Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative introduction connecting enzyme innovation, regulatory dynamics, and commercial strategy to orient executive decision-making in the biocatalysts sector

The following executive summary delivers a strategic synthesis of contemporary dynamics shaping the biocatalysts landscape, designed for leaders who must navigate scientific complexity, regulatory shifts, and evolving commercial models.This introduction frames the critical intersections between enzyme science and industrial application, outlining the factors that define competitive advantage. Technological advances in enzyme engineering and process intensification are reshaping how companies think about formulation, throughput, and lifecycle costs. Meanwhile, heightened regulatory scrutiny in pharmaceutical and food-grade applications increases the premium on traceability and robust supply chain governance. Investors, R&D heads, and commercial strategists require a unified view that translates biochemical attributes into business outcomes.

By situating biocatalysts within the broader transitions in chemical manufacturing, sustainability goals, and digital transformation, this section sets expectations for the deeper analytical chapters that follow. It establishes the analytical lens used throughout: one that balances technical rigor with commercial pragmatism and that privileges actionable insight over descriptive reporting. As a result, readers will be equipped to align innovation priorities with market-facing decisions in research, process design, and go-to-market execution.

A comprehensive examination of the technological, regulatory, and business model shifts that are industrializing enzyme use and accelerating strategic partnerships across sectors

The biocatalysts sector is undergoing transformative shifts driven by converging technological and market forces that are redefining value creation across the product lifecycle.On the technology front, advances in protein engineering, directed evolution, and computational design are enabling more robust enzymes that operate under broader process conditions and deliver higher selectivity. These capabilities reduce downstream purification burdens and unlock new chemistries for chemical synthesis and specialty applications. Concurrently, process innovations such as continuous flow manufacturing are being paired with immobilized enzyme systems to improve productivity and lower operational variability. These developments are complemented by digital tools for process monitoring and predictive maintenance, which enhance yield consistency and reduce time-to-market.

Strategically, sustainability imperatives and regulatory drivers are elevating enzymes as preferred alternatives to traditional chemical catalysts. Industrial users are prioritizing green chemistry pathways that reduce hazardous byproducts, energy consumption, and waste streams. As a consequence, partnerships between enzyme innovators and end users are shifting from transactional supply relationships to co-development models that embed biocatalysts into product design. This collaborative orientation accelerates application-specific optimization and shortens adoption cycles.

Finally, business models are adapting to reflect the complexity of delivering enzymatic solutions at scale. Licensing arrangements, performance-based contracts, and integrated service offerings are emerging to de-risk adoption for end users and create recurring revenue streams for technology owners. Taken together, these shifts indicate a sector moving from niche, laboratory-driven innovation to industrialized, partner-centric deployment.

A strategic analysis of how 2025 tariff changes in the United States are reshaping sourcing, processing efficiency, and regional manufacturing decisions across the enzyme value chain

Tariff policy developments in the United States during 2025 introduce a material layer of complexity for supply chain planning and cost engineering in the biocatalysts ecosystem.Higher tariffs on imported raw materials and intermediate biological reagents can increase the landed cost of enzyme manufacturing when components are sourced internationally, prompting manufacturers to reconsider sourcing strategies and inventory policies. In response, some organizations are evaluating nearshoring options, expanding domestic supplier networks, and investing in backward integration for critical inputs to preserve margin and continuity of supply. These moves often require capital and operational adjustments but can reduce exposure to trade volatility.

Additionally, tariff-induced cost pressure accelerates the incentive to optimize processes for greater material efficiency. Continuous processing and enzyme immobilization strategies can provide resilience by lowering unit input requirements and reducing waste, thereby mitigating the impact of higher input tariffs. Parallel to operational responses, procurement and commercial teams are renegotiating contracts to include tariff pass-through clauses and hedging mechanisms where feasible.

From a strategic perspective, tariff dynamics also influence localization decisions in final assembly and formulation. Regional manufacturing footprints become more attractive as a means to serve key markets with lower trade friction, while also enabling closer collaboration with customers on regulatory compliance and product customization. Overall, the cumulative impact of tariff changes in 2025 underscores the importance of supply chain agility, supplier diversification, and process innovation to preserve competitiveness.

Key segmentation insights that connect source, process, form, grade, channel, enzyme type, and application considerations to prioritize R&D and commercial deployment strategies

Segmentation analysis reveals differentiated strategic priorities across source, process, form, grade, distribution channel, type, and application dimensions that inform targeted product development and commercialization strategies.Based on Source, enzymatic offerings span Animal, Microbial, Plant, and Recombinant origins, each presenting distinct implications for scalability, purity profiles, and regulatory acceptance. Animal-derived enzymes often face tighter scrutiny in food and pharmaceutical applications, while microbial and recombinant sources are frequently favored for their consistency and ease of scale-up. Plant-based enzymes can offer cost advantages for certain industrial applications but may require unique extraction and stabilization approaches.

Based on Process, operator choices between Batch and Continuous modes affect how formulations are engineered and how performance is validated. Continuous processes align well with immobilized enzyme systems to deliver steady-state productivity and reduced footprint, whereas batch processes retain advantages for flexible, low-volume specialty production and rapid product changeovers.

Based on Form, the market is characterized by Immobilized and Liquid enzyme presentations, each shaping logistics and application design. Immobilized forms facilitate reuse, enhanced stability, and simplified downstream separation, which is especially attractive for high-value chemical synthesis. Liquid enzymes provide formulation flexibility and are often easier to dose in applications such as food and detergents, though they may require cold chain management.

Based on Grade, differentiation across Food, Industrial, and Pharmaceutical grades defines purity, documentation, and quality management systems. Pharmaceutical-grade enzymes demand the highest levels of traceability and validation, while industrial grades tolerate broader impurity profiles but require robust performance under harsh process conditions. Food-grade enzymes balance regulatory compliance with sensory and safety considerations.

Based on Distribution Channel, engagement models include Direct Sales, Distributors, and Online Sales, each dictating partner capabilities and margin structures. Direct sales enable deep technical collaboration and custom development, distributors offer market reach and localized logistics, and online channels are increasingly important for smaller-scale purchases and rapid replenishment.

Based on Type, enzyme classes such as Carbohydrase, Lipase, Polymerase and Nuclease, and Protease have unique application footprints and R&D trajectories. Carbohydrases and lipases are central to food and detergent applications, polymerases and nucleases are critical for molecular biology and diagnostics, and proteases span diverse uses from leather processing to pharmaceuticals.

Based on Application, end markets include Animal Feed, Biofuel, Chemical Synthesis, Detergent, Food & Beverage, Leather, Paper & Pulp, Pharmaceutical, and Textile, each imposing specific performance criteria and regulatory constraints. For example, biofuel and chemical synthesis prioritize catalytic efficiency and operating stability, while food and pharmaceutical applications prioritize safety, sensory neutrality, and regulatory documentation. Integrating these segmentation lenses supports portfolio prioritization, enabling firms to allocate R&D and commercial resources where technical differentiation aligns with market demand.

Regional intelligence detailing how Americas, Europe Middle East & Africa, and Asia-Pacific dynamics influence investment, regulatory strategy, and manufacturing localization decisions

Regional dynamics shape how companies prioritize investment, partnerships, and regulatory engagement in the biocatalysts domain, with distinct opportunity sets in the Americas, Europe, Middle East & Africa, and Asia-Pacific.In the Americas, the market environment favors rapid commercialization of enzyme-enabled solutions due to strong industrial biotech ecosystems, established regulatory pathways for food and pharmaceutical products, and significant demand from biofuel and specialty chemical producers. Industry players here often focus on scaling and integrating continuous production capabilities and building supplier networks that support high-service expectations.

Europe, Middle East & Africa presents a heterogeneous landscape where regulatory rigor and sustainability mandates drive innovation. In parts of Europe, stringent environmental regulations and an emphasis on circular economy principles are incentivizing the adoption of enzymatic processes that reduce waste and energy consumption. In the Middle East & Africa, strategic investments in industrial modernization and petrochemical diversification create pockets of demand for industrial enzymes, while regulatory environments vary significantly across jurisdictions.

Asia-Pacific stands out for its manufacturing scale, cost-competitive supply chains, and rapidly growing demand across food & beverage, textiles, and animal feed segments. The region is also a hotspot for enzyme manufacturing capacity expansion and recombinant enzyme development, driven by strong academic-industry collaboration and supportive government initiatives. However, diverse regulatory regimes and varying quality expectations require careful market-specific strategies for export and local partnership.

Across all regions, localization of regulatory compliance, supply continuity, and customer support remains critical. Companies seeking to grow globally must balance global platform capabilities with regionally tailored product and service offerings to meet differing technical preferences and regulatory requirements.

A focused analysis of competitive positioning showing how scientific platforms, manufacturing scale, and integrated service offerings drive market differentiation and partnership value

Competitive dynamics in the biocatalysts sector are shaped by a blend of scientific capability, application expertise, and go-to-market execution, with companies differentiating through proprietary enzyme platforms, integrated service models, and strategic partnerships.Leading technology owners invest heavily in protein engineering and high-throughput screening to expand substrate scope and thermal stability. These capabilities underpin licensing relationships and co-development projects with end users in pharmaceutical synthesis and specialty chemicals. Companies that couple technical depth with strong process engineering teams are able to move solutions from bench-scale proof-of-concept to validated production faster, shortening commercialization cycles.

Service-oriented players are building value by offering formulation expertise, immobilization technologies, and in-plant support that reduce adoption friction for customers. Distribution partners with deep market networks provide crucial access to localized customers and deliver logistical capabilities that support cold chain and regulatory documentation needs. Cross-sector collaborations between enzyme developers and industrial end users-especially in sectors like food, detergents, and bio-based chemicals-are increasingly common, as they align product specifications with process constraints and performance metrics.

Strategically, successful companies are those that manage intellectual property prudently, prioritize scalable manufacturing, and invest in regulatory and quality systems appropriate to their target grades. Firms that demonstrate transparent supply chain practices and can provide robust technical support to customers gain a sustained competitive edge in markets where reliability and traceability matter.

Actionable recommendations for leaders to accelerate adoption, reduce supply risk, and align manufacturing and commercial models with enzyme-driven value propositions

Industry leaders must adopt a pragmatic set of actions that accelerate adoption, secure supply reliability, and extract strategic value from enzyme technologies.First, invest in modular manufacturing and process intensification to enable flexible production capable of supporting both batch and continuous operations. Such investments reduce time-to-changeover and allow companies to serve diverse application requirements without excessive capital lock-up. Concurrently, prioritize enzyme formats that match customer needs: immobilized systems for high-value, continuous applications, and liquid formulations where dosing flexibility and rapid deployment are key.

Second, strengthen supplier diversification and nearshoring options to mitigate tariff and geopolitical risk. Establishing qualified alternative suppliers for critical raw materials and building inventory strategies tied to lead-time variability will reduce operational stress during global disruptions. Additionally, pursue strategic partnerships with end users to co-develop solutions that embed enzymes into product design, thereby aligning incentives and accelerating commercialization.

Third, enhance regulatory and quality capabilities tailored to different grade requirements. Implement robust traceability systems and validation protocols to support food and pharmaceutical applications, while maintaining cost-effective quality approaches for industrial grades. Investing in these capabilities not only reduces compliance risk but also becomes a commercial differentiator.

Fourth, build commercial models that reflect the complexity of enzyme adoption. Consider performance-based contracts, integrated service offerings, and hybrid channel strategies that combine direct technical sales with distributor reach and online access for smaller transactions. Finally, allocate R&D resources to enzyme classes and applications that align with strategic priorities, concentrating on those types and end uses where enzyme properties deliver the clearest technical and economic advantages.

A transparent methodology combining stakeholder interviews, technical literature review, and cross-sectional segmentation analysis to validate strategic findings and recommendations

The research methodology underpinning this analysis combined qualitative and quantitative approaches to ensure robustness, relevance, and practical applicability.Primary research included structured interviews with technical leaders in enzyme development, process engineers from industrial users, procurement executives, and regulatory specialists. These conversations provided first-hand perspectives on operational constraints, validation hurdles, and decision criteria for enzyme selection. Secondary research encompassed peer-reviewed literature, patent filings, regulatory guidance documents, and company disclosures to triangulate technological trends and quality expectations. Where appropriate, case studies of recent industrial implementations were reviewed to distill best practices and common pitfalls.

Cross-sectional analysis integrated segmentation lenses-source, process, form, grade, distribution channel, enzyme type, and application-to identify where technical differentiation intersects with commercial opportunity. Regional analyses drew on trade data, regulatory frameworks, and localized industry structures to inform recommendations on manufacturing footprint and market entry. Throughout, findings were validated through iterative stakeholder feedback to ensure practical relevance and to refine the strategic implications for manufacturers, customers, and investors.

A concise conclusion that synthesizes strategic imperatives around capability investment, process choices, and supply resilience to convert scientific advances into commercial success

In conclusion, the biocatalysts landscape is at an inflection point where scientific progress, process innovation, and evolving commercial models converge to create durable competitive advantages for those who act decisively.Organizations that invest in enzyme engineering, scale-appropriate manufacturing, and regulatory excellence will be well positioned to meet the diverse requirements of food, industrial, and pharmaceutical customers. Process choices between batch and continuous operation, and the selection of immobilized versus liquid forms, will materially influence cost structures and application fit. Moreover, tariff dynamics and regional regulatory variability underscore the need for supply chain flexibility and localized engagement.

Finally, the firms that succeed will be those that translate technical capability into value for customers through integrated offerings, performance-based relationships, and strategic partnerships. By aligning R&D priorities with clear application needs, and by operationalizing resilience in sourcing and manufacturing, industry participants can convert emerging opportunities into sustainable growth.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

19. China Biocatalysts Market

Companies Mentioned

- AB Enzymes GmbH

- Advanced Enzyme Technologies Ltd.

- Amano Enzyme Inc.

- BLD Pharmatech Ltd.

- Buchler GmbH

- Cambrex Corporation

- Chiral Chemicals

- ChiroBlock GmbH

- Chr. Hansen Holding A/S

- Codexis, Inc.

- DuPont de Nemours, Inc.

- Dyadic International, Inc.

- Koninklijke DSM N.V.

- Novozymes A/S

- Specialty Enzymes & Biotechnologies Ltd.

Table Information

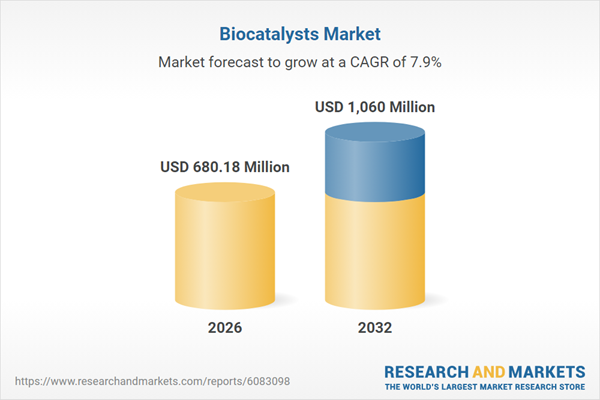

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 680.18 Million |

| Forecasted Market Value ( USD | $ 1060 Million |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |