Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, broad market adoption is frequently obstructed by the continuing issue of shadow IT, which hides visibility into an organization's technology stack. This phenomenon generates isolated data silos and security vulnerabilities that make it difficult to establish a cohesive asset management strategy, serving as a major hurdle to the market's thorough expansion among global enterprises.

Market Drivers

The increasing embrace of hybrid IT and multi-cloud architectures serves as a major catalyst for the Global Cloud Asset Management Market. As businesses shift from singular on-premise systems to scattered environments that blend private, public, and edge infrastructures, maintaining a centralized inventory becomes progressively difficult. This fragmentation requires management solutions capable of gathering data from various providers to guarantee security and operational continuity. Underscoring the necessity for such tools, Nutanix's 'Enterprise Cloud Index' from March 2024 noted that 90% of IT decision-makers view a hybrid multicloud model as their ideal operating framework, highlighting the inevitable complexity that demands strong oversight mechanisms.Concurrently, the rising need for financial governance and cloud cost optimization is fueling substantial market growth. Organizations face mounting pressure to align cloud usage with business outcomes, requiring detailed visibility into resource utilization to enact effective FinOps strategies. Without automated asset management, companies face the risk of significant financial losses due to dormant instances and excessive provisioning. The 'State of FinOps' report by the FinOps Foundation in February 2024 revealed that 50% of practitioners consider reducing waste their top priority. This urgency is further emphasized by Flexera's 2024 data, which estimated that organizations waste 32% of their cloud spend, confirming the critical need for asset management solutions to enforce fiscal discipline.

Market Challenges

The enduring presence of shadow IT represents a significant obstacle to the Global Cloud Asset Management Market's growth by fundamentally compromising the visibility needed for effective resource governance. When business units purchase infrastructure and software without central oversight, they create fractured data silos that asset management tools cannot effectively monitor or index. This lack of transparency nullifies the core value proposition of asset management platforms, which depends on a unified, holistic view of an organization's inventory to drive compliance and cost optimization. Consequently, enterprises often hesitate to deploy these solutions globally, as the platforms struggle to prove their return on investment when a large portion of the technology estate remains hidden from the central ledger.The magnitude of this visibility gap is substantial and directly limits market penetration. According to the Cloud Security Alliance, 55% of organizations in 2025 reported that employees were adopting SaaS applications without the involvement of security teams. This high rate of unmanaged procurement forces asset management vendors to race against the speed of internal adoption, limiting their ability to deliver a comprehensive governance strategy. As long as unauthorized acquisition evades formal tracking mechanisms, the market will encounter friction in implementing the centralized control necessary for thorough asset management.

Market Trends

The incorporation of Generative AI into asset management platforms signifies a paradigm shift from static inventory tracking to predictive lifecycle optimization. sophisticated algorithms are now capable of analyzing extensive datasets of usage patterns to forecast capacity needs and automate complex configuration adjustments, thereby reducing the manual effort previously required to maintain cloud health. This technological progression empowers organizations to proactively detect inefficiencies and ensure policy adherence before operational disruptions arise, moving beyond reactive governance. In the 'State of AI' report from March 2024, Dynatrace found that 83% of technology leaders consider AI mandatory for keeping pace with the dynamic nature of cloud environments, validating the essential role of intelligent automation in managing modern digital estates.Simultaneously, the market is adjusting to the specific challenges presented by ephemeral computing resources, requiring detailed tracking mechanisms for serverless functions and containerized environments. Traditional asset management tools frequently fail to record the rapid creation and termination of these short-lived assets, resulting in blind spots that hinder accurate security monitoring and billing. To address this, modern solutions are evolving to capture real-time telemetry data that accounts for resources existing for only seconds or minutes. Highlighting the speed at which systems must now operate, Sysdig's 'Cloud-Native Security and Usage Report' from February 2024 revealed that 70% of containers exist for less than five minutes, emphasizing the critical velocity required for asset management systems to maintain total visibility.

Key Players Profiled in the Cloud Asset Management Market

- IBM Corporation

- Oracle Corporation

- Amazon Web Services Inc.

- BMC

- Hewlett Packard Enterprise

- Cisco Systems Inc.

- Flexera Software LLC

- Snow Software

- ServiceNow Inc.

- Micfo Inc.

Report Scope

In this report, the Global Cloud Asset Management Market has been segmented into the following categories:Cloud Asset Management Market, by Deployment Model:

- Public cloud

- Private cloud

- Hybrid cloud

Cloud Asset Management Market, by Solution Type:

- Cloud discovery and inventory

- Cloud cost management

- Cloud security management

- Cloud governance and compliance

- Cloud optimization

Cloud Asset Management Market, by Industry Vertical:

- IT

- Healthcare

- Financial services

- Retail

- Manufacturing

- Media and entertainment

- Government

- Others

Cloud Asset Management Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Cloud Asset Management Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Cloud Asset Management market report include:- IBM Corporation

- Oracle Corporation

- Amazon Web Services Inc.

- BMC

- Hewlett Packard Enterprise

- Cisco Systems Inc.

- Flexera Software LLC

- Snow Software

- ServiceNow Inc.

- Micfo Inc

Table Information

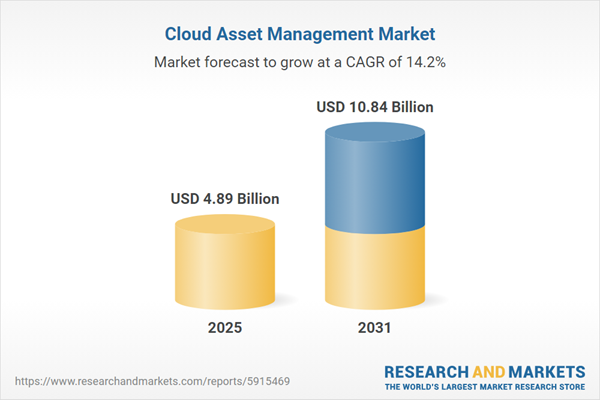

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 4.89 Billion |

| Forecasted Market Value ( USD | $ 10.84 Billion |

| Compound Annual Growth Rate | 14.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |