Speak directly to the analyst to clarify any post sales queries you may have.

The cashmere clothing market is entering a period of strategic transformation, with brands and suppliers adapting to shifts in consumer demand, technologies, and global sourcing challenges. Senior decision-makers must anticipate market movements while ensuring their approach aligns with evolving expectations for quality and value.

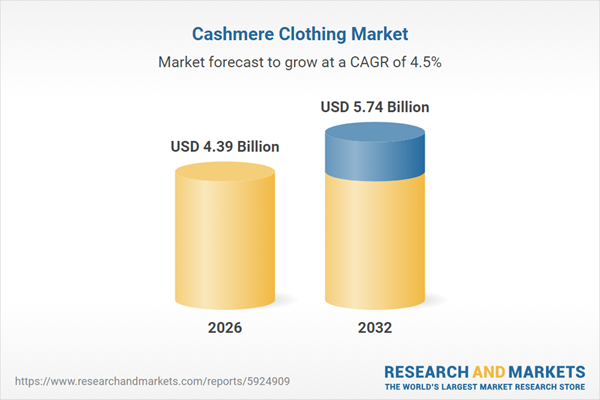

Market Snapshot: Cashmere Clothing Market

In 2025, the cashmere clothing market reached a value of USD 4.21 billion and is forecasted to grow to USD 4.39 billion by 2026. The market is projected to sustain a CAGR of 4.51%, leading to an estimated worth of USD 5.74 billion by 2032. The sector’s expansion reflects strong demand for premium textiles fueled by rising consumer awareness and innovation, driving brands to redefine their competitive positioning and channel strategies.

Scope & Segmentation

- Product Types: Includes ponchos, capes, scarves, shawls, wraps, and sweaters; each meets distinct demand cycles and reflects consumer preferences for versatility and luxury.

- Distribution Channels: Coverage spans brand websites, specialty stores, department stores, boutiques, and third-party e-commerce platforms, informing both direct-to-consumer and wholesale approaches.

- Gender Segments: Men’s, women’s, and unisex offerings shape merchandising strategies and product development, supporting inclusive marketing efforts across collections.

- Regional Coverage: Encompasses Americas, Europe, Middle East & Africa, and Asia-Pacific, each region requiring tailored approaches due to differences in digital adoption, heritage value, and aftercare expectations.

- Key Technologies: Emphasizes digital storytelling, traceability systems, omnichannel engagement, and circular service models. Adoption of these technologies strengthens customer trust and streamlines engagement, from origin tracking to post-purchase services.

With governance requirements and customer expectations rising, detailed segmentation allows organizations to prioritize initiatives, drive targeted marketing, and ensure product relevance. Adoption of traceability and digital engagement tools enables both independent ateliers and large brands to differentiate and connect with specific buyer cohorts in a fragmented market.

Key Takeaways for Senior Decision-Makers

- Prioritizing ethical sourcing and transparency in provenance is now core to brand integrity, expanding differentiation beyond traditional luxury positioning.

- Technology integration through digital channels supports greater reach and enables personalized interactions that improve brand resonance and supply chain oversight.

- Expanding circular service models, such as repair and take-back, is helping companies foster loyalty and maximize product lifecycle returns.

- Adapting to omnichannel retail requirements is vital, as diverse channels have become fundamental for sustaining consumer engagement and growth.

- Effectively tailoring product assortment and pricing by segment type and region ensures optimal margin and supports a balanced portfolio responsive to seasonal, gifting, and quality-driven demand.

- Recognizing regional distinctions in consumer behavior—such as heritage and aftercare value in the Americas versus digital-first purchasing in Asia-Pacific—enables more precise market entry and expansion strategies.

Tariff Impact: Strategic Considerations in Sourcing and Margin Management

Recent tariff adjustments in the United States are prompting brands to review sourcing frameworks and reinforce margin management practices. Companies reliant on imports are addressing these pressures through nearshoring, broadening supplier networks, and pursuing vertical integration. These measures ensure resilience against price fluctuations, safeguard quality material access, and support agile inventory management. Cross-functional collaboration strengthens the ability to maintain product standards and align allocation strategies with market shifts.

Methodology & Data Sources

The findings in this report use primary interviews, technical fabric assessments, and retail audits—both digital and physical—paired with ongoing policy review. Inputs from designers, sourcing directors, and retail partners provide insights, while traceability in evaluation ensures clarity and actionable outcomes.

Why This Report Matters

- Enables leadership to make informed investment and sourcing choices, even amid complex global supply and trade developments.

- Equips teams with actionable insights for refining product mixes and route-to-market options in an environment shaped by digital shifts and changing values.

- Outlines the operational drivers for sustaining brand equity, protecting margins, and extending the long-term value of customer relationships.

Conclusion

Long-term performance in the premium cashmere sector depends on synchronizing sourcing, product innovation, and omnichannel execution. Companies that prioritize transparency, product durability, and values-driven engagement can secure a stronger market position as the landscape evolves.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Cashmere Clothing Market

Companies Mentioned

The key companies profiled in this Cashmere Clothing market report include:- Autumn Cashmere, Inc.

- Brunello Cucinelli S.p.A.

- Burberry Limited

- Citizen Cashmere Ltd.

- Corso Vannucci srl

- Ermenegildo Zegna N.V.

- Fast Retailing Co., Ltd.

- Gap Inc.

- GOBI Cashmere Europe GmbH

- H&M Hennes & Mauritz AB (publ)

- Harrods Ltd.

- Hermès International S.A.

- Huzhou Zhenbei Cashmere Products Co., Ltd.

- Inditex S.A.

- Jennie Cashmere Inc.

- JM Knitwear Pvt. Ltd.

- John Hanly and Co Ltd

- Kering S.A.

- Loro Piana S.p.A.

- LVMH Moët Hennessy Louis Vuitton

- Malo spa

- Naked Cashmere

- Om Cashmeres

- Pringle of Scotland Ltd.

- Ralph Lauren Corporation

- Sofia Cashmere

- TSE & Cashmere House, Inc.

- White + Warren

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 4.39 Billion |

| Forecasted Market Value ( USD | $ 5.74 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |