Key Highlights

- The growing preference for farm mechanization and an increase in the number of government-funded policies are promoting the market's growth. China has introduced the 'Made in China 2025' scheme, which aims at focusing on producing 90% of its own agricultural equipment with high-end machines, like agricultural tractors, holding a one-third share of their segments by 2020. This, in turn, boosts indigenously produced tractors leading to the growth of the agricultural tractor market in the country.

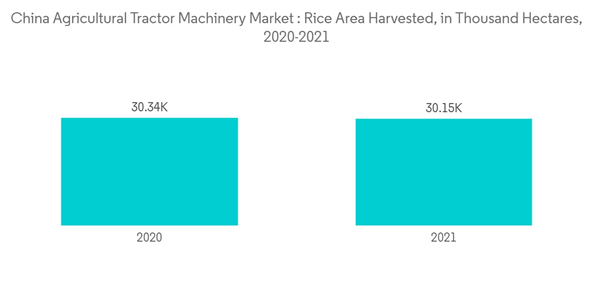

- According to Food and Agriculture Organization (FAO), rice, maize, wheat, sugarcane, potato, tea, and many others are the major crops produced in the country. In 2021, farmers in China produced around 212.84 million metric tons of rice. At the same time, the production volume of wheat amounted to approximately 136.95 million metric tons in China. The production volume of rice, wheat, and corn in China increased continuously until 2015, remained flat thereafter, but grew again in 2021.

- China's total demand for agricultural products, including food, feed, biofuel, or other use, is projected to increase substantially by mid-century. This is reflected in a 13% increase in per capita calorie demand in the 2050 BAU scenario relative to 2010 and a 6% increase relative to 2020.

- The increase in the demand for crop products (34%) is projected to be driven mainly by the country's additional usage of farm types of machinery requirements. In particular, the demand for cereals is projected to increase from 420 metric tons in 2010 to 530 metric tons in 2050, driven mainly by the increase in cereal feed demand (84%).

China Agricultural Tractor Machinery Market Trends

Growing Preference For Farm Mechanization

- Agricultural mechanization is essential to increase farmers’ income in modern agriculture. However, the use of machinery for crop production in China is quite inefficient. According to a study conducted by China Agricultural University (CAU), Beijing, in 2020, the national crop planting and harvesting mechanization rate reached 71%.

- The comprehensive mechanization rate of planting and harvesting exceeds 95%, 85%, and 90% for wheat, rice, and maize, respectively. To accelerate agricultural mechanization, the Chinese government issued a series of policies to encourage farmers to use machinery, including financial subsidies for machine purchases and machine operations and support for cooperatives to provide machinery for individual farmers.

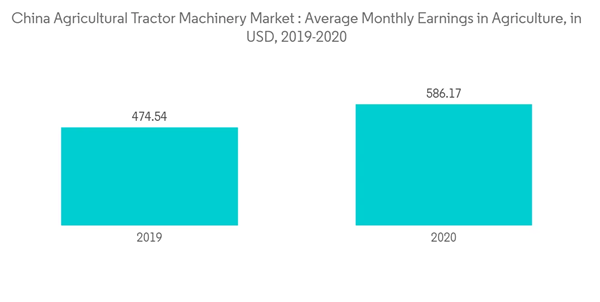

- There is a growing need for farm mechanization in the region, as farmers’ income has not been able to keep pace, such as to cater to the increasing cost of production, including labor wages. Farm mechanization, such as using tractors in agriculture, will reduce the wage-labor costs as less manpower is used for farming, besides enhancing manpower productivity. There is an urgent need for farm mechanization in crops such as rice, wheat, corn, potato, oilseed rape, cotton, and sugarcane to boost production.

- Tractors (25-100 HP) dominate the market due to the low purchase cost compared to high-end tractors. Several regional regulatory bodies, such as China Agricultural Industry Mechanization Association (CAIMA), promote farm mechanization by educating cooperatives and individual farmers about the benefits of using high-horsepower tractors in larger farm areas. Thus, the rapid increase in farm mechanization by farmers across the region drives the sales of tractors, promoting the market growth.

Row Crop Tractors Dominate the Market

- With the growing unavailability of farm laborers and the growing farm mechanization of agriculture, the demand for row-crop tractors boosts the sales of the China agricultural tractor machinery market. The increasing demand for low power under limited arable land, precision, handling, and efficiency has shaped the development of the modern planter tractor, and it continues to drive the development of these tractors.

- The row-crop tractor is specifically tailored to grow crops that meet all agricultural demands, such as plowing, harrowing, leveling, pulling seed drills, weed control, and running various machines, like water pumps and belt pulley threshers. These tractors are provided with replaceable driving wheels of different tread widths.

- Due to low-end production capacity, China needs a more effective supply of agricultural machinery, including tractors. It cannot meet the full-scale agricultural diversification needs due to inadequate technologies supporting product growth.

- To boost the domestic production of farm machinery, the Chinese government framed a new agricultural machinery subsidy policy to purchase agricultural machinery, including tractors. The types of subsidy equipment cover 45 items in 23 categories and 11 categories, including farming and land preparation machinery, planting and fertilizing machinery, and field management machinery. The buyers of tractors above 60 HP and above can enjoy a subsidy of CNY 150,000 (USD 21563.81).

China Agricultural Tractor Machinery Industry Overview

The agricultural tractors market in China is moderately consolidated, with very few players cornering most of the market share. Deere & Company, CNH Industrial NV, AGCO Corporation, Kubota Corporation, and YTO Group Corporation are some of the major players operating in this market. New product launches, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market in the country. Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years. These companies are making strategic partnerships by partnering with domestic companies to expand their distribution network and launch new innovative tractors that cater to the needs of the farmers in this region.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Deere & Company

- CNH Industrial NV

- AGCO Corporation

- Kubota Corporation

- Tractors and Farm Equipment Limited

- YTO Group Corporation

- Shandong Wuzheng Group Co. Ltd

- Shandong Shifeng (Group) Co. Ltd