Speak directly to the analyst to clarify any post sales queries you may have.

A strategic introduction to coronary artery disease that frames clinical pathways, stakeholder pressures, regulatory shifts, and technological imperatives for decision makers

Coronary artery disease remains a central clinical and commercial focus for cardiovascular care stakeholders, driven by persistent prevalence, evolving patient demographics, and continuous technological innovation. In clinical practice, management pathways span conservative medical therapy, percutaneous interventions, and surgical revascularization, each defined by distinct device needs, procedural workflows, and post-procedural care pathways. Payers, providers, and manufacturers operate under growing pressure to demonstrate value in outcomes while reducing total cost of care, which in turn accelerates adoption of minimally invasive platforms, enhanced imaging modalities, and devices designed to shorten length of stay and minimize complications.Against this backdrop, regulatory dynamics and reimbursement shifts are reshaping development priorities and commercialization strategies. Regulatory agencies are increasingly focused on real-world evidence and post-market surveillance, prompting manufacturers to embed clinical evidence generation into product lifecycles. Meanwhile, hospital systems and outpatient surgical centers are reorganizing care delivery to emphasize throughput and patient experience, creating new adoption pathways for streamlined interventional tools and advanced imaging systems. Therefore, stakeholders must reconcile clinical efficacy with operational efficiency and regulatory compliance to maintain competitive positioning and meet evolving standards of care.

How converging technological advances, care delivery reorganizations, and supply chain priorities are reshaping clinical adoption, procurement, and innovation pathways in coronary care

The landscape for coronary artery disease management is undergoing transformative shifts that redefine product development, clinical adoption, and commercial strategy. Advancements in device design, such as thinner-strut drug-eluting platforms and bioresorbable scaffolds, are paired with improvements in intraprocedural imaging, enabling operators to execute more precise interventions with potentially lower complication rates. Concurrently, digital and computational tools-ranging from procedural decision-support algorithms to image-fusion platforms-are increasingly integrated into cath lab workflows to support real-time assessment and longitudinal patient monitoring.Furthermore, the move toward ambulatory care and same-day discharge pathways is altering the economics of device selection, incentivizing products that facilitate rapid recovery and predictable outcomes. Supply chain resilience and regional manufacturing priorities have become more prominent as recent policy changes and trade considerations influence sourcing strategies. Together, these developments create a complex environment in which clinical value, operational compatibility, and regulatory readiness determine the pace of adoption. Leaders who align product roadmaps with these concurrent shifts, and who commit to robust evidence and stakeholder engagement, will be best positioned to influence clinical guidelines and institutional purchasing decisions.

Understanding the systemic consequences of recent United States tariff policy adjustments and how they affect supply chains, procurement practices, and manufacturer strategies

Policy changes in trade and tariffs influence the commercial calculus for medical device manufacturers, health systems, and distributors by altering cost structures, sourcing decisions, and inventory strategies. Tariff-driven increases in input costs channeled through global component suppliers tend to compress margins for original equipment manufacturers and can lead to repricing debates with hospital procurement teams. These pressures incentivize strategic responses such as nearshoring of key manufacturing operations, renegotiation of supplier contracts, and accelerated qualification of alternative component sources to preserve continuity of supply.Clinicians and health systems experience second-order effects from these adjustments through changes in device availability, preferred vendor lists, and device selection protocols. Providers may favor devices with established local supply chains or longer product life cycles to mitigate procurement risk. In response, manufacturers often prioritize product portfolios with clear clinical differentiation, streamline SKUs to simplify logistics, and intensify engagement with group purchasing organizations to secure formulary placement. Finally, innovation pathways feel the impact as development teams balance cost pressures with the need to fund clinical studies and obtain regulatory approvals. Effective mitigation requires transparent communication across the value chain, scenario planning for procurement contingencies, and investment in domestic manufacturing capabilities where feasible.

In-depth segmentation insights revealing how product types, procedural pathways, and end-user settings uniquely influence adoption, evidence needs, and commercial priorities

A segmented view of the coronary device landscape reveals distinct clinical and commercial dynamics across product, procedure, and end-user categories that shape adoption patterns and competitive focus. Within product types, balloon catheters, coronary stents, embolic protection devices, guidewires, and imaging systems each occupy unique clinical niches. Coronary stents in particular are differentiated into bare metal stents, bioresorbable scaffolds, and drug-eluting stents, with each subtype presenting different evidence requirements, procedural considerations, and clinician preferences. Imaging systems bifurcate into intravascular ultrasound and optical coherence tomography platforms, providing variable resolution and depth penetration that influence lesion assessment and interventional decision-making.Procedure type further stratifies demand and clinical workflows. Coronary artery bypass grafting procedures are performed both off pump and on pump, representing surgical complexity and ICU resource implications. Percutaneous coronary interventions are executed as balloon angioplasty or with adjunctive stenting, and device selection is often influenced by lesion characteristics, operator experience, and adjunct imaging guidance. Finally, end-user segmentation into ambulatory surgical centers, cardiology clinics, and hospitals determines purchasing authority, procedural volume thresholds, and post-procedure care pathways. Ambulatory surgical centers prioritize devices that enable rapid throughput and same-day discharge, cardiology clinics emphasize diagnostics and minimally invasive tools that expand outpatient care, and hospitals retain a dominant role for high-complexity procedures requiring comprehensive perioperative support. Taken together, these layers of segmentation explain how clinical need, operational constraints, and institutional priorities channel product development and commercialization strategies.

Regional intelligence that explains how Americas, Europe Middle East & Africa, and Asia-Pacific differences shape regulatory pathways, clinical adoption, and commercial execution

Regional dynamics exert a profound influence on clinical practice patterns, regulatory expectations, and commercial approaches across the global coronary landscape. In the Americas, established reimbursement frameworks and high procedural volumes support rapid uptake of advanced interventional devices, while concentrated payer negotiations and group purchasing mechanisms shape pricing and contracting strategies. Providers in this region increasingly prioritize technologies that demonstrate clear outcome improvements and that align with efforts to reduce hospitalization durations and readmission rates.In Europe, the Middle East & Africa, a heterogeneous regulatory environment and varied reimbursement landscapes require tailored market access approaches. Adoption is shaped by country-level health technology assessment pathways, variation in procedural infrastructure, and differential availability of specialized imaging resources. Stakeholders in this region often seek strong cost-effectiveness evidence and partnership models that include training and service support. Conversely, Asia-Pacific demonstrates a dynamic combination of high-growth adoption corridors and strong local manufacturing ecosystems. Diverse patient demographics, rapid expansion of interventional cardiology capacity, and proactive regulatory initiatives in several countries create opportunities for targeted launches and region-specific clinical programs. Across regions, manufacturers must adapt regulatory strategies, clinical engagement plans, and supply logistics to local intricacies in order to achieve sustained traction.

Strategic corporate behaviors and competitive tactics among leading firms that drive clinical differentiation, M&A activity, and integration of diagnostic and therapeutic capabilities

Leading companies in the coronary device space are advancing through a combination of incremental innovation, strategic M&A, and deeper integration of diagnostics with therapeutic platforms. Corporate strategies emphasize strengthening clinical evidence, streamlining device portfolios for operational efficiency, and expanding service and training offerings to reduce the barrier to adoption. Portfolio differentiation increasingly relies on demonstrating procedural efficiency gains and improvements in long-term patient outcomes, which in turn necessitates investments in longer-term clinical studies and registries.Competitive dynamics also feature targeted investments in imaging and analytics, where firms seek to bundle devices with software-enabled decision support that enhances procedural precision and post-procedural follow-up. Partnerships between device manufacturers and technology companies are becoming more common to accelerate digital enhancements and to create interoperable solutions that fit within hospital IT ecosystems. Emerging companies and specialized startups are contributing disruptive ideas, particularly in bioresorbable materials, micro-imaging modalities, and device coatings, prompting established players to accelerate internal R&D or pursue bolt-on acquisitions. Overall, success depends on a clear articulation of clinical value, robust real-world evidence strategies, and operational models that support adoption across a range of care settings.

Actionable strategic priorities that industry leaders should implement to strengthen supply resilience, clinical evidence, pricing approaches, and adoption across care settings

Industry leaders can act decisively to capitalize on clinical needs and policy shifts by implementing a set of prioritized, practical measures. First, diversify and requalify supply chains with an emphasis on dual-sourcing critical components and qualifying regional manufacturing partners to reduce exposure to trade policy shocks. Second, invest in clinical evidence generation that aligns with payer priorities, focusing on outcomes that matter for reimbursement decisions and institutional procurement committees. Third, accelerate integration of high-resolution intravascular imaging and analytics into product bundles to demonstrate procedural efficiency and measurable improvements in clinical decision-making.Additionally, pursue targeted commercialization strategies that expand into ambulatory surgical centers and outpatient cardiology clinics, supported by training programs that streamline operator onboarding and by value-based contracting models that align incentives with clinical outcomes. Forge strategic partnerships with digital health providers to enable longitudinal patient monitoring and to capture post-market performance data. Finally, maintain adaptive pricing and SKU consolidation strategies to simplify procurement and reduce logistical complexity. By implementing these measures in a coordinated manner, organizations can enhance resilience, improve clinical adoption, and protect commercial margins while responding to evolving regulatory and payer expectations.

A transparent mixed-methods research methodology combining clinician interviews, literature synthesis, and scenario analysis to validate insights and identify practical limitations

The research behind this analysis combined qualitative and quantitative approaches to produce balanced, verifiable insights. Primary data collection included structured interviews with interventional cardiologists, clinical researchers, procurement officers, and regulatory specialists to capture frontline perspectives on device performance, adoption drivers, and sourcing challenges. Secondary research encompassed peer-reviewed clinical literature, regulatory filings, procedural guidelines, and public financial disclosures to contextualize clinical evidence and corporate developments. Triangulation of these inputs enabled validation of thematic findings and identification of consistent trends across sources.Analytical techniques incorporated comparative product mapping, procedural workflow analysis, and scenario-based assessment of supply chain disruptions. Data quality procedures included source cross-checks, expert review panels, and a documented audit trail for key assumptions. Limitations were acknowledged where primary data were uneven across specific subsegments or regions, and where evolving policy actions necessitate ongoing monitoring. Ethical considerations were upheld through anonymization of interview responses and adherence to confidentiality agreements with experts. This methodological approach ensures that the conclusions drawn are robust, transparent, and oriented toward practical decision-making.

A conclusive synthesis that integrates clinical trends, technology advances, and policy pressures to guide strategic decision making and operational priorities for stakeholders

In conclusion, the coronary artery disease environment is characterized by rapid technological advancement, shifting care delivery models, and evolving policy influences that together create both risk and opportunity for stakeholders. Clinical practice continues to migrate toward precision-guided interventions supported by advanced imaging and data analytics, while care delivery trends favor outpatient pathways that demand device simplicity and reliability. Policy and procurement developments introduce supply-side complexity, prompting manufacturers and providers to redesign sourcing and commercialization approaches.To navigate this landscape, stakeholders must align clinical evidence programs with procedural workflows, invest in interoperable imaging and analytics solutions, and adopt flexible supply chain strategies that mitigate geopolitical and policy risks. Sustained collaboration among device manufacturers, clinical leaders, and payers will be essential to translate technological promise into measurable improvements in patient outcomes and operational efficiency. The convergence of clinical need, innovation, and policy imperatives makes this a pivotal moment for decisive strategy and proactive execution.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Coronary Artery Disease Market

Companies Mentioned

The key companies profiled in this Coronary Artery Disease market report include:- Abbott Laboratories

- B. Braun SE

- Becton, Dickinson and Company

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- Canon Medical Systems Corporation

- Edwards Lifesciences

- FUJIFILM Holdings Corporation

- GE HealthCare Technologies, Inc.

- Genesee Biomedical Inc.

- Getinge AB

- Hitachi, Ltd.

- Koninklijke Philips N.V.

- Medtronic PLC

- Merck KGaA

- MicroPort Scientific Corporation

- Siemens Healthineer AG

- Stryker Corporation

- Teleflex Incorporated

- Terumo Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | January 2026 |

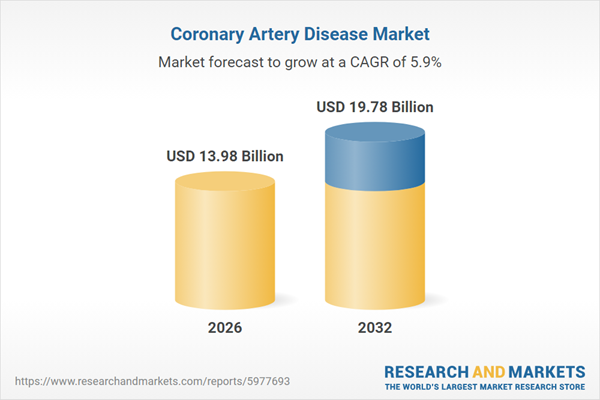

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 13.98 Billion |

| Forecasted Market Value ( USD | $ 19.78 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |