Bioplastics packaging refers to the use of bioplastics, which are derived from renewable biological sources, in the production of various types of packaging materials. Bioplastics are an alternative to conventional plastics that are typically made from fossil fuels. The goal of bioplastics packaging is to provide a more environmentally friendly and sustainable solution to the challenges posed by traditional plastic packaging, which contributes to plastic pollution and has a significant carbon footprint. Bioplastics can be used to produce a wide range of packaging materials, including flexible films, rigid containers, bags, wraps, trays, and more. They can be adapted to various packaging applications, making them versatile alternatives to traditional plastics.

The paramount driver of the bioplastics packaging market is the urgent need to address the environmental impact of traditional plastics. Bioplastics, derived from renewable sources, have a lower carbon footprint and are designed to be biodegradable or compostable, reducing the negative environmental consequences associated with conventional plastics. Moreover, governments and regulatory bodies across the world are implementing measures to reduce plastic waste and encourage the adoption of more sustainable packaging options. Regulations banning or restricting single-use plastics and promoting the use of eco-friendly materials are driving businesses to explore bioplastics as an alternative solution. Besides, many companies are setting ambitious sustainability goals and adopting eco-friendly practices. Bioplastics align with these goals, allowing businesses to demonstrate their commitment to environmental responsibility through their packaging choices. The integration of bioplastics into packaging strategies also helps enhance brand image and consumer loyalty, thus propelling the market.

Bioplastics Packaging Market Trends/Drivers:

Increasing demand for eco-friendly and sustainable packaging solutions

The integration of artificial intelligence (AI) and automation into bioplastics packaging systems is revolutionizing the way visual data is analyzed and utilized. AI-powered algorithms can swiftly process vast amounts of high-speed visual data, extracting meaningful insights and patterns that were once labor-intensive and time-consuming to obtain. This integration enables real-time decision-making based on actionable information, minimizing the need for manual intervention and reducing operational costs. Businesses can identify anomalies, predict potential issues, and optimize processes with greater efficiency, enhancing overall productivity. Additionally, AI-driven automation extends the utility of bioplastics packagings beyond mere data capture, transforming them into proactive tools that contribute to streamlined operations and improved product quality. As industries across sectors seek to embrace the benefits of AI and automation, the demand for bioplastics packagings equipped with these capabilities is expected to rise significantly.Implementation of favorable government initiatives

Governments worldwide are enacting regulations that target single-use plastics, which constitute a significant portion of plastic waste. Bans or restrictions on items like plastic bags, straws, and utensils have spurred the exploration of bioplastics as a viable replacement. Moreover, government initiatives often provide incentives for the use of biodegradable and compostable materials in packaging. These materials align with circular economy principles and waste reduction strategies. Besides, these agencies allocate funding for research and development of sustainable materials, including bioplastics. This support accelerates technological advancements, leading to the creation of more efficient, cost-effective, and versatile bioplastics suitable for various packaging applications.Development of new and advanced bioplastics

Newly developed bioplastics are designed to offer enhanced functionality and performance compared to their predecessors. Innovations in material science have led to bioplastics with improved mechanical strength, durability, and heat resistance. These advancements make them suitable for a wider range of packaging applications, including items that require protection from external factors, such as moisture and oxygen. As bioplastics become more versatile, businesses are increasingly incorporating them into packaging solutions for various industries. Besides, the development of advanced bioplastics allows manufacturers to tailor materials to specific packaging needs. Whether it's flexible films, rigid containers, or specialized shapes, bioplastics can now be customized to meet the requirements of diverse products. This flexibility enables businesses to replace conventional plastics with bioplastics without compromising on packaging aesthetics or functionality.Bioplastics Packaging Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global bioplastics packaging market report, along with forecasts at the global, regional and country levels for 2025-2033. The report categorizes the market based on product type, packaging type, and end user.Breakup by Product Type:

- PLA

- TPS

- PHA

- Bio-PE

- Bio-PA

- Bio-PET

- Bio-PP

- Others

PLA represents the leading product type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes PLA, TPS, PHA, bio-PE, bio-PA, bio-PET, bio-PP, and others. According to the report, PLA accounted for the largest market share.PLA is derived from renewable resources, primarily cornstarch or sugarcane, making it an attractive choice for environmentally conscious consumers and businesses. Its bio-based origins contribute to reducing reliance on fossil fuels, aligning with the global push for sustainability and reduced carbon emissions. Moreover, advancements in PLA technology have led to improved material properties, including enhanced strength, heat resistance, and barrier capabilities. These enhancements address previous concerns about PLA's limitations and broaden its potential applications, making it suitable for a variety of packaging requirements. Besides, PLA has a transparent appearance that resembles traditional plastics, which is appealing to both consumers and businesses. Brands often choose PLA packaging to showcase their products' contents, enhancing the consumer's visual experience and allowing for easy identification of the packaged items.

Breakup by Packaging Type:

- Flexible Plastic Packaging

- Rigid Plastic Packaging

Flexible plastic packaging holds the largest market share

A detailed breakup and analysis of the market based on the packaging type has also been provided in the report. This includes flexible plastic packaging and rigid plastic packaging. According to the report, flexible plastic packaging represents the leading segment.Flexible bioplastics offer unparalleled versatility in terms of design, shape, and size. They can be easily molded, folded, and adapted to different packaging requirements, making them suitable for a wide range of products, from snacks and beverages to personal care items and household products. This adaptability aligns with the diverse needs of industries, driving their extensive market presence. Moreover, they offer consumer convenience through features such as resealable zippers, tear notches, and spouts. These attributes enhance the usability of products and contribute to a positive consumer experience. The ease of carrying, opening, and resealing flexible packages aligns with modern consumer preferences for on-the-go convenience.

Breakup by End User:

- Food

- Beverages

- Consumer Goods

- Pharmaceuticals

- Industrial Goods

- Others

Food industry currently dominates the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes food, beverages, consumer goods, pharmaceuticals, industrial goods, and others. According to the report, food industry accounted for the largest market share.Packaging plays a critical role in preserving the freshness, quality, and safety of food products. Bioplastics packaging offers a reliable solution that meets the stringent standards for food contact materials. Consumers are increasingly seeking food products with packaging that is safe, non-toxic, and free from harmful chemicals. Bioplastics, often derived from renewable sources, provide a sustainable option that aligns with these health-conscious consumer preferences. Besides, Many food products have a limited shelf life due to factors such as oxidation, moisture, and microbial growth. Bioplastics packaging can be engineered to provide barrier properties that protect food items from external elements, thereby extending their shelf life. This is particularly relevant in the food industry, where minimizing food waste is a crucial objective.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and Middle East and Africa. According to the report, Europe accounted for the largest market share.Europe has been at the forefront of enacting regulations and policies aimed at reducing plastic waste and promoting sustainable packaging practices. Initiatives such as the European Green Deal and the Single-Use Plastics Directive have set ambitious targets for reducing plastic pollution. These regulations drive businesses to adopt eco-friendly packaging materials like bioplastics to comply with evolving laws. Moreover, European countries have invested significantly in research and innovation related to bioplastics. Collaborative efforts between academia, industry, and government have led to advancements in bioplastics' material properties, performance, and applications. This innovation has paved the way for the widespread adoption of bioplastics in packaging.

Competitive Landscape:

The competitive landscape of the market is characterized by a dynamic interplay of established players and innovative startups. Nowadays, leading companies are investing in research and development to create innovative bioplastics materials that offer improved properties, such as enhanced durability, barrier capabilities, and heat resistance. These innovations enable them to provide packaging solutions that meet the specific needs of different industries while remaining environmentally friendly. Moreover, key players are forming strategic collaborations and partnerships with other stakeholders across the value chain. This includes partnerships with material suppliers, packaging manufacturers, retailers, and consumer brands. Besides, companies are focusing on sourcing bioplastics materials sustainably and ensuring transparency in their supply chains.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ALPAGRO Packaging

- Amcor plc

- Arkema S.A.

- BASF SE

- Biome Bioplastics Limited (Biome Technologies plc)

- Braskem S.A.

- Eastman Chemical Company

- Koninklijke DSM N.V.

- Mondi PLC

- NatureWorks LLC (Cargill Incorporated)

- Novamont S.p.A

- Tetra Laval International SA

- TIPA Corp Ltd.

- WestRock Company

Notable Developments:

NatureWorks LLC, a leading producer of bioplastics, has been focused on expanding its production capacity for its Ingeo biopolymer, a versatile material used in various packaging applications. The company has also been collaborating with partners to develop new grades of Ingeo with improved performance properties, such as enhanced barrier properties for food packaging.BASF SE has introduced products like ecovio, a biodegradable and compostable plastic that is suitable for various packaging applications. The company has also collaborated with partners to explore the use of renewable raw materials in bioplastics production.

Tetra Pak, a packaging and processing solutions company, partnered with Braskem, a major bioplastics producer, to launch a sustainable packaging solution. The collaboration focused on using bioplastics derived from sugarcane to create caps and closures for Tetra Pak's carton packages.

Key Questions Answered in This Report

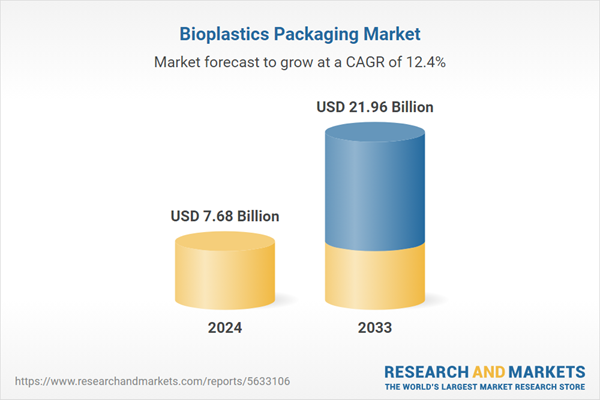

1. How big is the bioplastics packaging market?2. What is the future outlook of bioplastics packaging market?

3. What are the key factors driving the bioplastics packaging market?

4. Which region accounts for the largest bioplastics packaging market share?

5. Which are the leading companies in the global bioplastics packaging market?

Table of Contents

Companies Mentioned

- ALPAGRO Packaging

- Amcor plc

- Arkema S.A.

- BASF SE

- Biome Bioplastics Limited (Biome Technologies plc)

- Braskem S.A.

- Eastman Chemical Company

- Koninklijke DSM N.V.

- Mondi PLC

- NatureWorks LLC (Cargill Incorporated)

- Novamont S.p.A

- Tetra Laval International SA

- TIPA Corp Ltd.

- WestRock Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 7.68 Billion |

| Forecasted Market Value ( USD | $ 21.96 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |