Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative introduction that situates conservation voltage reduction within modern grid modernization priorities and operational strategies for distribution efficiency

Conservation voltage reduction (CVR) has emerged as a practical lever for utilities to improve distribution efficiency, reduce energy losses, and align operational objectives with evolving grid dynamics. Over the past decade, CVR has moved from pilot projects to mainstream engineering consideration as distribution operators seek low-friction interventions that can be layered with broader grid modernization investments. As an introduction to the topic, this section frames CVR as a systems-level intervention that sits at the intersection of hardware evolution, software intelligence, regulatory drivers, and changing end-use patterns across commercial, industrial, residential, and utility domains.The narrative begins by clarifying the core purpose of CVR: modestly lowering distribution voltage within acceptable regulatory and equipment tolerance bands to reduce energy consumption and peak demand without materially affecting service quality. Importantly, CVR is not a standalone silver bullet; it functions best as part of a coordinated program that includes sensing, automated control, analytics, and verification. Equipment advances such as more responsive voltage regulators and smart sensors, alongside improvements in control systems and analytics, have increased the precision and predictability of CVR interventions.

Furthermore, the introduction recognizes the broader context in which CVR operates. Increasing penetration of distributed energy resources, the electrification of transport and heating, and growing regulatory emphasis on resilience and decarbonization shape how utilities prioritize CVR investments. This opening sets the stage for subsequent sections that explore transformative landscape shifts, tariff-related supply implications, granular segmentation insights, and regional dynamics that affect the design and deployment of CVR programs.

How technological, regulatory, and load-pattern revolutions are redefining conservation voltage reduction into a software-driven, grid-integrated operational capability

The landscape for conservation voltage reduction is undergoing multiple transformative shifts driven by technological advances, regulatory change, and evolving system-level needs. First, the maturation of sensor networks and grid-edge telemetry has enabled near-real-time visibility down to feeder and even line segments, which allows CVR strategies to be more surgical and less disruptive to customer service quality. This increased observability reduces operational uncertainty and enables utilities to harmonize CVR with other distribution automation functions.Second, the integration of advanced analytics and control systems into distribution management platforms has shifted CVR from rule-of-thumb adjustments to optimization-driven outcomes. Predictive analytics and prescriptive control enable dynamic voltage setpoints that react to load composition, weather, and distributed energy resource output, which in turn reduces the risk of equipment stress while maximizing energy conservation. This technical evolution is accompanied by a cultural shift within utilities toward data-driven operations, where continuous measurement and closed-loop verification become standard practice.

Third, the rapid adoption of distributed energy resources and electrification trends such as electric vehicles and heat pumps have changed baseline load profiles and introduced new variability. As a result, CVR programs must now interoperate with demand response, reactive power compensation, and distribution automation to preserve power quality and reliability. Finally, regulatory expectations around resilience and emissions reduction are increasingly shaping investment priorities, compelling utilities to view CVR not only as an efficiency measure but also as a component of broader decarbonization and grid-stability strategies. These shifts together reframe CVR as an adaptable, software-enabled service rather than a static hardware adjustment.

Cumulative implications of tariff-driven procurement shifts in 2025 reshaping supply chains, project planning, and design strategies for CVR programs

The introduction of tariffs and trade policy changes in 2025 affecting electrical equipment and components has produced a cumulative set of effects that reshape procurement, project timelines, and supplier strategies relevant to conservation voltage reduction deployments. When import duties increase on items such as automated controls, line sensors, smart meters, and voltage regulators, utilities and integrators must reassess total cost of ownership and sourcing pathways. Higher landed costs create incentives to evaluate alternative component specifications, extend equipment lifecycles through preventive maintenance, and renegotiate supplier contracts to capture cost reductions elsewhere.In practical terms, tariff pressures drive several strategic responses. Some organizations accelerate localization of supply chains or shift purchases toward domestic or regional manufacturers where feasible, accepting tradeoffs in lead time or feature sets. Others redesign solution architectures to rely more heavily on software and edge computing that can offset incremental hardware costs by extracting more value from existing assets. Procurement teams also increase the use of framework agreements and volume commitments to stabilize pricing and ensure priority access to constrained components.

Beyond procurement, tariffs introduce complexity in project planning and risk management. Capital projects that depend on imported specialized regulators or controls face increased schedule risk, which prompts earlier-stage contingency planning and more rigorous supplier due diligence. Meanwhile, operators that prioritize resilience and sovereignty may opt for higher initial expenditures to secure regional supply and simplify compliance obligations. In this environment, the net effect is a shift toward diversified vendor ecosystems, modular design practices that reduce dependency on single suppliers, and stronger emphasis on total lifecycle engineering to preserve functional objectives while navigating trade policy headwinds.

Comprehensive segmentation insights that map end-use nuances, hardware-software-service interdependencies, and application-driven CVR deployment priorities

A nuanced segmentation analysis reveals the varied demand signals and technical requirements that shape conservation voltage reduction initiatives across end uses, components, and applications. Across end use categories, commercial environments include healthcare settings such as clinics and hospitals, hospitality venues encompassing hotels and restaurants, and retail assets like department stores and supermarkets; each subsegment exhibits distinct tolerances for voltage variation, operational hours, and criticality of continuous service. Industrial settings span manufacturing operations-both discrete and process-mining activities divided into surface and underground operations, and oil and gas sectors with upstream and downstream differences. Residential loads differentiate between multi family dwellings, including apartments and condominiums, and single family homes where rural and urban patterns diverge. Utility-level distinctions encompass distribution and transmission domains, with distribution focusing on feeder-level and substation-level interventions while transmission considerations involve bulk-level and subtransmission dynamics.From a component perspective, hardware, services, and software form the primary pillars of CVR delivery. Hardware assets consist of automated controls such as RTUs and SCADA interfaces, sensors including line sensors and advanced smart meters, and voltage regulation devices ranging from on-load tap changers to switched capacitors. Services encompass consultancy functions including audits and strategic planning, installation activities such as commissioning and integration, and maintenance practices that balance corrective and preventive approaches. Software includes analytics capabilities-both predictive and prescriptive-control systems covering distribution management and supervisory functionalities, and energy management modules for demand forecasting and load balancing.

Application-layer segmentation highlights the operational intentions behind CVR deployments. Demand response capabilities sit alongside distribution automation features like fault detection and feeder monitoring, while reactive power compensation employs capacitor banks and static VAR compensators to address power quality issues. Voltage optimization spans advanced volt-var control schemes and conservation voltage reduction programs that adjust setpoints to realize energy efficiency without compromising reliability. By synthesizing these segmentation lenses, stakeholders can tailor technology mixes, performance metrics, and implementation roadmaps to the distinct technical and commercial needs of each customer class and system level.

Regional dynamics and policy-driven imperatives that determine CVR adoption pathways across the Americas, EMEA, and Asia-Pacific grids

Regional dynamics materially influence how conservation voltage reduction is evaluated and deployed, as distinct policy environments, grid architectures, and industrial compositions create divergent priorities and implementation pathways. In the Americas, utilities operate across a broad spectrum of service territories from dense urban centers to extensive rural feeders, and current priorities emphasize resilience, modernization of aging infrastructure, and integration of renewable generation and distributed resources. These factors make CVR attractive as a relatively low-disruption measure that can be layered with distribution automation investments to enhance efficiency while preserving power quality for industrial and commercial customers alongside residential consumers.In the Europe, Middle East & Africa region, regulatory regimes and energy transition commitments are primary drivers. Many jurisdictions combine stringent efficiency targets with active grid codes that regulate voltage ranges and power quality, which compels utilities and regulators to consider CVR within tightly defined operating envelopes. Meanwhile, electrification and variable renewables growth create technical complexity that favors advanced control strategies and coordination between CVR, reactive power compensation, and demand-side programs to maintain system stability.

Across Asia-Pacific, rapid urbanization and high growth in electrification-particularly in transport and heating-are reshaping distribution networks and consumption patterns. Utilities in this region confront a dual mandate of expanding capacity and improving operational efficiency, which supports CVR pilots and scaled programs where regulatory frameworks permit. Additionally, manufacturing clusters and industrial users with substantial process loads create unique demand-side opportunities for CVR, although equipment sourcing and local supply chain maturity influence deployment speed and technology choices.

Competitive positioning and collaborative strategies that distinguish equipment manufacturers, software innovators, and integrators within the CVR ecosystem

Companies operating in the conservation voltage reduction ecosystem take on varied strategic postures that reflect their core capabilities and market roles. Equipment manufacturers increasingly position themselves as systems suppliers, bundling voltage regulators, sensors, and automated control hardware with lifecycle services and interoperability commitments. These vendors emphasize modularity, open communication standards, and ruggedized hardware to meet the heterogeneous needs of utilities and industrial customers. Meanwhile, software firms focus on analytics, control algorithms, and cloud-enabled orchestration layers that allow utilities to operationalize CVR alongside distribution management and DER integration. Their differentiation rests on the sophistication of predictive models, ease of integration, and the robustness of verification and reporting features.Service-oriented firms, including consultancy and systems integrators, bridge the gap between device vendors and utility operations by delivering audits, strategy development, commissioning, and preventive maintenance packages. Their advantage lies in deep domain expertise, field execution capabilities, and the capacity to tailor solution architectures to local regulatory and operational constraints. Utilities themselves often act as ecosystem integrators, conducting pilots, championing standards adoption, and selectively partnering with vendors to retain strategic control over critical distribution assets. Across this landscape, competitive dynamics favor collaboration; joint ventures, strategic partnerships, and co-development arrangements accelerate product-market fit while sharing implementation risk. Leadership in this space requires a balance of product depth, proven field performance, and the ability to support complex contracting models that align incentives between suppliers and operators.

Practical and immediate actions utilities and suppliers must adopt to deploy CVR at scale while managing supply risk and ensuring verifiable operational outcomes

Industry leaders seeking to extract consistent operational value from conservation voltage reduction should pursue a set of actionable measures that align technical performance, procurement resilience, and organizational readiness. First, prioritize interoperable architectures that allow modular substitution of hardware components and enable phased deployment; this reduces single-supplier risk and simplifies upgrades as standards and grid conditions evolve. Second, invest in analytics and verification systems that provide continuous measurement of voltage profiles and energy outcomes; robust measurement and verification bolsters regulatory compliance and helps translate operational adjustments into quantifiable benefits.Third, develop diversified procurement strategies to mitigate tariff and supply-chain risk. This includes engaging regional manufacturers where appropriate, qualifying multiple vendors for critical components such as voltage regulators and sensors, and structuring contracts with flexibility on delivery timelines and technology substitution. Fourth, align CVR initiatives with parallel programs such as demand response, distribution automation, and reactive power compensation so that operational objectives are harmonized rather than competing. Fifth, expand workforce competencies through targeted training on advanced control logic, telemetry diagnostics, and cybersecurity practices so field teams can confidently operate integrated CVR systems.

Finally, adopt a phased approach to rollouts that begins with targeted pilots designed to validate assumptions across representative feeder types and customer mixes. Use these pilots to stress-test verification approaches, refine operational playbooks, and build stakeholder confidence before scaling. By combining modular design, strong analytics, procurement agility, cross-program coordination, and disciplined piloting, leaders can reduce implementation risk and realize consistent, verifiable improvements in distribution efficiency and reliability.

A rigorous multi-method research framework combining primary interviews, component assessments, case studies, and expert validation to ensure actionable and verifiable insights

This research employed a multi-method approach to synthesize technical, regulatory, and operational insights relevant to conservation voltage reduction. Primary data gathering included structured interviews with utility engineers, distribution planners, equipment suppliers, systems integrators, and regulatory advisors to capture real-world deployment experience, procurement considerations, and performance expectations. These qualitative inputs were complemented by case study analysis of recent CVR pilots and implementations, where operational logs, verification reports, and technical postmortems were reviewed to identify recurring success factors and failure modes.Secondary analysis encompassed a review of technical standards, regulatory filings, white papers, and peer-reviewed literature to contextualize control strategies, voltage tolerance considerations, and device interoperability requirements. In addition, component-level assessments evaluated typical specifications and functional tradeoffs for automated controls, sensors, and voltage regulation devices, with attention to lifecycle maintenance implications and integration complexity. To ensure analytical rigor, findings were triangulated across sources and validated through workshops with subject-matter experts who reviewed preliminary conclusions and recommended refinements.

Finally, the methodology emphasized transparency and reproducibility. Assumptions, data limitations, and areas of uncertainty were documented, and sensitivity checks were performed where technical variability could materially alter recommended approaches. This structured research process produced a balanced body of evidence designed to inform practitioners about practical design choices, procurement strategies, and operational practices without relying on single-source claims or unverified anecdotal evidence.

A concise conclusion that synthesizes technical, procurement, and operational imperatives to realize reliable and verifiable CVR benefits across diverse distribution contexts

Conservation voltage reduction occupies a pragmatic and increasingly strategic position within distribution system planning and operations. When executed with appropriate sensing, automation, analytics, and verification, CVR can deliver persistent reductions in energy losses and help reconcile grid efficiency objectives with broader reliability and decarbonization goals. The evolving technology landscape-characterized by smarter sensors, more capable control systems, and integrated analytics-has shifted CVR from a manual adjustment to an optimized operational practice that interacts with demand response, reactive power compensation, and distributed energy resources.However, successful CVR adoption requires deliberate attention to segmentation, procurement resilience, and the interoperability of systems. End-use differences across commercial, industrial, residential, and utility domains dictate tailored control strategies, while component choices and service models determine ease of deployment and maintenance over time. Trade policy developments and supply-chain constraints add further complexity, underscoring the need for diversified sourcing and modular architectures. In conclusion, CVR is most effective when embedded within a broader programmatic approach that emphasizes measurement and verification, cross-program coordination, and phased scaling based on rigorous pilot learnings and validated operational playbooks.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Conservation Voltage Reduction Market

Companies Mentioned

- ABB Ltd

- Eaton Corporation plc

- Efacec Power Solutions, S.A.

- General Electric Company

- Hitachi Energy Ltd

- Itron, Inc.

- Landis+Gyr AG

- S&C Electric Company

- Schneider Electric SE

- Siemens AG

- Utilidata, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

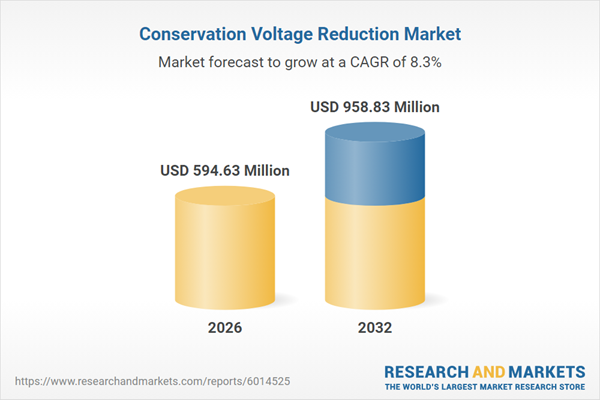

| Estimated Market Value ( USD | $ 594.63 Million |

| Forecasted Market Value ( USD | $ 958.83 Million |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |