Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive introduction to the cementing unit landscape clarifying operational drivers, technological inflection points, and stakeholder expectations across the value chain

The cementing unit sector operates at the intersection of field services, equipment engineering, and energy transition pressures, forming a critical node in well integrity operations. This introduction clarifies the remit of the executive summary by outlining the primary drivers, technological inflection points, and stakeholder expectations that shape procurement and operational approaches within cementing activities.Beginning with operational imperatives, the cementing unit must deliver reliable high-pressure pumping, precise control of cement slurry placement, and compatibility with evolving well designs. In parallel, capital allocation and lifecycle considerations increasingly favor solutions that reduce emissions, improve uptime, and enable remote diagnostics. Therefore, the overview frames the discussion in terms of operational resilience, technological adaptability, and regulatory compliance, providing a foundation for subsequent analysis on segmentation, regional dynamics, and strategic responses required by operators and vendors alike.

Major transformative shifts reshaping equipment specification, supply chain resilience, and technology adoption in contemporary cementing operations

Recent years have seen a set of transformative shifts that are redefining how cementing units are specified, procured, and operated. First, the drive toward decarbonization and emissions reduction has elevated interest in alternative power and propulsion systems, prompting engineering teams to reassess the viability of electrification, hybrid solutions, and lower-emission diesel configurations. This transition is not instantaneous; instead, it unfolds as a pragmatic rebalancing between performance requirements and environmental targets, with vendors accelerating development of electric motor-driven and battery-ready options while maintaining proven diesel-engine platforms for high-demand deployments.Second, digitalization has moved from pilot projects to integrated operational practice. Cementing units now incorporate condition monitoring, telemetry, and predictive maintenance capabilities that shorten turnaround times and improve reliability. These capabilities are increasingly tied to modular equipment designs that facilitate rapid redeployment and standardized interfaces across rigs and well sites. Third, supply-chain pressures and geopolitical factors have incentivized diversification of suppliers and local content strategies, pushing manufacturers to rethink production footprints and aftermarket support models. Taken together, these shifts are encouraging a more flexible, resilient, and performance-driven approach to specifying cementing equipment for contemporary well programs.

Assessment of 2025 United States tariff measures and their cascading effects on procurement pathways, supplier strategies, and operational continuity for cementing equipment

The imposition of tariffs and trade measures by the United States in 2025 has introduced material considerations for procurement strategies, supplier selection, and cost management across the cementing equipment ecosystem. While tariffs typically affect prices and sourcing decisions, their cumulative effect is better understood through supply-chain reactions: manufacturers and purchasers reassess sourcing geographies, prioritize components that can be localized, and adjust inventory strategies to buffer against cost volatility.Consequently, procurement teams are accelerating supplier diversification and emphasizing component standardization to mitigate tariff-driven disruption. In parallel, engineering teams are revising bill-of-materials and service agreements to reduce reliance on tariff-affected imports by favoring subsystems that can be produced domestically or sourced from tariff-exempt jurisdictions. These adjustments often require closer collaboration between vendors and end users to reconceptualize warranty terms, lead times, and spare parts logistics, ensuring operational continuity while accommodating the cost and timing impacts of new trade barriers.

Granular segmentation insights that link unit configurations, power choices, mobility options, and user profiles to operational priorities and procurement logic

Understanding demand drivers requires a careful reading of how equipment differentiation maps to operational needs across distinct technical and commercial segments. Unit type distinctions such as Diesel Engine, Electric, Hydraulic, and Solar configurations affect not only fuel and emissions profiles but also maintenance paradigms and on-site integration complexity. For example, electric-drive and solar-assisted approaches reduce onsite combustion emissions and shift maintenance capital toward electrical systems, whereas diesel-driven systems remain preferred where extended runtime and refueling logistics dominate.Power source variations, including Diesel Engine, Electric Motor, Hydraulic System, and Pneumatic arrangements, similarly shape lifecycle considerations and spare-parts ecosystems, influencing maintenance labor skill sets and hydraulic fluid management protocols. Mobility designations - Modular, Skid Mounted, Trailer Mounted, and Truck Mounted - inform deployment flexibility and site-readiness, with modular and skid-mounted units offering standardized interfaces for quicker installation while truck and trailer mounts prioritize rapid relocation for pad-to-pad operations.

Pressure rating categories spanning Up To 6000 Psi, 6000 To 10000 Psi, and Above 10000 Psi determine the suitability of units for a range of well types and cementing complexities, steering technical specification and materials selection. End-user segmentation among Drilling Contractors, Independent Operators, Integrated Majors, and National Oil Companies captures divergent procurement cycles, risk tolerances, and service-level expectations, which in turn dictate contract structures, aftermarket support, and preferred commercial models. Integrating these segmentation lenses enables a more nuanced match between equipment capabilities and operator priorities, supporting procurement choices that balance performance, cost, and operational agility.

Key regional dynamics that shape procurement preferences, compliance imperatives, and aftersales support models across the Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional dynamics continue to be a decisive factor for deployment strategies, service networks, and regulatory compliance. In the Americas, demand patterns reflect investment cycles in onshore shale plays and deepwater projects, with a heightened emphasis on rapid redeployability and robust aftermarket support; local fabrication capacity and service hubs materially influence vendor selection and total cost of ownership considerations. In contrast, Europe, Middle East & Africa presents a heterogeneous landscape where regulatory stringency, national content rules, and legacy offshore infrastructure create divergent paths to adoption of newer technologies, often privileging compliance-ready configurations and long-term service agreements.The Asia-Pacific region displays a mix of rapidly growing onshore activity and significant offshore development, prompting a split between modular, easily transportable units for emergent fields and higher-capacity systems for established offshore wells. Across all regions, cross-border logistics, local certification requirements, and availability of skilled technicians are recurring determinants of equipment selection and lifecycle support models. Therefore, regional strategy must align technical specifications with local regulatory frameworks and service ecosystem realities to ensure reliable operations and predictable support.

Insights on supplier differentiation focusing on engineering depth, aftermarket excellence, and strategic partnerships that drive procurement decisions

Competitive positioning among suppliers is increasingly defined by the depth of engineering support, aftermarket reach, and the ability to deliver configurable solutions that integrate across digital and mechanical domains. Leading manufacturers are differentiating through investments in reliability engineering, condition-based monitoring, and modular product families that reduce customization time. Meanwhile, service providers that can offer comprehensive maintenance packages, rapid spare-parts distribution, and performance guarantees are becoming preferred partners for operators seeking to minimize downtime and operational risk.Strategic alliances and aftermarket distribution networks play an outsized role in expanding geographic coverage and improving service-level responsiveness. Vendors with localized assembly or refurbishment capabilities reduce lead times and exposure to trade-related cost variability, while those offering training programs and field-support centers build stronger relationships with customers. As procurement teams prioritize total lifecycle performance, suppliers that can demonstrate consistent reliability, transparent service metrics, and flexible commercial arrangements will gain traction among cautious buyers and long-term operators alike.

Actionable recommendations for industry leaders to enhance resilience through modular design, predictive maintenance, and diversified sourcing strategies

Industry leaders should adopt a multi-pronged strategy that balances technological investment with pragmatic operational changes to preserve uptime and control costs. First, prioritize the modularization of equipment and standardization of interfaces to accelerate deployment and simplify spare-parts inventories. This reduces complexity across rigs and supports faster interchangeability between diesel-driven, electric motor, or hybrid configurations when site conditions demand different performance profiles.Second, invest in condition-based monitoring and remote diagnostic capabilities to shift maintenance from reactive to predictive practices, thereby reducing unplanned downtime and optimizing crew utilization. Third, develop flexible sourcing strategies that include qualified local suppliers and regional assembly options to mitigate tariff impacts and shorten lead times. Fourth, calibrate commercial models to include performance-linked service agreements and transparent metrics that align vendor incentives with operational reliability. Taken together, these actions create a resilient operating model that supports both near-term responsiveness and long-term innovation adoption.

Research methodology outlining qualitative synthesis, technical validation, and scenario-based triangulation to inform practical industry decisions

The research underpinning this summary synthesizes technical literature, industry best practices, and primary qualitative inputs from operators, equipment engineers, and service managers to construct a practical view of equipment and operational dynamics. Data collection prioritized first-hand interviews with field engineers and procurement leads, supported by engineering specifications and regulatory documents to validate technical assertions. Comparative analysis focused on equipment configuration trade-offs, supply-chain sensitivities, and service delivery mechanisms rather than quantitative forecasting.Triangulation of insights was achieved by cross-referencing interview findings with publicly available standards, manufacturer technical sheets, and regulatory guidance, ensuring that conclusions reflect practical constraints and operational realities. Where appropriate, scenario analysis was applied to illustrate how changes in trade policy, regional infrastructure, or technological adoption could influence procurement decisions and support models. This methodological approach emphasizes clarity, transparency, and applicability for decision-makers seeking to translate findings into operational and strategic initiatives.

Concluding synthesis emphasizing technical adaptability, aftersales capability, and supply-chain resilience as the pillars for sustained operational performance

In closing, the cementing unit environment is shifting toward more flexible, low-emission, and digitally enabled solutions, driven by operational imperatives and evolving regulatory expectations. Equipment choices increasingly hinge on a balance between proven high-pressure performance and the operational advantages of electrified or modular systems, while procurement strategies must incorporate supply-chain resilience in the face of trade policy shifts and regional variations.Future success will favor organizations that integrate technical adaptability with robust aftermarket capability, prioritize condition-based maintenance, and adopt sourcing strategies that mitigate geopolitical and logistical risk. By aligning engineering choices with regional realities and end-user risk tolerance, operators and vendors can enhance reliability, optimize lifecycle outcomes, and maintain competitive operational performance.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Cementing Unit Market

Companies Mentioned

- Baker Hughes Company

- Basic Energy Services, Inc.

- C&J Energy Services, Inc.

- Calfrac Well Services Ltd.

- China Oilfield Services Limited

- Halliburton Company

- Schlumberger Limited

- Sinopec Oilfield Service Corporation

- Trican Well Service Ltd.

- Weatherford International plc

- WELLCARE OIL TOOLS PRIVATE LTD

- Xi'An Zz Top Oil Tools Co.,Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

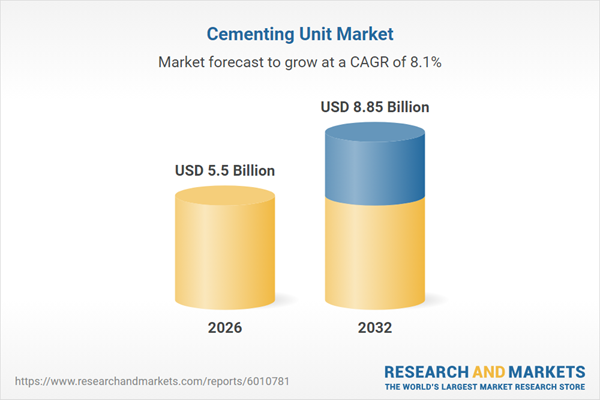

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 5.5 Billion |

| Forecasted Market Value ( USD | $ 8.85 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |