- Automotive Manufacturer

- Suppliers and Component Manufacturers

- Fleet Operators

- Aftermarket Services

Global Digital Twin in Automotive Market, by Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Digital Twin in Automotive Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Siemens AG.

- SAP SE.

- IBM Corporation

- ANSYS, Inc.

- GENERAL ELECTRIC.

- GENERAL MICROSOFT CORPORATION

- PTC Inc.

- Dassault Systemes SE

- Hitachi Ltd.

- Altair Engineering Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 2.23 Billion |

| Forecasted Market Value ( USD | $ 13.4 Billion |

| Compound Annual Growth Rate | 33.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |