Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive overview of copper alloy fundamentals and strategic drivers shaping material selection, manufacturing, and performance expectations across industries

The copper alloy sector occupies a central role in modern industrial ecosystems, combining metallurgical versatility with critical functional performance across electrical, mechanical, and architectural applications. Copper-based alloys such as brass, bronze, copper-nickel, and nickel silver offer tailored combinations of conductivity, corrosion resistance, machinability, and formability that make them indispensable in sectors ranging from electrical infrastructure to marine and aerospace systems. Materials selection decisions increasingly weigh not only intrinsic properties but also life-cycle impacts, recyclability, and supply chain resilience.Recent technological and regulatory shifts have elevated the strategic importance of alloy choices. Electrification trends drive demand for high-conductivity copper alloys in connectors and cables, while stringent building codes and aesthetic preferences sustain demand for architectural and decorative copper alloy products. Simultaneously, end users are prioritizing materials with lower lead content and greater reclaimed material content to meet health and sustainability standards. Fabrication and manufacturing processes-casting, extrusion, forging, and rolling-remain foundational to realizing the desired microstructure and performance characteristics, and process innovations continue to refine tolerances and surface finishes.

This executive summary synthesizes the technical, commercial, and geopolitical factors shaping the copper alloy landscape and highlights how manufacturers, specifiers, and purchasers can respond to shifting cost drivers, tariff actions, and market preferences. By focusing on performance-driven alloy selection, resilient sourcing, and manufacturing adaptability, stakeholders can maintain competitive advantage while navigating a complex regulatory and trade environment.

How electrification, circular economy mandates, advanced manufacturing, and geopolitical shifts are collectively reshaping alloy selection, processing, and supply chain strategy

The copper alloy landscape is undergoing transformative shifts driven by technological innovation, sustainability imperatives, and geopolitical recalibration. Electrification and the expansion of renewable energy infrastructures are elevating the importance of alloys that combine high conductivity with corrosion resistance, prompting revisits of alloy composition and conductor design. At the same time, decarbonization commitments and circular economy mandates are accelerating investments in recycling, secondary material recovery, and alloy compositions that tolerate higher scrap content without compromising critical performance.Concurrently, advanced manufacturing techniques such as precision extrusion, cold rolling refinements, and selective additive processes are enabling tighter tolerances, reduced material waste, and novel geometries previously unattainable through conventional routes. Digital tools, including production analytics and digital twins, have begun to inform process control across casting, forging, and rolling operations, improving yield and lowering variability. These process-level innovations are complemented by material science advances that refine microalloying strategies, enabling targeted tradeoffs between strength, conductivity, and machinability.

Geopolitical dynamics and trade policy shifts are reshaping supplier networks and accelerating nearshoring decisions, while stricter environmental regulations are intensifying scrutiny of lead-bearing brass variants and galvanic behavior in mixed-metal assemblies. Together, these trends compel stakeholders to adopt integrated strategies that align alloy development, manufacturing excellence, and supply chain diversification with long-term sustainability and regulatory compliance objectives.

Assessment of how 2025 tariff measures have altered procurement economics, supplier diversification strategies, and long-term supply chain resilience in the copper alloy ecosystem

The tariff actions enacted in 2025 have produced layered effects across procurement, cost structures, and supplier relationships, prompting companies to reassess sourcing geographies and contractual terms. Tariffs applied to specific categories of copper alloys and semi-finished forms have increased landed costs for some imported inputs, creating immediate pressure on margins for downstream fabricators and distributors. The impact has been uneven: manufacturers that rely on integrated domestic feedstock or that maintain diversified supplier portfolios have been able to mitigate exposure, while those dependent on narrow import pathways have faced more acute cost pass-through decisions.In response, many buyers have pursued a range of tactical and strategic mitigations. Tactical actions include renegotiating supplier payment terms, increasing inventory buffers for critical forms such as billets and sheets to smooth procurement cycles, and accelerating qualification of alternative alloy grades or secondary material sources. From a strategic perspective, organizations are accelerating supplier development in lower-tariff jurisdictions, investing in localized processing capabilities, and in some cases adapting product designs to reduce reliance on tariff-impacted inputs by substituting comparable alloys or adjusting form factors to leverage domestically produced shapes.

Regulatory uncertainty has also increased the value of contractual flexibility, including clauses that allow price adjustments tied to tariff changes or commodity indices. Over the medium term, sustained tariff volatility is likely to perpetuate supplier consolidation around resilient regional hubs and to reinforce the premium associated with vertically integrated producers that can internalize upstream processing. For stakeholders, the imperative is to blend near-term operational responses with longer-term investments in supply chain architecture to insulate products and customers from episodic tariff shocks.

In-depth segmentation analysis showing how alloy chemistry, product form, manufacturing route, application, and end-use industry intersect to shape procurement and design decisions

A granular view of segmentation reveals differentiated dynamics across alloy families, product forms, end-use industries, manufacturing routes, and specific applications. Based on alloy type, the market is examined across brass, bronze, copper-nickel, and nickel silver, with brass further subdivided into lead-free brass and leaded brass, bronze further differentiated into aluminum bronze and phosphor bronze, copper-nickel dissected into Cupro Nickel 70-30 and Cupro Nickel 90-10, and nickel silver explored through Nickel Silver 60-20-20 and Nickel Silver 65-18-17. Each alloy subgroup exhibits distinct performance attributes and regulatory implications, with lead-free brass increasingly favored in potable water and consumer-facing fixtures while phosphor bronze and aluminum bronze retain prominence where wear resistance and strength are prioritized.Based on form, products are studied across billets, rods, sheets and plates, tubes and pipes, and wires, with billets produced via continuous cast and direct chill methods, rods available as hollow or solid configurations, sheets and plates supplied as cold rolled or hot rolled stock, tubes and pipes sourced in seamless and welded formats-the welded category further produced as cold drawn or hot extruded-and wires offered as flat wire and round wire. Form selection is a critical determinant of downstream processing costs and fabrication yield, influencing decisions on inventory strategy and supplier selection.

Based on end-use industry, the landscape is examined across aerospace, automotive, construction, electrical and electronics, and marine sectors, where aerospace applications include aircraft structures and hydraulic systems, automotive uses encompass brake lines, heat exchangers, and radiators, construction covers commercial, infrastructure, and residential projects, electrical and electronics demand includes cables, connectors, and printed circuit boards, and marine deployment focuses on deck fittings and ship piping. Each end-use imposes distinct specifications for corrosion resistance, machinability, and conductivity.

Based on manufacturing process, the market is reviewed across casting, extrusion, forging, and rolling, each process imparting unique metallurgical characteristics and influencing cost, tolerances, and surface finish. Based on application, copper alloys are analyzed across architectural components, decorative items, electrical components, fasteners and hardware, and mechanical components, with architectural components further broken down into door frames and window frames, decorative items into plaques and sculptures, electrical components into cables and connectors, fasteners and hardware into bolts, nuts, and washers, and mechanical components into bearings and gears. Understanding the intersection of alloy chemistry, manufacturing process, and final application is essential to optimizing performance, compliance, and total delivered value.

Comparative regional intelligence highlighting how supply concentration, regulatory rigor, and industrial demand in the Americas, EMEA, and Asia-Pacific influence alloy selection and sourcing strategies

Regional dynamics vary substantially, with each geography presenting a distinct mix of demand drivers, supply chain structures, and regulatory frameworks that influence strategic choices. In the Americas, demand patterns are shaped by infrastructure modernization programs, automotive electrification, and a strong domestic fabrication base; consequently, there is growing emphasis on local sourcing, scrap reclamation capacity, and regulatory compliance for lead content in plumbing and building materials. Fabricators in the region are investing in process automation and inventory strategies to manage tariff-induced cost volatility and to shorten lead times for critical forms such as tubes, wires, and sheets.In Europe, Middle East & Africa, regulatory rigor and sustainability mandates are primary forces driving material selection and supplier qualification. The region's focus on circularity and traceability has elevated the importance of recycled content verification, chain-of-custody documentation, and low-lead alloy alternatives. Industrial clusters in Western Europe continue to demand tight tolerances and high-finish components for electrical and architectural applications, while certain Middle Eastern and African markets prioritize corrosion-resistant copper-nickel alloys for marine and desalination infrastructure.

The Asia-Pacific region remains a pivotal hub for both upstream refining and downstream fabrication, with expansive capacities for billets, rods, sheets, tubes, and wire. Rapid urbanization and manufacturing growth sustain demand across construction, automotive, and electrical sectors, and the region is a focal point for process innovation and scale economics. However, supply concentration also introduces vulnerability to policy shifts and trade realignments, prompting regional buyers and global OEMs to weigh diversification strategies and localized manufacturing partnerships to mitigate risk and support rapid product cycles.

Competitive and supplier landscape overview showing how vertical integration, technical capability, and sustainability credentials determine commercial differentiation and customer selection

Competitive dynamics center on producers that combine metallurgical expertise, process flexibility, and reliable upstream supply with those that offer specialized downstream finishing and value-added services. Leading firms differentiate through vertically integrated platforms that control melting, casting, rolling, and distribution, enabling them to offer consistent chemistries and traceability while absorbing upstream cost volatility. Other successful entities focus on niche positions, excelling in specific alloy grades, premium surface finishes, or complex formed components tailored for aerospace, marine, and high-performance electrical applications.Strategic partnerships between alloy producers, fabricators, and end users are becoming more common as a route to accelerate product qualification and to align specifications with manufacturing realities. Investments in sustainability credentials, such as documented recycled content and lower emissions footprint, are increasingly viewed as competitive assets that facilitate procurement wins in regulated markets. Technology leadership in process control and quality assurance, including the application of real-time monitoring and materials characterization, further separates contract manufacturers that can consistently meet the most demanding tolerances from those that cannot.

For buyers, supplier selection is now informed by a broader set of performance indicators beyond unit cost. Service levels, geographic footprint, inventory flexibility, certification depth, and the capacity to support co-development programs are all decisive factors. Companies that can demonstrate robustness across this expanded value set are better positioned to capture long-term commercial engagements with OEMs and infrastructure integrators.

Practical strategic actions for manufacturers and buyers to strengthen resilience, accelerate material transitions, and capture higher-value customer engagements through process and sourcing innovations

Industry leaders should adopt an integrated set of actions that balance short-term operational resilience with long-term strategic positioning. First, refine supplier portfolios to increase geographic and process diversification while preserving qualification standards; this may involve dual sourcing critical forms, identifying regional fabrication partners, and establishing contingency inventories for billets, sheets, and specialized wire formats. Second, accelerate adoption of lead-free and higher-recycled-content alloys where end-use specifications allow, pairing material changes with validated process adjustments to manage machinability and finishing outcomes.Third, invest in manufacturing process modernization across casting, extrusion, forging, and rolling lines to reduce scrap, improve tolerances, and shorten qualification cycles for new alloy grades. Prioritizing process analytics and condition-based maintenance will enhance uptime and product consistency. Fourth, embed tariff and regulatory scenario planning into procurement contracts and product engineering cycles to enable rapid design or sourcing pivots. This should include contractual clauses for cost pass-throughs, indexation, and change control mechanisms for alloy substitutions.

Finally, deepen engagement with customers through cooperative development programs that translate alloy science into application-specific benefits, such as improved corrosion resistance, enhanced thermal performance, or simplified assembly. This collaborative approach accelerates validation timelines and creates higher switching costs, strengthening commercial relationships and supporting premium positioning in crowded markets.

Transparent multi-method research approach combining stakeholder interviews, technical literature review, and data triangulation to produce actionable and validated copper alloy insights

The research approach underpinning this executive summary combined primary and secondary inquiry, targeted technical review, and cross-validation to ensure analytic rigor and practical relevance. Primary inputs included structured interviews with metallurgists, procurement heads, and manufacturing managers across fabricators, OEMs, and distributors, supplemented by interviews with regulatory specialists and trade policy analysts to clarify tariff impacts and compliance imperatives. These qualitative discussions provided contextual nuance on supplier behavior, product qualification timelines, and process constraints that shape real-world material decisions.Secondary research encompassed the review of technical literature, standards, and material specifications relevant to copper alloys, as well as public policy documents and trade notices that informed the analysis of regulatory and tariff developments. Process-level insights were validated through examination of manufacturing best-practice guidelines for casting, extrusion, forging, and rolling, and by consulting metallurgical references to align alloy performance descriptions with expected application outcomes.

Data triangulation was applied to reconcile differing perspectives and to surface consistent patterns across stakeholder groups. The methodology emphasized transparency in source attribution and conservative interpretation of conflicting inputs, with a clear focus on operationally actionable conclusions rather than hypothetical scenarios. Quality assurance steps included peer review by practicing metallurgists and senior industry analysts to ensure technical accuracy and strategic relevance.

Concise synthesis of strategic imperatives for translating metallurgical capabilities into resilient sourcing, compliant product design, and long-term commercial advantage

In summary, the copper alloy landscape is at a strategic inflection point where material science advances, sustainability demands, and geopolitically driven trade measures converge to reshape procurement, manufacturing, and product development decisions. Stakeholders that proactively adapt their alloy portfolios, diversify sourcing, and modernize processing capabilities will be positioned to capture the benefits of electrification, infrastructure renewal, and stricter regulatory environments. Conversely, organizations that rely on narrow supply chains or resist necessary material and process changes face heightened exposure to cost pressure and qualification bottlenecks.A calibrated response integrates near-term tactical measures-such as inventory hedging, supplier clause adjustments, and tactical alloy substitutions-with longer-term investments in recycling, process analytics, and supplier collaboration. By prioritizing traceability, documented recycled content, and low-lead alternatives where relevant, manufacturers can satisfy regulatory requirements and end-customer expectations while unlocking new procurement opportunities. Ultimately, success in the evolving copper alloy domain will be determined by the ability to translate metallurgical capability into predictable, certified performance within targeted end-use contexts, supported by procurement architectures that are resilient to policy and market volatility.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Copper Alloy Market

Companies Mentioned

The key companies profiled in this Copper Alloy market report include:- ALB Copper Alloys Co.,Ltd.

- Anchor Bronze & Metals, Inc.

- Anhui Truchum Advanced Materials & Technology Co., Ltd.

- Aurubis AG

- Aviva Metals, Inc.

- Belmont Metals, Inc.

- COPPER ALLOYS LTD

- FUKUDA METAL FOIL & POWDER CO., LTD.

- JX Advanced Metals Corporation

- KME Group SpA

- Kushal Copper Corporation

- LINHUI

- Marmetal Industries, LLC

- Materion Corporation

- Miba AG

- Mitsubishi Materials Corporation

- Modison Copper Pvt. Ltd.

- Multimet Overseas

- NGK Metals Corporation

- SAĞLAM METAL

- Senor Metals Pvt. Ltd.

- The Electric Materials Company

- Vaishnavi Metal Products Corporation Pvt. Ltd.

- Wieland-Werke AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2026 |

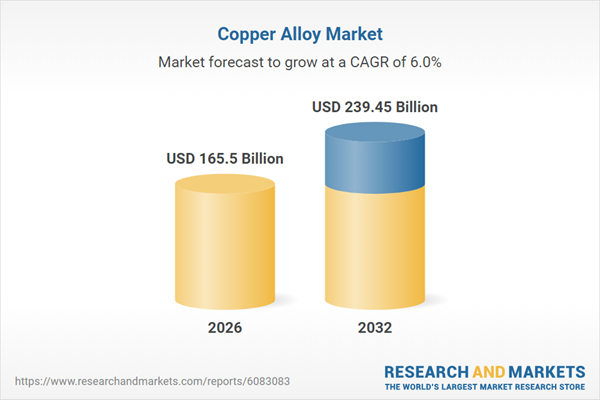

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 165.5 Billion |

| Forecasted Market Value ( USD | $ 239.45 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |