Global Connected Car Devices Market - Key Trends & Drivers Summarized

What Are Connected Car Devices, and Why Are They Essential in Modern Vehicles?

Connected car devices are electronic systems integrated into vehicles that enable connectivity and data exchange between the car, external devices, and infrastructure, enhancing safety, convenience, and efficiency. These devices include telematics units, GPS navigation, in-car entertainment systems, sensors, vehicle-to-everything (V2X) communication, and diagnostic tools. Connected car technology enables real-time information sharing, such as traffic updates, navigation assistance, and remote vehicle diagnostics, making vehicles smarter and more efficient. For consumers, these devices improve the driving experience by providing safety alerts, infotainment, and remote control capabilities, while for manufacturers, they facilitate fleet management, predictive maintenance, and data collection.The importance of connected car devices lies in their contribution to the overall vehicle ecosystem, which prioritizes safety, automation, and convenience. As automotive technology evolves, these devices support advanced driver-assistance systems (ADAS), real-time location tracking, and vehicle-to-vehicle (V2V) communication, paving the way for semi-autonomous and autonomous driving. Connected car devices are also integral to the smart city infrastructure, where vehicle data contributes to efficient traffic management and urban planning. With the automotive industry increasingly focused on data-driven solutions and safety enhancements, connected car devices are becoming indispensable components in modern and future vehicles.

How Are Technological Advancements Transforming Connected Car Devices?

Technological advancements are driving the capabilities of connected car devices, making them more versatile, efficient, and responsive to user needs. One major development is the integration of 5G technology, which enhances the speed and reliability of data transfer, enabling real-time communication between vehicles, infrastructure, and pedestrians (V2X). This high-speed connectivity supports advanced applications, such as collision avoidance, traffic optimization, and autonomous driving. Furthermore, the adoption of edge computing in connected car devices reduces data processing time by processing information locally within the vehicle, allowing for faster responses in time-sensitive situations like emergency braking.Artificial intelligence (AI) and machine learning are also significantly enhancing the functionality of connected car devices. AI algorithms analyze driving patterns, predict potential hazards, and enable personalized in-car experiences. Predictive maintenance tools powered by AI provide proactive alerts for vehicle servicing needs, reducing downtime and increasing vehicle lifespan. Additionally, advancements in cybersecurity are making connected car devices more secure, addressing concerns about data privacy and unauthorized access. These technological improvements make connected car devices a crucial part of the automotive industry's digital transformation, supporting safer and more efficient driving experiences.

What Are the Key Applications of Connected Car Devices Across Different Use Cases?

Connected car devices are applied across a range of functions that cater to both consumers and automotive manufacturers. Telematics devices, for example, provide real-time data on vehicle performance, location, and driving behavior, essential for fleet management in logistics and car rental companies. GPS navigation and infotainment systems are standard features in consumer vehicles, offering drivers convenience and access to location-based services. For safety, connected car devices such as cameras, radar, and LiDAR support ADAS applications, including adaptive cruise control, lane-keeping assist, and blind-spot detection, which reduce the risk of accidents and improve driving ease.Vehicle-to-infrastructure (V2I) communication, a growing segment in connected car applications, allows vehicles to interact with traffic lights, road signs, and smart city networks, optimizing traffic flow and reducing congestion. In electric vehicles (EVs), connected car devices monitor battery health, charging status, and provide guidance to nearby charging stations. Additionally, remote diagnostics and over-the-air (OTA) software updates are becoming popular applications, enabling automakers to update vehicle software and diagnose issues remotely, enhancing the convenience for vehicle owners. These varied applications highlight the versatility of connected car devices, which are central to advancing vehicle automation, safety, and efficiency.

What Factors Are Driving Growth in the Connected Car Devices Market?

The growth in the connected car devices market is driven by several factors, including advancements in automotive technology, increasing consumer demand for in-car connectivity, and the push toward autonomous driving. With the rise of 5G networks, connected car devices have become more efficient, offering real-time data exchange essential for V2X communication and safety applications. The demand for ADAS and safety features has also surged, as consumers seek vehicles equipped with advanced safety systems, positioning connected car devices as critical components in modern cars. Additionally, the automotive industry's shift toward electric and autonomous vehicles has spurred demand for connected devices that support features like battery monitoring, remote diagnostics, and navigation assistance.The growth of smart city initiatives worldwide has further boosted the adoption of connected car technology, as governments invest in V2I infrastructure that enhances traffic management and reduces congestion. Consumers' preference for convenient, digital experiences in their vehicles has increased the adoption of infotainment systems, navigation, and telematics, driving market demand. Moreover, the increasing availability of OTA updates allows automakers to deliver software upgrades and security patches seamlessly, adding value to connected car devices. These factors collectively contribute to the robust growth of the connected car devices market, underscoring their role in shaping the future of smart, safe, and autonomous vehicles.

Report Scope

The report analyzes the Connected Car Devices market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Driver Assistance Systems, Telematics, Other Technologies); Connectivity (Long Range / Cellular Network, Dedicated Short Range Communication); End-Use (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Driver Assistance Systems segment, which is expected to reach US$121.5 Billion by 2030 with a CAGR of a 16.9%. The Telematics segment is also set to grow at 17.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $32.1 Billion in 2024, and China, forecasted to grow at an impressive 15.9% CAGR to reach $44.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Connected Car Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Connected Car Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Connected Car Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Autoliv, Inc., Continental AG, Delphi Automotive PLC, Denso Corporation, Harman International Industries, Incorporated and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Connected Car Devices market report include:

- Autoliv, Inc.

- Continental AG

- Delphi Automotive PLC

- Denso Corporation

- Harman International Industries, Incorporated

- Infineon Technologies AG

- Magna International, Inc.

- Panasonic Corporation

- Robert Bosch GmbH

- Valeo S.A.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Autoliv, Inc.

- Continental AG

- Delphi Automotive PLC

- Denso Corporation

- Harman International Industries, Incorporated

- Infineon Technologies AG

- Magna International, Inc.

- Panasonic Corporation

- Robert Bosch GmbH

- Valeo S.A.

Table Information

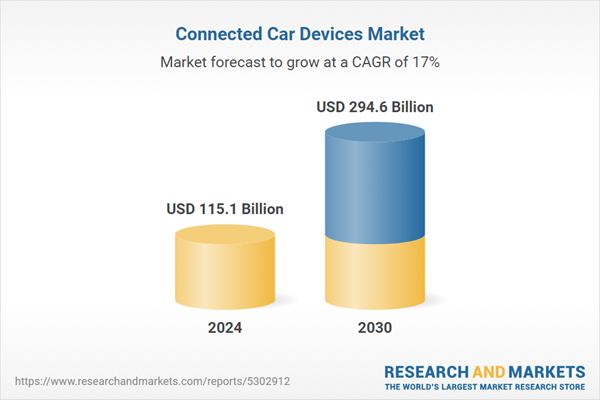

| Report Attribute | Details |

|---|---|

| No. of Pages | 172 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 115.1 Billion |

| Forecasted Market Value ( USD | $ 294.6 Billion |

| Compound Annual Growth Rate | 17.0% |

| Regions Covered | Global |