Global Chilled Soups Market - Key Trends and Drivers Summarized

Why Are Chilled Soups Becoming a Popular Choice Among Consumers?

Chilled soups have gained significant popularity in recent years, emerging as a go-to option for health-conscious consumers and those seeking convenience in their meals. These ready-to-eat soups, often made with fresh vegetables, herbs, and natural ingredients, offer a refreshing and nutritious alternative to traditional hot soups, especially in warmer climates or during summer months. The increasing demand for convenient, ready-to-consume food products has made chilled soups a popular choice for those with busy lifestyles. Unlike their canned or instant counterparts, chilled soups are often perceived as fresher and healthier, containing fewer preservatives and artificial additives. Additionally, they are easy to incorporate into daily meals, providing a quick and nutritious option for lunch or dinner without the need for cooking or reheating. As consumers become more focused on healthy eating and time-saving food options, chilled soups have carved out a niche in the growing market for fresh, minimally processed foods.How Are Health and Wellness Trends Driving the Chilled Soups Market?

Health and wellness trends have had a profound impact on the chilled soups market, shaping both consumer demand and product offerings. As people become increasingly aware of the importance of clean eating and nutrient-dense diets, there has been a marked shift toward fresh, plant-based, and organic products. Chilled soups, made from wholesome ingredients like vegetables, fruits, and legumes, align perfectly with this trend. Many consumers view chilled soups as a healthier option due to their lower sodium content, lack of preservatives, and inclusion of fresh, nutrient-rich ingredients. Moreover, the rise of plant-based diets and vegetarianism has fueled demand for vegetable-heavy, vegan-friendly soups, which often dominate this market. Chilled soups are also tapping into the growing interest in functional foods - those that provide specific health benefits beyond basic nutrition. Many brands now offer soups enriched with superfoods like kale, quinoa, and turmeric, appealing to consumers looking for meals that not only satisfy hunger but also support overall health and wellness. Additionally, the emphasis on clean labels and transparency in ingredients has bolstered the appeal of chilled soups, as more consumers prioritize foods that are free from artificial additives, GMOs, and other controversial ingredients. This combination of convenience, freshness, and health benefits has helped chilled soups become a staple in the modern, health-conscious consumer's diet.What Technological Innovations Are Driving Innovation in Chilled Soups?

Technological advancements are playing a critical role in the production and distribution of chilled soups, enabling manufacturers to deliver fresher, longer-lasting products. One of the most significant developments is the use of high-pressure processing (HPP), a method that extends the shelf life of fresh foods without the need for heat or preservatives. HPP allows chilled soups to maintain their nutritional content, flavor, and texture while ensuring food safety. This technology is particularly valuable for soups made with delicate, fresh ingredients that can lose quality through traditional thermal processing. By utilizing HPP, companies are able to offer a product that retains its fresh taste and health benefits for a longer period, meeting consumer demand for freshness without sacrificing convenience. Another critical innovation is in packaging technology. Modified atmosphere packaging (MAP), which replaces oxygen with other gases such as nitrogen or carbon dioxide, is being used to slow down the spoilage of chilled soups, allowing them to stay fresh longer on store shelves. This, combined with eco-friendly, recyclable packaging solutions, caters to both sustainability trends and the demand for convenience. Cold chain logistics have also seen improvements, ensuring that chilled soups remain at the optimal temperature throughout transportation and storage, thus reducing the risk of spoilage and maintaining product integrity. These advancements in processing and packaging are critical in supporting the continued growth of chilled soups, making them more accessible and appealing to a broader audience.What Factors Are Fueling the Growth of the Chilled Soups Market?

The growth in the chilled soups market is driven by several factors, including changing consumer lifestyles, the rise of health and wellness trends, and technological advancements in food processing and packaging. As consumer lifestyles become busier, there is an increasing demand for convenient yet nutritious meal options, and chilled soups provide an easy solution for those looking for a quick, healthy meal. The shift toward plant-based eating and the growing interest in fresh, minimally processed foods have also contributed to the market's expansion, as more consumers opt for products that offer a balance between convenience and health benefits. The emphasis on natural ingredients, clean labels, and functional foods has driven both innovation and consumer interest in chilled soups, as brands continue to introduce new varieties tailored to specific dietary preferences and health goals. Technological advancements, such as high-pressure processing and improved packaging solutions, have enabled companies to offer chilled soups with longer shelf lives while maintaining freshness and nutritional value. This has made chilled soups a viable option not only in grocery stores but also in grab-and-go sections of cafes and convenience stores, further driving market growth. The rise of e-commerce and direct-to-consumer food delivery services has also expanded the market, making it easier for consumers to access chilled soups from the comfort of their homes. Additionally, growing consumer awareness of environmental issues has led to an increased demand for sustainable packaging options, pushing brands to adopt eco-friendly materials that align with consumer values. Together, these trends are propelling the chilled soups market forward, ensuring its continued expansion in both domestic and global markets.Report Scope

The report analyzes the Chilled Soups market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Packaging (Cups / Tubs, Pet Bottles, Pouches, Carton Packaging).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cups / Tubs segment, which is expected to reach US$941.5 Million by 2030 with a CAGR of 4.8%. The Pet Bottles segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $341.9 Million in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $380.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chilled Soups Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chilled Soups Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chilled Soups Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

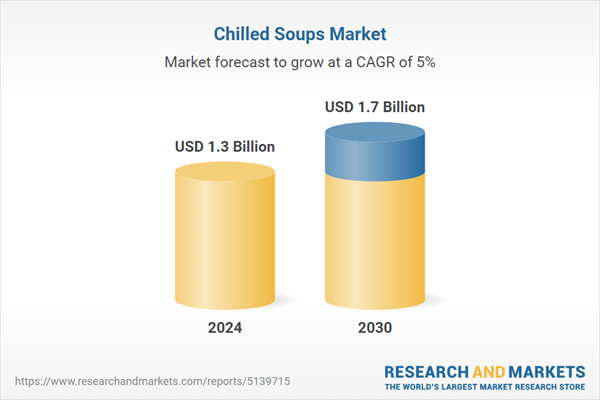

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Campbell Soup Company, PepsiCo, Inc., Sonoma Brands, Soupologie, The Billington Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Chilled Soups market report include:

- Campbell Soup Company

- PepsiCo, Inc.

- Sonoma Brands

- Soupologie

- The Billington Group

- The Hain Daniels Group Ltd.

- Tio Gazpacho

- Woolworths Group Limited.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Campbell Soup Company

- PepsiCo, Inc.

- Sonoma Brands

- Soupologie

- The Billington Group

- The Hain Daniels Group Ltd.

- Tio Gazpacho

- Woolworths Group Limited.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 326 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.3 Billion |

| Forecasted Market Value ( USD | $ 1.7 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |