Speak directly to the analyst to clarify any post sales queries you may have.

A strategic introduction framing the care management solutions landscape, core objectives, stakeholder priorities, and immediate executive imperatives

This executive summary presents a focused introduction to care management solutions and their strategic implications for organizational leaders in health systems, payer organizations, and employer-sponsored programs. It outlines the structural drivers that are reshaping operational priorities, the evolving expectations of patients and clinicians, and the converging forces of technology and policy that now determine the pace and scale of adoption. By framing the conversation around both near-term operational imperatives and longer-term transformation trajectories, this introduction sets the stage for evidence-based decision making across procurement, integration, and clinical redesign efforts.In recent cycles, stakeholders have reoriented priorities toward interoperability, consumer engagement, and risk-aware care models. Consequently, initiatives that may once have been confined to pilot status now require enterprise-level governance, reproducible implementation pathways, and clear interoperability roadmaps. This content emphasizes those imperatives and introduces the analytical lenses used throughout the report: structural segmentation, regional dynamics, company positioning, and actionable recommendations. These lenses are applied to help executives understand where to concentrate resources, how to sequence initiatives, and what capabilities are essential to sustain improved care continuity and cost-efficient delivery.

Key transformative shifts reshaping care management delivery models, technology adoption patterns, payer-provider dynamics and patient-centric expectations

The care management landscape is undergoing transformative shifts driven by digital maturation, value-based payment expansion, and heightened consumer expectations for convenience and personalization. Technology adoption is no longer limited to point solutions; instead, there is a shift toward platforms that support cross-continuum coordination, data-driven risk stratification, and real-time patient engagement. As a result, organizations are prioritizing integration across electronic health records, case management tools, and patient-facing applications to create seamless workflows that support both clinicians and care coordinators.Concurrently, reimbursement models are pushing providers and payers to take on more outcome-based risk, which in turn accelerates investment in predictive analytics and population health orchestration capabilities. This dynamic favors solutions that deliver measurable care continuity improvements and demonstrable reductions in avoidable utilization. Moreover, workforce constraints and clinician burnout have elevated the importance of automation and workflow augmentation; pragmatic use of digital tools to streamline administrative tasks is now a core competency rather than a differentiator. Together, these shifts create an environment in which strategic partnerships, modular technology stacks, and pragmatic implementation roadmaps determine who realizes sustainable value from care management investments.

Assessment of cumulative impacts from United States tariff changes anticipated in 2025 on supply chains, procurement strategies and technology sourcing decisions

The cumulative impact of United States tariff changes in 2025 has reverberated through global supply chains and procurement strategies relevant to care management solutions, particularly where hardware components or internationally sourced software services are part of an implementation. Organizations have responded by reassessing supplier diversity, shortening vendor approval cycles for critical components, and increasing emphasis on contractual protections that mitigate sudden cost escalations. These procurement adaptations reflect a broader emphasis on supply chain resilience and contractual flexibility in sourcing cloud infrastructure, clinical devices, and integrated care platforms.In addition, procurement teams have placed greater scrutiny on total cost of ownership drivers such as maintenance, service-level agreements, and cross-border data handling provisions. Implementation leaders have consequently prioritized vendors with demonstrable local support ecosystems or hybrid delivery models that reduce exposure to tariff-driven disruptions. More broadly, these tariff-related adjustments have accelerated conversations around nearshoring, multi-vendor redundancy, and contingency planning for critical infrastructure. For decision-makers, the key implication is to balance cost containment with continuity of service and data sovereignty considerations when finalizing vendor relationships.

Granular segmentation intelligence illuminating component, deployment, end user and application dimensions that drive adoption, integration and care outcomes

A granular view of segmentation reveals which solution characteristics and deployment choices most influence adoption, implementation complexity, and value realization. Based on component, the spectrum includes Services and Solutions; Services commonly encompass consulting, implementation services, and support and maintenance, which collaboratively shape the speed and success of deployments. Organizations that intentionally align these service elements with internal change management and clinical training programs shorten time to operational stability and improve clinician acceptance.When considering deployment mode, options range from cloud-based to on-premise architectures, and cloud-based approaches further distinguish between private cloud and public cloud configurations. The selection between private and public cloud reflects trade-offs among scalability, control, and compliance, and it often depends on organizational risk tolerance as well as existing IT investments. From an end-user perspective, the segment breakdown includes employers, healthcare providers, and payers; healthcare providers subdivide into ambulatory care centers, clinics, and hospitals, while payers separate into government payers and private insurers. Each end-user category exhibits distinct operational drivers and procurement processes, which shape product requirements and go-to-market approaches.

Application segmentation includes care coordination, data analytics, patient engagement, population health management, and risk stratification; within data analytics there is a practical split between descriptive analytics and predictive analytics, and risk stratification distinguishes clinical risk from financial risk. Together, these application-level distinctions inform functional priorities during procurement and highlight where implementation complexity is likely to arise. For example, deployments emphasizing predictive analytics and financial risk stratification require deeper data integration and higher levels of model governance than those focused primarily on patient engagement or descriptive reporting.

Regional insights highlighting differential demand patterns across Americas, Europe Middle East and Africa and Asia Pacific for care management priorities

Regional dynamics materially affect strategic priorities and implementation approaches for care management initiatives. In the Americas, emphasis often falls on interoperability with mature electronic health record ecosystems, payer-provider integration, and initiatives that support both commercial and government-sponsored programs. Stakeholders in this region tend to prioritize scalability and robust reporting capabilities to meet regulatory and contractual transparency requirements while also pursuing patient engagement strategies attuned to diverse populations.In Europe, Middle East and Africa there is a heterogeneous mix of regulatory regimes and health system architectures that drive varying levels of centralization and procurement complexity. National digital health strategies, data protection frameworks, and varying degrees of public-sector involvement create divergent adoption pathways, with some markets accelerating nationally coordinated care management platforms and others favoring decentralized, regionally tailored solutions. Finally, in Asia-Pacific the landscape is characterized by rapid digital adoption, hybrid public-private models, and a strong appetite for mobile-first patient engagement. Organizations operating across these geographies must adapt governance, localization, and partnership approaches to align with regional regulatory expectations and differing provider workflows. Across all regions, executives should place emphasis on scalable integration, culturally competent patient engagement design, and compliance-ready data governance structures to realize the most durable outcomes.

Competitive intelligence detailing strategic positioning, partnership models, product portfolios and core value propositions among care management vendors

Company-level dynamics shape the competitive landscape through distinct approaches to product architecture, partnership strategies, and service models. Some firms emphasize platform breadth-offering integrated suites that span care coordination, analytics, and patient engagement-while others pursue depth through highly specialized solutions focused on predictive analytics or risk stratification. Strategic partnerships with health systems, payers, and technology infrastructure providers have become a critical means of accelerating market entry and extending implementation capacity, particularly where local support and regulatory alignment are essential.Moreover, vendors that combine robust implementation services with outcome-oriented contracting models tend to reduce buyer risk and accelerate executive buy-in. Competitive differentiation increasingly comes from demonstrable clinical workflows, ease of integration with existing EHRs, and evidence of measurable operational impact on care continuity. Additionally, vendors that invest in modular APIs and open interoperability frameworks enable faster integration and provide purchasers with greater long-term flexibility. For procurement teams, company selection should prioritize technical interoperability, service delivery capability, and a proven approach to change management that aligns with clinical and operational priorities.

Actionable recommendations for industry leaders to accelerate implementation, optimize partnerships, and realize measurable gains in care continuity and outcomes

Industry leaders can pursue several actionable moves to accelerate impact and mitigate implementation risk. First, align procurement and clinical governance by embedding clinical champions into vendor selection and contract negotiation processes; this alignment ensures that functional requirements reflect frontline workflows and avoids costly rework during deployment. Second, prioritize modular, standards-based architectures that support phased rollouts and reduce vendor lock-in, enabling organizations to adopt best-of-breed capabilities over time while preserving interoperability.Third, invest in implementation services and change management resources that are directly tied to outcome measures; contracting for support and maintenance should include clear performance indicators and escalation paths to sustain momentum post-launch. Fourth, strengthen data governance and model validation processes when deploying predictive analytics or risk stratification capabilities to ensure clinical relevance and regulatory compliance. Finally, cultivate a diversified partner ecosystem that includes technology vendors, implementation partners, and local support providers to build redundancy into supply chains and accelerate local adoption. Taken together, these actions create a replicable playbook for leaders seeking to translate strategic intent into measurable improvements in care continuity and patient experience.

Rigorous research methodology overview detailing primary and secondary approaches, data triangulation, validation techniques and analyst governance frameworks

The research methodology supporting these insights employs a structured approach combining primary stakeholder engagement, secondary evidence synthesis, and rigorous validation. Primary data collection includes executive interviews and structured practitioner consultations to capture real-world implementation experiences, procurement considerations, and outcome expectations. Secondary evidence synthesis draws on peer-reviewed literature, policy documents, and vendor technical documentation to establish baseline factual context and identify convergent themes.To ensure reliability, findings undergo data triangulation across multiple evidence streams and are subject to internal analyst governance that reviews assumptions, validates source integrity, and reconciles divergent inputs. The approach emphasizes transparency in methodology, including how segmentation boundaries are defined and how regional differences are interpreted. Where predictive models or analytics are discussed, the methodology clarifies data lineage, feature selection considerations, and validation techniques to support responsible use of insights. Finally, iterative peer review cycles with domain experts were used to refine practical recommendations and ensure applicability across diverse organizational contexts.

Concluding synthesis that distills strategic takeaways, emergent priorities and roadmap considerations for stakeholders committed to transforming care management

The concluding synthesis distills the essential strategic takeaways and emergent priorities for stakeholders focused on transforming care management. Organizations that succeed will be those that marry pragmatic implementation discipline with clear governance structures, ensuring that technology decisions are driven by clinical workflows and measurable outcomes. Emphasis on interoperability, modular architectures, and outcome-linked service models will continue to separate high-performing deployments from those that struggle to scale. Leaders should also monitor external factors-such as evolving procurement rules and supply chain shifts-that can alter vendor risk profiles and sourcing strategies.Ultimately, the path to improved care continuity and better patient outcomes is iterative and requires sustained executive sponsorship, disciplined change management, and an adaptable technology roadmap. By concentrating on the most impactful use cases, prioritizing data governance and model validation, and building resilient partnerships, organizations can convert strategic intent into operational improvements. This synthesis serves as a practical roadmap for stakeholders seeking to align investments with clinical priorities and to institutionalize capability improvements across the care continuum.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Care Management Solutions Market

Companies Mentioned

The key companies profiled in this Care Management Solutions market report include:- Allscripts Healthcare Solutions, Inc.

- Epic Systems Corporation

- GE HealthCare Technologies Inc.

- Health Catalyst, Inc.

- IBM Corporation

- Inovalon Holdings, Inc.

- Koninklijke Philips N.V.

- McKesson Corporation

- Oracle Cerner Corporation

- Teladoc Health, Inc.

- UnitedHealth Group Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

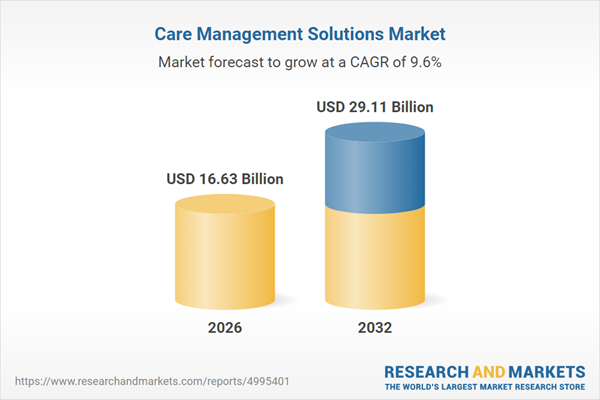

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 16.63 Billion |

| Forecasted Market Value ( USD | $ 29.11 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |