Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive introduction to brown rice dynamics emphasizing nutritional benefits, supply chain modernization, consumer preferences, and product positioning in evolving food systems

Brown rice has re-emerged as a central ingredient in contemporary food systems, driven by evolving consumer preferences, advances in processing, and renewed supply chain attention. Nutrition-conscious consumers increasingly prioritize whole-grain options for sustained energy, fibre intake, and micronutrient benefits, while culinary innovators rediscover brown rice for its texture and flavor complexity. Concurrently, producers and processors have invested in milling, sorting, and packaging technologies that preserve nutrient integrity and extend shelf life, bridging the gap between traditional production practices and modern retail requirements.

Alongside these product-level shifts, demand patterns reflect greater interest in provenance, traceability, and sustainable agricultural practices. This has prompted supply chain actors to emphasize crop rotation strategies, integrated pest management, and water-use efficiencies, particularly in regions where climate variability amplifies production risk. Retailers respond by differentiating assortments between conventional and organic offerings and by introducing value-added formats such as ready-to-eat preparations and fortified blends that address convenience and nutritional needs. E-commerce channels have accelerated access to niche varieties and premium packaging, enabling smaller producers to reach national and international consumers without the constraints of conventional distribution.

As sustainability and health narratives intersect, brown rice occupies a unique position: it appeals to mainstream grocery shoppers seeking healthier staples, to specialty consumers focused on organic or heritage varieties, and to industrial users who require consistent quality for brewing and feed applications. This diverse utility elevates brown rice from a single-category commodity to a strategic ingredient with multiple commercial pathways, necessitating careful alignment between cultivation practices, processing investments, and channel strategies to capture emerging opportunities while managing risk.

Overview of decisive transformative shifts reshaping brown rice supply chains, processing innovations, consumer health preferences, and sustainability driven strategic change

The brown rice value chain is undergoing transformative shifts driven by technology, consumer health priorities, and a broader sustainability agenda. Precision agriculture and improved seed varieties have increased yield stability in some growing regions, while digital agronomy tools enable farmers to optimize inputs and monitor crop health remotely. These innovations help mitigate the volatility introduced by climate variability, even as extreme weather continues to pressure production in key geographies. Processing technologies-such as improved dehulling, antioxidant-preserving storage, and low-oxygen packaging-have enhanced product quality and shelf life, permitting broader geographic distribution and enabling new product forms.

Consumer behavior has evolved in parallel, with a pronounced tilt toward whole grains, plant-forward diets, and products that communicate health credentials clearly. This shift fuels demand for organic and traceable brown rice offerings and incentivizes brands to invest in certification and transparent sourcing narratives. Retail innovation, including subscription models and curated online assortments, has made specialty varieties more accessible, while foodservice operators increasingly incorporate brown rice into menu concepts that emphasize quality and nutrition.

Sustainability considerations now shape strategic decisions across the chain. Water stewardship, reduced methane emissions associated with paddy management, and responsible packaging practices have become core performance metrics for buyers and investors. Consequently, companies are experimenting with alternative cultivation techniques, collaborative procurement models, and circular approaches to packaging. These systemic changes are reconfiguring competitive dynamics, favoring actors who can combine agronomic resilience, product differentiation, and credible sustainability practices to meet the expectations of modern buyers.

Analysis of the cumulative effects of recent United States tariff measures on sourcing, supply chain resilience, compliance costs, and strategic supplier diversification across the brown rice chain

The tariff landscape introduced by the United States in 2025 has translated into a complex set of operational and strategic consequences for participants across the global brown rice chain. Elevated import duties on targeted origin categories prompted buyers to re-evaluate sourcing strategies, accelerating supplier diversification and encouraging increased reliance on regional production hubs. This realignment has driven short-term logistical friction as contracting parties sought alternative suppliers and adjusted payment, inspection, and compliance processes to meet new regulatory constraints. In turn, origination patterns shifted, creating demand pressure in non-targeted producing regions and prompting rapid credentialing and capacity expansion activities among exporters.

Beyond immediate sourcing changes, the tariff adjustments increased the premium on supply chain agility. Companies with flexible procurement networks and established relationships across multiple regions navigated disruption more effectively, while those with concentrated supplier footprints faced constraints that affected production planning and product assortments. Traders and processors responded by renegotiating commercial terms, refining hedging approaches, and investing in cost-containment measures to preserve competitiveness in affected channels. Compliance-related administrative burdens also rose, prompting firms to upgrade documentation workflows and customs expertise to avoid transactional delays.

The cumulative outcome reinforced the strategic importance of nearshoring, greater inventory visibility, and contractual diversification. While some downstream buyers absorbed additional landed cost through price adjustments or margin compression, others accelerated investments in value-add formats and private-label product strategies to protect shelf presence. The tariff episode underscored the necessity for scenario-based supply planning and the value of multi-sourced procurement frameworks that reduce exposure to concentrated policy risk.

In-depth segmentation insights linking source, application, grain length, packaging, and distribution channel distinctions to demand signals and product positioning strategies

Insightful segmentation is essential to understand where opportunities and operational priorities intersect across the brown rice continuum. Based on Source, market is studied across Conventional and Organic, a distinction that informs cultivation practices, certification requirements, and buyer expectations. Conventional supply chains emphasize yield consistency and cost efficiency, whereas organic channels require traceable inputs, certification auditing, and often command premium positioning that aligns with health-conscious and environmentally minded consumers.

Based on Application, market is studied across Brewing, Feed, and Food. The Brewing is further studied across Beer and Rice Wine, and this sub-segmentation highlights how quality parameters differ for fermentation versus beverage clarity and aroma profiles. The Feed is further studied across Livestock Feed and Poultry Feed, where nutrient density, contaminants control, and bulk handling specifications vary by animal category. The Food is further studied across Food Service and Household, each with distinct pack size, format, and consistency requirements driven by operational pace and consumer dining behavior.

Based on Grain Length, market is studied across Long Grain, Medium Grain, and Short Grain, with culinary uses and regional preferences influencing product development, textural expectations, and milling tolerances. Long grain varieties typically deliver separated kernels suitable for pilafs and long-cook applications, while short grain varieties provide the stickiness and mouthfeel required for certain cultural cuisines and value-added products. Based on Packaging Type, market is studied across Bulk and Retail Packaged. The Retail Packaged is further studied across Plastic Bags, Pouches, and Vacuum Sealed formats, each offering different shelf life, perceived quality, and suitability for e-commerce fulfillment and in-store presentation.

Based on Distribution Channel, market is studied across Convenience Stores, Online Retailers, Specialty Stores, and Supermarkets & Hypermarkets. The Online Retailers is further studied across Brand Website and Marketplace, where direct-to-consumer control contrasts with marketplace reach dynamics. The Specialty Stores is further studied across Health Food Stores and Rice Mills, each serving distinct consumer segments that prioritize provenance or artisanal handling. Integrating these segmentation lenses enables firms to tailor product specifications, packaging choices, and promotional narratives to channel expectations and end-use requirements, thereby optimizing assortment decisions and improving product-market fit.

Comprehensive regional insights highlighting production hubs, consumption preferences, regulatory drivers, and channel maturation across the Americas, EMEA, and Asia-Pacific regions

Regional dynamics materially shape production, consumption, and trade flows for brown rice, necessitating region-specific strategies and operational calibrations. In the Americas, shifts toward whole grains and health-forward ingredients have nudged retailers and foodservice operators to expand brown rice assortments, while domestic production zones have strengthened traceability and sustainability credentials to meet buyer expectations. Meanwhile, import requirements and logistics costs influence the balance between local sourcing and foreign procurement, especially for specialty varieties not widely cultivated domestically.

In Europe, Middle East & Africa, consumers exhibit diverse culinary preferences and regulatory landscapes, creating differentiated demand pockets for organic, short-grain, and heritage varieties. European buyers increasingly emphasize sustainability certifications and reduced environmental footprints, whereas demand in the Middle East often centers on premium milling and packaging standards for hospitality channels. African markets combine rising urban consumption with infrastructure constraints, which in turn favor consolidated supply chains and investments in storage and processing capacity to minimize post-harvest losses.

Asia-Pacific remains the epicenter for both production and consumption of brown rice varieties, with complex intra-regional trade flows and strong cultural preferences for specific grain lengths and textures. Innovations in rice breeding, irrigation efficiency, and cooperative extension services have emerged here, as have advanced processing clusters capable of producing branded, value-added items for export. Across all regions, channel maturity varies: online retail penetration and specialty retail channels are more advanced in some markets, while convenience and traditional trade persist in others. These geographic nuances dictate where to prioritize investments in certification, packaging formats, and promotional strategies to align with local buyer and consumer behaviors.

Key company-level strategic behaviors and innovation profiles revealing vertical integration, value-added product portfolios, and channel-aligned commercialization tactics

Leading companies in the brown rice space demonstrate a combination of vertical integration, innovation in product formats, and strategic positioning around health and sustainability credentials. Many firms invest in upstream partnerships with growers to secure consistent quality and to implement agronomic practices that reduce input variability. This approach supports traceability and quality assurance programs while enabling collaborative R&D around seed selection, agronomy, and post-harvest handling that preserves nutritional content.

On the processing and branding side, companies differentiate through value-added offerings-such as pre-cooked rice, fortified blends, and culinary-ready formats-designed to capture convenience-oriented consumers and foodservice buyers. Packaging innovations that extend freshness and support e-commerce fulfillment have become priorities, and firms that standardize packaging across channels achieve cost efficiencies while preserving product integrity. Strategic alliances between processors, logistics providers, and certification bodies expedite market entry for premium or organic lines and reduce the time required to qualify new supplier origins.

Commercially, some companies pursue brand-led strategies to educate consumers on the nutritional merits of brown rice, while others expand private-label programs with major retail partners to lock in shelf presence. Additionally, a subset of players focuses on geographic specialization, controlling localized processing footprints to reduce supply chain friction and to better tailor product attributes-such as grain length and polishing degree-to regional palates. Collectively, these company-level actions reveal that competitiveness depends on the capacity to manage quality consistently, to innovate around formats, and to align commercial channels with evolving consumer expectations.

Actionable strategic and operational recommendations for leaders to enhance sourcing resilience, product differentiation, sustainability credentials, and channel execution

Industry leaders should adopt a set of pragmatic actions to capture opportunity while managing policy, environmental, and operational risks. First, diversify sourcing geographies and establish multi-tiered supplier agreements that provide flexibility in the face of trade policy shifts or climate-driven yield volatility. Complement this by investing in upstream partnerships focused on agronomic training, water management, and input optimization to secure consistent quality and reduce exposure to single-origin shocks.

Second, prioritize product differentiation through value-added formats and clear health positioning. Develop pre-cooked, mixed-grain, or fortified brown rice products for convenience channels, and align packaging formats-plastic bags, pouches, vacuum sealed-with channel needs to improve shelf appeal and e-commerce compatibility. Simultaneously, pursue certifications and transparent traceability to meet the expectations of consumers and institutional buyers who demand provenance and ethical production practices.

Third, build supply chain resilience through inventory visibility tools, scenario planning, and enhanced customs and compliance capabilities. Adopt digital traceability platforms and invest in logistics partnerships that shorten lead times and reduce variability. Fourth, tailor channel strategies to the segmentation landscape: allocate SKUs and marketing investments differently across supermarkets, specialty stores, online retailers, and convenience channels to maximize reach and profitability. Finally, incorporate sustainability into the core commercial proposition by demonstrating measurable water, soil, and emissions outcomes; this will strengthen brand credibility and reduce regulatory and reputational risk over time.

These recommendations combine tactical investments with strategic planning, enabling firms to compete on quality, reliability, and consumer relevance while maintaining flexibility under shifting external conditions.

Robust mixed-methods research methodology combining primary stakeholder engagement, secondary trade and regulatory analysis, field assessments, and scenario testing for robust insight generation

The research approach used to inform these insights combines qualitative and quantitative techniques designed to triangulate findings across supply chain stakeholders and consumption contexts. Primary data collection included structured interviews with growers, processors, traders, and retail category managers to capture operational realities, procurement priorities, and innovation trajectories. These conversations informed an understanding of production practices, packaging constraints, and acceptance criteria for different applications, including brewing, feed, and foodservice uses.

Secondary research synthesized agricultural extension reports, trade statistics, and regulatory documentation to map export-import flows, quality standards, and certification requirements. Processing facility visits and technical assessments provided empirical context for milling tolerances, storage conditions, and packaging performance. Consumer sentiment was assessed through targeted surveys and point-of-sale observations to understand preferences by grain length, packaging type, and channel. Analytical methods included supply chain mapping, segmentation alignment, scenario planning regarding trade policy shifts, and sensitivity assessments for key operational variables.

Quality control measures comprised cross-verification of interview findings with trade data, replication of packaging shelf-life observations, and validation of claims related to organic certification pathways. The methodology prioritized transparency and reproducibility, documenting data sources, interview sampling frames, and analytical assumptions. Limitations include the variability in regional data quality and the rapid evolution of policy environments, which can change trade dynamics with limited lead time; these were addressed through scenario-based analyses and continuous stakeholder engagement to maintain relevance.

Strategic conclusion synthesizing risk mitigation, product innovation, and sustainability priorities to convert structural trends into competitive advantage for brown rice stakeholders

In conclusion, brown rice represents a versatile ingredient positioned at the intersection of health-driven consumer demand, supply chain modernization, and sustainability imperatives. Product innovation, packaging adaptations, and channel-specific strategies offer multiple pathways for companies to capture value, while trade policy developments and climate variability underscore the importance of sourcing flexibility and supply chain transparency. By aligning cultivation practices with buyer expectations and by investing in value-added formats, organizations can both meet current consumer preferences and anticipate future shifts in demand.

The cumulative insight points to three enduring priorities: maintain diversified and transparent sourcing relationships, accelerate product and packaging innovation to serve evolving culinary and convenience needs, and embed measurable sustainability outcomes into commercial propositions. Firms that operationalize these priorities through concrete partnerships, targeted investments, and rigorous scenario planning will be better positioned to navigate policy interruptions and to scale in higher-value channels.

Ultimately, success in the brown rice space depends on integrating agronomic reliability with clear consumer-facing narratives and channel-aware execution. Those who do so will convert structural trends into sustained competitive advantage and will be able to respond nimbly to regulatory and market disruptions while delivering consistent quality to end users.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Brown Rice Market

Companies Mentioned

The key companies profiled in this Brown Rice market report include:- Asia Golden Rice Company Limited

- Chandrika Group of Mills

- Daawat Foods Limited

- Ebro Foods, S.A.

- Elworld Agro & Organic Foods Pvt. Ltd.

- Hain Celestial Group

- Hinode by SunFoods LLC

- India Gate Foods

- Kikkoman Corporation

- Kohinoor Foods Limited by Adani Wilmar Ltd.

- KRBL Limited

- Lotus Foods Inc.

- Lundberg Family Farms

- Manna Foods

- Mars, Incorporated

- New Bharat Group

- Pride of India

- Riviana Foods Inc.

- Shrilal Mahal Group

- Sri Sri Tattva

- SunRice by Ricegrowers Ltd.

- T.K. Rice Mill And Ash Co., Ltd.

- The Little Rice Company

- Thrive Market

- Wonnapob Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | January 2026 |

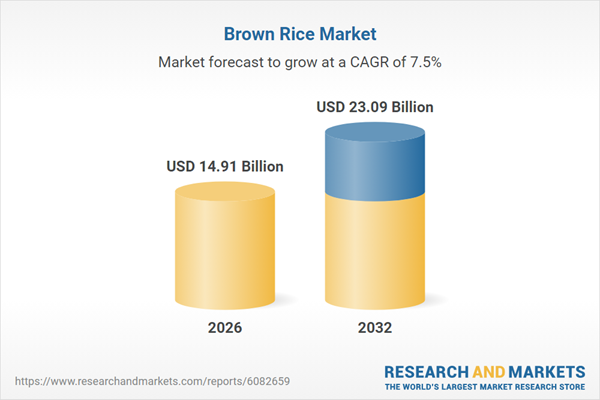

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 14.91 Billion |

| Forecasted Market Value ( USD | $ 23.09 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |