Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative introduction clarifying why enzyme innovation and deployment are decisive levers for scaling diverse biofuel production pathways and meeting sustainability goals

The biofuel enzymes sector is at a strategic inflection point where advances in enzyme engineering, process intensification, and feedstock diversification are converging to redefine how renewable fuels are produced and scaled. Enzymes now underpin critical steps across multiple biofuel pathways, from starch saccharification and lignocellulosic deconstruction to lipid pretreatment for sustainable aviation fuel. Their catalytic specificity and operational robustness determine not only biochemical yields but also the economic and environmental profiles of biofuel production. As such, enzyme science and commercial enzyme deployment are central to meeting evolving regulatory requirements, lifecycle carbon targets, and airline and transportation sector decarbonization commitments.Recent innovations in protein engineering, directed evolution, and high-throughput screening have accelerated the creation of enzyme variants with enhanced activity at industrial conditions, broader substrate tolerance, and improved inhibitor resistance. These technological shifts are complemented by process innovations such as immobilization, enzyme recycling, and co-product valorization, which together reduce enzyme loading and improve overall process economics. Concurrently, closer integration between enzyme developers, feedstock suppliers, and fuel producers is fostering more application-driven enzyme design, shortening development timelines and improving scalability pathways.

This introduction frames the subsequent sections by highlighting the technical drivers, commercial dynamics, and regulatory context that shape enzyme demand and adoption across fuel ethanol, biodiesel, biogas, renewable diesel, and sustainable aviation fuel routes. It sets the stage for an examination of transformative industry shifts, tariff impacts, segmentation insights, regional dynamics, competitive moves, and practical recommendations that executives and technical leaders need to navigate the coming years.

How converging advances in enzyme engineering, digital discovery platforms, and industry collaboration are reshaping commercial biofuel production pathways

The landscape for biofuel enzymes is experiencing transformative shifts driven by technological maturation, policy realignment, and evolving feedstock economics. First, enzyme technology has moved beyond incremental improvements to platform-level capabilities that enable meaningful process redesigns. Protein engineering techniques such as machine learning-guided design and continuous evolution approaches are producing variants that operate efficiently under harsh industrial conditions, tolerate common inhibitors found in pretreated biomass, and enable reduced enzyme dosages. As a result, process engineers can re-evaluate unit operations, consolidate steps, and lower operational complexity while preserving or improving yields.Second, the convergence of digital tools with laboratory automation and analytical advances is compressing discovery cycles and enabling earlier demonstration of commercial viability. Automated screening and predictive models are guiding the selection of enzyme families for particular feedstocks and pretreatment regimes, thereby reducing scale-up uncertainty. In parallel, advances in formulation science, including immobilization strategies and stable liquid concentrates, are improving storage, handling, and continuous processing compatibility, which encourages adoption in large-scale facilities.

Third, broader energy system shifts are changing demand signals for specific enzyme functionalities. Growth in sustainable aviation fuel and renewable diesel projects, along with a renewed focus on cellulosic ethanol and waste-to-fuel pathways, has diversified enzyme application requirements. Enzyme providers are therefore prioritizing modular solutions that can be adapted across biobutanol, biogas, and hydrogen co-processing contexts. Finally, public-private collaborations and industrial consortia are accelerating precompetitive research and shared infrastructure investments, lowering barriers for smaller enzyme developers and facilitating cross-sector technology transfer. These combined shifts are not only reshaping product roadmaps but also influencing partnership structures, procurement strategies, and capital allocation across the value chain.

The cumulative commercial and supply chain consequences of trade measures introduced in 2025 and how they have reshaped enzyme sourcing and domestic production priorities

The introduction of tariffs and trade measures in 2025 has had a material effect on supply chains and cost structures for biofuel enzymes, particularly for manufacturers and producers that rely on cross-border sourcing of raw materials, enzyme preparations, and specialty reagents. Tariff frameworks increased landed costs for a range of inputs, prompting buyers to reassess supplier portfolios and to accelerate localization strategies where feasible. Firms that sourced enzyme formulations, carrier materials, or precursors from regions subject to duties experienced compressed margins and were compelled to either renegotiate contracts or pass through costs to downstream consumers.Heightened trade barriers also amplified the strategic value of domestic enzyme production capabilities. Companies with in-country fermentation capacity and downstream formulation assets were able to mitigate tariff exposures, offering customers more stable pricing and shorter lead times. This capacity premium translated into strengthened procurement preferences for vertically integrated suppliers and prompted several industrial players to evaluate nearshoring for both raw materials and finished enzyme products. In parallel, intellectual property and technology transfer arrangements gained prominence as partners sought to replicate successful enzyme platforms within tariff-safe jurisdictions.

Operationally, tariffs influenced inventory strategies and working capital management. Producers extended safety stocks to buffer against supply disruptions and reconfigured logistics to favor suppliers in unaffected trade corridors, increasing transportation complexity but reducing exposure to sudden duty escalations. From an R&D perspective, the tariffs accelerated interest in enzyme solutions that reduce dependency on imported chemicals or carriers, as well as formulations optimized for locally abundant feedstocks. While the cumulative impacts varied by company scale and geographic footprint, the overarching effect was to spur structural adjustments across procurement, manufacturing footprint planning, and collaboration models within the biofuel enzyme ecosystem.

Comprehensive segmentation analysis linking enzyme families, formulations, origins, grades, and biofuel pathways to practical technology and procurement choices

Segmentation insight across enzyme type reveals differentiated technical and commercial priorities for amylases, cellulases, lipases, proteases, and xylanases. Within amylases, the split between alpha-amylases and beta-amylases creates distinct process roles; alpha-amylases are often prioritized for rapid starch liquefaction under high-temperature conditions, while beta-amylases contribute to targeted saccharification profiles that influence downstream fermentation kinetics. Cellulase families, including beta-glucosidases, endoglucanases, and exoglucanases, are frequently optimized as consortia to address the complex architecture of lignocellulosic biomass and to overcome product inhibition during saccharification. Lipases and proteases similarly occupy specialized niches, with lipases central to transesterification and pretreatment approaches for lipid-rich feedstocks, and proteases supporting process conditioning and co-product valorization in multiproduct biorefineries.Grade differentiation between industrial-grade and research-grade enzymes shapes procurement and application pathways. Industrial-grade enzymes are engineered for robustness, cost efficiency, and regulatory compliance at scale, driving adoption in continuous operations and commercial plants. Research-grade enzymes continue to play a critical role in process development and early-stage demonstrations, enabling iterative optimization before scale-up decisions. Biofuel type segmentation highlights the distinct enzyme functionality requirements across biobutanol, biodiesel, biogas, fuel ethanol, renewable diesel/HVO, and sustainable aviation fuel. Within fuel ethanol, the distinctions between cellulosic ethanol and conventional ethanol change enzyme selection criteria, with cellulosic routes demanding more intensive cellulase cocktails and inhibitors-tolerant variants. Sustainable aviation fuel pathways introduce further specificity; the alcohol-to-jet route emphasizes alcohol-compatible pretreatment and catalytic compatibility, while lipid-to-jet pretreatment calls for lipid-active enzymes and degumming strategies.

Formulation considerations-dry, immobilized, and liquid-affect logistics and process integration. Dry formulations, whether granular or powder, offer advantages in storage and dosing for batch or semi-batch operations. Immobilized formats, including carrier-bound systems and cross-linked enzyme aggregates, enable reuse and continuous processing but require upfront process integration. Liquid concentrates and ready-to-use liquids simplify dosing and support immediate process deployment, often preferred in retrofit scenarios. Enzyme origin is another core segmentation axis; microbial sources dominate, with bacterial, fungal, and yeast origins yielding distinct performance profiles. Bacterial genera such as Bacillus and Clostridium are prized for industrial robustness, fungal sources like Aspergillus and Trichoderma provide potent lignocellulolytic activities, and yeast hosts such as Pichia and Saccharomyces are leveraged for heterologous expression and secretion efficiency. Finally, application area segmentation frames end-user priorities across biodiesel production, bioethanol production, cellulosic ethanol, lignocellulosic ethanol, and starch-based ethanol, each pathway imposing unique enzyme performance, formulation, and supply chain requirements. Together, these segmentation dimensions inform product roadmaps, commercialization strategies, and partnership models for enzyme developers and end users alike.

Regional dynamics and policy-driven priorities across the Americas, Europe Middle East & Africa, and Asia-Pacific that are directing enzyme selection and manufacturing strategies

Regional dynamics are shaping enzyme demand and deployment patterns in ways that reflect policy, feedstock availability, and industrial capacity. In the Americas, a combination of established starch-to-ethanol infrastructure, growing renewable diesel projects, and increasing investment in cellulosic pathways creates diverse use cases for enzyme technologies. Producers and technology providers in this region often emphasize scale-up readiness, supply chain resilience, and compatibility with large-volume continuous operations. North American and South American feedstock profiles differ substantially; for example, sugarcane-rich geographies prioritize enzymes tailored to sucrose and bagasse-derived streams, while corn-dominant areas focus on starch hydrolysis and high-throughput amylase solutions.In Europe, the Middle East & Africa, policy-driven mandates, and sustainability criteria have heightened interest in low-carbon fuels and lifecycle optimization. European markets are notable for stringent sustainability reporting and a preference for feedstock-agnostic enzyme solutions that support circularity and waste-to-fuel initiatives. Regulatory drivers in this region favor advanced biofuels and create opportunities for enzymes that enable cellulosic and waste-based conversions. In the Middle East and Africa, feedstock constraints and water considerations influence enzyme selection toward processes with reduced water intensity and resilience to local conditions.

Asia-Pacific exhibits a rapidly evolving landscape characterized by large-scale refining capacity, substantial investments in renewable diesel and SAF, and a growing emphasis on localized enzyme production to minimize import dependence. Countries in this region are investing in both conventional ethanol and advanced biofuel projects, necessitating a range of enzyme solutions from robust industrial-grade formulations to specialized cellulase cocktails for diverse lignocellulosic feedstocks. Across all regions, localization of manufacturing, strategic partnerships between enzyme providers and fuel producers, and the development of application-specific formulations are recurring themes that guide procurement and adoption decisions.

Competitive landscape analysis revealing how collaboration, licensing, and targeted innovation are accelerating commercialization across biofuel enzyme segments

Competitive insights point to a landscape where a mixture of multinational enzyme producers, specialized biotech firms, and emerging technology startups are pursuing complementary strategies to capture opportunity in biofuel applications. Larger industrial biotech and enzyme companies are leveraging their fermentation and formulation scale to supply high-volume industrial-grade enzymes, focusing on cost reduction, distribution reach, and regulatory compliance. These established players increasingly emphasize tailor-made formulations for major fuel producers, invest in process partnership pilots, and pursue licensing models that accelerate adoption without requiring full vertical integration by fuel companies.Conversely, smaller biotechnology firms and academic spinouts are concentrating on high-value innovation niches: novel cellulase consortia optimized for recalcitrant biomass, thermostable lipases for lipid pretreatment, and enzyme variants engineered for inhibitor resistance. These innovators often progress through collaborative pilots with end users, contract development partnerships, or selective licensing agreements while preserving core intellectual property for breakout applications. Strategic alliances between enzyme developers and chemical or catalyst providers are also becoming more common, particularly where hybrid biochemical-thermochemical routes or co-processing with existing refining assets is the commercial objective.

Investment patterns indicate that companies with modular, application-focused go-to-market strategies are more agile in responding to new feedstock opportunities and regulatory shifts. At the same time, partnerships that bridge R&D capabilities with downstream engineering and offtake relationships have proven effective for de-risking commercialization. Mergers and acquisitions continue to be used selectively to acquire unique enzyme platforms or to expand formulation capabilities, while joint ventures and consortia reduce the burden of scale-up capital for pioneering pathways. For industry stakeholders, monitoring these competitive dynamics is essential to inform sourcing, partnership selection, and internal capability development.

Actionable recommendations for executives to align enzyme R&D, procurement, and process integration with resilience and sustainability objectives

Industry leaders should pursue a coordinated strategy that aligns technology development, procurement, and process design to capture near-term efficiency gains and secure medium-term strategic advantage. First, prioritize investment in enzyme variants and formulations that reduce total enzyme loading and increase tolerance to inhibitors commonly generated by pretreatment steps. Such technology choices lower operating expenditure and provide robustness across feedstock variability, improving plant uptime and yield consistency. Second, strengthen supply chain resilience by developing dual-sourcing strategies and exploring localized production or toll manufacturing relationships to mitigate tariff exposures and logistics disruptions.Third, embed open innovation mechanisms and precompetitive consortia participation into R&D planning to accelerate access to emerging enzyme platforms without shouldering the full cost of early-stage development. Collaborative pilots with technology providers and end users can shorten validation cycles and build shared process knowledge. Fourth, align procurement and R&D through structured technical acceptance criteria, trials, and staged adoption roadmaps that allow for gradual scale-up while retaining contractual flexibility. Fifth, examine process redesign opportunities that leverage immobilized enzymes or continuous processing to reduce downstream separation costs and enable enzyme recycling, thereby improving lifecycle economics.

Finally, incorporate lifecycle assessment and carbon accounting into enzyme selection criteria to ensure alignment with evolving regulatory frameworks and corporate sustainability targets. Transparent environmental metrics and third-party verification will increasingly influence offtake agreements and financing decisions. By combining targeted technology bets with pragmatic supply chain planning and collaborative development models, industry leaders can lower risk while positioning for scalable and sustainable biofuel production.

A transparent and multi-dimensional research methodology combining literature review, stakeholder interviews, patent analysis, and practical case study synthesis

The research methodology underpinning this analysis synthesized technical literature, industry announcements, regulatory developments, and primary stakeholder interviews to produce a rigorous and application-focused perspective. Literature review encompassed peer-reviewed enzymology research, process engineering studies, and publicly available technical white papers to capture the state of enzyme science and process integration approaches. Patent and intellectual property trends were examined to identify innovation trajectories and emerging platform technologies that affect enzyme performance and manufacturability.Primary data collection included structured interviews with technical leaders at fuel producers, enzyme developers, and engineering firms, along with discussions with procurement and sustainability specialists to capture real-world constraints and adoption drivers. These engagements were supplemented by case studies of pilot and demonstration projects that provided insights into scale-up challenges, formulation performance, and operational best practices. Trade policy and tariff impacts were analyzed through review of regulatory texts, trade notices, and logistics reports, with attention to how changes in duty structures influence sourcing decisions and manufacturing footprints.

Analytical synthesis integrated qualitative insights with comparative technology assessment frameworks, focusing on enzyme performance metrics, process compatibility, and supply chain considerations. Scenarios and sensitivity analyses were used qualitatively to explore how changes in feedstock mix, formulation strategy, or tariff exposure could influence strategic choices. Throughout the methodology, emphasis was placed on cross-validating claims via multiple sources to ensure robustness and to highlight practical implications for corporate decision-makers engaged in enzyme selection, partnership formation, and capital planning.

A decisive synthesis emphasizing why integrated enzyme strategies combining technical, supply chain, and sustainability planning are essential for biofuel commercialization

In conclusion, enzymes are central to the commercial viability and sustainability performance of diverse biofuel pathways. Advances in enzyme engineering, formulation science, and digital discovery have collectively reduced technical barriers and opened new routes to valorize nontraditional feedstocks, enabling more resilient and circular fuel production models. Trade policy shifts and tariff implementation in 2025 accelerated strategic moves toward localization and supply chain diversification, underscoring the importance of manufacturing flexibility and contractual innovation. Segmentation across enzyme type, grade, biofuel pathway, formulation, origin, and application area reveals a nuanced landscape in which product design must be closely matched to process requirements and regional ecosystem constraints.For decision-makers, the imperative is to invest in enzyme solutions that combine technical robustness with supply chain resilience while pursuing collaborative development models that de-risk scale-up. Companies that integrate lifecycle assessment into selection criteria and that foster partnerships across the value chain will be better positioned to meet regulatory expectations and offtake requirements. As the industry matures, the most successful organizations will balance targeted internal capability building with strategic external partnerships, leveraging both to accelerate the transition from pilot demonstrations to commercial operations. This conclusion reinforces the need for integrated strategies that connect enzyme innovation, process engineering, procurement, and sustainability to realize the full potential of biofuels.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Biofuel Enzymes Market

Companies Mentioned

The key companies profiled in this Biofuel Enzymes market report include:- Advanced Enzyme Technologies

- Amano Enzyme Inc.

- Antozyme Biotech Pvt. Ltd.

- Bestzyme Bio-Engineering Co., Ltd.

- Biolaxi Corporation

- Creative Enzymes

- DUPONT DE NEMOURS, INC.

- Dymatic Chemicals, Inc.

- Enzyme Bioscience Pvt. Ltd.

- Fengchen Group Co.,Ltd.

- Genencor International, Inc.

- HUNAN LERKAM BIOLOGY CORP.,LTD.

- Iogen Corporation

- Jiangsu Yiming Biological Technology Co., Ltd.

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Lallemand Inc.

- Longchang chemical Co., Ltd.

- Merck KGaA

- Mianyang Habio Bioengineering Co., Ltd.

- NOOR ENZYMES (DWC) LLC

- Novo Holdings A/S

- Prozomix Limited

- Sekisui Diagnostics Group

- The Archer-Daniels-Midland Company

- VTR Bio-Tech Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

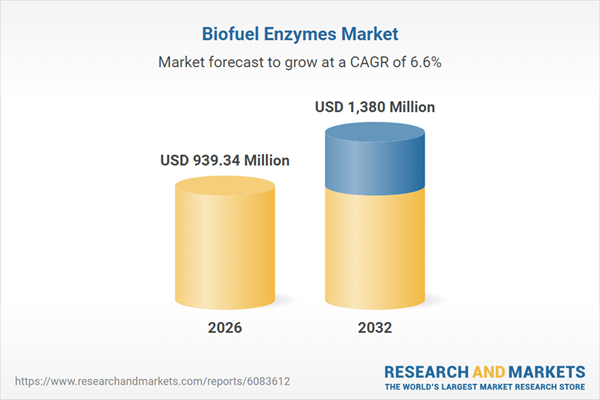

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 939.34 Million |

| Forecasted Market Value ( USD | $ 1380 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |