Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

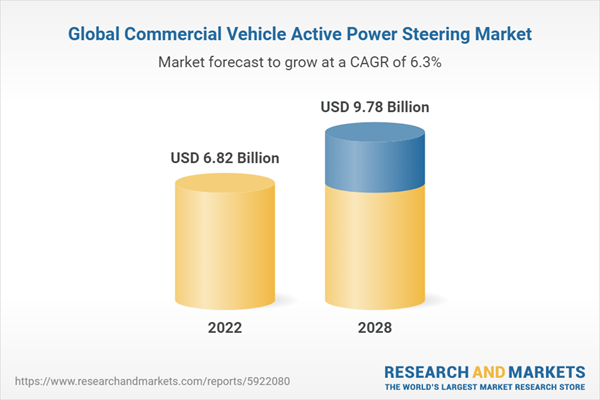

The Global Commercial Vehicle Active Power Steering Market has witnessed notable growth in recent years, driven by advancements in steering technology and the increasing demand for enhanced vehicle handling and safety in commercial vehicles. Active Power Steering (APS) systems, designed to adapt to various driving conditions, contribute to improved maneuverability, reduced driver fatigue, and enhanced overall driving experience in commercial vehicles.

One key driver of the market is the rising focus on driver-assistance technologies and safety features in the commercial vehicle segment. Active Power Steering systems offer real-time adjustments to steering assistance based on factors such as vehicle speed, road conditions, and driver inputs, contributing to safer and more responsive driving in diverse environments.

Additionally, the growing emphasis on fuel efficiency and emissions reduction in the commercial vehicle sector has spurred the adoption of advanced steering technologies. Active Power Steering systems, by optimizing steering effort and responsiveness, contribute to overall vehicle efficiency and play a role in meeting stringent environmental standards.

The market is also influenced by technological innovations, including the integration of electronic control units (ECUs) and sensors in steering systems. These advancements enable APS systems to gather and process real-time data, facilitating dynamic adjustments and enhancing the precision of steering control. As commercial vehicle manufacturers increasingly integrate these technologies into their fleets, the market for Commercial Vehicle Active Power Steering is expected to continue its upward trajectory.

However, challenges such as cost considerations, especially in price-sensitive commercial vehicle segments, and the need for standardized systems across different vehicle models may impact the widespread adoption of Active Power Steering. Furthermore, regional variations in regulatory standards and consumer preferences contribute to a diverse market landscape.

For the most up-to-date and specific information on the Global Commercial Vehicle Active Power Steering Market, it is recommended to refer to the latest industry reports, market analyses, and news updates.

Key Market Drivers

Safety and Driver Assistance Trends

The growing emphasis on safety and driver assistance features in the commercial vehicle sector is a primary driver for the adoption of Active Power Steering (APS) systems. These technologies enhance vehicle maneuverability, reduce driver fatigue, and contribute to overall road safety by providing responsive steering control, especially in challenging driving conditions.Fuel Efficiency and Emissions Reduction

The global push for fuel efficiency and emissions reduction has a direct impact on the adoption of advanced steering technologies in commercial vehicles. Active Power Steering systems optimize steering effort, leading to improved fuel efficiency by reducing energy requirements for steering maneuvers. As regulatory standards worldwide become more stringent, APS systems contribute to meeting environmental targets.Technological Advancements in Steering Systems

Ongoing advancements in steering system technologies, including electronic control units (ECUs) and sensors, drive the adoption of APS in commercial vehicles. These technological enhancements enable real-time data processing, allowing APS systems to adjust steering parameters dynamically based on factors such as vehicle speed, road conditions, and driver behavior, thereby enhancing overall steering precision.Enhanced Driving Experience

The demand for an enhanced driving experience is fueling the adoption of APS in commercial vehicles. These systems provide drivers with smoother and more responsive steering control, contributing to a comfortable and less fatiguing driving experience. As the commercial vehicle market increasingly focuses on driver comfort and satisfaction, APS becomes a significant value-added feature.Market Competitiveness and Product Differentiation

In the competitive commercial vehicle market, manufacturers are adopting APS to differentiate their products and gain a competitive edge. APS is becoming a key selling point for original equipment manufacturers (OEMs) looking to offer advanced features that align with market trends and customer preferences, contributing to market growth.Rising Demand for Commercial Vehicles

The overall growth in the demand for commercial vehicles, driven by factors such as e-commerce expansion, urbanization, and increased transportation needs, directly influences the APS market. As the commercial vehicle fleet expands globally, the adoption of steering technologies that enhance efficiency and safety becomes crucial for fleet operators and manufacturers.Global Urbanization and Infrastructure Development

The ongoing global trend of urbanization and infrastructure development contributes to the adoption of APS in commercial vehicles. With the increasing need for maneuverability in urban environments, APS systems play a vital role in enhancing the agility and responsiveness of commercial vehicles, aligning with the requirements of urban logistics and transportation.Regulatory Standards and Compliance

Stringent regulatory standards governing vehicle safety and emissions drive the integration of APS systems in commercial vehicles. Compliance with safety regulations and emission standards encourages OEMs to adopt advanced steering technologies that contribute to overall vehicle performance and regulatory adherence.It's essential to note that the commercial vehicle market is dynamic, and the landscape may have evolved since my last update. For the latest and most specific information, consulting recent industry reports or market analyses is recommended.

Download Free Sample Report

Key Market Challenges

Cost Implications

The integration of advanced technologies, sensors, and electronic control units in Active Power Steering systems adds to the overall cost of commercial vehicles. Cost considerations are particularly significant in the commercial vehicle sector, which is often price-sensitive. The challenge lies in developing cost-effective APS solutions that balance advanced features with market affordability.Complexity of Integration

The integration of APS systems into existing commercial vehicle architectures can be complex. Ensuring seamless compatibility with other vehicle systems, such as braking and stability control, requires extensive testing and validation. Complexity in integration may lead to challenges in maintenance and repairs, posing difficulties for both OEMs and aftermarket service providers.Standardization Issues

The absence of standardized designs and functionalities for APS systems poses challenges for manufacturers and consumers alike. Standardization would streamline manufacturing processes, facilitate interoperability, and potentially reduce costs. However, achieving consensus on standard APS specifications across different commercial vehicle models and manufacturers is a complex task.Maintenance and Repair Challenges

The advanced nature of APS systems may pose challenges for maintenance and repairs. Commercial vehicle operators and service providers may face difficulties in obtaining specialized knowledge and equipment required for servicing APS components. The complexity of repairs can contribute to increased downtime and maintenance costs.Limited Aftermarket Availability

The availability of APS components in the aftermarket may be limited compared to more traditional steering systems. As APS becomes a standard feature in new commercial vehicles, ensuring a robust aftermarket with readily available components and skilled technicians is crucial for the ongoing support of these systems.Resistance to Technology Adoption

Some segments of the commercial vehicle market may exhibit resistance to the adoption of advanced technologies, including APS. Factors such as concerns about reliability, perceived complexity, and a lack of awareness about the benefits of APS may hinder widespread acceptance, particularly in regions or industries where traditional steering systems are well-established.Regional Regulatory Variations

Compliance with varying regional safety and emissions standards poses a challenge for manufacturers. Different regions may have distinct regulatory requirements, and adapting APS systems to meet these standards adds complexity to the development process. This challenge necessitates a flexible approach to design and implementation to cater to diverse regulatory landscapes.Weight Considerations

While APS systems aim to enhance vehicle efficiency, the additional components and electronic systems may contribute to increased vehicle weight. Commercial vehicles often operate under strict weight regulations, and the challenge lies in balancing the benefits of APS with the need to minimize overall vehicle weight for optimal fuel efficiency and load-carrying capacity.Key Market Trends

Integration with Advanced Driver Assistance Systems (ADAS)A prominent trend in the Commercial Vehicle APS market is the integration of steering technologies with Advanced Driver Assistance Systems. APS systems are evolving to work in tandem with ADAS, offering features such as lane-keeping assistance and automated steering, enhancing overall vehicle safety and easing the burden on drivers.

Electric Power Steering (EPS) Dominance

There is a growing preference for Electric Power Steering (EPS) in commercial vehicles. EPS systems, a subset of APS, use electric motors for steering assistance, providing more flexibility in adjusting steering feel and effort. The trend towards EPS reflects a broader industry shift toward electrification and the desire for energy-efficient steering solutions.Development of Steer-by-Wire Technology

Steer-by-wire technology, where there is no physical connection between the steering wheel and the wheels, is gaining traction. This trend allows for innovative vehicle design, increased cabin space, and enhanced flexibility in steering system configurations. The development of steer-by-wire is indicative of the industry's pursuit of cutting-edge technologies to redefine steering systems.Focus on Fuel Efficiency and Emissions Reduction

The Commercial Vehicle APS market aligns with the industry-wide focus on fuel efficiency and emissions reduction. APS systems contribute to these goals by optimizing steering effort, reducing energy consumption, and enhancing overall vehicle efficiency. As environmental regulations become more stringent, APS technologies are expected to play a crucial role in meeting sustainability targets.Adoption of Artificial Intelligence (AI)

The incorporation of Artificial Intelligence (AI) in APS systems is a notable trend. AI algorithms analyze real-time data from various sensors, optimizing steering parameters based on driving conditions. This trend contributes to improved precision and responsiveness in steering control, aligning with the broader trend of AI integration in vehicle technologies.

Customization and Personalization

The market is witnessing a trend towards customization and personalization of APS features. Commercial vehicle manufacturers are offering adjustable steering modes and parameters, allowing drivers to tailor the steering feel to their preferences. This trend caters to a diverse range of driving styles and preferences among commercial vehicle operators.Rise of Autonomous Commercial Vehicles

As the commercial vehicle industry explores autonomy, APS systems are adapting to support autonomous driving functionalities. APS technologies are evolving to provide dynamic steering adjustments in different autonomy levels, enhancing the safety and efficiency of autonomous commercial vehicles.Enhanced Connectivity and Telematics Integration

APS systems are increasingly integrated into connected vehicle ecosystems. Telematics systems allow for remote monitoring and control of steering parameters, facilitating proactive maintenance and diagnostics. The trend towards enhanced connectivity contributes to a more comprehensive approach to fleet management and vehicle health.Segmental Insights

By Type

Hydraulic Power Steering has been a traditional and widely adopted steering type in commercial vehicles. It operates using hydraulic fluid to assist in steering, transmitting force from the steering wheel to the steering mechanism. While effective in providing robust steering assistance, HPS systems are often associated with higher energy consumption compared to newer technologies. However, their durability and reliability make them suitable for heavy-duty applications, such as large trucks and buses.Electric Power Steering has gained prominence in the commercial vehicle sector due to its energy efficiency and design flexibility. EPS systems use an electric motor to assist steering, eliminating the need for a hydraulic pump. This results in reduced energy consumption and enhanced fuel efficiency. EPS also provides the flexibility to adjust steering feel and responsiveness electronically, contributing to a more tailored driving experience. Its adoption aligns with the broader industry trend towards electrification and sustainability.

Electro-hydraulic Power Steering combines elements of both hydraulic and electric power steering systems. EHPS systems utilize an electric motor to drive a hydraulic pump, providing steering assistance. This hybrid approach seeks to harness the efficiency of electric power steering while retaining the familiarity and robustness of hydraulic systems. EHPS is often seen as a transitional technology, offering benefits in terms of fuel efficiency and adaptability to various vehicle sizes and applications.

The choice between these steering types depends on factors such as vehicle size, intended application, and energy efficiency goals. While EPS gains traction for its green credentials and adaptability to modern vehicle architectures, HPS and EHPS continue to serve specific niches within the commercial vehicle market, emphasizing reliability and familiarity. The evolution of steering technologies in commercial vehicles is ongoing, and manufacturers are likely to explore further innovations and integrations to meet the diverse needs of fleet operators and drivers.

By Demand Category

ABS (Acrylonitrile Butadiene Styrene) plastics find extensive use in automotive applications, particularly in interior components, exterior trim, and various structural elements. Known for their durability, impact resistance, and versatility, ABS plastics contribute to lightweighting efforts in vehicle design while maintaining structural integrity. Common applications include interior panels, dashboard components, and exterior body parts.Fiberglass is a composite material consisting of glass fibers embedded in a resin matrix. In the automotive industry, fiberglass is often employed to manufacture body panels, hoods, and other exterior components. Its high strength-to-weight ratio makes fiberglass a popular choice for enhancing structural integrity without adding excessive weight to the vehicle.

Silicone, not to be confused with Silicon, is a material known for its flexibility, heat resistance, and electrical insulating properties. While not a primary material for automotive structural components, silicon-based materials are commonly used in gaskets, seals, and various engine components. Silicones contribute to ensuring proper sealing and thermal management in critical areas of the vehicle.

Carbon fiber is a high-strength, lightweight material that has gained prominence in the automotive industry for its exceptional properties. Used extensively in high-performance and luxury vehicles, carbon fiber is employed in components such as body panels, chassis components, and interior trim. Its strength and weight characteristics contribute to improved performance and fuel efficiency, albeit at a higher production cost compared to traditional materials.

In summary, these materials play distinct roles in various automotive applications, contributing to aspects such as weight reduction, structural integrity, and overall performance. The choice of material depends on factors like cost, performance requirements, and the specific function of the automotive component. If you have a more specific focus on applications within the automotive industry, please clarify so that I can provide more targeted information.

Regional Insights

North America remains a major hub for the automotive industry, with the United States, Canada, and Mexico playing key roles. The region is characterized by a diverse market with a strong demand for trucks and SUVs. The automotive sector in North America is influenced by consumer preferences for larger vehicles, stringent safety standards, and increasing interest in electric and autonomous technologies. Production facilities are spread across the region, and there is a focus on innovation and sustainability.Europe is a prominent player in the global automotive market, home to renowned luxury and performance car manufacturers. The European market places a strong emphasis on fuel efficiency, stringent emission standards, and advanced safety features. Electric vehicles (EVs) and hybrid technologies have gained traction, reflecting a commitment to sustainability. Germany is a powerhouse with several iconic automakers, and there's a growing trend toward digitalization and connectivity in vehicles.

The Asia-Pacific region, particularly China, has become a driving force in the automotive industry. China is the world's largest automotive market, characterized by a mix of domestic and international automakers. The region has seen significant growth in EV sales, with a focus on addressing air quality concerns and reducing reliance on traditional fuel sources. Japan and South Korea remain influential players with a strong presence in both conventional and electric vehicle markets.

Latin America has a diverse automotive landscape with varying economic conditions across countries. Brazil and Mexico are significant markets, with a preference for smaller, fuel-efficient vehicles. Economic factors often influence consumer choices, and there's an ongoing challenge related to infrastructure and road conditions. The region experiences a mix of global and local manufacturers catering to diverse consumer needs.

The Middle East has a notable appetite for luxury vehicles, with countries like the United Arab Emirates being key markets. In Africa, the automotive landscape is influenced by factors such as affordability, durability, and adaptability to rugged terrains. Some regions see a demand for both traditional and off-road vehicles, and there's potential for growth with increasing urbanization and economic development.

Report Scope:

In this report, the Global Commercial Vehicle Active Power Steering Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Commercial Vehicle Active Power Steering Market, By Type:

- Hydraulic Power Steering (HPS)

- Electric Power Steering (EPS)

- Electro-Hydraulic Power Steering (EHPS)

Commercial Vehicle Active Power Steering Market, By Demand Category:

- OEM

- Aftermarket

Commercial Vehicle Active Power Steering Market, By Vehicle Type:

- Light Commercial Vehicles

- Medium Commercial Vehicles

- Heavy Commercial Vehicles

Commercial Vehicle Active Power Steering Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- Turkey

- Iran

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Commercial Vehicle Active Power Steering Market.Available Customizations:

Global Commercial Vehicle Active Power Steering Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ZF Friedrichshafen AG

- AB Volvo

- Tedrive steering systems GmbH

- Ognibene Power SPA

- BMW AG

- Knorr-Bremse

- Bosch

- Daimler AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 6.82 Billion |

| Forecasted Market Value ( USD | $ 9.78 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |