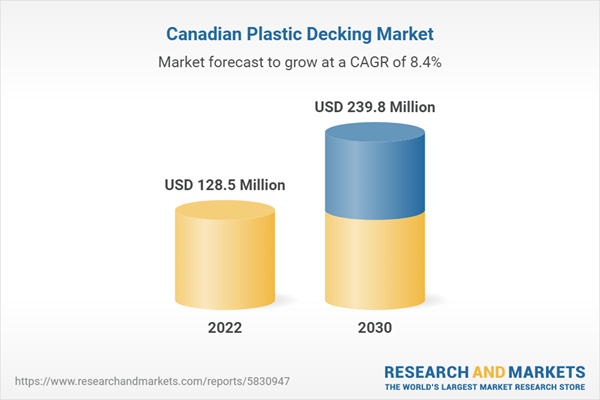

The Canada plastic decking market size is expected to reach USD 239.8 million by 2030. The market is projected to expand at a CAGR of 8.4% from 2023 to 2030. Rising demand for aesthetic work and living spaces has propelled the demand for plastic decking across Canada and is anticipated to follow similar trends throughout the forecast period.

Plastic deck boards offer a wood-grain finish for enhanced slip-resistance and are splinter-free. They also offer safety benefits. These decks reduce the risk of collapse owing to their waterproof and weatherproof qualities. These decks eliminate organic ingredients including wood, which makes them waterproof and weatherproof. These decks are resistant to mildew, mold, or water damage and avoid insect infestation. In addition, they can withstand extreme weather conditions including snow, rain, blistering heat, and others. These factors are expected to propel the demand for plastics in the decking industry over the forecast period.

Plastic decking is more aesthetically appealing with different wood grain patterns and a variety of colors. In addition, high-density polyethylene can be reinforced with fiberglass to build heat-reflective decking. This kind of plastic deck stands apart and displays unparalleled strength and ease of maintenance.

The Canada plastic market is highly fragmented owing to the presence of major players such as Fiberon LLC; Advanced Environmental Recycling Technologies, Inc.; Azek Building Products, Inc., and Cardinal Building Projects, as well as a number of other small and medium-sized country players. Strategic initiatives carried out by these companies for market expansion are highly effective and are fueling the market growth in the country.

Canada Plastic Decking Market Report Highlights

- The Canada plastic decking industry was valued at USD 128.5 million in 2022 and is estimated to grow at a CAGR of 8.4% from 2023 to 2030

- In terms of revenue, the polyvinyl chloride (PVC) resin segment is expected to register a high CAGR over the forecast period. Rising urbanization has been a significant driver for PVC decking in the country. PVC decking is a popular choice for residential and commercial spaces as it is low-maintenance and durable. Due to the reduced level of maintenance required, PVC is frequently promoted as being more affordable over time than alternatives such as all-wood or composite decking

- The industrial application segment dominated the market and accounted for more than 26% of the revenue share in 2022. Due the rising environmental concerns and consumer awareness, manufacturers are developing wood alternatives. For instance, Miura Board offers deck boards that consist of 100% recycled plastics and post-consumer carpet fibers into a durable, weatherproof composite. These boards are environmentally friendly, versatile, durable, and ideal for industrial applications

- Various strategic initiatives were recorded over the past few years to boost the growth of Canada's plastic decking industry. For instance, in January 2023, Fiberon introduced new products at its 2023 Virtual Experience. Within the Virtual Experience, participants can interact with the full product portfolio of the company, including railing, decking, furniture, etc. The company also introduced its new Fiberon Concordia PE Decking Astir collection with new colors such as prairie wheat, mountain ash, and seaside mist

Table of Contents

Companies Mentioned

- Green Bay Decking

- TAMKO Building Products LLC

- UPM (UPM ProFi)

- UFP Industries, Inc.

- Advanced Environmental Recycling Technologies, Inc.

- Azek Building Products, Inc.

- Cardinal Building Products

- Certainteed Corporation

- Fiberon

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 69 |

| Published | May 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 128.5 Million |

| Forecasted Market Value ( USD | $ 239.8 Million |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Canada |

| No. of Companies Mentioned | 9 |