Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative framing of cylinder head technology, market forces, and strategic priorities for manufacturers, suppliers and decision-makers navigating powertrain evolution

The automotive cylinder head remains a pivotal element of internal combustion engine architecture, mediating combustion processes, thermal management and valvetrain dynamics. As the powertrain landscape diversifies, the cylinder head's role has both specialized and expanded, driving the need for renewed strategic focus from OEMs, aftermarket suppliers and engineering partners. This introduction frames the technical, commercial and regulatory factors that intersect to shape supplier priorities and buyer behavior across global vehicle fleets.Across mature and emerging markets, evolving emissions standards, fuel diversification and performance expectations have placed a premium on materials selection, machining precision and integration with advanced valvetrain topologies. Consequently, engineering teams must reconcile thermal efficiency with manufacturability, cost control and serviceability. Meanwhile, supply-chain resilience and channel strategies influence how replacement parts and OEM components move from production to the point of fitment, demanding coordinated approaches among design, procurement and distribution stakeholders.

In setting the stage for deeper analysis, this section delineates the functional importance of cylinder heads, summarizes contemporary engineering drivers, and establishes the strategic lenses-technical performance, material innovation, channel dynamics and regulatory alignment-that inform the subsequent sections of this executive summary.

A concise analysis of how materials innovation, valvetrain complexity, fuel diversification and supply-chain resilience are reshaping cylinder head strategies

The cylinder head landscape is undergoing transformative shifts driven by converging technological, regulatory and commercial forces. Advances in materials engineering, notably the adoption of lightweight aluminum alloys and enhanced casting and machining techniques, are enabling higher thermal conductivity and tighter tolerances, which in turn support higher compression ratios and more aggressive combustion strategies. At the same time, valvetrain complexity has increased with broader adoption of dual overhead cam designs and multi-valve configurations to improve breathing efficiency, fueling a demand for design flexibility and precision manufacturing.Concurrently, fuel diversification and the gradual electrification of powertrains are reorienting long-term product roadmaps. Although full electrification advances unevenly by region and vehicle segment, hybridization and continued refinement of internal combustion engines sustain the need for optimized cylinder head designs, particularly for heavy and light commercial applications where energy density and fueling infrastructure remain critical. Regulatory pressure for lower emissions and improved fuel economy is accelerating adoption of technologies such as variable valve timing and cylinder deactivation, which impose new tolerances and actuation interfaces on cylinder head assemblies.

Supply-chain resilience also constitutes a major shift. OEMs and tier suppliers are revising sourcing strategies to mitigate disruption risk, accelerate local content, and reduce lead-times. This combination of material, architectural, regulatory and supply considerations is reshaping product development priorities and capital allocation across the value chain.

How 2025 tariff measures in the United States are reshaping sourcing, manufacturing footprints and supplier diversification strategies across the cylinder head value chain

United States tariff actions projected for 2025 have prompted widespread reassessment of sourcing, production placement and cost pass-through strategies within the cylinder head ecosystem. Tariff changes affect not only the landed cost of raw castings and machined components but also influence decisions about where to locate finishing operations, assembly cells and aftermarket distribution hubs. As a consequence, procurement teams and strategic planners are evaluating near-term re-shoring, regionalization and supplier diversification to maintain continuity and protect margins.In response to tariff-driven input cost volatility, many manufacturers are increasing emphasis on local supply development and dual-sourcing arrangements to preserve flexibility. These measures are frequently coupled with engineering-for-cost initiatives that target material optimization, modularization of head assemblies and simplification of machining sequences to reduce dependence on high-tariff imported subassemblies. Additionally, companies are renegotiating contractual terms and price adjustment mechanisms to share or reallocate tariff exposure between suppliers and OEMs.

Transitionary actions include establishing regional finishing centers closer to demand nodes, investing in automation to offset higher domestic labor costs, and advancing strategic inventory positioning to buffer against tariff-related disruptions. While tariffs are only one element of a broader macroeconomic picture, they serve as a catalyst for more resilient procurement architectures and a renewed focus on manufacturing footprint strategies that balance cost efficiency with geopolitical risk mitigation.

Comprehensive segmentation insights explaining how channels, materials, fuel types, vehicle classes and engine architectures create differentiated technical and commercial demands

Segment-level dynamics illuminate where technical innovation and commercial opportunity intersect across sales channels, materials, fuel types, vehicle classes and engine architectures. When viewed through the lens of sales channel segmentation, aftermarket activity emphasizes repairability, parts interchangeability and cost competitiveness, while OEM relationships prioritize engineering integration, prototype validation and lifecycle support. These differing imperatives inform supplier positioning and service offerings as companies aim to serve both channels without compromising margin or technical credibility.Material segmentation between aluminum and cast iron remains a central axis of product strategy. Aluminum's weight and thermal advantages make it the preference for many contemporary passenger car and light commercial engines, whereas cast iron continues to appear in applications requiring exceptional durability and wear resistance, particularly in heavy commercial configurations. Fuel type segmentation encompassing CNG, diesel, gasoline and LPG introduces distinct thermal and combustion management requirements that directly affect port geometry, combustion chamber shape and cooling passage design, leading engineering teams to tailor head designs to specific fuel chemistries and operating temperatures.

Vehicle type segmentation spanning heavy commercial vehicle, light commercial vehicle and passenger car drives divergent priorities: heavy commercial platforms emphasize durability and serviceability, light commercial designs balance payload efficiency with operating cost, and passenger cars focus on noise, vibration and harshness as well as emissions performance. Engine configuration segmentation across dual overhead cam, pushrod and single overhead cam topologies dictates valvetrain packaging and complexity; within dual overhead cam families, four-valve and two-valve variants create different flow and actuation challenges, and pushrod and single overhead cam configurations are further subdivided into three-valve and two-valve or four-valve and two-valve implementations that shape head wall thicknesses, cam carrier designs and sealing strategies. When combined, these segmentation dimensions create a matrix of technical requirements that suppliers must address with modular architectures, targeted manufacturing capabilities and flexible engineering resources.

Region-specific strategic considerations revealing how Americas, Europe Middle East & Africa, and Asia-Pacific dynamics influence engineering, sourcing and commercial models

Regionally differentiated dynamics have a profound effect on product development, sourcing choices and channel strategies across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the interplay between regulatory tightening, strong aftermarket networks and a manufacturing base that is increasingly optimizing for near-market production has encouraged investments in localized machining and assembly capacity. This regional focus reduces exposure to cross-border trade volatility and supports shorter lead-times for replacement parts and OEM program launches.In Europe, Middle East & Africa, regulatory rigor and advanced powertrain engineering centers drive high expectations for emissions performance and material innovation. OEMs and tier suppliers in this region often lead in valvetrain complexity and thermal management solutions, while aftermarket ecosystems prioritize compatibility, certification and warranty alignment. Political and economic heterogeneity across the region requires suppliers to adapt their commercial models to varying certification regimes and procurement practices.

Asia-Pacific continues to be a critical hub for both OEM production and supplier innovation, hosting expansive casting capacity and a deep manufacturing talent pool. The region's diverse vehicle mix, from high-volume passenger cars to robust commercial vehicle segments, encourages a wide spectrum of cylinder head configurations and materials approaches. Taken together, regional considerations influence where R&D investments occur, how supply networks are structured, and how go-to-market strategies are prioritized for different product lines.

Key competitive patterns and supplier capabilities that determine leadership in cylinder head engineering, manufacturing efficiency and channel reach

Competitive dynamics within the cylinder head arena are shaped by a mix of global component specialists, regional casting houses and engineering-focused suppliers that offer integrated design-to-manufacture capabilities. Leading firms tend to combine deep metallurgical expertise, proprietary machining processes and close OEM partnerships that enable early integration into engine programs. This integration supports co-development of complex features such as multi-valve ports, integrated coolant channels and upgraded sealing systems that improve combustion efficiency and durability.At the same time, an active aftermarket segment benefits from suppliers that emphasize distribution reach, warranty support and parts compatibility. These companies often prioritize manufacturing efficiency and standardized interfaces to ensure interchangeability across a broad vehicle base. Collaboration between aftermarket suppliers and independent service networks is increasingly important, with digital parts catalogs and fitment verification tools improving part selection and reducing warranty friction.

New entrants and niche engineering houses are also influencing the competitive mix by offering rapid prototyping, simulation-driven design services and additive manufacturing techniques for low-volume, high-complexity components. These capabilities allow OEMs and tier manufacturers to accelerate validation cycles and trial new geometries without committing to large-scale tooling investments. Overall, the competitive landscape rewards firms that balance engineering depth with flexible manufacturing and strong channel relationships.

Actionable strategic priorities that combine modular engineering, resilient sourcing, aftermarket engagement and advanced manufacturing to drive competitive advantage

Industry leaders should adopt a multi-dimensional action plan that aligns engineering priorities with resilient sourcing and differentiated go-to-market approaches. First, prioritize modular design principles that allow core cylinder head architectures to be adapted across fuel types and vehicle classes; this reduces development lead-times while preserving performance differentiation. Simultaneously, accelerate material engineering programs focused on aluminum alloys and advanced surface treatments to meet thermal management and durability targets without compromising manufacturability.Second, pursue supply-chain strategies that blend regional sourcing with dual-sourcing arrangements to mitigate tariff exposure and logistical risk. Establishing regional finishing or assembly centers can shorten lead-times and enhance responsiveness to aftermarket demand spikes. In parallel, invest in digital supply-chain visibility tools to enable dynamic inventory allocation and rapid supplier substitution when disruptions occur.

Third, strengthen aftermarket engagement through improved parts traceability, warranty alignment and technical documentation that supports service networks. Offerings such as extended-lifecycle validation packages and retrofit-friendly designs will create aftermarket differentiation. Finally, allocate resources to simulation-driven validation, additive prototyping and automation in machining to reduce time-to-market and lower unit costs, thereby enabling firms to compete on both technical merit and commercial terms.

A robust triangulated research methodology combining primary industry interviews, technical literature review and supply-chain analysis to derive actionable insights

This research employed a triangulated methodology combining primary interviews, technical literature synthesis and supply-chain analysis to construct a holistic view of the cylinder head ecosystem. Primary inputs included structured interviews with engineering leads, procurement managers and aftermarket channel specialists to surface practical constraints and emergent priorities. These perspectives were synthesized with technical white papers, patent activity and materials science literature to validate engineering trends and to map capability gaps in manufacturing.Supply-chain analysis integrated public procurement disclosures, trade flow indicators and input cost trendlines to assess sourcing vulnerabilities and logistical bottlenecks. Where appropriate, case studies of recent program launches and supplier relocations were used to illustrate how companies operationalized strategic responses to tariff changes and demand shifts. Throughout the research process, findings were cross-validated to ensure that technical assertions aligned with commercial realities and that regional dynamics were reflected in supply and demand narratives.

The methodology emphasized transparency in assumptions, iterative validation with domain experts, and a focus on actionable implications for stakeholders responsible for product design, procurement and aftermarket strategy.

Concluding synthesis underscoring how engineering innovation, supply-chain resilience and commercial alignment will determine cylinder head competitiveness

In conclusion, the cylinder head remains a strategic component whose design and supply dynamics will continue to influence powertrain competitiveness in the near and medium term. Material choices, valvetrain architecture and fuel compatibility are core levers that engineering teams must balance against manufacturability and total cost of ownership. Regulatory pressures and the march toward alternative drivetrains are changing priorities, but internal combustion applications will persist in many vehicle classes, necessitating sustained innovation across materials and manufacturing techniques.Moreover, commercial success will increasingly depend on resilient sourcing strategies and close alignment between OEM development programs and aftermarket service propositions. Firms that combine modular design, targeted regional production footprints and advanced validation methods stand to gain both technical and commercial advantages. Finally, a disciplined approach to inventory and supplier diversification will help organizations navigate tariff-induced volatility while preserving their ability to deliver high-quality components to both OEMs and end-users.

Taken together, these conclusions underline the importance of integrated strategies that marry engineering excellence with supply-chain pragmatism and market-responsive commercial models.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Automotive Cylinder Head Market

Companies Mentioned

The key companies profiled in this Automotive Cylinder Head market report include:- BMW AG

- BYD Company Limited

- Changan Automobile Co., Ltd

- Daimler Truck Holding AG

- Dongfeng Motor Corporation

- FAW Group Corporation

- Ford Motor Company

- Geely Automobile Holdings Limited

- General Motors Company

- Honda Motor Co., Ltd

- Hyundai Motor Company

- Kia Corporation

- Mahindra & Mahindra Limited

- Mazda Motor Corporation

- Mitsubishi Motors Corporation

- Nissan Motor Co., Ltd

- Peugeot S.A.

- Renault Group

- SAIC Motor Corporation Limited

- Stellantis N.V.

- Suzuki Motor Corporation

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen AG

- Volvo Car AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

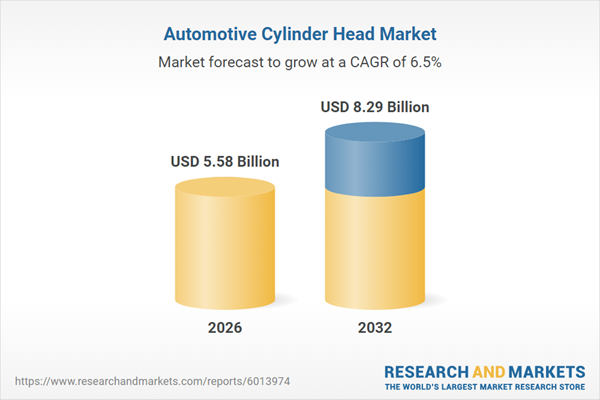

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 5.58 Billion |

| Forecasted Market Value ( USD | $ 8.29 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |