Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for Colloidal Silica Unveiling Core Attributes Market Drivers and Emerging Opportunities Across Diverse Industrial Verticals

Colloidal silica is a dispersion of finely divided silicon dioxide nanoparticles in a liquid medium, celebrated for its exceptional stability, high surface area, and precise particle size control. These attributes enable enhanced performance across applications ranging from semiconductor wafer polishing to pharmaceutical formulations. As an advanced material, its unique colloidal behavior ensures uniformity in processes that demand stringent control over particle interactions and surface reactivity.Moreover, the synergy of chemical inertness, tunable pH, and rheological properties has positioned colloidal silica as a pivotal component in industries driven by performance and reliability requirements. In personal care and cosmetics, it delivers textural refinement and emulsion stability. Within industrial sectors, its role in adhesives, catalyst binders, and refractories underscores its versatility. Furthermore, the material’s capacity to function as a suspension stabilizer and surface modifier has accelerated its adoption under sustainability imperatives, where lighter formulations and reduced environmental footprint are paramount.

Consequently, the evolving regulatory environment and intensified research into nanoparticle toxicology have catalyzed a focus on high-purity grades, reinforcing the importance of stringent quality controls. As such, stakeholders are applying advanced analytical techniques to verify particle size distributions, surface chemistry, and colloidal stability. This multifaceted landscape sets the stage for deeper exploration of transformative shifts and strategic considerations shaping the colloidal silica domain.

Identifying the Transformative Shifts Reshaping the Colloidal Silica Landscape Amidst Technological Innovation and Sustainability Imperatives

Recent years have witnessed transformative shifts in the colloidal silica landscape, driven by a convergence of technological breakthroughs and heightened sustainability demands. Advanced process controls in ion exchange and sol-gel methods have enabled manufacturers to deliver nanoparticles with exceptional uniformity, empowering high-precision applications in semiconductors and advanced coatings.Furthermore, the industry is responding to the imperative for greener manufacturing by optimizing precipitation and Stöber routes to reduce energy consumption and chemical waste. Collaborative efforts between research institutions and processing equipment suppliers are refining these processes, leading to novel functionalized surfaces that enhance binding efficiency, abrasive performance, and anti-settling characteristics.

In addition, digitalization of quality monitoring through inline particle characterization and machine learning algorithms has streamlined production, enabling real-time adjustments that maintain batch consistency. This technological infusion is complemented by an increased focus on life cycle assessments, nudging stakeholders toward low-temperature synthesis and water-based dispersion systems to minimize environmental impact.

Meanwhile, end users are exploring next-generation applications, such as self-healing coatings and tailored drug delivery platforms, leveraging the high surface reactivity and colloidal stability. As value chains evolve, strategic partnerships between raw material suppliers, toll processors, and end-use formulators are becoming more prevalent, facilitating agility in innovation cycles and accelerating time to market for differentiated colloidal silica solutions.

Analyzing the Cumulative Impact of New United States Tariffs on Colloidal Silica Imports and Domestic Supply Chains in 2025

The introduction of new United States tariffs on colloidal silica imports has prompted a recalibration of supply chains and sourcing strategies. With duties applied to select feedstocks and finished dispersions, importers have experienced cost pressures that, in turn, influence procurement decisions. As a result, many organizations have begun to reassess their reliance on traditional overseas suppliers and explore alternative origins with more favorable trade conditions.Consequently, domestic manufacturers are capturing incremental demand by expanding production capacities and diversifying feedstock portfolios. While the short-term impact has manifested in elevated input costs, longer-term implications include closer collaboration between raw material producers and formulators to optimize production efficiencies. This strategic shift has also spurred investments in localized storage and distribution infrastructure to mitigate tariff exposure and reduce lead times.

Additionally, the tariff landscape has catalyzed a deeper evaluation of material performance relative to cost. Users are increasingly examining particle size distributions and purity levels to ensure that any incremental expense is justified by enhanced functional benefits. This scrutiny has accelerated trials of high-purity grades in sensitive applications, reinforcing quality assurance protocols and driving innovation in surface modification chemistries.

As the industry adapts, cross-border partnerships continue to evolve, with some stakeholders negotiating tariff exemptions for R&D-specific imports. In parallel, trade associations are engaging regulators to articulate the downstream economic impact, underscoring the strategic importance of maintaining competitive access to advanced colloidal silica grades.

Harnessing Detailed Segmentation Insights to Decode Product Types Particle Dimensions Purity Levels Manufacturing Methods and Key Functional Applications

A nuanced segmentation framework for colloidal silica reveals critical insights into product selection and application alignment. Based on product type, the distinction between acidic colloidal silica and alkaline colloidal silica highlights compatibility with acid-sensitive processes versus alkaline formulations, guiding end users toward optimal performance. Particle size segmentation, spanning below 20 nanometers through 20-40 nanometers to above 40 nanometers, informs decisions around dispersion stability, surface reactivity, and final product rheology.Purity level emerges as another pivotal dimension, with high-purity grades tailored for semiconductor slurry applications and tablet coatings, whereas low-purity variants cater to robust industrial uses such as catalyst binders and refractory additives. In terms of manufacturing process, ion exchange methods yield particles with controlled ionic profiles, precipitation techniques facilitate scalable production, sol-gel routes offer precise control over porosity, and Stöber processes deliver uniform spherical morphologies.

Grade type further differentiates the market by end-use requirements, encompassing cosmetic grade for personal care formulations, electronic grade for CMP slurries and insulating materials, industrial grade for adhesives, sealants and polishing media, and pharmaceutical grade for excipient and coating functionalities. Functional segmentation underscores the roles of colloidal silica as an abrasive, additive, anti-settling agent, binder, surface modifier, suspension stabilizer, and thickener, each application drawing on unique material attributes.

Finally, distribution channels range from established offline networks to digital platforms that facilitate direct procurement. This comprehensive segmentation perspective enables stakeholders to pinpoint areas of competitive advantage and tailor strategies that align with evolving technical and regulatory demands.

Mapping Regional Dynamics in the Americas Europe Middle East & Africa and Asia-Pacific to Uncover Growth Hotspots and Emerging Trends in Colloidal Silica

Regional dynamics in the colloidal silica industry vary significantly across major geographies, revealing distinct drivers and challenges. In the Americas, established manufacturing ecosystems and proximity to key end users in electronics, personal care, and pharmaceuticals underpin steady demand growth. Investments in local production and distribution infrastructure have strengthened supply chain resilience, even as trade policies introduce occasional volatility.In Europe, Middle East & Africa, stringent environmental regulations and a strong emphasis on sustainability shape both production methods and material specifications. Regional stakeholders are prioritizing low-carbon synthesis pathways and integrating life cycle assessments into product development. Collaboration between chemical producers and end-use industries in EMEA has fostered innovation in bio-based formulations and circular economy initiatives.

Meanwhile, Asia-Pacific remains the largest and most dynamic region, driven by rapid industrialization, expanding semiconductor manufacturing capacity, and burgeoning personal care markets. Key markets such as China, Japan, South Korea, and India continue to invest in advanced colloidal silica applications, supported by government incentives for high-tech manufacturing. In addition, the region’s evolving infrastructure for specialty chemical production is enabling domestic players to scale up high-purity offerings, intensifying competitive pressures and spurring continuous process improvement.

Across all regions, digital procurement channels are gaining prominence, allowing stakeholders to streamline ordering and access detailed technical documentation more efficiently. This regional analysis highlights where growth hotspots intersect with innovation clusters, guiding strategic investment decisions in the global colloidal silica landscape.

Profiling Leading Stakeholders and Emerging Innovators Driving Competitive Dynamics and Strategic Differentiation in the Global Colloidal Silica Industry

The competitive landscape of the colloidal silica market is defined by both established leaders and agile innovators. Major players such as Cabot Corporation, Evonik Industries, Wacker Chemie, Nissan Chemical, and Tokuyama Corporation maintain significant scale advantages, leveraging extensive R&D capabilities to introduce high-performance grades with enhanced purity and tailored surface functionalities. These incumbents continue to optimize their manufacturing networks to ensure reliable global supply and consistent quality standards.At the same time, emerging entrants are challenging traditional hierarchies by focusing on niche applications and sustainable production methods. Smaller specialty producers are piloting bio-based feedstocks and low-temperature sol-gel processes that reduce resource intensity. By forging partnerships with academic institutions and technology providers, these innovators accelerate time to market for novel formulations aimed at next-generation electronic and biomedical uses.

Strategic M&A activity has also reshaped competitive dynamics, as larger organizations seek to bolster their portfolios with complementary capabilities in nanoformulation and advanced process analytics. Such consolidation has the dual effect of expanding geographic reach while integrating new competencies in surface chemistry and quality control.

Moreover, companies are increasingly differentiating through customer-centric services, offering technical support, application labs, and collaborative product development platforms. This emphasis on value-added services enhances customer loyalty and creates high barriers to entry, ensuring that the competitive playing field remains dynamic and innovation-driven.

Delivering Actionable Strategic Recommendations for Industry Leaders to Strengthen Supply Chain Resilience Foster Innovation and Accelerate Market Penetration

To navigate the evolving colloidal silica landscape, industry leaders should prioritize strengthening supply chain resilience through diversified sourcing strategies and strategic inventory management. Establishing regional production hubs and collaborating with multiple raw material suppliers can mitigate the impact of trade policy shifts and logistical disruptions. Additionally, firms should foster innovation by investing in process optimization technologies such as real-time particle characterization and advanced process control systems.Enhancing sustainability performance is equally critical; organizations are encouraged to adopt greener synthesis pathways and pursue life cycle assessments that highlight environmental benefits. By aligning product development with circular economy principles, companies can reduce carbon footprints and respond proactively to tightening regulatory requirements.

Moreover, accelerating market penetration requires a customer-centric approach that integrates technical support and co-development models. Enabling joint application testing and tailored formulation services cultivates deeper customer engagement and uncovers new growth avenues. In parallel, digitalization of procurement interfaces and data analytics platforms can streamline order processing and provide actionable market intelligence.

Finally, forging strategic alliances with academic and technology partners will unlock access to cutting-edge research and facilitate rapid commercialization of next-generation colloidal silica solutions. This collaborative ecosystem ensures that stakeholders remain ahead of performance benchmarks and sustain competitive differentiation in a market defined by continuous innovation.

Outlining Rigorous Research Methodology Employed to Gather Validate and Analyze Data Underpinning the Comprehensive Colloidal Silica Market Study

The research methodology underpinning this comprehensive report combines rigorous secondary and primary data collection, ensuring robustness and reliability. Initially, an extensive review of publicly available literature, technical patents, and regulatory filings established a foundational understanding of colloidal silica technologies, production processes, and application trends.Building on this groundwork, in-depth interviews were conducted with key stakeholders across the value chain, including raw material suppliers, manufacturers, end users, and industry experts. These qualitative insights were triangulated with quantitative data obtained from company disclosures, trade association reports, and customs statistics to validate emerging trends and performance drivers.

Analytical frameworks such as SWOT analysis, Porter’s Five Forces, and life cycle assessments were employed to evaluate competitive dynamics, technological barriers, and environmental considerations. Advanced statistical techniques, including cluster analysis and correlation matrices, were utilized to identify segmentation patterns and forecast impact scenarios under varying regulatory and trade environments.

Throughout the process, data integrity was maintained through cross-referencing multiple sources, conducting consistency checks, and engaging third-party validators. This multi-stage validation protocol ensures that the report’s findings are grounded in empirical evidence and reflect the latest developments in the colloidal silica market.

Concluding Key Takeaways and Strategic Imperatives to Navigate Future Opportunities Challenges and Risks in the Evolving Colloidal Silica Market Landscape

This report synthesizes the critical dynamics shaping the colloidal silica industry, highlighting the interplay of technological innovation, sustainability mandates, and trade policies. Key takeaways include the growing importance of high-purity grades in advanced electronics and healthcare applications, the strategic shift toward localized production in response to tariff pressures, and the emergence of greener synthesis techniques driven by environmental regulations.Furthermore, detailed segmentation analysis underscores the need for precise alignment between particle characteristics and end-use requirements, emphasizing the value of tailored formulations across diverse applications. Regional insights reveal distinct growth patterns in the Americas, EMEA, and Asia-Pacific, each influenced by unique regulatory, economic, and infrastructural factors.

Competitive profiling illustrates a dynamic landscape where global incumbents and niche innovators vie for market leadership through technological differentiation and customer-focused services. Actionable recommendations encourage stakeholders to enhance supply chain resilience, invest in advanced process controls, prioritize sustainability, and leverage collaborative R&D partnerships.

Collectively, these strategic imperatives provide a clear framework for decision makers to navigate future challenges, capitalize on emerging opportunities, and maintain competitive advantage in the rapidly evolving colloidal silica market.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

20. China Colloidal Silica Market

Companies Mentioned

The key companies profiled in this Colloidal Silica market report include:- Adeka Corporation

- Akzo Nobel N.V.

- Allied High Tech Products, Inc.

- Applied Material Solutions, Inc.

- Bayer AG

- Cabot Corporation

- Chemiewerk Bad Köstritz GmbH

- Ecolab Inc.

- Evonik Industries AG

- Fuso Chemical Co., Ltd.

- Guangdong Well-Silicasol Co., Ltd.

- Guangdong Well-t Nanotech Co., Ltd

- Hubei Huifu Nanomaterial Co., Ltd

- Jinan Yinfeng Silicon Products Co., Ltd.

- Kamei Chemicals Inc.

- Linyi Kehan Silicon Products Co., Ltd.

- Merck KGaA

- Nissan Chemical Corporation

- Nyacol Nano Technologies, Inc.

- Remet Corporation

- Sterling Chemicals, Inc.

- The Dow Chemical Company

- W.R. Grace & Co.

- Wacker Chemie AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

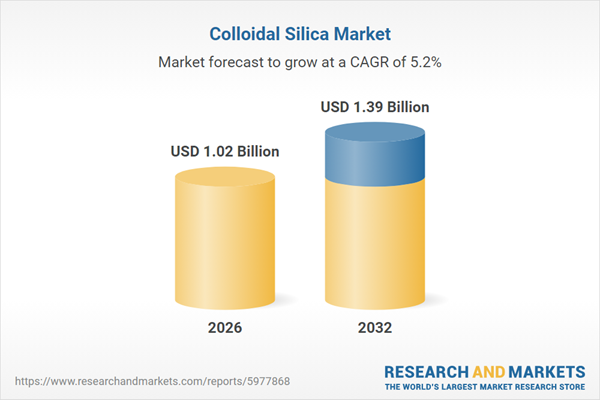

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.02 Billion |

| Forecasted Market Value ( USD | $ 1.39 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |