Speak directly to the analyst to clarify any post sales queries you may have.

Introduction framing why modern cut flower packaging influences freshness retention, logistic efficiency, regulatory compliance, and consumer perception across channels

The cut flower packaging landscape is at a turning point where operational rigor, material science, and consumer expectations converge to define commercial success. This introduction outlines the strategic relevance of packaging not as a commodity wrapper but as a core enabler of freshness retention, logistical efficiency, regulatory compliance, and brand differentiation. Packaging decisions now influence product mortality across cold chains, retailer acceptance at point of sale, and the environmental footprint that modern buyers increasingly scrutinize.Across global supply chains, packaging choices affect inventory velocity, return rates, and time-to-market for seasonal varieties. For importers and distributors, packaging must reconcile competing demands: protective performance during multimodal transit, handling ergonomics for high-volume fulfillment, and alignment with retailer or event specifications. Consumers evaluate packaging through the lens of convenience, perceived quality, and sustainability claims, making packaging a direct contributor to value perception.

This executive summary sets the scope for subsequent sections by framing packaging as a strategic asset. It emphasizes the need for integrated decision-making among procurement, product design, operations, and commercial teams so that packaging investments drive measurable improvements in product integrity, customer experience, and regulatory alignment.

Transformative shifts in cut flower packaging driven by sustainability mandates, technological integration, regulatory change and evolving retailer and consumer expectations

The industry is experiencing a series of transformative shifts that are reshaping how packaging is evaluated and deployed. Sustainability mandates from major retailers and import regulators are accelerating the replacement of single-use plastics with recyclable or compostable alternatives, driving greater scrutiny of material provenance and end-of-life pathways. Concurrently, advances in material science are delivering foams, films, and paper solutions that balance protection with lower environmental impact, enabling a new generation of packaging formats optimized for delicate floriculture products.Technology is intersecting with packaging design to create smarter, data-enabled solutions. Temperature and humidity monitoring, QR-enabled traceability, and packaging engineered for automated handling are reducing post-harvest loss and increasing traceability across complex routes. As retailers expand omni-channel fulfillment, packaging must be versatile enough to protect items for e-commerce shipments while remaining attractive and convenient for in-store display.

Supply-side dynamics are also shifting. Consolidation among distributors, evolving tariff regimes, and increasing frequency of extreme weather events are forcing companies to rethink sourcing strategies and contingency planning. As customer expectations evolve toward faster delivery and transparent environmental claims, the most successful firms are those that embrace cross-functional innovation and that treat packaging as a vector for both risk mitigation and brand-building rather than as a purely transactional line item.

Cumulative impact of United States tariffs implemented through 2025 on import dynamics, supply chain resilience, cost pass-through and strategic sourcing decisions

Through 2025, tariff policies enacted by the United States have layered an additional dimension of complexity onto cut flower packaging strategies, affecting cost structures, sourcing decisions, and logistical planning. Tariffs on certain imported agricultural goods have prompted buyers and suppliers to evaluate the elasticity of sourcing from traditional production regions versus diversification to alternative suppliers. The result has been an increased emphasis on nearshoring, supplier consolidation, and contractual provisions to share or absorb tariff risk.Companies that previously relied on a narrow set of export partners have begun to qualify secondary suppliers and to redesign packaging specifications to accommodate different handling and transit regimes. Tariff-related cost pressures have also accelerated negotiations around packaging responsibilities in purchase agreements, with several retailers and chains seeking to standardize packaging to simplify cross-supplier compliance and reduce friction at ports of entry.

Additionally, tariff-induced shifts have sharpened the focus on total landed cost, driving investment in packaging solutions that reduce product damage and shrinkage during transit. Firms are balancing short-term cost mitigation-through tariff engineering, classification reviews, and sourcing shifts-with longer-term investments in supply chain resilience, including better packing protocols, cold-chain redundancies, and collaborative logistics arrangements that can absorb disruptions without compromising freshness or availability.

Segmentation-driven insights revealing how distribution channels, materials, end users, flower types and price tiers shape packaging design and go-to-market strategies

Understanding segmentation is essential to designing packaging that aligns with channel requirements, material performance needs, end-user expectations, varietal sensitivities, and pricing strategies. Based on distribution channels, market participants must account for distinct handling and presentation needs across florists, online retailers, supermarkets and hypermarkets, and wholesalers and distributors. Within florists, chain operations prioritize standardized, easily stacked packaging while independent florists value bespoke presentation and small-format convenience. Online retailers face the dual challenge of protecting shipments through parcel networks while delivering an unboxing experience for direct-to-consumer orders and complying with the return policies of third-party marketplaces. Supermarkets and hypermarkets range from mass grocers that demand high throughput, cost-effective mass packaging to premium grocers that require elevated presentation and sustainable credentials. Wholesalers and distributors differentiate between domestic distributors focused on short haul replenishment and export distributors that need robust, export-grade protection for extended multimodal transit.Material segmentation drives functional and sustainability trade-offs across foam trays, mesh bags, paper wraps, and plastic sleeves. Foam trays, available in expanded polystyrene and polyethylene foam variants, offer high impact protection and thermal buffering but raise end-of-life concerns. Mesh bags made from nylon or polyester provide breathability and visibility, suitable for certain stems and bunches while enabling lower material use. Paper wraps, including kraft and specialty papers, support recyclability and premium presentation but require moisture management strategies. Plastic sleeves in LDPE and PET formats remain prevalent for point-of-sale protection and water containment, and their recyclability depends on local infrastructure.

End-user segmentation-corporate buyers, event planners, and retail consumers-shapes minimum order profiles, customization requirements, and demand for brand-aligned packaging. Corporate buyers and event planners often prioritize consistent supply, traceability and bespoke branding, while retail consumers emphasize convenience, freshness cues and sustainability claims. Flower type packaging considerations vary by species: chrysanthemums demand robust handling to preserve multiple florets; lilies, in Asiatic and Oriental varieties, require careful protection for protruding stamens and large heads; roses, whether long-stem or spray varieties, need stem protection and transport stability; and tulips, including parrot and standard types, benefit from packaging that prevents head droop and retains humidity.

Price-tier segmentation-economy, premium, and standard-further informs packaging strategy. Economy offerings, including bulk bunches and value packs, prioritize cost-efficient, high-volume packaging solutions. Premium segments, which include designer arrangements and luxury floral brands, call for differentiated materials and presentation formats that support premium pricing through refined aesthetics and sustainable claims. Standard tiers balance cost and presentation, often adopting modular packaging that can scale across channels.

Regional dynamics and competitive advantages across the Americas, Europe Middle East and Africa, and the Asia-Pacific in cut flower packaging supply chains and trade flows

Regional dynamics influence sourcing practices, packaging preferences, regulatory expectations, and logistics design. In the Americas, proximity between production zones and major consumption markets supports rapid transit and enables more experimental packaging tailored to freshness retention and retail merchandising. Cold-chain investments and consolidated distribution hubs in key metros encourage packaging that balances thermal performance with ease of handling for high-turn environments.Europe, Middle East & Africa presents a heterogeneous landscape where regulatory standards, recycling infrastructure and retailer sustainability programs vary widely. In Western Europe, strict waste and recyclability regulations have driven adoption of recyclable or compostable materials and increased demand for packaging that can be processed within municipal systems. Retailers across the region are increasingly enforcing supplier packaging criteria, which shapes materials selection and labeling requirements. In parts of the Middle East and Africa, longer transit times, variable cold-chain maturity, and differing retail formats require robust export packaging that protects quality under more challenging climatic and handling conditions.

Asia-Pacific remains a center of production and material innovation, with major flower-producing countries and advanced packaging manufacturers converging to deliver specialized formats. The region's manufacturing capabilities support rapid prototyping and cost-competitive production of both conventional and bio-based packaging. Domestic consumption trends toward digital-first purchasing in many markets, creating pressure for e-commerce-ready packaging designs. Across regions, trade patterns, logistics networks, and local sustainability expectations determine which packaging innovations scale most rapidly, underscoring the need for regionally differentiated strategies.

Key company behaviors and capabilities that determine leadership including innovation in materials, vertical integration, partnerships and differentiated supply solutions

Companies that lead in this space combine material innovation, supply chain integration, and commercial agility. Leading packaging manufacturers are investing in research and development to create materials that reduce weight while maintaining barrier and cushioning properties, and are expanding capabilities to produce recyclable mono-material constructions. Packaging converters and co-packers that offer end-to-end services-ranging from design and prototyping to fulfillment-ready configuration-are increasingly valued partners for exporters and retailers seeking to reduce complexity.On the distribution side, wholesalers and exporters that integrate packaging specification early in the sourcing process achieve better freshness outcomes and lower damage rates. Retailers and online platforms that partner with suppliers on standardized packaging protocols reduce inbound complexity and improve shelf readiness. Technology providers that offer temperature, humidity, and shock monitoring systems are differentiating through data-driven insights that reduce collar-to-consumer loss and inform continuous improvement.

Across the value chain, successful companies are also those that adopt collaborative models-joint packaging trials, shared sustainability roadmaps, and contractual mechanisms that allocate packaging responsibilities and costs transparently. Leadership is less about a single technology and more about the organizational capability to translate packaging innovations into repeatable operational processes and measurable quality improvements.

Actionable recommendations for industry leaders to optimize packaging operations, accelerate sustainable transitions, and protect margins amidst trade and logistic disruption

Industry leaders should prioritize a set of pragmatic, high-impact initiatives that balance short-term operational needs with medium-term strategic transitions. Focused pilots for alternative materials that are chosen with clear end-of-life pathways and evaluated through small-batch trials can rapidly validate performance and consumer acceptance without wide-scale disruption. Prioritizing mono-material constructions where possible reduces complexity for recyclability and enables faster adoption in regions with mature processing infrastructure.Strengthening contractual clarity with suppliers and buyers is a low-friction way to allocate responsibility for packaging costs and compliance obligations, particularly in the context of tariff volatility. Establishing packaging standards and interoperability protocols across major distribution partners reduces friction at receiving docks and accelerates time-to-shelf. Investing in temperature and humidity sensors for critical routes combined with data-sharing agreements allows continuous process refinement and targeted interventions to reduce spoilage.

From an organizational perspective, creating cross-functional packaging governance that includes procurement, sustainability, operations and marketing ensures that packaging decisions balance cost, protection, regulatory compliance and brand fit. Finally, pursuing selective nearshoring or dual-sourcing strategies for critical varieties and packaging components builds resilience against tariff shocks and shipping disruptions while preserving quality standards.

Research methodology combining qualitative stakeholder interviews, supply chain mapping, materials testing and policy analysis to underpin robust packaging insights and recommendations

The research underpinning this summary employs a mixed-methods approach designed to capture both qualitative nuance and operational realities across the packaging value chain. Primary research included structured interviews with procurement leads, packaging engineers, logistics operators, retail category managers, and growers to surface practical constraints, innovation priorities, and contractual behaviors. These perspectives were supplemented with direct observations of packing operations and fulfillment flows to validate claims about handling environments and damage modes.Secondary research involved a systematic review of regulatory frameworks, packaging material properties, and supply chain case studies to contextualize primary findings. Technical evaluations of materials incorporated laboratory-based assessments of cushioning, moisture retention, and compatibility with cold-chain protocols. Policy analysis examined recent tariff measures and customs practices to understand how duties influence sourcing and packaging decisions.

Analytical methods combined thematic synthesis of qualitative inputs with process mapping to identify critical control points where packaging interventions yield the highest reductions in loss and handling cost. Sensitivity checks were used to test the robustness of recommendations across different distribution scenarios and material availabilities, ensuring that proposed actions are actionable across a variety of operational contexts.

Concluding synthesis of strategic priorities, operational levers and risk mitigations that companies must adopt to thrive in the evolving cut flower packaging landscape

In conclusion, packaging has evolved from a low-consideration input to a strategic lever that aligns operational performance, commercial objectives, and sustainability ambitions. Firms that treat packaging as an integrated component of product design and supply chain planning will be better positioned to reduce loss, satisfy retailer and regulatory requirements, and meet the changing expectations of consumers. The combined pressures of evolving sustainability standards, technological enablement, and trade policy dynamics demand deliberate action across material selection, vendor management, and cross-functional governance.Operational resiliency will be achieved through diversified sourcing, standardized packaging protocols, and investments in cold-chain visibility that reduce the likelihood of quality degradation during transit. Strategic differentiation will come from thoughtful packaging that communicates brand values, eases handling across channels, and supports circularity goals where infrastructure permits. Ultimately, the organizations that win will be those that pair pragmatic pilots with longer-term investments, ensuring that packaging upgrades deliver both immediate improvements to product integrity and measurable progress against sustainability commitments.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Cut Flower Packaging Market

Companies Mentioned

The key companies profiled in this Cut Flower Packaging market report include:- A-ROO Company LLC

- Amcor Plc

- Atlas Packaging Ltd

- Clondalkin Group Holdings B.V.

- Dilpack Kenya Limited

- DS Smith Plc

- FloPak LLC

- Greif Inc

- Hawaii Box & Packaging Inc

- Huhtamaki Oyj

- International Paper Company

- Koenpack B.V.

- Mondi Group Plc

- Mos Packaging Printing Factory Co., Ltd

- Packaging Industries Limited

- Pacombi Group B.V.

- Petla Packaging Co., Ltd

- Robert Mann Packaging Ltd

- Sealed Air Corporation

- Sirane Limited

- Smurfit Kappa Group Plc

- Stora Enso Oyj

- Tetra Laval International SA

- Uflex Limited

- WestRock Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

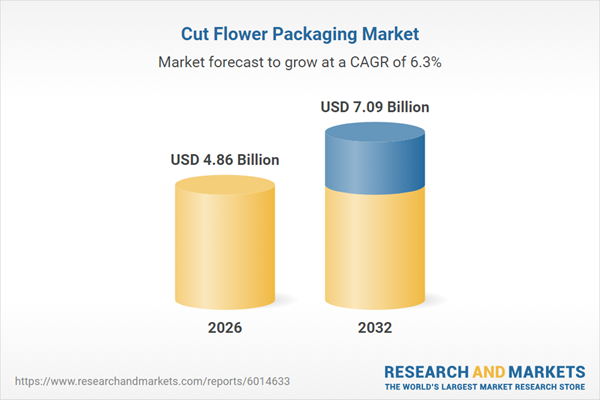

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 4.86 Billion |

| Forecasted Market Value ( USD | $ 7.09 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |