Speak directly to the analyst to clarify any post sales queries you may have.

Framing the clinical and operational significance of beating heart stabilizers amid device refinement, surgeon preferences, and procedural efficiency pressures

Beating heart stabilizers occupy a critical niche at the intersection of cardiac surgery innovation and procedural optimization. These devices enable surgeons to perform precise myocardial interventions while the heart remains perfused and beating, reducing ischemic time and expanding procedural options for high-risk patients. Over the past decade, iterative design refinements and material science advances have enhanced device ergonomics and tissue compatibility, enabling more predictable operative handling and improved intraoperative visualization.Clinical stakeholders increasingly appreciate that refined stabilizer geometry and interface mechanics contribute directly to shorter clamp times and fewer rhythm disturbances during procedures. Consequently, adoption patterns now reflect a preference for devices that balance rigid immobilization with minimal myocardial compression. At the same time, hospitals and ambulatory providers are weighing device selection against workflow implications, sterilization protocols, and physician training requirements. Taken together, these factors position beating heart stabilizers not only as a technical tool but as a strategic lever for improving perioperative efficiency, patient safety, and procedural outcomes across diverse cardiac interventions.

How technological integration, materials innovation, and evolving regulatory and procurement expectations are reshaping the beating heart stabilizer landscape

The landscape for beating heart stabilizers is undergoing transformative shifts driven by converging technological, clinical, and regulatory trends. Advancements in imaging integration and real-time feedback systems have allowed stabilizers to function more seamlessly with minimally invasive approaches, blurring traditional distinctions between open and less-invasive cardiac procedures. Concurrently, materials innovation-particularly in biocompatible polymers and low-profile alloys-has reduced device footprint and improved handling characteristics, which supports expanded use in anatomically challenging cases.Regulatory emphasis on device traceability and post-market surveillance is encouraging manufacturers to invest in quality systems and data capture mechanisms that document clinical performance in real-world settings. Payment and procurement strategies are also evolving, with hospital supply chains seeking devices that demonstrate clear workflow benefits and compatibility with value-based care initiatives. As a result, competition is intensifying around differentiated features such as modular designs, sterilization efficiency, and compatibility with robotic or catheter-based adjuncts. These shifts collectively signal a maturation of the segment where innovation success will increasingly hinge on clinical validation, interoperability, and the ability to address provider workflow priorities.

Practical commercial and supply chain adaptations resulting from the United States tariff adjustments in 2025 and their implications for procurement resilience

The introduction and escalation of United States tariffs in 2025 introduced a new dimension of commercial risk for manufacturers and distributors operating across borders. Tariff policy changes have influenced sourcing decisions, prompting suppliers to reassess production footprints and supplier contracts to limit exposure to increased landed costs. In response, many organizations initiated near-term inventory adjustments and renegotiated supply agreements to create more resilient procurement pipelines while keeping clinical continuity intact.Beyond immediate cost implications, tariffs have accelerated strategic moves such as diversifying supplier bases and pursuing localized manufacturing where regulatory and quality frameworks enable feasible scale-up. Companies are also re-evaluating component standardization to reduce the number of tariff-classified parts subject to import duties. In parallel, distributors and hospital procurement teams have increased scrutiny of total cost of ownership and supply chain transparency to mitigate downstream budgetary volatility. These adaptive measures have emphasized operational agility and contractual flexibility as central components of tariff risk management for medical device stakeholders.

Detailed segmentation-driven perspectives revealing how end-user settings, procedural applications, distribution strategies, and device types influence adoption and R&D priorities

Segmentation analysis yields precise insights into how clinical settings, procedural types, distribution models, and device variants shape adoption pathways and commercial focus for beating heart stabilizers. Based on End User, the clinical adoption dynamics differ meaningfully among Ambulatory Surgical Centers, Cardiac Centers, and Hospitals, with each care setting prioritizing device attributes that align with throughput, case complexity, and sterilization workflows. Based on Application, procedural demand patterns vary between Coronary Artery Bypass Grafting and Valve Repair And Replacement, and within valve procedures the specific needs for Aortic Valve Replacement and Mitral Valve Replacement introduce distinct anatomical and access considerations that influence stabilizer geometry and attachment methods. Based on Distribution Channel, procurement strategies diverge between Direct Sales and Distributors, where direct engagement supports bespoke clinical training and configurability while distributor pathways enable broader regional reach and inventory support. Based on Product Type, the technical and clinical differentiation between Apical Stabilizers and Septal Stabilizers drives targeted design priorities; apical devices emphasize placement stability for anterior targets while septal devices prioritize access and maneuverability for interventions near the interventricular septum.Integrating these segmentation dimensions reveals where clinical value aligns with commercial opportunity. For instance, ambulatory settings and hospitals pursuing higher procedural throughput will value designs that shorten setup and turnover times, whereas cardiac centers managing complex valve interventions will demand stabilizers optimized for nuanced anatomic reach. Distribution choices further influence adoption velocity, since direct sales can expedite surgeon training and feedback loops while distributor-led models can scale regional availability more rapidly. Product-level distinctions also guide R&D prioritization, as incremental improvements in attachment mechanisms or interface materials may unlock disproportionate clinical benefit for specific applications.

Region-specific clinical, regulatory, and commercial dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific that dictate tailored market approaches

Regional dynamics shape clinical practice patterns, regulatory expectations, and procurement behavior in ways that materially affect device strategy and commercial planning. In the Americas, procedural pathways and reimbursement frameworks often favor early adoption of innovations that improve perioperative efficiency, with major centers serving as pivotal clinical evaluation sites and influencing broader adoption across hospital networks. In Europe, Middle East & Africa, diverse regulatory landscapes and variable access environments create opportunities for targeted deployments in tertiary cardiac centers alongside phased rollouts into regional hospitals, while collaborations with local partners help navigate regulatory and procurement complexity. In the Asia-Pacific region, rapid capacity expansion in cardiac services, coupled with localized manufacturing capabilities and concentrated training initiatives, is driving interest in devices that offer a balance of cost-effectiveness and clinical robustness.Consequently, commercial models must adapt regionally: tailored clinical evidence packages and localized training programs drive uptake in highly regulated markets, while flexible distribution partnerships and manufacturing alliances accelerate access in growth-oriented settings. Cross-border regulatory harmonization efforts and international post-market data sharing will further influence where and how manufacturers prioritize resource allocation and clinical engagements across these regions.

How technological differentiation, clinical validation, supply chain reliability, and service models determine competitive advantage among beating heart stabilizer manufacturers

Competitive positioning in the beating heart stabilizer space depends on a combination of technological differentiation, clinical evidence, and the strength of commercial and service relationships. Leading companies have prioritized iterative product improvements that address surgeon ergonomics and intraoperative visualization, while investing in clinical studies and registries to demonstrate comparative performance in real-world settings. Strategic partnerships-with specialty distributors, regional training centers, and device platform integrators-have enabled broader clinical validation and faster adoption across complex cardiac programs.In parallel, several organizations have focused on manufacturing excellence and supply chain transparency to provide consistent device availability, especially in environments where inventory buffers are constrained. Service offerings, including structured training curricula, simulation-based onboarding, and rapid-response field support, have become important differentiators that influence hospital procurement committees. Looking ahead, firms that combine strong clinical engagement with modular product roadmaps and flexible commercialization models are likely to sustain competitive advantage as practitioners demand devices that integrate seamlessly into evolving procedural ecosystems.

Practical strategic actions for manufacturers and providers to align product innovation, clinical evidence, and supply chain resilience for scalable adoption

Industry leaders should pursue a balanced strategy that aligns product development with clinical workflows, regulatory realities, and procurement constraints to accelerate sustainable adoption. Prioritize investments in clinical evidence generation that reflect real-world procedural diversity and capture meaningful endpoints related to intraoperative handling and patient safety. Concurrently, design next-generation stabilizers with modular elements that address both apical and septal use cases to reduce SKUs while meeting anatomical requirements.Strengthen regional commercialization by combining direct clinical engagement in key tertiary centers with distributor partnerships that extend geographic reach and inventory support. Enhance supply chain resilience through dual sourcing and by considering targeted local manufacturing where regulatory and cost structures permit. Finally, integrate training and service offerings into commercial contracts to reduce friction during initial deployment and to shorten the path from purchase to routine clinical use. These coordinated actions will help organizations deliver measurable clinical value while managing operational and commercial risk effectively.

Transparent mixed-methods approach combining clinician interviews, regulatory and procedural literature, and scenario-based supply chain analysis to ground conclusions in practice

This research synthesized primary interviews with clinical and procurement stakeholders, secondary literature on device design and regulatory guidance, and structured analysis of procurement practices and supply chain responses. Primary inputs included cardiac surgeons, perfusionists, hospital procurement leaders, and distribution executives who provided qualitative perspectives on clinical performance expectations, training needs, and adoption barriers. Secondary sources encompassed peer-reviewed surgical literature, regulatory agency guidance documents, standards for device traceability, and publicly available clinical registries to ensure triangulation of clinical claims and safety considerations.Analytical methods combined thematic coding of qualitative interviews with scenario-based supply chain analysis to identify stress points under policy and operational changes. Wherever possible, device design claims were validated against clinical procedure descriptions and expert adjudication to ensure practical relevance. The approach emphasized transparency in assumptions, clear traceability of insights to source inputs, and the use of multiple corroborating viewpoints to strengthen confidence in the conclusions presented herein.

Concluding synthesis emphasizing the intersection of innovation, evidence, and supply chain resilience as determinants of long-term impact for beating heart stabilizers

Beating heart stabilizers represent an essential technology class that intersects clinical innovation with operational priorities across diverse cardiac care settings. Advances in integration, materials, and device ergonomics are expanding clinical capabilities while placing a premium on real-world evidence and service models that support rapid, safe adoption. Tariff-related disruptions in 2025 underscored the importance of supply chain flexibility and contractual agility, reinforcing the need for manufacturers and distributors to synchronize procurement strategies with clinical rollout plans.Looking forward, success in this segment will hinge on aligning product roadmaps with nuanced application needs-apical versus septal-and tailoring commercialization strategies by region and care setting. Organizations that combine robust clinical validation, adaptable manufacturing pathways, and comprehensive training and support services will be positioned to meet provider expectations and help improve procedural outcomes. The collective implication is that strategic focus and operational excellence, rather than singular product claims, will determine long-term impact and adoption.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Beating Heart Stabilizers Market

Companies Mentioned

- Abbott Laboratories

- B. Braun Melsungen AG

- Chase Medical

- Cook Medical LLC

- Getinge AB

- Haemonetics Corporation

- HTKD Medical

- Lepu Medical

- LivaNova PLC

- Medtronic plc

- Nipro Corporation

- Scanlan International LLC

- Terumo Corporation

- Visionary Medtech Solutions Pvt. Ltd.

- Wego New Life

Table Information

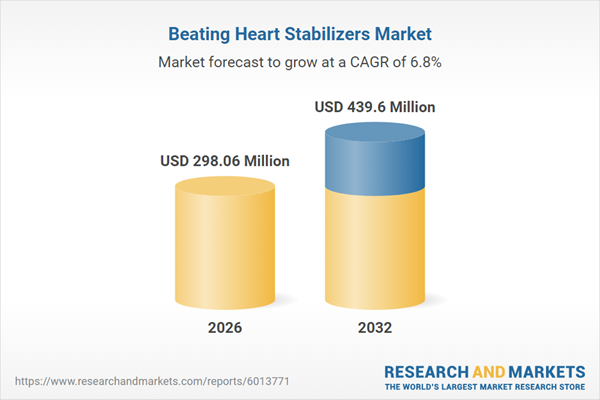

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 298.06 Million |

| Forecasted Market Value ( USD | $ 439.6 Million |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |