Speak directly to the analyst to clarify any post sales queries you may have.

The B2B payments market is undergoing a swift transformation as organizations prioritize digital solutions that enable seamless, secure, and efficient financial transactions. Senior decision-makers are seeking flexible payment architectures to support evolving business demands, operational efficiencies, and compliance requirements across increasingly complex global networks.

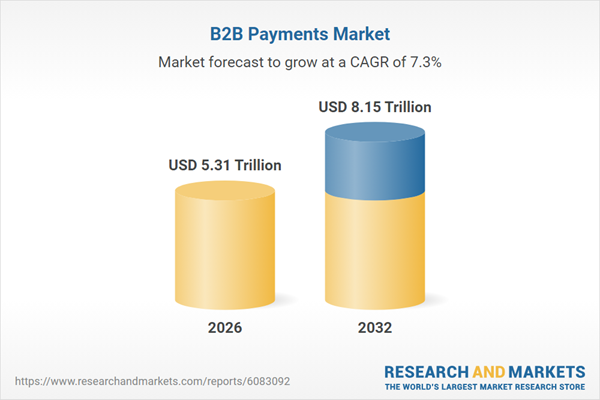

Market Snapshot: B2B Payments Market Growth Outlook

The B2B payments market is set for considerable growth, expanding from USD 4.97 trillion in 2025 to USD 5.31 trillion in 2026, with a projected CAGR of 7.30%. By 2032, this market is expected to reach USD 8.15 trillion. Market expansion is fueled by accelerated digitization, changes in regulatory frameworks, and the broadening scope of global trade. For companies competing in this environment, advancements in payment technology and integration are essential to meet client and partner expectations.

Scope & Segmentation of the B2B Payments Market

This report delivers comprehensive analysis of the modern B2B payments landscape, examining how finance and treasury leaders implement technology to meet shifting operational, regulatory, and commercial needs. Segmentation highlights include:

- Transaction Types: Cross-border and domestic payments demand tailored routing, foreign exchange treatment, and compliance handling to manage risk and efficiency.

- Payment Methods: ACH, credit cards, cryptocurrency, paper checks, and wire transfers offer differing fee structures, reconciliation processes, and settlement timelines that impact treasury workflows.

- Pricing Models: Subscription-based and transaction-fee arrangements influence vendor selection, cost predictability, and flexibility for scaling operations.

- End-User Industries: Banking, financial services, insurance, energy, utilities, healthcare, IT, telecom, manufacturing, retail, e-commerce, and logistics sectors encounter distinct regulatory obligations and process requirements.

- Organization Size: Large enterprises and small to mid-sized businesses deploy technology in diverse ways, shaped by resource availability and strategic priorities.

- Geographies: Americas, Europe, Middle East, Africa, and Asia-Pacific regions exhibit varying governance models, payment workflows, and integration norms.

- Core Technologies: Instant rails, tokenization, payment orchestration, middleware integration, and embedded finance are central to security and efficiency enhancements.

B2B Payments Market: Key Takeaways for Senior Decision-Makers

- The integration of real-time payment solutions and advanced authentications accelerates the pace of cash management and enhances forecasting accuracy.

- Modernizing legacy payment infrastructures reduces manual workloads and supports forward-looking, data-driven finance strategies.

- Stringent compliance and shifting sanctions drive the implementation of robust controls and transparency across all payment workflows.

- Vendor consolidation and adoption of payment orchestration platforms decrease operational friction and support unified, scalable solutions.

- Aligning payment segment strategies by transaction type, industry, and organization size ensures investment addresses real operational challenges and risk profiles.

- Regional and corridor-specific approaches are necessary as companies manage global payment flows amidst uncertainty and variable technology standards.

B2B Payments Market: Tariff Impacts on Global Trade Flows

Recent United States tariff changes for 2025 are introducing fresh challenges for global payment workflows. These adjustments are reshaping how procurement and finance assign working capital, with careful attention to payment scheduling and compliance documentation. Companies are reviewing correspondent banking structures, evaluating alternative payment rails, and enhancing administrative and reporting frameworks. These tariff-linked complexities make it critical to integrate payment architecture closely with sourcing and liquidity planning in order to reduce operational risk and ensure efficiency.

Methodology & Data Sources

This analysis combines qualitative interviews with treasury and compliance leaders, scenario-based review of regulatory policies, and systematic mapping of vendor capabilities. Additional data stems from regulatory publications, network documentation, and industry records. Rigorous cross-checking and practitioner feedback shape actionable findings representative of operational realities.

Why This Report Matters for Finance and Treasury Leaders

- Provides expert-driven strategic insights to aid in upgrading payment processes and technology choices.

- Clarifies investment priorities by detailing market segmentation, regional differences, and compliance trends to support effective resource allocation.

- Enables companies to align technology and vendor selection with governance, risk management, and productivity targets.

Conclusion

The B2B payments sector continues to evolve, demanding adaptive systems and corridor-specific strategies. Enterprises that align payment architecture with governance and operational needs are positioned for resilient, compliant, and efficient operations.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China B2B Payments Market

Companies Mentioned

The key companies profiled in this B2B Payments market report include:- Adyen N.V.

- American Express Company

- Bank of America Corporation

- Bottomline Technologies Inc.

- Capital One Financial Corporation

- Citigroup Inc.

- Coupa Software Inc.

- Edenred Payment Solutions

- FIS Global

- Flywire Corporation

- HighRadius Corporation

- Mastercard Inc.

- Nuvei Corporation

- Payoneer Inc.

- PayPal Holdings, Inc.

- Paystand, Inc.

- Ramp Business Corporation

- Rapyd Financial Network Ltd.

- Slope Inc.

- Square Payments by Block Inc.

- Stripe, Inc.

- Tipalti Inc.

- Two AS

- U.S. Bank

- Visa Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 5.31 Trillion |

| Forecasted Market Value ( USD | $ 8.15 Trillion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |