The marketplace for autopilots shows substantial expansion because of automated equipment progress and growing flight safety needs as well as expanding global air travel operations. Modern air transportation corporations and plane companies dedicate significant investment toward evolving autopilot systems, as these technologies offer improved efficiency, piloting ease, and better aircraft dependability. The implementation of artificial intelligence and machine learning is further enhancing autopilot capabilities, facilitating more targeted navigation and real-time decision-making. Additionally, the market demand for advanced autopilot solutions continues to rise as UAVs are increasing in popularity within commercial segments, defense operations, and logistics sectors. The combination of aviation regulations that promote automation along with automatic flight operations creation initiatives drive the autopilot systems market share.

The autopilot systems market is booming in the United States, supported by robust investments in aerospace technology, heightened demand for business and commercial aviation, and government-backed autonomous flight programs. Aircraft manufacturers and defense contractors in the country focus on developing advanced autopilot systems to strengthen flight safety and efficiency. The increasing use of UAVs for surveillance, cargo delivery, and emergency response is further driving autopilot systems market growth. For instance, in September 2024, the US Air Force awarded USD 3.6 Million to Reliable Robotics for test flights using autonomous flight systems. This supports cargo missions and commercial development to meet FAA and Department of Defense airworthiness standards under AFWERX’s TACFI program. Furthermore, with advancements in AI-driven autopilot solutions, the U.S. remains at the forefront of innovation in automated flight technology.

Autopilot Systems Market Trends:

Enhancing Safety

Safety stands as a paramount factor driving the adoption of autopilot systems in transportation industries. Human errors function as a main cause in aviation accidents as well as automotive and marine accidents. Autopilot systems reduce human error risks since they execute tasks with exceptional accuracy thus lowering the probability of human-caused errors. These systems operate in aviation to provide stability while flying, manage navigation, and respond automatically to unplanned events to enhance aviation security for passengers alongside crew members. Advanced driver-assistance systems (ADAS) enabled with autopilot features in the automotive sector prevent collisions and monitor both safety distances alongside blind-spot regions. According to survey, 82% of Indian drivers sampled are willing to invest in ADAS-equipped vehicles, primarily by safety benefits. Similarly, in marine vessels, autopilot systems prevent collisions and enable continuous tracking in adverse weather conditions. Furthermore, the incorporation of cutting-edge sensors and algorithms enabled advanced autopilot systems to make real-time decisions, reinforcing safety benchmark across all transportation modes.Improving Efficiency and Cost Savings

Autopilot systems contribute significantly to improving operational efficiency and reducing costs in transportation industries. In commercial aviation, autopilot systems optimize flight paths, control altitude, and maintain precise airspeeds, leading to reduced fuel consumption and lower operating expenses. These efficiency gains translate into cost savings for airlines, ultimately benefiting consumers through potentially lower ticket prices. In the automotive sector, the development of autonomous driving capabilities holds the promise of decreased traffic congestion, shorter travel times, and reduced fuel consumption. Estimated reduction on main engine fuel consumption is 0.25% to 1.5%, through effective autopilot and rudder settings. As vehicles communicate with each other and traffic infrastructure, they can better navigate routes, avoiding congested areas and optimizing travel efficiency. For shipping companies, autopilot systems enable more streamlined routes and fuel-efficient operations, enhancing the economic viability of maritime transportation.Advancements in Technology

The relentless progress in technology, particularly in sensors, artificial intelligence, and computing power, plays a pivotal role in driving the sophistication and capabilities of autopilot systems. High-precision sensors, such as cameras, radar, and LiDAR, provide real-time data about the environment, enabling autopilot systems to make informed decisions and react swiftly to dynamic situations. For instance, Qantas has utilized AI since 2018 for dynamic flight routing and fuel management, achieving a 2% fuel saving, equivalent to USD 92 Million annually. Artificial intelligence and machine learning algorithms enable these systems to continuously learn from data, improving their performance over time and handling complex scenarios with greater efficiency. Furthermore, advancements in computing power allow for faster data processing, ensuring quick and accurate responses from autopilot systems. As technology continues to evolve, autopilot systems are poised to become even more robust, reliable, and capable, propelling the transformation of transportation industries and paving the way for a safer, more efficient, and autonomous future.Autopilot Systems Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global autopilot systems market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, component, platform, system, and application.Analysis by Product Type:

- Rotary Wing Aircraft

- Fixed Wing Aircraft

The market for fixed-wing aircraft includes traditional airplanes and drones (unmanned aerial vehicles). Fixed-wing aircraft are characterized by their forward motion generated by the interaction of their wings with the air, providing lift. They are widely used in commercial aviation for long-distance passenger and cargo transport, offering high cruising speeds and fuel efficiency. In the defense sector, fixed-wing aircraft play a crucial role in providing strategic airlift, conducting aerial reconnaissance, and performing combat missions. Additionally, the growing application of drones for various purposes, including surveillance, agricultural monitoring, and package delivery, has significantly expanded the fixed-wing aircraft market. The continuous advancements in aircraft design, materials, and propulsion technologies are driving the demand for more efficient, eco-friendly, and capable fixed-wing aircraft across both civilian and military domains, aligning with the autopilot systems market outlook for enhanced automation and operational efficiency.

Analysis by Component:

- GPS (Global Positioning System)

- Gyroscope

- Software

- Actuators

Analysis by Platform:

- Airborne Platform

- Land Based

- Sea

- Subsea

Analysis by System:

- Attitude and Heading Reference System

- Flight Director System

- Flight Control System

- Avionics System

- Others

The flight director system (FDS) is another crucial segment in aviation. The FDS is an integral part of the cockpit avionics, providing pilots with guidance and commands to achieve specific flight paths and maneuvers. By processing data from various aircraft systems and avionics, the FDS presents the flight crew with guidance cues on the primary flight display (PFD), aiding in the execution of precise and efficient flight operations. The FDS works in coordination with the autopilot system and is particularly valuable during complex flight situations, such as take-offs, approaches, and landings. Furthermore, as airlines and aircraft operators focus on enhancing flight efficiency and safety, the demand for sophisticated FDS technology has seen significant growth, making it a prominent market segment in the aviation industry.

The flight control system (FCS) is a key component in both manned and unmanned aircraft. The FCS is responsible for managing and regulating the aircraft's flight surfaces, such as ailerons, elevators, rudders, and flaps, to ensure stable and controlled flight. In manned aircraft, the FCS receives input from the pilot through the control yoke or stick and assists in translating these inputs into appropriate movements of flight control surfaces. Moreover, in the case of unmanned aircraft and drones, the FCS operates autonomously, receiving data from onboard sensors and autopilot systems to maintain desired flight paths and execute mission objectives. As the aviation industry progresses towards autonomous and remotely operated vehicles, the demand for advanced FCS technology is on the rise, making it a prominent and evolving market segment.

The avionics system segment holds a key position in the global autopilot systems market, driven by advancements in digital flight control, navigation, and automation technologies. Modern avionics integrate sensors, flight management systems, and AI-driven algorithms to enhance autopilot precision and reliability. Additionally, increasing demand for real-time data processing, situational awareness, and automated decision-making in commercial, military, and UAV applications supports market expansion. Moreover, regulatory compliance with aviation safety standards and ongoing investments in AI-powered avionics further strengthen the segment’s growth, ensuring improved flight efficiency, safety, and operational capabilities across global aviation sectors.

Analysis by Application:

- Commercial

- Civil

- Military

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Autopilot Systems Market Analysis

In 2024, United States accounted for 84.30% of the market share in North America. The growing adoption of autopilot systems in the aviation sector is fuelled by the increasing presence of established manufacturers in the United States. According to reports, there are approximately 1,509 aircraft, engine & parts manufacturing businesses in the US as of 2023. These manufacturers are advancing cutting-edge technology, leading to improved system reliability, precision, and overall safety in aircraft. The competitive nature of the industry encourages continuous innovation, as companies work to enhance their flight systems. Moreover, the need for better fuel efficiency and the push toward reducing operational costs have also contributed to the wider implementation of autopilot systems. These systems reduce the need for human intervention, offering cost savings while maintaining a high standard of operational safety. The aviation industry's expansion, driven by an increase in air traffic and growing demand for advanced technology, further accelerates the integration of autopilot systems into both commercial and military aircraft, highlighting the region’s pivotal role in shaping the future of autonomous flight technologies.Europe Autopilot Systems Market Analysis

The adoption of autopilot systems in applications such as Flight Director System and Flight Control System is accelerating due to rising air traffic in European region. According to reports, year 2023 recorded 10.2 Million flights, +10% compared to 2022. This increase is prompting the aviation industry to focus on enhancing operational efficiency, safety, and reliability during flights. Advanced autopilot systems are being integrated to manage navigation, altitude, and speed with greater precision, reducing pilot workload and improving flight performance. The emphasis on automating critical functions has driven innovation in system capabilities, enabling seamless communication with onboard avionics and external systems. Additionally, the growing complexity of airspace management has created a demand for technologies that ensure smoother operations under varying flight conditions. These systems also support fuel optimization and route planning, which align with broader goals of operational cost reduction and environmental sustainability. The aviation sector's adoption of such systems reflects a commitment to meeting stringent safety standards and improving passenger experiences. Enhanced training programs for pilots and crew further complement the effective implementation of these technologies. As a result, the focus on upgrading existing aircraft and the development of next-generation aircraft equipped with sophisticated autopilot solutions is steadily rising, highlighting the importance of integrating automation for safer and more efficient aviation operations. This trend is expected to reshape how the industry manages increasing flight demands.Asia Pacific Autopilot Systems Market Analysis

The adoption of autopilot systems is accelerating, fuelled by increased investments in the aviation sector and rising demand for air travel. According to Press Information Bureau, Government of India, over the last decade, India's aviation sector has seen remarkable expansion. The country’s operational airports have risen from 74 in 2014 to 157 in 2024, with plans to reach 350-400 by 2047. Meanwhile, the number of domestic air travelers has more than doubled, prompting Indian airlines to notably grow their fleets. Advancements in avionics technologies have enhanced the precision and reliability of autopilot systems, making them an integral component of modern aircraft. The focus on improving flight safety and reducing pilot workload is driving the integration of these systems in both commercial and private aviation. Air passenger growth has created a need for more efficient flight operations, where autopilot systems play a crucial role in optimizing navigation, fuel management, and overall efficiency. Additionally, the expanding aviation infrastructure supports the deployment of advanced flight control technologies, fostering their widespread implementation. Airlines and aircraft manufacturers are prioritizing automation to address operational challenges, streamline pilot responsibilities, and enhance passenger experience.Latin America Autopilot Systems Market Analysis

In Latin America, military spending is contributing to the growing adoption of autopilot systems. With defense forces seeking enhanced operational efficiency and safety, there is an increasing demand for autonomous systems in surveillance, reconnaissance, and other military applications. For instance, military spending in Central America and the Caribbean in 2023 was 54 % higher than in 2014. Autopilot systems are becoming integral in both unmanned aerial vehicles and other defense technologies, reducing the need for human intervention in high-risk missions. This growing reliance on autonomous technology is further fuelled by national defense strategies that prioritize modernization and technological advancement. As defense budgets increase, there is a stronger push to adopt autopilot systems to maintain competitive advantage and improve overall mission effectiveness.Middle East and Africa Autopilot Systems Market Analysis

The growing adoption of autopilot systems in the Middle East and Africa is largely driven by the expansion of commercial transport operations such as trucks and delivery vans. For instance, Saudi Arabia's logistics sector, valued at USD 57 Billion by 2030, benefits autopilot systems adoption with Vision 2030-backed infrastructure, including 4.5 Million Ton air cargo target, enhancing transport efficiency for growing trade across Asia, Europe, and Africa. As the demand for efficient logistics and transportation networks grows, businesses in the region are integrating autonomous systems into their fleets to optimize fuel consumption, enhance safety, and reduce labor costs. These systems allow for more reliable and precise operations, ensuring that goods are transported efficiently across vast distances.Competitive Landscape:

Major aerospace and defense companies’ active participation within the autopilot systems market to develop advanced automation technologies, which boost safety standards, operational efficiency, and strengthen market dynamics. The market leaders are investing into artificial intelligence, sensor integration, and machine learning technologies to generate more specific adaptive autopilot approaches. Moreover, the market develops through strategic partnerships together with mergers and acquisitions which allow companies to achieve greater capabilities and market reach. Additionally, manufacturers aim to improve autonomous flight technologies because of growing demand for unmanned aerial vehicles (UAVs). For instance, in August 2023, the AIRL at IISc Bangalore developed an indigenous industrial-grade drone autopilot system using Vega Microcontrollers under the Digital India RISC-V Program, advancing India’s self-reliance in unmanned aerial systems with MeITY’s support. Furthermore, the market participants demonstrate strong investments to research and development that leads to constant improvements in system reliability and functionality to stay competitive.The report provides a comprehensive analysis of the competitive landscape in the autopilot systems market with detailed profiles of all major companies, including:

- Bae Systems PLC

- Cloud Cap Technology Inc.

- Furuno Electric Co. Ltd.

- Garmin International Inc.

- Genesys Aerosystems Group Inc.

- Honeywell International Inc.

- Lockheed Martin Corporation

- Micropilot Inc.

- Rockwell Collins Inc.

- Trimble Inc.

Key Questions Answered in This Report

1. How big is the autopilot systems market?2. What is the future outlook of the autopilot systems market?

3. What are the key factors driving the autopilot systems market?

4. Which region accounts for the largest autopilot systems market share?

5. Which are the leading companies in the global autopilot systems market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Autopilot Systems Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Product Type

6.1 Rotary Wing Aircraft

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Fixed Wing Aircraft

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by Component

7.1 GPS (Global Positioning System)

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Gyroscope

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Software

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Actuators

7.4.1 Market Trends

7.4.2 Market Forecast

8 Market Breakup by Platform

8.1 Airborne Platform

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Land Based

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Sea

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Subsea

8.4.1 Market Trends

8.4.2 Market Forecast

9 Market Breakup by System

9.1 Attitude and Heading Reference System

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Flight Director System

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Flight Control System

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Avionics System

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Others

9.5.1 Market Trends

9.5.2 Market Forecast

10 Market Breakup by Application

10.1 Commercial

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Civil

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Military

10.3.1 Market Trends

10.3.2 Market Forecast

11 Market Breakup by Region

11.1 North America

11.1.1 United States

11.1.1.1 Market Trends

11.1.1.2 Market Forecast

11.1.2 Canada

11.1.2.1 Market Trends

11.1.2.2 Market Forecast

11.2 Asia Pacific

11.2.1 China

11.2.1.1 Market Trends

11.2.1.2 Market Forecast

11.2.2 Japan

11.2.2.1 Market Trends

11.2.2.2 Market Forecast

11.2.3 India

11.2.3.1 Market Trends

11.2.3.2 Market Forecast

11.2.4 South Korea

11.2.4.1 Market Trends

11.2.4.2 Market Forecast

11.2.5 Australia

11.2.5.1 Market Trends

11.2.5.2 Market Forecast

11.2.6 Indonesia

11.2.6.1 Market Trends

11.2.6.2 Market Forecast

11.2.7 Others

11.2.7.1 Market Trends

11.2.7.2 Market Forecast

11.3 Europe

11.3.1 Germany

11.3.1.1 Market Trends

11.3.1.2 Market Forecast

11.3.2 France

11.3.2.1 Market Trends

11.3.2.2 Market Forecast

11.3.3 United Kingdom

11.3.3.1 Market Trends

11.3.3.2 Market Forecast

11.3.4 Italy

11.3.4.1 Market Trends

11.3.4.2 Market Forecast

11.3.5 Spain

11.3.5.1 Market Trends

11.3.5.2 Market Forecast

11.3.6 Russia

11.3.6.1 Market Trends

11.3.6.2 Market Forecast

11.3.7 Others

11.3.7.1 Market Trends

11.3.7.2 Market Forecast

11.4 Latin America

11.4.1 Brazil

11.4.1.1 Market Trends

11.4.1.2 Market Forecast

11.4.2 Mexico

11.4.2.1 Market Trends

11.4.2.2 Market Forecast

11.4.3 Others

11.4.3.1 Market Trends

11.4.3.2 Market Forecast

11.5 Middle East and Africa

11.5.1 Market Trends

11.5.2 Market Breakup by Country

11.5.3 Market Forecast

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Value Chain Analysis

13.1 Overview

13.2 Inbound Logistics

13.3 Operations

13.4 Outbound Logistics

13.5 Marketing and Sales

13.6 Services

14 Porters Five Forces Analysis

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Competition

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15 Price Indicators

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players

16.3 Profiles of Key Players

16.3.1 Bae Systems PLC

16.3.1.1 Company Overview

16.3.1.2 Product Portfolio

16.3.1.3 Financials

16.3.1.4 SWOT Analysis

16.3.2 Cloud Cap Technology Inc.

16.3.2.1 Company Overview

16.3.2.2 Product Portfolio

16.3.3 Furuno Electric Co. Ltd.

16.3.3.1 Company Overview

16.3.3.2 Product Portfolio

16.3.3.3 Financials

16.3.4 Garmin International Inc.

16.3.4.1 Company Overview

16.3.4.2 Product Portfolio

16.3.5 Genesys Aerosystems Group Inc.

16.3.5.1 Company Overview

16.3.5.2 Product Portfolio

16.3.5.3 Financials

16.3.5.4 SWOT Analysis

16.3.6 Honeywell International Inc.

16.3.6.1 Company Overview

16.3.6.2 Product Portfolio

16.3.6.3 Financials

16.3.6.4 SWOT Analysis

16.3.7 Lockheed Martin Corporation

16.3.7.1 Company Overview

16.3.7.2 Product Portfolio

16.3.7.3 Financials

16.3.7.4 SWOT Analysis

16.3.8 Micropilot Inc.

16.3.8.1 Company Overview

16.3.8.2 Product Portfolio

16.3.8.3 Financials

16.3.8.4 SWOT Analysis

16.3.9 Rockwell Collins Inc.

16.3.9.1 Company Overview

16.3.9.2 Product Portfolio

16.3.10 Trimble Inc.

16.3.10.1 Company Overview

16.3.10.2 Product Portfolio

16.3.10.3 Financials

16.3.10.4 SWOT Analysis

List of Figures

Figure 1: Global: Autopilot Systems Market: Major Drivers and Challenges

Figure 2: Global: Autopilot Systems Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Autopilot Systems Market: Breakup by Product Type (in %), 2024

Figure 4: Global: Autopilot Systems Market: Breakup by Component (in %), 2024

Figure 5: Global: Autopilot Systems Market: Breakup by Platform (in %), 2024

Figure 6: Global: Autopilot Systems Market: Breakup by System (in %), 2024

Figure 7: Global: Autopilot Systems Market: Breakup by Application (in %), 2024

Figure 8: Global: Autopilot Systems Market: Breakup by Region (in %), 2024

Figure 9: Global: Autopilot Systems Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: Global: Autopilot Systems (Rotary Wing Aircraft) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Autopilot Systems (Rotary Wing Aircraft) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Autopilot Systems (Fixed Wing Aircraft) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Autopilot Systems (Fixed Wing Aircraft) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Autopilot Systems (Global Positioning System) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Autopilot Systems (Global Positioning System) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Autopilot Systems (Gyroscope) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Autopilot Systems (Gyroscope) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Autopilot Systems (Software) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Autopilot Systems (Software) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Autopilot Systems (Actuators) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Autopilot Systems (Actuators) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Autopilot Systems (Airborne Platform) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Autopilot Systems (Airborne Platform) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Autopilot Systems (Land Based) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Autopilot Systems (Land Based) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Autopilot Systems (Sea) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Autopilot Systems (Sea) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Autopilot Systems (Subsea) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Autopilot Systems (Subsea) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Autopilot Systems (Attitude and Heading Reference System) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Autopilot Systems (Attitude and Heading Reference System) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Autopilot Systems (Flight Director System) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Autopilot Systems (Flight Director System) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Autopilot Systems (Flight Control System) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Autopilot Systems (Flight Control System) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Autopilot Systems (Avionics System) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Autopilot Systems (Avionics System) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Autopilot Systems (Other Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Autopilot Systems (Other Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Global: Autopilot Systems (Commercial) Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Global: Autopilot Systems (Commercial) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Global: Autopilot Systems (Civil) Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Global: Autopilot Systems (Civil) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Global: Autopilot Systems (Military) Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Global: Autopilot Systems (Military) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: North America: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: North America: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: United States: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: United States: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Canada: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Canada: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Asia Pacific: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Asia Pacific: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: China: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: China: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: Japan: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: Japan: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: India: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: India: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: South Korea: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: South Korea: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Australia: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Australia: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Indonesia: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Indonesia: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Others: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Others: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Europe: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Europe: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Germany: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Germany: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: France: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: France: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: United Kingdom: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: United Kingdom: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Italy: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Italy: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Spain: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Spain: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Russia: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Russia: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Others: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Others: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Latin America: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Latin America: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Brazil: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Brazil: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Mexico: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 89: Mexico: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 90: Others: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 91: Others: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 92: Middle East and Africa: Autopilot Systems Market: Sales Value (in Million USD), 2019 & 2024

Figure 93: Middle East and Africa: Autopilot Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 94: Global: Autopilot Systems Industry: SWOT Analysis

Figure 95: Global: Autopilot Systems Industry: Value Chain Analysis

Figure 96: Global: Autopilot Systems Industry: Porter’s Five Forces Analysis

List of Tables

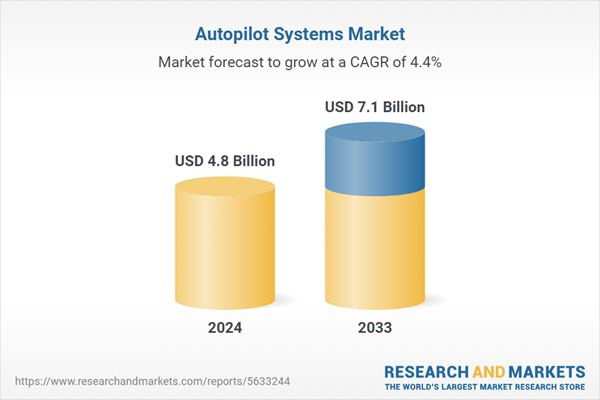

Table 1: Global: Autopilot Systems Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Autopilot Systems Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 3: Global: Autopilot Systems Market Forecast: Breakup by Component (in Million USD), 2025-2033

Table 4: Global: Autopilot Systems Market Forecast: Breakup by Platform (in Million USD), 2025-2033

Table 5: Global: Autopilot Systems Market Forecast: Breakup by System (in Million USD), 2025-2033

Table 6: Global: Autopilot Systems Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 7: Global: Autopilot Systems Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 8: Global: Autopilot Systems Market: Competitive Structure

Table 9: Global: Autopilot Systems Market: Key Players

Companies Mentioned

- Bae Systems PLC

- Cloud Cap Technology Inc.

- Furuno Electric Co. Ltd.

- Garmin International Inc.

- Genesys Aerosystems Group Inc.

- Honeywell International Inc.

- Lockheed Martin Corporation

- Micropilot Inc.

- Rockwell Collins Inc.

- Trimble Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.8 Billion |

| Forecasted Market Value ( USD | $ 7.1 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |