Speak directly to the analyst to clarify any post sales queries you may have.

The cocoa butter equivalent market is experiencing ongoing transformation, driven by demand for reliable alternatives in multiple industries. Senior leaders face increasingly complex choices as suppliers innovate and global supply chains evolve.

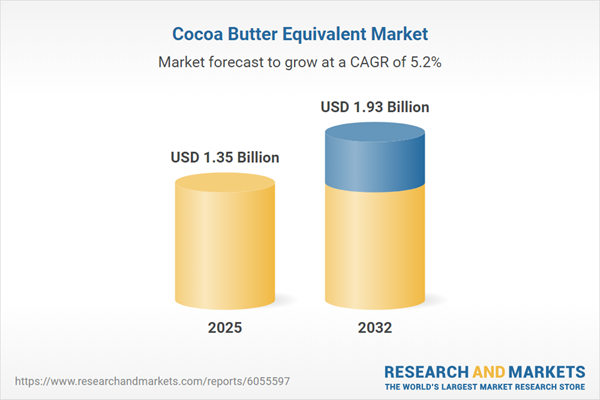

Market Snapshot: Cocoa Butter Equivalent Market Size and Growth Outlook

The global cocoa butter equivalent market expanded from USD 1.28 billion in 2024 to USD 1.35 billion in 2025 and is projected to sustain a CAGR of 5.18% through 2032, reaching USD 1.93 billion. This growth reflects rising adoption across confectionery, personal care, and pharmaceutical sectors seeking consistent ingredient supply, cost control, and the ability to fine-tune product qualities.

Scope & Segmentation: Key Categories and Regional Analysis

This report provides a comprehensive view of the cocoa butter equivalent landscape, focusing on segmentation, technological advancements, and global coverage for executive decision-making.

- Product Types: Kokum Butter, Mango Butter, Palm & Palm Kernel Oil, Sal Fat, Shea Butter

- Source Types: Animal-Based CBEs, Vegetable-Based CBEs

- Processing Techniques: Fractionation Process, Hydrogenation Process, Interesterification Process

- Grades: Food Grade, Industrial Grade

- Applications: Confectionery (Chocolate Compound, Chocolate Production), Cosmetics & Personal Care (Hair Care Products, Lip Care Products, Skin Care Products), Food Industry (Bakery Shortening, Ice Cream Production), Pharmaceuticals (Cream Bases, Suppositories)

- Distribution Channels: Offline (Specialty Stores, Supermarkets/Hypermarkets), Online (Company Websites, E-commerce Platforms)

- Regional Coverage: Americas (United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru), Europe, Middle East & Africa (United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland, United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel, South Africa, Nigeria, Egypt, Kenya), Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan)

Key Takeaways: Strategic Insights for Decision-Makers

- Technological advancements, including fractionation and interesterification, allow precise control of fat characteristics for niche and mainstream applications.

- The move toward clean-label and vegan-friendly products is spurring R&D into alternative vegetable sources, such as kokum, mango, sal, and shea butters.

- Supply stability and cost management are increasingly crucial as global cocoa yields fluctuate and regulations shift, especially for companies serving sensitive segments like confectionery and personal care.

- Blockchain and IoT-driven traceability platforms are gaining traction, enabling real-time visibility for ingredient sourcing and compliance.

- Collaborative innovation among ingredient suppliers, research institutions, and downstream manufacturers is shaping new, high-value cocoa butter equivalent product lines.

- Diversity in distribution channels strengthens market reach and supports resilient procurement models.

US Tariff Impact on Cost Structures and Supply Chains

Recent changes in US import tariffs have increased landed costs for select cocoa butter equivalent feedstocks. This has led procurement teams to diversify suppliers and explore nearshoring strategies, strengthening resilience against regulatory changes and currency fluctuations. Manufacturers are also accelerating formulation revisions to minimize cost impacts while safeguarding quality standards.

Methodology & Data Sources

This analysis uses a robust mixed-method approach that combines extensive secondary research from global trade databases, industry reports, and regulatory filings, together with primary interviews involving formulation experts, supply chain leaders, and sustainability officers across major cocoa butter equivalent producers and their customers. Data triangulation and expert workshops have ensured accuracy when developing strategic recommendations.

The Cocoa Butter Equivalent Market: Why This Report Matters

- Delivers a clear, actionable understanding of shifts in ingredient sourcing, technology adoption, and regulatory influences shaping the cocoa butter equivalent market.

- Equips procurement leaders and product developers with segment-specific insights to future-proof supply chains and enhance operational flexibility.

- Highlights emerging technology opportunities and regional nuances, helping organizations align innovation efforts and strategic investments with growth trends.

Conclusion

The cocoa butter equivalent market demands a forward-looking, collaborative approach. Senior decision-makers who leverage detailed market insights and invest in adaptive, sustainable strategies will be positioned for long-term value and resilience.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Cocoa Butter Equivalent market report include:- AAK AB

- Archer Daniels Midland Company

- Ariyan International Inc.

- Barry Callebaut AG

- Bunge Loders Croklaan Group B.V.

- Cargill, Incorporated

- Felda IFFCO Sdn. Bhd.

- Ferrero International S.A.

- Fuji Oil Holdings Inc.

- Golden Agri-Resources Ltd.

- IOI Corporation Berhad

- Konsonet

- Manorama Industries Limited

- Mewah Group

- Mondelez International, Inc.

- Musim Mas Holdings Pte. Ltd.

- Palsgaard A/S

- PT Smart Tbk

- Socfin Group S.A.

- The Hershey Company

- The Nisshin OilliO Group, Ltd.

- United Plantations Berhad

- Usha Edible Oil

- Wilmar International Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.35 Billion |

| Forecasted Market Value ( USD | $ 1.93 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |