Speak directly to the analyst to clarify any post sales queries you may have.

Overview of cryoablation evolution and clinical integration across cardiology, oncology, cosmetics, and pain care with implications for adoption and policy

Cryoablation has evolved from a niche therapeutic option into a versatile modality that spans cardiology, oncology, cosmetic procedures, and pain management. As a technique that uses controlled freezing to target pathological tissue while preserving surrounding structures, cryoablation now integrates advanced catheter designs, cryoprobes, and procedural platforms that are reshaping clinical workflows. Recent years have seen notable refinement in device ergonomics, imaging compatibility, and single‑use disposables that collectively improve procedural efficiency and lower infection risks. These technical advances are matched by expanding clinical indications driven by peer‑reviewed evidence demonstrating durable outcomes across diverse use cases, including rhythm control in cardiac electrophysiology and minimally invasive tumor ablation in oncologic care.Adoption is being guided by clinician preference for predictable lesion formation, reduction in collateral damage relative to thermal techniques, and the ability to perform procedures in outpatient or ambulatory settings when paired with optimized anesthesia and analgesia pathways. Concurrently, regulatory authorities and health systems are placing greater emphasis on real‑world evidence and post‑market surveillance, prompting manufacturers to strengthen clinical registries and data collection. In this environment, device makers and health systems must balance innovation with demonstrable safety profiles and reproducible outcomes, while payers and procurement teams increasingly require structured value propositions tied to clinical pathways and cost‑of‑care reductions.

Moving forward, the sector’s trajectory will be defined by how well stakeholders translate incremental device improvements into scalable care models, professional education, and reimbursement conversations that enable broader patient access without compromising safety or clinical efficacy.

Technological, procedural, and supply chain shifts that are collectively reshaping cryoablation adoption, site‑of‑care dynamics, and long‑term access to treatment

Multiple transformative shifts are converging to redefine the landscape for cryoablation technologies and services. On the technological front, catheter and probe innovations are delivering greater procedural precision through improved thermodynamics, refined tip geometries, and compatibility with high‑resolution mapping and imaging systems. These enhancements reduce procedural variability and enable operators to target complex anatomies with enhanced confidence. Parallel progress in disposable platforms and modular systems is altering cost structures and inventory practices, making minimally invasive cryo procedures more accessible outside traditional operating rooms.Clinical practice is also shifting. The growth of hybrid procedural suites that combine imaging, electroanatomic mapping, and cryotherapy facilitates multidisciplinary interventions and shorter procedural times. This structural evolution allows more procedures to occur in ambulatory settings where care pathways are optimized for throughput and patient convenience. Simultaneously, the convergence of cryoablation with adjunctive technologies-such as intra‑procedural imaging, robotics, and software that supports lesion assessment-is improving reproducibility and enabling safer adoption for complex indications.

Supply chain resilience and regulatory adaptation have become strategic priorities. Manufacturers are reengineering sourcing strategies to mitigate component constraints and tariff exposure, while regulatory bodies emphasize post‑market data to monitor safety and long‑term effectiveness. Together, these shifts create an environment where clinical evidence, operational efficiency, and supply reliability determine which products scale effectively. Stakeholders that anticipate these forces and align device design, clinical training, and market access strategies will capture disproportionate value as clinical pathways and site‑of‑care dynamics continue to evolve.

How changes in United States tariff policy influence supply chains, sourcing decisions, pricing strategies, and clinical access across the cryoablation device sector

The introduction of tariffs affecting medical device components and finished goods can have a broad, cumulative impact across the cryoablation ecosystem. Increased import duties raise cost pressures for manufacturers that rely on specialized components sourced internationally, prompting a re‑evaluation of supplier contracts and procurement strategies. These cost pressures can ripple through to distributors, hospital purchasing departments, and ambulatory surgical centers as procurement teams seek to preserve patient access while managing capital budgets. Hospitals and integrated health systems may respond by adjusting purchasing cycles, prioritizing platforms with predictable lifecycle costs, or negotiating bundled service agreements to stabilize long‑term expenditures.Tariff‑induced shifts also incentivize geographic diversification of manufacturing and assembly. Some companies accelerate nearshoring or establish regional manufacturing hubs to reduce exposure to cross‑border duties, while others redesign products to rely on locally available components. Such structural changes improve supply continuity but require capital investment and time for qualification. In parallel, distributors and device OEMs increase emphasis on total cost of ownership and service offerings to sustain relationships with large end users. For smaller device innovators, tariffs can complicate early commercialization by increasing unit costs and squeezing limited margin buffers, which in turn affects decisions around clinical trial expansion and inventory depth.

From an operational standpoint, tariff dynamics influence strategic planning around pricing, contract negotiations, and market entry timing. Organizations that proactively model tariff scenarios, diversify supplier networks, and strengthen local partnerships will be better positioned to preserve access, maintain device availability, and support clinicians without abrupt disruption to patient care.

Segmentation insights across clinical applications, device architectures, end‑user environments, and distribution pathways to inform targeted commercialization strategies

A nuanced segmentation view offers clarity on where clinical demand and procurement focus are concentrating across cryoablation use cases, device types, end users, and distribution channels. Within applications, cardiac arrhythmia procedures are bifurcated between cryoballoon ablation and cryocatheter ablation, each serving electrophysiology teams focused on pulmonary vein isolation and targeted lesion formation respectively. Cosmetic treatments span skin lesion removal and tattoo removal, a domain that emphasizes outpatient convenience and cosmetic outcome metrics. Oncology use cases cover kidney tumor, liver tumor, and prostate tumor ablations, where percutaneous access, imaging integration, and lesion durability are critical. Pain management applications encompass back pain, joint pain, and peripheral nerve pain, calling for devices optimized for precision and nerve‑sparing effects. Each application creates distinct clinical evidence needs, reimbursement conversations, and training requirements.End user segmentation highlights differences in procedural throughput, capital intensity, and staffing. Ambulatory surgery centers prioritize efficiency, turnover, and rapid recovery protocols, making disposable and easy‑to‑deploy platforms attractive. Hospitals offer complex case capability and infrastructure for hybrid procedures, supporting devices that integrate with imaging and advanced monitoring. Specialty clinics focus on streamlined treatments and patient experience, favoring devices that enable same‑day procedures and predictable cosmetic or pain outcomes. Device type segmentation further clarifies product design and commercialization vectors: catheter based systems, including cryoballoon and cryocatheter systems, align closely with electrophysiology pathways and cardiac lab workflows, while cryoprobe systems, encompassing endoscopic and percutaneous probes, serve surgical and interventional oncology use cases.

Across distribution channels, relationships matter: distributors provide breadth and local servicing, hospital direct models can support deep clinical partnerships and training, and online channels facilitate consumable and elective cosmetic device procurement. Understanding how these segmentation layers interact enables targeted product development, tailored clinician education, and distribution strategies that match end‑user expectations and care setting constraints.

Regional dynamics across the Americas, Europe Middle East & Africa, and Asia‑Pacific that influence regulatory pathways, adoption patterns, and commercialization tactics

Regional dynamics shape regulatory pathways, clinician practice patterns, and commercial approaches in distinct ways that influence how cryoablation technologies are adopted and scaled. In the Americas, established electrophysiology centers and a well‑developed outpatient surgery infrastructure support broad uptake of catheter‑based systems, while reimbursement complexity and regional payer negotiations require manufacturers to present strong value propositions and clinical evidence packages. The Americas also exhibit diverse supply chain footprints, with opportunities for regional manufacturing and strategic distributor partnerships that reduce lead times for high‑use centers.The Europe, Middle East & Africa region presents a heterogeneous regulatory and reimbursement landscape where device approvals, national health technology assessments, and procedural coding vary markedly. Adoption in several European markets is driven by centralized hospital systems and publicly funded care pathways, which emphasize cost‑effectiveness and long‑term outcomes. In the Middle East and Africa, investment in specialized cardiac and oncology centers is creating demand for proven, turnkey solutions, though variability in infrastructure and clinician training can influence deployment speed.

Asia‑Pacific combines large patient populations with rapidly developing specialist centers and an appetite for innovative device adoption. Key dynamics include significant investments in interventional capabilities, growing domestic manufacturing competencies, and an emphasis on cost‑effective technologies that can be scaled across diverse care settings. Across all regions, local clinical champions, robust training programs, and alignment with regional reimbursement criteria are decisive factors in accelerating adoption and ensuring sustainable utilization of cryoablation technologies.

Corporate strategies and competitive factors shaping device portfolios, clinical evidence programs, and partnership models within the cryoablation sector

Competitive dynamics in cryoablation are defined by a mix of established medtech platforms and agile startups that bring focused innovation to specific clinical niches. Leading organizations routinely pursue strategies that combine platform diversification, clinical evidence generation, and partnerships with health systems to secure long‑term adoption. Investment in integrated solutions-where hardware is complemented by software for lesion assessment, procedural guidance, and data capture-has become a differentiator that supports clinician efficiency and post‑market surveillance. Equally important are service models that include training, proctoring, and bundled support to accelerate physician confidence and shorten time to routine use.Emerging companies frequently target unmet needs with single‑use consumables, novel thermodynamic approaches, or probes engineered for specific anatomic challenges. These entrants often partner with academic centers for early‑stage evidence and rely on focused distribution agreements to achieve initial scale. Strategic partnerships and selective acquisitions allow mature firms to fill portfolio gaps, expand into new clinical segments, or secure manufacturing capabilities that enhance supply resilience.

Across the competitive landscape, success is increasingly determined by the ability to demonstrate reproducible clinical outcomes, deliver operational simplicity for busy procedural teams, and provide clear economic rationale for payers and hospitals. Companies that invest in longitudinal outcome data, clinician training ecosystems, and localized manufacturing or logistics will be better positioned to navigate procurement cycles and earn preference in both hospital and ambulatory settings.

Practical strategic steps leaders can deploy to strengthen supply resilience, accelerate clinical adoption, and align commercial models with payer and provider expectations

Industry leaders should prioritize a set of actionable initiatives that translate market intelligence into durable commercial advantage and improved patient access. Begin by strengthening supply chain resilience through multi‑tier sourcing and selective nearshoring to reduce exposure to tariffs and component shortages. This operational move should be paired with product design reviews that identify opportunities to substitute vulnerable components without compromising performance. Parallel investments in clinician training and proctoring programs are essential to reduce variability in outcomes, accelerate adoption, and increase procedural throughput in ambulatory and hospital settings.Commercial teams must refine value propositions to align with payer expectations and hospital procurement frameworks, emphasizing real‑world evidence, total cost of ownership, and patient‑centric outcomes. Consider structured pilot programs with leading health systems to generate localized evidence and build clinical champions who can advocate for broader adoption. Additionally, invest in digital enablement-software tools that enhance lesion assessment, procedural documentation, and remote support-to differentiate platforms and create recurring revenue opportunities through analytics and service subscriptions.

Finally, pursue strategic partnerships that expand distribution reach while preserving clinical oversight. For novel or high‑risk indications, collaborate with academic centers for rigorous evidence generation and with specialty clinics to optimize outpatient workflows. By executing a coordinated approach that blends operational resilience, evidence generation, clinician support, and digital augmentation, industry leaders can convert market complexity into sustainable growth and improved patient outcomes.

Description of the research approach combining clinician interviews, regulatory and clinical literature review, supply chain analysis, and validation workshops to ensure reliable insights

The research underpinning this analysis combines primary qualitative input, systematic document review, and triangulation of regulatory and clinical sources to ensure validity and relevance. Primary research included structured interviews with practicing electrophysiologists, interventional oncologists, pain specialists, ambulatory surgical center operators, and procurement leaders to capture procedural preferences, adoption barriers, and device performance perceptions. These clinician perspectives were complemented by interviews with device engineers, regulatory affairs professionals, and distribution executives to surface supply chain dynamics, manufacturing considerations, and commercial channel strategies.Secondary research involved targeted review of peer‑reviewed clinical literature, regulatory filings, product technical documents, and procedure registries to corroborate device performance characteristics and post‑market safety signals. Policy and reimbursement landscape analysis drew on public health authority publications, coding manuals, and payer guidance to map the reimbursement and access environment across key regions. Findings were iteratively validated through cross‑stakeholder workshops and sanity checks against clinical practice patterns observed in high‑volume centers.

Limitations are acknowledged: evolving regulatory decisions and novel clinical data emerging after the analysis period may alter specific evidence thresholds, and tariff or trade policy developments can shift supply chain dynamics rapidly. To mitigate these factors, the methodology emphasizes transparency in data sources, conservative interpretation of early clinical signals, and recommendations that prioritize operational resilience and evidence generation.

Synthesis of strategic implications for clinical practice, product development, regional commercialization, and supply chain resilience as cryoablation matures

In conclusion, cryoablation stands at an inflection point where technological refinement, evolving care delivery models, and shifting trade dynamics collectively shape both near‑term adoption and long‑term strategic opportunity. Devices that deliver reproducible lesion formation, integrate with adjunctive imaging and mapping tools, and support efficient outpatient workflows will be most attractive to clinicians and health systems. At the same time, tariff pressures and supply chain constraints underscore the need for manufacturing flexibility and strong distributor relationships to maintain consistent device availability across diverse care settings.Segmentation clarity-understanding the distinct requirements of cardiac arrhythmia, cosmetic procedures, oncology, and pain management-enables more precise product development and market entry strategies. Regional nuances in regulation, reimbursement, and infrastructure further require localized evidence generation and tailored commercial approaches. Finally, companies that combine robust clinical evidence with practical service models, digital enablement, and operational resilience will have the strongest foundation to expand adoption while preserving quality of care.

Stakeholders that translate these insights into coordinated action-aligning R&D, supply chain, clinical training, and market access-will be best positioned to capture the opportunities presented by cryoablation’s expanding role across multiple therapeutic areas.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Cryoablation Devices Market

Companies Mentioned

The key companies profiled in this Cryoablation Devices market report include:- AtriCure, Inc.

- Boston Scientific Corporation

- BVM Medical Limited

- ConMed Corporation

- CooperSurgical, Inc.

- CRYO SCIENCE SP. Z OO

- CryoConcepts LP

- CryoLife, Inc.

- GE HealthCare Technologies Inc.

- IceCure Medical Ltd.

- Integer Holdings Corporation

- Johnson & Johnson Services, Inc.

- Medtronic PLC

- Merit Medical Systems, Inc.

- METRUM CRYOFLEX Sp. z o.o.

- MicroPort Scientific Corporation

- Olympus Corporation

- Quantum Surgical SAS

- Smith & Nephew PLC

- Stryker Corporation

- Varian Medical Systems, Inc. by Siemens Healthineers AG

Table Information

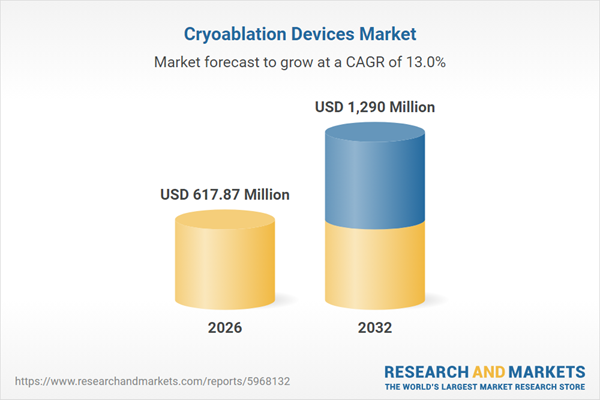

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 617.87 Million |

| Forecasted Market Value ( USD | $ 1290 Million |

| Compound Annual Growth Rate | 13.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |