Speak directly to the analyst to clarify any post sales queries you may have.

Clarifying why binder chemistry and formulation strategy are strategic imperatives that determine electrode performance, manufacturability, and long-term reliability

Binders play a foundational role in modern electrochemical energy storage systems, binding active materials, maintaining electrode integrity, and enabling manufacturability at scale. Over the past decade, incremental improvements in polymer chemistry, formulation techniques, and process compatibility have produced meaningful gains in electrode lifetime, rate capability, and manufacturability, even as active material compositions have evolved to include higher‑capacity silicon blends and nickel‑rich cathodes. As a result, binders are no longer an inert additive but a performance enabler whose selection interacts directly with electrode architecture, slurry rheology, and downstream coating processes.Consequently, the industry has shifted its attention from single‑parameter selection to holistic design, where mechanical adhesion, electrochemical stability, and compatibility with solvents and conductive additives are balanced to optimize cell performance. In practice, that means formulators, electrode manufacturers, and OEMs must evaluate binder chemistry within the context of electrode porosity, calendering schedules, and anticipated cycle life. Also, environmental and regulatory pressures are accelerating the transition toward water‑based systems and lower‑emissions processing, which introduces new technical constraints and opportunities. This introduction establishes the central premise of the report: binders are strategic materials whose optimization unlocks improved cell performance, lower total cost of ownership, and more sustainable manufacturing pathways.

Identifying the converging technological, regulatory, and supply chain drivers that are elevating binders from commodity additives to strategic differentiators in battery production

The landscape for battery binders is undergoing several transformative shifts driven by changes in cell chemistry, manufacturing scale, regulatory pressures, and end‑market demand. First, the integration of high‑capacity anode materials such as silicon and advanced cathode chemistries increases mechanical strain and chemical reactivity at the electrode level, prompting demand for binders that provide enhanced elasticity, adhesive strength, and chemical passivation. Secondly, manufacturing scale‑up and cost pressures are driving a migration from solvent‑based processes toward water‑based and dry processing routes, which in turn favors binder chemistries designed for aqueous dispersion and rapid film formation.Moreover, the emergence of next‑generation cell concepts-such as solid‑state architectures and anode‑free designs-creates novel performance constraints and compatibility requirements for polymeric binders. Regulatory attention to volatile organic compound emissions and circular economy mandates is accelerating investments in recyclable and low‑emission binder systems. At the same time, supply chain reconfiguration and onshoring trends are encouraging closer collaboration among polymer producers, electrode fabricators, and OEMs to ensure continuity of supply and co‑development of tailored binder solutions. Taken together, these shifts are elevating binders from commodity additives to differentiated components that can materially influence cell performance and the economics of battery manufacturing.

Explaining how recent tariff measures reshaped sourcing, supplier strategies, and domestic capacity choices while accelerating resilience and technical substitution initiatives

United States tariff actions and associated trade policy adjustments in 2025 introduced a material inflection in binder supply chains and procurement strategies, compelling stakeholders to reassess supplier footprints and cost pass‑through mechanisms. In the immediate term, tariffs increased landed costs for certain imported polymer intermediates and specialty additives, which led purchasers to recalibrate sourcing models and seek alternative raw material streams. Consequently, many downstream formulators accelerated qualification of domestic suppliers, intensified second‑source agreements, and pursued local capacity build‑outs to mitigate exposure to cross‑border policy volatility.In response to tariff pressures, some firms revised long‑term supply contracts to include flexible pricing clauses and inventory buffers to smooth procurement peaks. Others increased collaboration with upstream chemical manufacturers to secure priority allocations and co‑invest in capacity expansions within more favorable trade jurisdictions. Simultaneously, tariff‑driven cost inflation catalyzed R&D efforts aimed at substituting high‑cost polymer grades with functionally equivalent chemistries compatible with water‑based processing. Over time, these adaptations promoted supplier consolidation in select regions and encouraged vertically integrated players to internalize binder synthesis to control costs and intellectual property. Looking ahead, a durable outcome of the tariff environment is stronger emphasis on supply chain resilience, localized manufacturing, and technical differentiation as competitive levers in binder strategy.

Providing a comprehensive segmentation lens that connects binder chemistry, functional requirements, processing routes, application roles, and end‑user demands to purchasing and R&D choices

A nuanced segmentation framework is essential for understanding performance tradeoffs and customer requirements in binder selection. When considering type, attention centers on chemistries such as Carboxymethyl Cellulose (CMC), Polyacrylic Acid (PAA), Polyethylene Oxide (PEO), Polymethyl Methacrylate (PMMA), Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride (PVDF), and Styrene Butadiene Rubber (SBR), each offering distinct mechanical, chemical, and processing characteristics that map to specific electrode designs and manufacturing conditions. Functionality‑based classification highlights the importance of binding strength, chemical stability, conductivity, and thermal resistance; these properties determine durability under cycling, tolerance to electrolyte chemistries, and performance at elevated temperatures.Process type segmentation distinguishes between dry process and wet process routes, which impose different rheological and film‑formation requirements on binder systems. Solvent process distinctions separate solvent‑based binders from water‑based binders, a critical axis given environmental and operational considerations in modern coating lines. Application segmentation separates anode binders from cathode binders, reflecting the asymmetric mechanical and electrochemical stresses experienced by each electrode. Finally, end‑user segmentation spans aerospace & defense, automotive, consumer electronics, energy storage systems, and industrial markets, where performance priorities shift from high energy density and cycle life to safety, reliability, and cost efficiency. Synthesizing these segmentation lenses enables suppliers and OEMs to align binder selection with product architecture, manufacturing strategy, and end‑market requirements in a way that supports both short‑term production goals and long‑term performance targets.

Analyzing how regional regulatory expectations, manufacturing capacity, and proximity to cell makers drive divergent binder priorities and sourcing strategies across global markets

Regional dynamics exert a profound influence on binder development, supply chain design, and buyer behavior. In the Americas, industrial scale‑up and strong automotive electrification programs prioritize localized supply, manufacturing integration, and formulations that suit large‑scale, high‑throughput coating lines. Manufacturers in this region frequently emphasize regulatory compliance, low‑emission processing, and rapid qualification cycles to meet OEM production ramp schedules. Conversely, Europe, Middle East & Africa see strong regulatory pressure toward sustainability, with a heightened focus on water‑based binders, recyclability, and lifecycle impact reduction, all of which motivate formulator investments in low‑VOC systems and closed‑loop manufacturing collaborations.Asia‑Pacific remains the epicenter of electrode production and polymer manufacturing capability, where integrated supply chains and mature process know‑how support rapid innovation and cost optimization. In this region, proximity to electrode cell makers accelerates co‑development of bespoke binder systems and faster scale‑up of novel chemistries. Across all regions, however, there is a converging trend toward greater supply chain transparency, local qualification testing, and strategic inventories that facilitate resilience against trade disruptions and component shortages. These regional distinctions should inform both sourcing strategies and targeted R&D investment to ensure binder solutions match the operational realities and regulatory landscapes of each geography.

Examining the strategic moves by polymer and specialty chemical firms to capture electrode value through partnerships, vertical integration, and factory‑scale technical services

Key company behaviors reveal strategic patterns that influence market structure and technology diffusion. Leading polymer producers and specialty chemical firms are pursuing differentiated routes to capture electrode value, including formulation partnerships, joint development agreements with battery manufacturers, and selective vertical integration into intermediate polymer synthesis. Many strategic players are investing in pilot production capabilities and technical service teams to accelerate on‑site process integration, troubleshoot slurry stability, and support scale‑up to full coating lines. This operator model reduces adoption risk for OEMs and shortens qualification timelines, creating a competitive advantage for suppliers offering integrated technical support.At the same time, a subset of companies concentrates on proprietary binder platforms that combine mechanical elasticity with enhanced ionic conductivity or interfacial stabilization, aiming to address demanding applications such as silicon‑dominant anodes and high‑voltage cathodes. Others focus on affordable, robust solutions optimized for commodity cell chemistries and high‑throughput manufacturing. Strategic M&A activity and collaboration agreements are common as firms seek complementary capabilities, broaden geographic reach, and secure feedstock supply. Across the board, success depends on the ability to convert laboratory promises into reproducible, factory‑scale performance while maintaining regulatory compliance and minimizing total cost of integration for cell manufacturers.

Actionable recommendations for executives to reduce supply risk, accelerate water‑based adoption, and align R&D with manufacturability and circularity imperatives

Industry leaders must adopt a mix of technical, commercial, and operational actions to capture value and mitigate risk in the evolving binder landscape. First, prioritize diversification of raw material supply chains while establishing robust qualification pathways for alternative polymer grades to reduce single‑source exposure and tariff sensitivity. Complement supply diversification with investments in local pilot production and formulation labs to accelerate co‑development with cell makers and shorten time to qualification. Second, increase R&D emphasis on water‑based and low‑VOC binder platforms that deliver comparable mechanical and electrochemical performance to solvent‑based systems, thereby reducing environmental compliance risk and improving manufacturability.Third, strengthen cross‑functional collaboration among procurement, R&D, and manufacturing to ensure binder selection aligns with coating, calendering, and cell testing protocols. Fourth, pursue partnerships with recycling and cathode/anode reclamation initiatives to design binders for end‑of‑life recovery and circularity. Fifth, implement digital process control and advanced rheology monitoring on coating lines to improve batch‑to‑batch consistency, reduce waste, and accelerate troubleshooting. Finally, engage proactively with regulators and OEM customers to establish testing standards and qualification criteria that de‑risk adoption and create transparent pathways for innovation to move from lab to factory.

Describing a rigorous methodology that blends expert interviews, laboratory verification, patent analysis, and supply chain mapping to validate binder performance and strategy

The research methodology integrates primary engagement, material characterization, and multilateral data triangulation to ensure robust, actionable findings. Primary research included structured interviews with polymer chemists, electrode formulators, coating line engineers, and procurement leaders, complemented by site visits to pilot plants and coating facilities where possible. Laboratory analysis comprised rheological profiling, adhesion testing, thermal stability screening, and compatibility assessments with representative electrolyte chemistries to validate functional claims and identify failure modes under accelerated cycling conditions. Proprietary test matrices were used to compare film formation, binder‑active material interactions, and mechanical degradation pathways.Secondary analysis drew on patent landscaping, regulatory filings, and company technical disclosures to contextualize innovation trajectories and collaboration networks. Supply chain mapping captured feedstock dependencies, logistics constraints, and potential bottlenecks, while scenario modeling explored responses to policy shifts, tariff regimes, and regional capacity expansions. Throughout, data validation relied on cross‑checking interview insights with laboratory outcomes and documented technical literature. The combination of hands‑on testing, supplier engagement, and scenario analysis ensured that conclusions reflect both laboratory performance and real‑world manufacturing constraints.

Summarizing why binder optimization, supply chain resilience, and integrated R&D are decisive factors for competitive advantage in battery manufacturing

In conclusion, binders are an increasingly strategic component in the battery value chain, with implications that reach far beyond simple adhesion. Advances in polymer chemistry, process engineering, and regulatory pressure are collectively redefining which binder attributes matter most for next‑generation cells. While short‑term disruptions such as tariff policy adjustments can pressure supply chains and procurement models, they also act as catalysts for localization, technical substitution, and deeper supplier‑customer collaboration. Over the medium term, suppliers that can pair robust, factory‑proven binder platforms with comprehensive technical support will enjoy differentiated access to high‑growth applications.Ultimately, successful outcomes will depend on aligning binder selection with electrode architecture, manufacturing process constraints, and end‑market priorities. Companies that adopt a systems view-integrating formulation science, process control, and lifecycle considerations-will be better positioned to deliver durable, high‑performance electrodes while meeting evolving environmental and regulatory expectations. This conclusion underscores that strategic investment in binder R&D, supply chain resilience, and cross‑industry collaboration is essential for those seeking to lead in battery materials and manufacturing innovation.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Binders in Battery Market

Companies Mentioned

The key companies profiled in this Binders in Battery market report include:- APV Engineered Coatings

- Arkema S.A.

- BASF SE

- Chongqing Lihong Fine Chemicals Co.,Ltd

- Daikin Industries, Ltd.

- DIC Group

- Elcan Industries Inc.

- Eneos Corporation

- Fujian Blue Ocean & Black Stone Technology Co.,Ltd.

- Fujifilm Holdings Corporation

- Hansol Chemical

- Industrial Summit Technology Corp

- Kureha Corporation

- LG Chem Ltd.

- Lubrizol Corporation

- MTI Korea Co., Ltd.

- Nanografi Nano Technology

- Resonac Holdings Corporation.

- Solvay S.A

- Sumitomo Seika Chemicals Co., Ltd

- Synthomer PLC

- Targray Technology International Inc.

- Trinseo S.A.

- UBE Corporation

- Zeon Corporation

Table Information

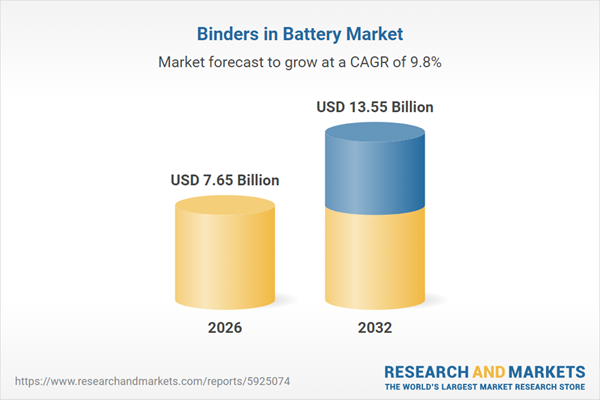

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 7.65 Billion |

| Forecasted Market Value ( USD | $ 13.55 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |