Speak directly to the analyst to clarify any post sales queries you may have.

Introduction to hemocytometer technology framed around clinical utility, laboratory workflow integration, and evolving practice standards that shape device relevance

The hemocytometer remains a cornerstone instrument in clinical laboratories and research settings, offering fundamental capabilities in cell counting, viability assessment, and basic urine analysis that underpin diagnostic and experimental workflows. Historically, these devices enabled direct manual quantification of cellular elements, and more recently they have integrated with automated systems to enhance throughput and reduce operator variability. As a result, the hemocytometer continues to bridge routine clinical practice and cutting-edge research, providing a practical interface between laboratory personnel and analytical outcomes. This introduction frames the technology not merely as a legacy tool but as a resilient platform that adapts to evolving clinical quality standards, laboratory accreditation requirements, and the rising demand for streamlined sample-to-answer workflows.

Transitioning from foundational context into operational considerations, it is important to recognize how the instrument’s design, consumable compatibility, and user training requirements directly influence adoption across different end users. While some institutions retain manual approaches for low-volume or cost-sensitive applications, others prioritize automated solutions for high-throughput or regulated environments. Consequently, the hemocytometer’s role must be evaluated across the full spectrum of diagnostic and research activities, where accuracy, repeatability, and ease of use determine clinical utility and workflow integration. This section establishes the frame for deeper analysis by highlighting the instrument’s contemporary relevance and the practical drivers of procurement and use.

Exploration of converging technological, operational and regulatory trends that are reshaping hemocytometer product roadmaps and laboratory adoption patterns

The landscape for hemocytometer technology is undergoing transformative shifts driven by technological integration, workflow automation, and heightened demands for data integrity and regulatory compliance. Advances in imaging sensors, machine learning-assisted counting algorithms, and connectivity standards are enabling automated hemocytometers to deliver faster, more consistent results while capturing metadata that supports traceability and quality control. At the same time, manufacturers and laboratory leaders are navigating the trade-offs between capital investment, maintenance overhead, and the operational benefits of automation, which has stimulated modular approaches that allow incremental upgrades to existing instrumentation.

Moreover, clinical and research priorities are encouraging interoperability between hemocytometers and laboratory information management systems, which facilitates instrument monitoring, remote diagnostics, and centralized quality oversight. Concurrently, expectations for reproducible results underpinned by standardized protocols are prompting more rigorous validation and training programs. As such, manual hemocytometers retain a role in resource-constrained settings and specific niche applications, whereas automated systems gain traction where throughput, regulatory documentation, and integration deliver measurable operational value. These converging forces are reshaping product roadmaps, partnership strategies, and end-user procurement criteria across the ecosystem.

Assessment of how 2025 United States tariff adjustments are reshaping supply chain decisions, sourcing strategies, and procurement risk management across the hemocytometer value chain

United States tariff changes announced for 2025 have introduced new considerations for supply chain design, procurement strategy, and cost management across the life sciences instrument sector. Tariff adjustments affect the landed cost of imported components and finished instruments, prompting manufacturers and distributors to reassess sourcing geographies, supplier agreements, and inventory strategies. Consequently, some suppliers are accelerating nearshoring initiatives or diversifying component suppliers to mitigate exposure to single-country tariffs, thereby preserving production continuity and pricing stability for customers.

In addition, distributors and end users are adapting procurement timelines and contract structures to accommodate potential volatility. For purchasers, this has meant negotiating longer-term supply agreements with price adjustment clauses, evaluating local calibration and maintenance support to reduce cross-border dependencies, and considering total cost of ownership when comparing manual and automated hemocytometer options. Regulators and institutional procurement offices have also become more attentive to documentation that supports origin and compliance, which feeds into vendor selection and vendor qualification processes. Thus, while tariff policy does not change the clinical fundamentals of hemocytometry, it does influence the commercial calculus around sourcing, inventory resilience, and service models, with practical implications for manufacturers, distributors, and laboratory buyers.

Insights into differentiated adoption dynamics revealed by product, end-user, application, and distribution segments that guide targeted product and commercial strategies

Segmentation analysis reveals differentiated pathways of adoption and product evolution across product types, end users, applications, and distribution strategies. When considering product type, there is a clear dichotomy between automated hemocytometers that emphasize throughput, digital integration, and reduced operator variability, and manual hemocytometers that continue to serve low-volume, field, and cost-sensitive contexts where hands-on control and minimal infrastructure requirements prevail. End-user segmentation highlights distinct adoption drivers among diagnostic laboratories, hospitals and clinics, pharma and biotech companies, and research institutes; diagnostic laboratories in turn encompass hospital laboratories and independent laboratories, while hospitals and clinics subdivide into private and public institutions, each with unique procurement cycles, quality requirements, and budget constraints.

Application segmentation further differentiates demand patterns, with blood cell counting serving both red blood cell and white blood cell quantification needs, cell viability assessment meeting assay development and cytotoxicity testing requirements, and urine analysis supporting primary care and diagnostic workflows. Distribution channel segmentation underscores the strategic choices between direct sales models that facilitate close technical engagement and distributor networks that broaden geographic reach and service coverage. Taken together, these segmentation lenses reveal how product design, support services, and commercial approaches must align with the specific priorities, regulatory expectations, and operational constraints of diverse customer cohorts, thereby informing targeted product positioning and go-to-market strategies.

Comparative regional dynamics and strategic imperatives across the Americas, Europe Middle East & Africa, and Asia-Pacific that inform localized product and service approaches

Regional dynamics exert a pronounced influence on technology adoption, procurement practices, and service expectations, producing distinct opportunity spaces for manufacturers and distributors. In the Americas, clinical laboratories and research institutions prioritize diagnostic reliability, regulatory compliance, and integration with established laboratory infrastructures, which favors automated solutions in metropolitan centers while sustaining manual methods in decentralized or resource-limited settings. Conversely, Europe, Middle East & Africa presents a heterogeneous landscape shaped by high regulatory standards in some markets, resource constraints in others, and varied procurement models that reward adaptable product configurations and strong local service capability.

Meanwhile, Asia-Pacific shows a mix of fast-growing research investment, expanding diagnostic networks, and diverse healthcare delivery models; this region often demonstrates rapid uptake of cost-efficient automation where infrastructure permits, alongside continued demand for manual devices in emerging healthcare settings. Across all regions, cross-border partnerships and regional distributors often play pivotal roles in navigating regulatory requirements, providing training, and ensuring timely maintenance support. Therefore, successful regional strategies require granular understanding of local procurement norms, regulatory pathways, and infrastructure readiness, enabling tailored offerings that resonate with institutional priorities and operational realities.

Analysis of competitive differentiation driven by automation, integration, service excellence, and evidence-based validation that shapes supplier selection and customer loyalty

Competitive landscapes in hemocytometry are shaped by a mixture of established instrument manufacturers, specialized niche suppliers, and service-oriented distributors that collectively influence innovation trajectories and procurement decisions. Key players differentiate through investment in imaging and automation capabilities, algorithm development for accurate counts and viability metrics, and the extent of integration with laboratory information systems and quality management tools. Strategic partnerships and channel expansion efforts also contribute to competitive positioning, enabling companies to offer bundled solutions that combine instrumentation, consumables, training, and after-sales service.

Furthermore, procurement officers and laboratory directors increasingly weigh factors such as ease of validation, operator training requirements, and the availability of local technical support when selecting suppliers. As a result, vendors that demonstrate transparent validation data, robust service networks, and flexible pricing or procurement models tend to secure stronger engagement from institutional buyers. In addition, companies that invest in user-centered design, modular upgrade paths, and interoperability with existing laboratory ecosystems strengthen their long-term appeal. Overall, competitive advantage arises from aligning product innovation with pragmatic service delivery and credible evidence of performance under real-world laboratory conditions.

Actionable strategic measures for suppliers and channel partners to enhance modularity, interoperability, regional service capability, and flexible commercial models for broader adoption

Industry leaders can take several actionable steps to capture opportunity and mitigate risk in a rapidly evolving hemocytometer landscape. First, prioritize modular product architectures that allow clinical and research customers to scale from manual to automated workflows without disruptive capital replacement, thereby lowering adoption barriers and extending device lifecycles. Second, invest in interoperable software and standardized data outputs to facilitate integration with laboratory information systems, quality management platforms, and electronic health records, which enhances traceability and unlocks operational efficiencies. Third, strengthen regional service capabilities through targeted distributor partnerships and local technical training programs, ensuring rapid maintenance response and effective user onboarding.

Additionally, incorporate total cost of operation considerations into commercial conversations by transparently presenting maintenance obligations, consumable requirements, and validation support. Emphasize robust validation data and deployable training curricula to reduce onboarding friction for regulated laboratories. Finally, adopt flexible commercial models that accommodate different procurement cycles and budget profiles, such as lease-to-own, scalable licensing, or hybrid direct-plus-distributor approaches. By executing these practical measures, vendors and channel partners will be better positioned to address end-user priorities, respond to supply chain pressures, and sustain competitive differentiation in diverse market contexts.

Methodology overview describing qualitative and secondary data triangulation, stakeholder validation, and segmented analysis to ensure transparent and actionable insights

This research synthesized primary and secondary data sources and applied a structured framework to analyze technology adoption, end-user behavior, and commercial dynamics in hemocytometry. Primary inputs included interviews with laboratory managers, procurement officers, and technical staff across diagnostic laboratories, hospitals and clinics, pharmaceutical and biotech organizations, and research institutes, enabling qualitative validation of adoption drivers and operational constraints. Secondary inputs comprised peer-reviewed literature, regulatory guidance documents, and manufacturer technical specifications to ensure factual grounding for device capabilities, validation practices, and interoperability standards. Methodologically, the study triangulated stakeholder perspectives with documented device features and regulatory context to derive actionable implications without relying on numerical projections.

Analytical rigor was maintained through cross-validation of sources and the application of segmentation lenses covering product type, end user, application, and distribution channel. The research also incorporated sensitivity checks related to supply chain and tariff impacts to elucidate commercial risk factors and mitigation approaches. Throughout the methodology, transparency and replicability guided data collection and synthesis, with clear documentation of interview protocols, inclusion criteria for secondary sources, and the rationale for segmentation choices. This approach provides decision-makers with a defensible evidence base to inform procurement decisions, product development priorities, and regional go-to-market actions.

Concluding synthesis highlighting the enduring clinical value of hemocytometers and the importance of interoperable, validated, and service-driven strategies for long-term adoption

In conclusion, the hemocytometer remains a vital instrument whose relevance endures through adaptability and alignment with contemporary laboratory needs. While automation, digital integration, and stricter quality expectations are steering product innovation and procurement behaviors, manual techniques persist where simplicity, cost control, and hands-on oversight matter most. Consequently, successful strategies will not hinge on a single technology choice but on offering adaptable solutions that meet the specific operational, regulatory, and budgetary needs of distinct end-user cohorts. Moreover, supply chain resilience and regional service presence have emerged as practical differentiators that affect vendor selection and long-term user satisfaction.

Looking ahead, laboratories and manufacturers that prioritize interoperability, clear validation evidence, and accessible training will reduce friction in adoption and foster stronger partnerships. At the same time, attentiveness to procurement frameworks, tariff-related sourcing decisions, and flexible commercial models will help stakeholders manage cost and availability risks. Ultimately, the path forward emphasizes pragmatic innovation and customer-centric service models that collectively sustain the clinical and research value of hemocytometry in diverse settings.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Hemocytometer Market

Companies Mentioned

The key companies profiled in this Hemocytometer market report include:- Abbott Laboratories

- Agilent Technologies

- Avantor

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc

- Danaher Corporation

- Glaswarenfabrik Karl Hecht

- Hausser Scientific

- HemoCue

- HORIBA Ltd

- Merck KGaA

- Merck KGaA

- Mindray Medical International Limited

- Mxrady Lab Solutions Private Limited

- NanoEntek

- Paul Marienfeld GmbH & Co KG

- Philips

- Qiagen N.V.

- Roche Diagnostics

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific Inc

- Thomas Scientific

- Unico

- Wuhan Servicebio Technology Co Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | January 2026 |

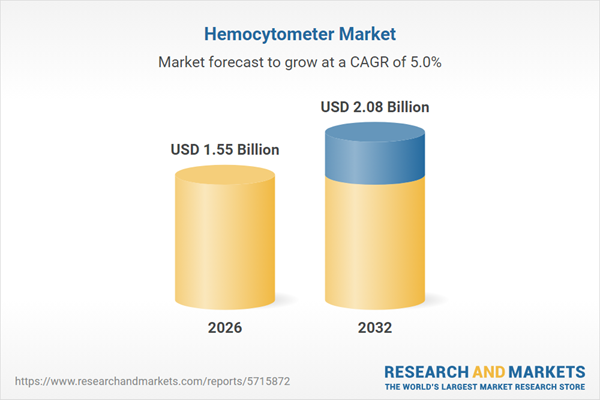

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.55 Billion |

| Forecasted Market Value ( USD | $ 2.08 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |