Global Battery Leasing Service Market - Key Trends & Drivers Summarized

What Is Driving the Rise of Battery Leasing Services?

Battery leasing services are emerging as a transformative solution in the transition to a circular economy and sustainable energy ecosystem. These services allow customers, particularly in the automotive and industrial sectors, to access batteries without upfront purchase costs, offering significant flexibility and cost-efficiency. As electric vehicles (EVs) gain widespread traction, leasing batteries rather than owning them mitigates concerns surrounding depreciation, maintenance, and end-of-life management. This model is particularly appealing for fleet operators and businesses seeking to optimize their total cost of ownership (TCO) while leveraging cutting-edge battery technologies. Battery leasing services also align with the global push toward reducing electronic waste, as providers take responsibility for refurbishing, repurposing, or recycling batteries at the end of their lifecycle. By combining financial convenience with sustainability, this model is reshaping how batteries are utilized across industries.How Are Technology and Infrastructure Enhancements Supporting Growth?

Advancements in technology and infrastructure are significantly bolstering the adoption of battery leasing services. Smart battery management systems (BMS) enable real-time monitoring of battery performance, usage patterns, and health, ensuring that leased batteries remain efficient and reliable throughout their lifecycle. Additionally, the integration of IoT and cloud-based platforms allows leasing companies to track and manage fleets of batteries seamlessly, enhancing operational efficiency and customer experience. Infrastructure developments, such as the expansion of EV charging networks and the establishment of battery swapping stations, are making battery leasing more convenient for consumers. Battery-as-a-Service (BaaS) models are particularly prominent in markets like China and India, where dense urban populations and high EV adoption rates demand flexible energy solutions. Furthermore, innovations in battery chemistry, including solid-state and high-energy-density batteries, are enabling providers to offer longer-lasting, safer, and more efficient leasing options, further driving consumer interest.Which Sectors Are Leading the Adoption of Battery Leasing Services?

The battery leasing service market is experiencing significant growth across multiple sectors, with transportation and logistics taking the lead. Electric vehicle manufacturers are partnering with leasing providers to offer customers affordable and flexible access to batteries, reducing barriers to EV adoption. Commercial fleets, including buses, trucks, and ride-hailing services, are embracing battery leasing to lower upfront investment costs and ensure operational flexibility. In the industrial sector, heavy machinery and equipment that rely on battery-powered operations are increasingly turning to leasing models to enhance efficiency and reduce downtime. Renewable energy storage is another key area, where businesses and utilities are leasing batteries to manage peak loads and integrate intermittent energy sources into the grid. The rise of micro-mobility solutions, such as e-scooters and e-bikes, has also contributed to the demand for leasing services, as startups and fleet operators prioritize scalability and cost optimization.What Factors Are Driving Growth in the Battery Leasing Service Market?

The growth in the Battery Leasing Service market is driven by several factors, including the rising adoption of electric vehicles, advancements in battery technologies, and the growing focus on sustainable energy practices. The increasing demand for affordable and flexible energy solutions has positioned leasing as an attractive alternative to ownership, particularly for businesses seeking to minimize capital expenditures. Battery leasing also addresses consumer concerns about battery lifespan, maintenance costs, and technological obsolescence, creating significant opportunities for providers. The expansion of battery swapping infrastructure, particularly in urban areas, has made leasing more convenient and practical for users. Additionally, government incentives and subsidies aimed at accelerating EV adoption and reducing carbon emissions are encouraging the growth of leasing models. The rapid development of Battery-as-a-Service platforms, supported by smart monitoring systems and IoT connectivity, has further streamlined operations and enhanced the value proposition for end-users. Lastly, the rising awareness of circular economy practices and the need for sustainable end-of-life battery management are compelling industries to adopt leasing models that align with long-term environmental goals.Report Scope

The report analyzes the Battery Leasing Service market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Service Type (Subscription Service, Pay-Per-Use Model Service); Battery Type (Lithium-ion Battery, Nickel Metal Hybrid Battery).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Subscription Service segment, which is expected to reach US$337.7 Million by 2030 with a CAGR of a 23.7%. The Pay-Per-Use Model Service segment is also set to grow at 14.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $46.5 Million in 2024, and China, forecasted to grow at an impressive 27.5% CAGR to reach $123.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Battery Leasing Service Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Battery Leasing Service Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Battery Leasing Service Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Battery Leasing Service market report include:

- Contemporary Amperex Technology Co., Ltd. (CATL)

- Gogoro, Inc.

- Gravity Power Solution

- Neuron Energy

- NIO, Inc.

- Numocity Technologies Private Limited

- Oyika

- Sun Mobility Pvt. Ltd.

- Tesla Power India Pvt. Ltd

- ECOBAT BATTERY

- Urja Mobility

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Contemporary Amperex Technology Co., Ltd. (CATL)

- Gogoro, Inc.

- Gravity Power Solution

- Neuron Energy

- NIO, Inc.

- Numocity Technologies Private Limited

- Oyika

- Sun Mobility Pvt. Ltd.

- Tesla Power India Pvt. Ltd

- ECOBAT BATTERY

- Urja Mobility

Table Information

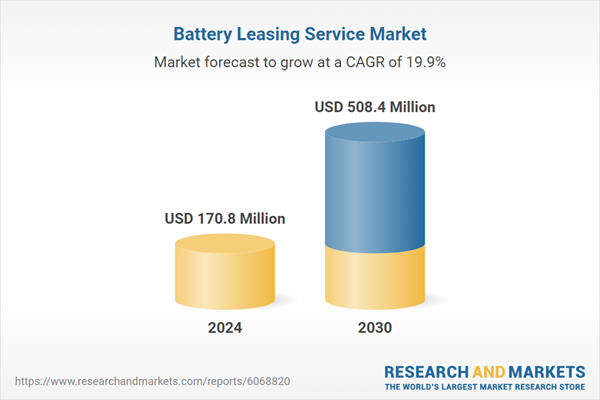

| Report Attribute | Details |

|---|---|

| No. of Pages | 265 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 170.8 Million |

| Forecasted Market Value ( USD | $ 508.4 Million |

| Compound Annual Growth Rate | 19.9% |

| Regions Covered | Global |