Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative overview of cloud DVR strategic context and the technical, commercial, and regulatory drivers shaping record-and-playback services across modern content ecosystems

Cloud DVR technology has evolved from a niche convenience to a strategic capability that redefines how content is recorded, monetized, and consumed. As service providers and content owners seek scalable, resilient ways to deliver time-shifted viewing across devices, cloud-based recording and playback infrastructures have become core to consumer engagement strategies. This executive summary opens by establishing the operational and commercial context for cloud DVR solutions, highlighting the interplay of platform innovation, licensing structures, and end-user behavior.In recent years, device diversity and platform convergence have driven technical requirements for low-latency recording, flexible retention policies, and seamless cross-device continuity. At the same time, business models have diversified; ad-supported experiences coexist with subscription approaches and on-demand pay-per-use offerings. These dynamics are underpinned by advances in cloud-native architectures, containerization, and edge distribution, which collectively reduce deployment friction and accelerate feature rollout.

Consequently, stakeholders must navigate a landscape where regulatory considerations, content rights management, and consumer privacy expectations intersect with engineering trade-offs. The introduction prepares leaders to interpret the deeper analyses that follow, equipping them to assess vendor strategies, prioritize product roadmaps, and align commercial models with evolving consumption patterns.

How edge compute, programmatic ad integration, evolving content rights, and hybrid cloud strategies are collectively redefining competitive advantage in cloud DVR services

The cloud DVR landscape is being reshaped by a set of transformative shifts that are altering competitive dynamics and creating new pathways to monetization. First, edge compute proliferation and greater CDN sophistication are lowering latency and improving stream continuity, enabling near-real-time recording and playback that closely mimic the experience of local DVRs. This technical maturation is unlocking more comprehensive feature sets such as multi-device resume, granular retention controls, and richer personalization tied to viewing profiles.Second, advertising technology integration is maturing from simple ad insertion to context-aware, programmatic approaches that allow targeted monetization of time-shifted content. As a result, ad-supported pricing models are becoming more sophisticated, blending addressable inventory with dynamic decisioning that preserves user experience while increasing yield. Third, content rights frameworks and licensing negotiations are evolving to accommodate cloud-native workflows; rights holders are increasingly receptive to flexible distribution models but insist on robust usage analytics and DRM compliance.

Fourth, consumer expectations continue to shift toward instant, uninterrupted access across mobile devices, smart TVs, and web platforms, forcing vendors to harmonize user interfaces and synchronization logic. Finally, organizational shifts toward hybrid and multi-cloud deployment strategies are enabling operators and OTT providers to optimize cost, performance, and regulatory compliance by distributing workloads across private and public environments. Together, these shifts are accelerating feature innovation and reframing how operators approach product differentiation and partnerships.

Assessing the cumulative supply chain, procurement, and commercialization consequences arising from 2025 United States tariff adjustments and global trade responses

Policy shifts in trade and tariff regimes, particularly adjustments announced or anticipated from the United States in 2025, have introduced a layer of operational uncertainty for companies that rely on cross-border hardware procurement and international content distribution. Higher tariffs on imported components and finished devices raise the effective cost of set-top boxes and specialized recording appliances, prompting operators to revisit hardware refresh cycles and supplier diversification strategies. In response, many vendors are accelerating efforts to standardize on modular, software-defined components that reduce dependence on tariff-sensitive hardware.Beyond hardware, tariffs can indirectly affect the supply chain for server and storage hardware used in centralised and edge cloud DVR deployments. This has led some providers to evaluate regional sourcing and manufacturing partnerships to mitigate cost volatility. Furthermore, changes in trade policy can influence vendor negotiations around licensing and content distribution, especially when content delivery involves cross-border support agreements or servers located in multiple jurisdictions.

In terms of commercialization, tariff-driven cost pressures are likely to shift negotiations between vendors and service providers, with increased emphasis on total cost of ownership and outcomes-based commercial terms. Operators may reallocate investment from capital-intensive on-premises hardware to subscription-based hosted services or managed deployments that distribute cost and operational risk. Moreover, regulatory responses by trade partners and reciprocal measures may add complexity to international rollouts, necessitating scenario planning and flexible contractual terms. Overall, the cumulative impacts of tariff changes in 2025 are accelerating structural adaptations across procurement, deployment, and commercial models, compelling stakeholders to pursue resilience through diversification and software-centric architectures.

Detailed segmentation analysis linking pricing, end-user profiles, platform diversity, application priorities, service models, and deployment topologies to actionable product and commercial strategies

A nuanced segmentation framework illuminates where value accrues and where competitive pressure will intensify as cloud DVR offerings proliferate. When viewed through the lens of pricing models, distinct commercial behaviours emerge across ad supported, pay per use, and subscription approaches, each demanding different measurement and monetization capabilities. Ad supported deployments prioritize precise ad insertion and measurement tools to protect CPMs, while pay per use systems require granular billing integration and trust in usage accounting. Subscription-oriented services emphasize retention mechanics, bundled offerings, and loyalty analytics to preserve long-term ARPU.Examining end-user categories reveals divergent operational priorities between commercial and residential deployments. Commercial environments emphasize multi-user access controls, compliance, and integration with existing enterprise media systems, whereas residential deployments focus on seamless family profiles, parental controls, and consumer UX parity across devices. Platform segmentation introduces another layer of complexity: mobile, set top box, smart TV, and web each present unique constraints and opportunities. Mobile platforms-comprising smartphone and tablet-demand bandwidth-adaptive streams and responsive playback experiences, while set top boxes-divided between operator STB and OTT STB-necessitate efficient local caching and synchronization with cloud retention policies. Smart TV distribution across OEMs such as LG and Samsung imposes constraints related to platform SDKs, certification cycles, and native app behaviours. Web access, split between app-based and browser-based experiences, requires careful orchestration of DRM, cookies or local storage policies, and cross-session continuity.

Application-driven segmentation clarifies technical priorities: ad insertion requires real-time decisioning and seamless splicing, catch up TV demands robust content ingestion and metadata normalization, and time shift functionality centers on retention policy enforcement and playback resilience. Service model choices-hosted, managed, and self managed-dictate operational responsibility and vendor engagement levels, with hosted models favoring speed-to-market, managed services offering hybrid operational control, and self managed implementations delivering maximal customization at the cost of internal operational burden. Deployment options-hybrid, private, and public-interact with regulatory and performance considerations, where hybrid deployments often provide a pragmatic balance between latency-sensitive edge functions and economical public cloud storage, private clouds meet strict data sovereignty requirements, and public clouds enable rapid scaling and geographic reach. By integrating these segmentation vectors, decision-makers can prioritize investments that align product capabilities with commercial objectives and regulatory constraints.

How regional regulatory regimes, device profiles, and consumer behaviours across the Americas, Europe Middle East & Africa, and Asia-Pacific dictate differentiated cloud DVR deployment and monetization approaches

Regional dynamics exert a profound influence on cloud DVR adoption, feature prioritization, and operational design. In the Americas, mature OTT ecosystems and high device penetration create fertile ground for feature-rich time-shift capabilities, sophisticated ad targeting, and bundled subscription offerings; however, this region also presents stringent data privacy expectations and intense competition that push incumbents to innovate on both user experience and monetization.Across Europe, Middle East & Africa, fragmentation in regulatory regimes and varied content licensing norms require flexible deployment models and local partner ecosystems. Operators in this macro-region frequently balance cross-border content rights with localized user preferences, making hybrid and private deployments attractive where sovereignty and latency are primary concerns. Moreover, diverse device profiles and broadband quality variations necessitate adaptive streaming strategies and resilient caching architectures.

In Asia-Pacific, rapid mobile-first consumption, growing smart TV adoption, and aggressive operator-led bundling shape a landscape that rewards low-latency playback, robust mobile integration, and scalable cloud architectures. This region’s mix of mature and emerging markets encourages experimentation with ad supported and pay per use pricing models, while also driving demand for cost-efficient edge deployments to manage high concurrent usage and reduce international egress costs. Collectively, these regional conditions stress-test deployment choices and commercial models, underscoring the need for localized go-to-market strategies and partner alignments that reconcile global platform capabilities with regional market realities.

Competitive and vendor landscape insights highlighting technical differentiation, partnership strategies, and commercial models that determine supplier success in cloud DVR offerings

Competitive dynamics in the cloud DVR space are shaped by a mix of incumbent media infrastructure vendors, nimble cloud-native entrants, and systems integrators that bridge content owners with service operations. Leading providers differentiate through the depth of their ad insertion capabilities, the resiliency of their recording and retrieval pipelines, and their ability to integrate DRM and rights management across diverse platforms. Strategic partnerships with CDN providers, analytics vendors, and device OEMs have become table stakes for those seeking to deliver consistent cross-device experiences.Successful companies are also investing in modular architectures and well-documented APIs to make integration with third-party monetization engines and recommendation platforms straightforward. This API-first approach reduces time to market for new features such as personalized retention windows, user-driven clip creation, and interactive ad formats. Moreover, vendor roadmaps increasingly emphasize orchestration layers that automate content ingestion, metadata enrichment, and rights reporting-capabilities that buyers prioritize when evaluating managed or hosted offerings.

From a go-to-market perspective, companies that offer flexible commercial models-blending managed operations with self-managed tooling or offering white-label consumer experiences-tend to win larger, multi-territory deals because they can accommodate varied regulatory and operational needs. Additionally, supportive professional services, robust SLAs, and transparent security certifications play a decisive role in vendor selection when enterprise and operator buyers must reconcile performance with compliance obligations.

Actionable strategic playbook for industry leaders that aligns modular architectures, unified monetization telemetry, and flexible deployment blueprints to accelerate adoption and manage regulatory and cost risks

Industry leaders should adopt a three-pronged approach that aligns technology, commercial structure, and operational resilience to capture and sustain advantage in the cloud DVR arena. First, accelerate the shift to software-defined, modular architectures that decouple recording, storage, and playback functions. This enables rapid iteration, simplifies vendor substitution, and reduces sensitivity to tariff-driven hardware cost fluctuations, while also facilitating edge-native components for latency-critical playback.Second, design monetization stacks that are agnostic to pricing model yet optimized for measurement fidelity. Implement common instrumentation across ad supported, pay per use, and subscription offerings so that yield management and retention analytics can be compared and optimized in a unified manner. By doing so, teams can redeploy inventory across models in response to consumer behaviour and competitive pressure without sacrificing measurement integrity.

Third, pursue deployment flexibility by combining hybrid strategies with regional sourcing and localized partner ecosystems to manage regulatory and cost risks. Establish a set of preset deployment blueprints-one optimized for low-latency urban environments, another for sovereignty-constrained markets, and a third for cost-sensitive, high-volume mobile markets-to accelerate market entry and reduce implementation risk. Additionally, invest in professional services and runbooks that enable customers to transition smoothly between hosted, managed, and self-managed modes.

Finally, prioritize privacy-by-design and rights-aware telemetry to ensure compliance while preserving the analytics necessary for personalization and ad targeting. These recommendations should be enacted through cross-functional teams that include engineering, legal, and commercial leaders to ensure technical feasibility, contractual alignment, and market responsiveness.

Transparent and reproducible research methodology combining executive interviews, technical validation, secondary source triangulation, and scenario analysis to ensure robust cloud DVR insights

This research synthesizes qualitative and quantitative evidence gathered through a structured methodology that balances primary engagements with corroborative secondary research to ensure analytical rigor. Primary inputs include interviews with technology leaders, product executives, and operator architects to capture first-hand perspectives on pain points, adoption barriers, and feature roadmaps. These conversations are complemented by technical deep dives with platform engineers to validate architectural assumptions and performance trade-offs.Secondary research draws on publicly available regulatory documents, vendor technical whitepapers, device SDK documentation, and industry publications to contextualize findings and triangulate claims. Data synthesis involves cross-referencing these inputs, identifying recurring themes, and isolating outliers for deeper validation. Where appropriate, scenario analysis is applied to explore the implications of policy shifts, such as tariff adjustments, and to stress-test vendor and operator strategies under alternative operational constraints.

Analytical processes include capability mapping, vendor scorecards, and deployment archetype development, which together enable consistent comparisons across technology and commercial dimensions. Throughout, attention is paid to methodological transparency, with assumptions and data sources documented to support traceability and enable informed decision-making by readers.

Concluding strategic synthesis that connects technological advancement, commercial structuring, and regional adaptations to guide pragmatic decision-making for cloud DVR initiatives

In conclusion, cloud DVR has transitioned from a feature differentiator to a strategic ingredient of modern content ecosystems, shaping how providers compete on experience, monetization, and operational resilience. Technical advances in edge compute, ad decisioning, and cloud orchestration have converged with shifting licensing practices to create opportunities for differentiated services that cater to diverse consumer behaviors and regional constraints. Stakeholders that embrace modular architectures, unified monetization telemetry, and flexible deployment blueprints will be best positioned to respond to tariff-driven cost volatility and regulatory complexity.Looking ahead, the winners will be those who align product capabilities with clear commercial value propositions, maintain agility through API-first designs, and invest in localized partnerships to reconcile global platforms with local market needs. By integrating the segmentation perspectives, regional nuances, and vendor dynamics outlined in this summary, decision-makers can prioritize initiatives that reduce risk, speed time to market, and enhance monetization potential. The research that follows offers the detailed evidence and practical tools necessary to operationalize these conclusions and to guide next-stage investment decisions.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Cloud DVR Market

Companies Mentioned

- Altice USA, Inc.

- AT&T Inc.

- Charter Communications, Inc.

- Comcast Cable Communications, LLC

- Cox Communications, Inc.

- DIRECTV, LLC

- Dish Network L.L.C.

- FuboTV, Inc.

- Verizon Communications Inc.

- YouTube, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

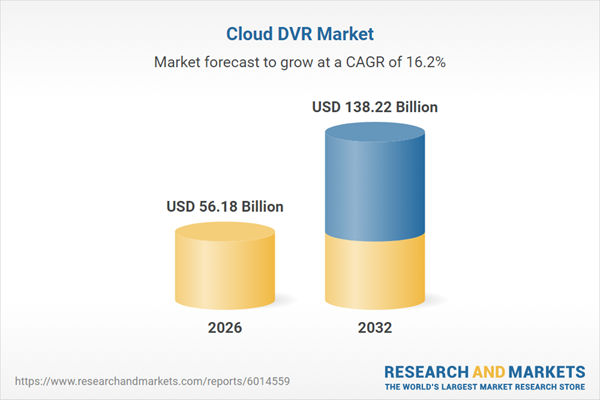

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 56.18 Billion |

| Forecasted Market Value ( USD | $ 138.22 Billion |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |