Speak directly to the analyst to clarify any post sales queries you may have.

The chronometers market is undergoing a significant transformation as a result of evolving craftsmanship, advancing technology, and shifting customer expectations. Senior executives are tasked with steering their organizations through this period of change to secure growth and operational resilience.

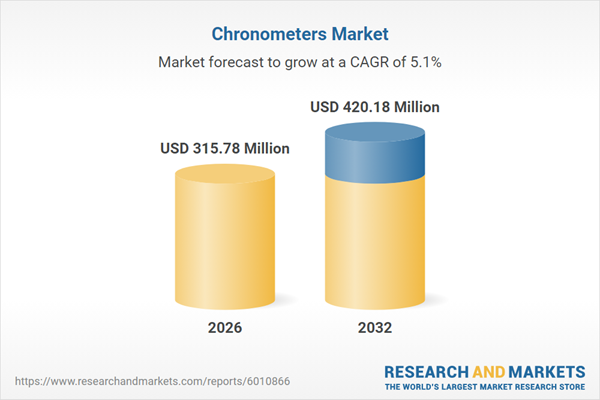

Market Snapshot: Chronometers Market Size and Outlook

The Chronometers Market grew from USD 296.35 million in 2025 to USD 315.78 million in 2026, and is projected to continue expanding at a CAGR of 5.11%, reaching USD 420.18 million by 2032. This upward trend reflects rising demand for precision timekeeping instruments across key regions and signals a dynamic landscape for both established and emerging brands.

Scope & Segmentation

- Movement Technologies: Automatic, manual, and quartz movements each address distinct buyer needs. Mechanical types attract enthusiasts valuing heritage and servicing, while quartz technologies cater to reliability-focused and cost-sensitive segments.

- Material Types: Choices range from ceramic and stainless steel to precious metals and titanium. Material selection influences aesthetics, performance, and lifecycle cost, crucial to aligning with brand positioning and customer trust.

- Distribution Channels: Both offline and online avenues are vital. Brick-and-mortar locations support experiential selling and service, while digital platforms enhance reach, data capture, and narrative-led engagement.

- Regions Covered: The report examines dynamics across the Americas, EMEA, and Asia-Pacific. Each region displays unique demand drivers, retail structures, and compliance requirements, necessitating nuanced go-to-market strategies.

Primary Keyword: Chronometers Market

Key Takeaways for Decision-Makers

- Craftsmanship and technical excellence underpin consumer loyalty, while modern digital capabilities reshape buyer journeys from research to after-sales.

- Value chain optimization hinges on integrating artisanal methods with scalable manufacturing and automated quality controls, improving both margin and market responsiveness.

- Retail and brand strategies increasingly blend heritage narratives with verifiable performance data to distinguish offerings in a crowded marketplace.

- Sustainability and transparent sourcing practices are now essential for brand equity and stakeholder confidence, reflected in procurement and aftercare models.

- Strategic omnichannel approaches that combine immersive offline experiences with digital engagement drive consideration, conversion, and retention across audience segments.

- Sector leadership requires aligning operational agility with evolving policy, consumer, and regulatory pressures to capture emerging growth opportunities.

Impact of 2025 Tariffs on the Chronometers Sector

Following the 2025 tariff revisions, chronometer manufacturers and suppliers revisited supply chain structures, sourcing strategies, and customs compliance. The result has been widespread supplier diversification, nearshoring, and investment in documentation and classification accuracy to prevent disruptions. Leaders with flexible relationships and robust customs management adapted most effectively, demonstrating the importance of operational resilience in maintaining timely deliveries and stable costs.

Methodology & Data Sources

This report is built on a triangulated research approach, combining executive interviews, technical reviews, and operational benchmarking. Insights from senior leaders were corroborated through analysis of engineering documents, materials science sources, and operational data across the supply chain. Benchmarking across representative companies validates the actionable nature of strategic recommendations.

Why This Report Matters

- Empowers senior leaders to anticipate and respond decisively to sectoral shifts in technology, policy, and consumer expectations.

- Equips decision-makers with clear guidance on aligning product development, channel strategy, and supply chain resilience with current and future market realities.

- Enables actionable comparison with competitors, supporting evidence-based strategy formation grounded in real-world operational and segment-specific benchmarks.

Conclusion

Sustaining competitive advantage in the chronometers market requires blending technical rigor, adaptive supply chain management, and customer-centric strategies. Executives who deploy resilient operating models and integrate stakeholder expectations position their organizations for continued success through the next chapter of sector evolution.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Chronometers Market

Companies Mentioned

- Audemars Piguet Holding SA

- Breitling SA

- Cartier International AG

- Chelsea Clock Company

- IWC Schaffhausen GmbH & Co. KG

- Jaeger-LeCoultre SA

- Longines Watch Co. Francillon Ltd.

- Omega SA

- Patek Philippe SA

- Rolex SA

- TAG Heuer SA

- Vortic Watch Co.

- WilsonClock

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 315.78 Million |

| Forecasted Market Value ( USD | $ 420.18 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |