Speak directly to the analyst to clarify any post sales queries you may have.

Foundational overview of prefabricated bathroom pods delineating their construction advantages, quality drivers, and relevance across modern building delivery models

Prefabricated bathroom pods are transforming how buildings are designed, delivered, and commissioned by shifting a traditionally on-site, sequential process into an integrated, off-site manufacturing workflow. These factory-built modules are preassembled with structural framing, finishes, sanitaryware, mechanical and electrical systems and are transported to the project site for rapid installation. Because they encapsulate complex assemblies within a controlled production environment, pods reduce on-site labor hours, compress schedules, and mitigate common coordination challenges inherent in conventional bathroom construction.Adoption is driven by a convergence of factors: increasing demand for schedule certainty in high-velocity projects, the need for consistent quality across repeatable units, and the pressure to optimize site labor during constrained market conditions. In addition, growing interest in sustainable construction practices and waste reduction favors factory-controlled processes that can maximize material yield and recyclability. As a result, developers, general contractors, and facility owners view prefabricated bathroom pods as a strategic lever to improve predictability, reduce rework, and enhance occupant experience while aligning with broader objectives such as carbon reduction and lifecycle cost management.

How digital transformation, advanced manufacturing, and sustainability priorities are reshaping prefabricated bathroom pod design, production, and procurement practices

The landscape for prefabricated bathroom pods is undergoing a series of transformative shifts driven by technological maturation, sustainability imperatives, and evolving client expectations. Digitization of the design and manufacturing pipeline - including BIM-enabled workflows, parametric modeling, and digital twins - has elevated the precision and configurability of pods, enabling manufacturers to deliver bespoke layouts at scale with fewer design iterations. Alongside digital tools, automation and robotics in component assembly are raising throughput while improving repeatability and reducing human-induced variability.Concurrently, sustainability considerations are reshaping material selections, waste management practices, and end-of-life planning. There is a distinct move toward circular material strategies, lower-emission binders, and lifecycle-oriented specifications that account for maintenance and refurbishment. These trends are complemented by shifting procurement frameworks that favor early engagement between manufacturers, designers, and contractors to integrate pods into whole-project delivery. As a result, the industry is navigating toward an ecosystem where modular solutions are selected not as isolated products but as coordinated elements of broader strategies for speed, quality, and environmental performance.

Detailed examination of how the 2025 tariff measures compelled supply chain redesign, procurement realignment, and product engineering adaptations across the industry

The introduction of tariffs in 2025 has created a strong incentive for actors across the prefabricated bathroom pod value chain to reassess sourcing strategies and supply chain architectures. Manufacturers that historically relied on globally distributed component sourcing have had to evaluate tariff classifications, duty mitigation techniques, and alternative supply origins to preserve margins and competitive pricing. In response, procurement teams intensified supplier qualification efforts, scrutinized the total landed cost of imported components, and prioritized domestic or nearshore partners where lead-time stability and tariff exposure could be reduced.Beyond sourcing, the tariff environment accelerated strategic adaptations such as product redesign to substitute tariff-exposed components with domestically available alternatives or to reconfigure bill-of-materials to qualify for preferential trade treatments. Supply chain resilience became a primary metric in vendor selection, provoking greater use of inventory buffering for critical components and heightened investment in forward logistics planning. Simultaneously, legal and compliance functions expanded their role, ensuring accurate tariff engineering, harmonized system codes, and documentation to avoid unexpected duties. Collectively, these responses reflect an industry shifting from opportunistic import models toward integrated procurement strategies that balance cost, compliance, and delivery certainty.

In-depth segmentation analysis linking materials, construction types, installation methods, applications, and distribution channels to strategic product and go-to-market choices

Material selection drives core performance characteristics of prefabricated bathroom pods, and the market is segmented across composite materials, hybrid systems, steel, and wood, with composites further differentiated into carbon fibers, concrete-based composites, and glass fiber solutions. Each material family presents trade-offs: composite systems offer high strength-to-weight ratios and design flexibility suitable for repeatable volumetric units, while steel delivers structural robustness and ease of connection for modular stacks. Wood-based pods cater to low-carbon and aesthetic preferences, particularly where embodied carbon is a procurement priority. Hybrid assemblies combine material advantages to balance cost, durability, and manufacturability.Construction intent separates needs between new construction projects and renovation or retrofit projects, with the former prioritizing integration into early-stage design and vertical transportation planning, and the latter emphasizing adaptability to existing structures and tighter tolerances. Installation methodologies are another critical axis, distinguished by horizontal slide-in systems and vertical drop-in solutions; horizontal installations typically favor larger floor plate logistics and rapid lateral insertion, while vertical drop-in configurations address high-rise construction and core-aligned stacks. In application terms, commercial sectors-particularly hotels and retail spaces-demand high consistency in finish quality and guest-facing performance, whereas industrial uses such as modular campsites and warehouses emphasize durability and rapid deployability. Institutional operators including hospitals and educational campuses require stringent hygiene, acoustic, and accessibility specifications, and residential deployments span multi-family apartment installations where repeatability and serviceability are central, as well as single-family solutions that prioritize customization and aesthetic integration. Finally, distribution channels split between offline and online models, with offline sales networks providing specification-level support and onsite coordination, and online platforms enabling standardized product configurations, rapid quoting, and streamlined procurement for repeatable deployments. Taken together, these segmentation lenses shape product development, manufacturing workflows, and go-to-market strategies by aligning technical attributes with client operating requirements and delivery constraints.

Regional perspectives on production, procurement, and specification drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific that influence deployment strategies

Regional dynamics play a defining role in how prefabricated bathroom pods are manufactured, specified, and deployed. In the Americas, demand is influenced by metropolitan construction cycles, labor market dynamics, and an accelerating appetite for industrialized construction techniques that shorten schedules. Domestic manufacturing capacity and policy incentives around infrastructure and housing shape supplier networks, causing many manufacturers to establish regional production hubs to minimize transportation complexity and lead times.Europe, the Middle East & Africa exhibit varied drivers: stringent building codes and strong sustainability regulations in parts of Europe incentivize low-carbon materials and circular design, while several Middle Eastern markets focus on upscale hospitality and rapid urbanization that favors modular bathroom solutions for speed and consistency. In many African markets, modular approaches are emerging as pragmatic responses to supply chain constraints and skills shortages. Across this broad region, compliance regimes, certification requirements, and specification norms drive customization and testing protocols. Asia-Pacific remains a major center for manufacturing scale, with dense supply chains and advanced fabrication capabilities. Rapid urbanization, high-rise construction practices, and the presence of large integrated contractors encourage adoption of vertical drop-in systems and prefabrication strategies that can be standardized at scale. Interregional trade flows, currency dynamics, and regional regulatory harmonization are therefore critical considerations for firms deciding where to locate production and how to configure distribution networks.

Strategic review of how leading manufacturers are using integration, quality assurance, partnerships, and service offerings to differentiate in a competitive modular landscape

Key companies in the prefabricated bathroom pod space are advancing through a combination of vertical integration, strategic partnerships, and capability investments in digital tooling. Rather than competing solely on price, many leading firms are differentiating through end-to-end coordination services that include design-for-manufacture consulting, installation planning, and post-installation support. Investment in quality assurance systems, standardized testing protocols, and certifications for hygiene and fire performance has become a common way to reduce client risk and win long-term relationships with large developers and institutional buyers.Additionally, firms are diversifying delivery models by offering modular product lines that range from highly configurable standardized units to full bespoke solutions for premium projects. Strategic alliances with logistics providers and specialty installers help mitigate the complexity of transporting and craning volumetric units into constrained urban sites. At the same time, several manufacturers are piloting subscription-based maintenance contracts and extended warranties to address lifecycle concerns and create recurring revenue streams. These combined approaches reflect an industry where operational excellence, trust in quality, and the ability to support the full project lifecycle determine competitive positioning more than single-product attributes.

Action-oriented recommendations for manufacturers and buyers to strengthen resilience, digital capability, sustainability credentials, and commercial service models for accelerated adoption

Industry leaders should prioritize four strategic imperatives to capture value from prefabricated bathroom pods while managing regulatory, supply chain, and operational risks. First, firms must build supply chain resilience by diversifying supplier bases, qualifying nearshore partners, and maintaining transparent total-cost analyses that include tariffs, logistics, and compliance costs. Securing alternative material sources and establishing contingency inventories for critical components will reduce volatility in delivery schedules.Second, invest in digital engineering and manufacturing systems that link architectural models with factory production lines. Integrating BIM with production scheduling and quality control reduces rework and enables higher customization without undermining throughput. Third, adopt sustainability and lifecycle frameworks that speak directly to owner-operator priorities: specify repairable components, prioritize low-embodied-carbon material options, and document maintenance regimes to increase asset longevity. Fourth, develop integrated commercial models that combine specification support, installation coordination, and post-delivery maintenance; offering turnkey solutions simplifies procurement for large clients and creates opportunities for recurring service revenues. Implementation of these recommendations should be staged with pilot projects to validate operational changes, allowing continuous improvement and rapid scaling of proven practices.

Robust mixed-methods research approach combining primary interviews, factory and site observations, technical evaluations, and regulatory review to validate practical insights

This research synthesizes qualitative and quantitative evidence gathered through structured interviews, site observations, product evaluations, and secondary literature review. Primary research included interviews with manufacturing managers, procurement leads, design consultants, general contractors, and installers to capture operational realities, specification drivers, and pain points. Site visits to factory floors and installation sites provided direct observation of production workflows, logistics handling, and quality-control measures, enabling triangulation of reported practices.Supplementing fieldwork, technical analysis of materials and assemblies was performed to assess durability, maintenance considerations, and compatibility with common mechanical and electrical systems. Regulatory and standards review ensured that performance claims align with prevailing codes across major jurisdictions. Data synthesis employed cross-validation methods to reconcile divergent inputs and produce a coherent set of insights. Throughout the process, emphasis was placed on transparency of sources, clear documentation of assumptions, and iterative validation with industry stakeholders to ensure the findings reflect practical realities rather than theoretical models.

Concise synthesis of how integrated product, process, and procurement decisions determine successful adoption and long-term value capture from prefabricated bathroom pods

Prefabricated bathroom pods represent a strategic response to contemporary pressures in construction: the need for speed, consistent quality, and improved lifecycle outcomes. The convergence of digital design, advanced manufacturing, and evolving procurement expectations is enabling modular bathroom solutions to move from niche deployments into mainstream programmatic use. However, successful scale-up depends on deliberate choices about materials, installation strategies, regional production footprints, and resilient supply chains.Organizations that align product development with operational capabilities, invest in digital integration, and proactively manage regulatory and tariff-related complexity will be best positioned to harness the benefits of modular bathroom systems. Ultimately, the transition to prefabrication is as much about reconfiguring project delivery models and contractual relationships as it is about the physical product; stakeholders who approach this holistically will gain the most consistent, long-term value.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Prefabricated Bathroom Pods Market

Companies Mentioned

The key companies profiled in this Prefabricated Bathroom Pods market report include:- Altor by Part Group

- B&T Manufacturing

- Bathsystem S.p.A.

- Baudet SAS

- Connex Offsite

- DPR Construction

- DuPod

- DURAPODS

- Elements Europe

- Eurocomponents Spa

- Fortis Construction Group

- Hydrodiseño

- Interpod Australia Pty Ltd

- Loom Crafts Shade Systems Pvt Ltd.

- Moduspaces by Dyester Corp

- NeoPod Systems

- Offsite Solutions

- Primex Building Systems Pvt. Ltd.

- PUDA Industrial Co., Ltd

- Sanika Group

- Sterchele Spa

- Taplanes Limited

- The Pod Company

- VOLUMETRIC MODULAR LTD.

- Walker Modular

- WOODBETON SPA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | January 2026 |

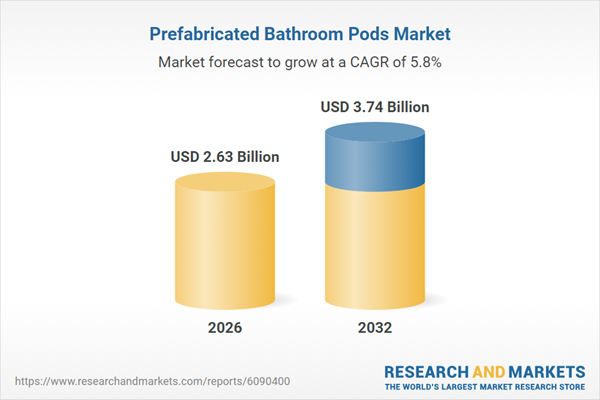

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 2.63 Billion |

| Forecasted Market Value ( USD | $ 3.74 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |