Due to an increasing demand for radioisotopes in therapeutic and diagnostic applications in the healthcare industry, a number of players developing and producing these radioisotopes have entered the country’s market. Some key facilities producing radioactive substances for different medical uses in Canada are Chalk River Laboratories, McMaster Nuclear Reactor, École Polytechnique, Royal Military College of Canada, University of Alberta, and Saskatchewan Research Council.

Moreover, in June 2023, the Minister of Innovation, Science, and Industry launched the Canadian Medical Isotope Ecosystem (CMIE) to support nuclear medicine & radiopharmaceutical projects run by notable market players such as BWXT Medical, Canadian Nuclear Laboratories (CNL), Bruce Power, and McMaster University. CMIE will be receiving around USD 35 million during a 5-year period to support initiatives to increase production and research activities of medical isotopes and radiopharmaceuticals in Canada.

An increasing number of organizations are undertaking initiatives to help address the growing need for nuclear medicine, which is anticipated to accelerate market growth. For instance, the Canadian government continues to undertake initiatives to strengthen the country’s healthcare sector. Since March 2020, the government has invested more than USD 2 billion in 36 major projects to boost Canada’s life science sector’s capacity. Moreover, the government is investing in the medical isotope segment to position the country as a global leader in the production and supply of radioisotopes for diagnosis and treatment.

However, stringent regulations pertaining to production, storage, and usage of nuclear medicine & radiopharmaceuticals is expected to restrain the growth of Canada’s nuclear medicine market. Radioactive substances are capable of mutating genes and may cause severe adverse effects, including fatalities. Thus, handling radioactive substances is strictly regulated by governments to ensure compliance with radiation safety policies. Approval procedures for products containing radioactive substances are stringent, which delays their market launch.

Canada Nuclear Medicine Market Report Highlights

- In terms of product, the diagnostics segment accounted for a larger revenue share in 2023, owing to benefits such as affordability, ease of handling, compatible half-life of radioisotopes, and applications such as diagnosis of cancer and cardiovascular diseases

- Based on application, the oncology segment dominated Canada’s nuclear medicine market in 2023, owing to rising R&D investments in nuclear medicine for cancer diagnosis and treatment

- In terms of end-use, hospitals & clinics dominated the nuclear medicine market in Canada in 2023, based on revenue, owing to increasing collaborations of health institutions with research organizations and industry leaders to expand access to state-of-the-art radiopharmaceuticals, thus improving patient care and outcomes

Table of Contents

Companies Mentioned

- GE Healthcare

- Nordion (Canada), Inc.

- Lantheus Medical Imaging, Inc.

- Cardinal Health

- Jubilant Life Sciences Ltd.

- Isologic Innovative Radiopharmaceuticals

- Curium Pharma

- adMare BioInnovations

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | December 2023 |

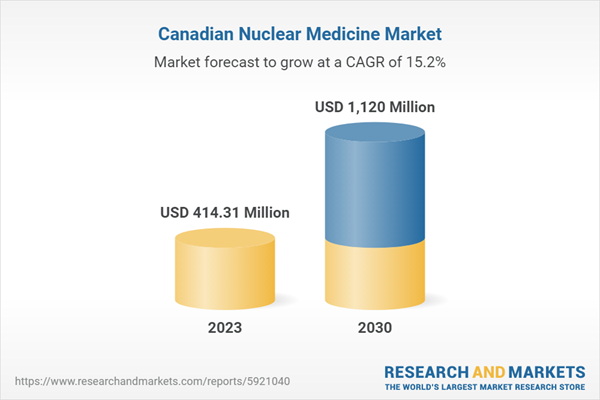

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 414.31 Million |

| Forecasted Market Value ( USD | $ 1120 Million |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Canada |

| No. of Companies Mentioned | 8 |