Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive strategic overview of dairy spreads category dynamics combining consumer trends, supply chain resilience, innovation imperatives and channel evolution

The dairy spreads category is at an inflection point where consumer tastes, ingredient sourcing, and retail channel dynamics intersect to create both opportunity and complexity for manufacturers, retailers, and ingredient suppliers. Rising consumer interest in convenience and snacking occasions has broadened demand beyond traditional baking and cooking uses, while premiumization and clean-label expectations are prompting reformulation and new product development. Concurrently, distribution landscapes are shifting as e-commerce and omnichannel merchandising change how shoppers discover and repurchase spreads. These converging forces require stakeholders to reassess category strategies, prioritize agility, and deepen consumer insight capabilities.Operationally, the category is navigating persistent input cost variability and logistics constraints that have highlighted the importance of flexible sourcing and proactive inventory management. Product innovation that balances indulgence with perceived health benefits is becoming a key differentiator, and the capacity to deploy targeted promotional tactics across convenience stores, hypermarkets and supermarkets, and online retail is increasingly linked to commercial success. As a result, brands must harmonize R&D, procurement, and commercial operations to respond rapidly to evolving shopper needs and to capitalize on growth pockets created by changing consumption patterns.

Deep examination of how premiumization, sustainability, retail channel transformation, and technological advances are fundamentally reshaping the dairy spreads landscape

The landscape for dairy spreads is being reshaped by several transformative shifts that extend beyond incremental product changes and into how companies design portfolios, source ingredients, and interact with consumers. One major shift is the acceleration of premium and functional positioning, where consumers are willing to pay a premium for products that convey clearer provenance, organic credentials, or functional benefits such as reduced sodium or added protein. This premiumization trend is widening the range of SKUs and encouraging smaller-batch, artisanal offerings alongside mainstream varieties.Another pivotal change concerns sustainability and transparency. Brands that can demonstrate lower-carbon supply chains, responsible animal welfare practices, or reduced packaging waste are gaining traction among environmentally conscious shoppers. This has driven investments in alternative packaging formats and in supply chain traceability technologies. Meanwhile, technological advances in manufacturing and formulation are enabling more stable spreadable textures and extended shelf life without reliance on artificial stabilizers, enabling brands to appeal to clean-label consumers.

Retail channel evolution is also significant: online retail growth has moved beyond an occasional purchase channel to a source of discovery for novel flavors and premium formats. Retailers and manufacturers are responding with exclusive SKUs, subscription models, and targeted digital promotions. Finally, consolidation and strategic partnerships are reconfiguring competitive dynamics as larger players seek to augment portfolios through acquisition while smaller, niche brands leverage direct-to-consumer channels and community-driven marketing to capture loyal followings. These shifts collectively demand a recalibration of go-to-market playbooks and more integrated cross-functional planning.

Analysis of how cumulative tariff measures have reshaped procurement, production footprints, logistics strategies, SKU economics, and trade compliance across the value chain

By 2025, the cumulative effect of tariff policies introduced in recent years has materially altered the cost structures and sourcing decisions for stakeholders in the dairy spreads value chain. Tariffs on select dairy imports and ancillary packaging components have created differential price pressures across raw materials and finished goods. In response, manufacturers have re-evaluated procurement strategies to prioritize domestic sourcing where viable, balanced against the need to maintain specific functional ingredient profiles that may only be available from certain international suppliers. This has led to more nuanced supplier segmentation and an emphasis on multi-sourcing to mitigate concentration risk.Tariff-related friction has also influenced supply chain design, prompting some firms to nearshore manufacturing, diversify production footprints, or reorganize logistics to minimize exposure to high-duty corridors. These structural adjustments often carried short-term adjustment costs, including capital expenditure to establish new lines or reconfigure facilities, but they improved long-term resilience and reduced lead-time variability. From a commercial perspective, the added cost pressure increased scrutiny on SKU profitability and accelerated SKU rationalization programs, as businesses removed low-margin variants to preserve overall category economics.

Compliance and administrative burdens have similarly risen, with firms investing in enhanced trade compliance systems and tariff engineering practices to optimize classification and duty outcomes. Private label and value-tier players adjusted formulations and packaging to maintain price competitiveness, while premium and organic-focused segments were less price-sensitive but faced the complexity of maintaining certification and provenance claims across altered supply networks. Overall, the tariff environment of 2025 pushed the industry toward greater operational diversification and a sharper focus on cost-to-serve analytics and trade policy monitoring as ongoing capabilities rather than episodic responses.

In-depth segmentation intelligence explaining how product types, packaging, channels, end users, forms, flavors, grades, and milk sources drive differentiated strategies

Meaningful segmentation reveals divergent growth and margin profiles that require tailored strategies across product, packaging, channel, end-use, form, flavor, grade, and source dimensions. Within product type, the category splits into butter, cream cheese spread, and yogurt spread, with butter further differentiated into salted, unsalted, and whipped variants; each subcategory demands distinct processing parameters and consumer messaging. Packaging choices of block, stick, and tub influence perceived convenience and portion control, which in turn alter retail shelf strategies and pricing elasticity. Distribution channel segmentation across convenience stores, hypermarkets & supermarkets, and online retail affects assortment depth, promotional cadence, and fulfillment complexity, creating channel-specific assortment playbooks.End user segmentation distinguishes foodservice and household demand patterns, where batch sizing, supply contracts, and specification consistency are critical for foodservice, while household channels emphasize convenience and variety. Form-based distinctions among solid, spreadable, and whipped products imply different ingredient systems and processing technologies, influencing manufacturing flexibility and shelf life. Flavor segmentation between flavored and plain items, with flavored variants further divided into fruit and garlic & herb, highlights opportunities for taste innovation and seasonal promotions that can attract trial. Product grade delineations of conventional versus organic drive sourcing constraints and certification requirements, affecting cost and positioning. Finally, source-related segmentation across buffalo milk, cow milk, and goat milk informs product origin claims, nutritional profiles, and niche positioning opportunities for specialty and ethnic markets. Together, these segmentation lenses enable stakeholders to target investment, optimize SKU portfolios, and align marketing and distribution strategies with differentiated consumer segments.

Regional intelligence detailing how the Americas, Europe Middle East & Africa, and Asia-Pacific exhibit distinct consumer, regulatory, and supply chain realities requiring bespoke approaches

Regional dynamics present varied consumer preferences, regulatory environments, and supply chain realities that shape how dairy spreads are produced, distributed, and marketed. In the Americas, demand has been influenced by a strong emphasis on convenience formats, functional positioning, and an openness to flavor innovation, while supply chains are adapting to tighter traceability requirements and sustainability commitments. In contrast, Europe, Middle East & Africa exhibits high regulatory complexity and a pronounced premium and organic segment where provenance and artisanal credentials resonate with consumers; logistical considerations across diverse markets also encourage regional manufacturing hubs and cross-border harmonization of standards. Asia-Pacific shows rapid retail modernization, a growing middle class, and significant potential for new consumption occasions, prompting investment in tailored flavors, smaller formats suitable for urban shoppers, and rapid e-commerce expansion.Across these regions, companies are adopting differentiated go-to-market approaches that reflect local channel structures, trade policies, and consumer taste profiles. Where retail consolidation is pronounced, category captains are forging strategic retailer partnerships to secure prominent shelf placement and promotional support. In regions with fragmented retail ecosystems, multi-channel distribution strategies and targeted local marketing play a larger role. These geographic nuances shape decisions about where to invest in manufacturing capability, how to structure distribution agreements, and which product attributes to emphasize in communications to maximize relevance in each regional context.

Strategic competitive assessment showing how scale players, niche innovators, and collaborative partnerships are shaping product portfolios, pricing strategies, and channel execution

Competitive dynamics in dairy spreads balance between large incumbent manufacturers, nimble regional players, and innovative challengers that specialize in niche positioning. Leading firms widely emphasize scale efficiencies, broad product portfolios, and strong retail relationships, enabling them to support extensive private-label programs and national promotions. However, smaller and emerging brands are successfully carving differentiated positions through premium quality, organic certification, novel flavors, or artisanal storytelling that resonates with discerning consumers. Partnerships between ingredient suppliers and manufacturers are also increasingly important as brands seek co-development of formulations that meet clean-label and functional claims while preserving desirable sensory profiles.Strategic behaviors worth noting include portfolio optimization to focus on higher-margin SKUs, selective premiumization to capture value from consumers willing to pay for provenance and functional benefits, and the leveraging of digital channels to build direct customer relationships. Another notable trend is greater collaboration between brands and retail partners for joint innovation, exclusive SKUs, and loyalty-driven promotions. In the context of supply chain volatility and tariff-driven cost pressures, larger players are often better positioned to absorb short-term shocks due to diversified sourcing and scale, while smaller manufacturers rely on agility, local sourcing, and community-focused marketing to sustain growth. The competitive landscape thus rewards clarity of positioning, operational adaptability, and the capacity to execute targeted channel strategies.

Practical and prioritized recommendations for industry leaders to enhance resilience, optimize portfolios, accelerate premium innovation, and strengthen channel-specific execution

Industry leaders seeking to strengthen market position should deploy a combination of operational, commercial, and innovation-focused measures. First, prioritize procurement diversification and supplier partnerships to reduce exposure to concentrated sourcing risks and tariff volatility, and invest in capabilities that enable rapid qualification of alternative suppliers. Second, align product portfolios with channel-specific strategies by rationalizing low-performing SKUs and reallocating investment toward formats and flavors that demonstrate higher engagement in convenience stores, hypermarkets & supermarkets, and online retail. Third, accelerate clean-label and sustainability initiatives that resonate with premium and organic consumer segments, documenting supply chain traceability and reducing packaging footprint to meet retailer and regulatory expectations.On the go-to-market front, develop differentiated pricing strategies and promotional calendars for household versus foodservice channels, acknowledging the differing purchase behaviors and specification needs. Invest in digital merchandising and direct-to-consumer channels to support discovery and subscription models, and use data analytics to refine assortment and personalize promotions. From an operational standpoint, consider selective nearshoring or regionalization of production to reduce cross-border tariff exposure and lead-time variability, and enhance trade compliance systems to capitalize on tariff engineering opportunities without compromising regulatory obligations. Collectively, these actions will strengthen resilience, improve margin capture, and increase the ability to respond to emerging consumption trends.

Transparent and rigorous research methodology combining primary interviews, validated secondary sources, segmentation mapping, scenario testing, and expert validation

This research combined primary interviews, secondary data synthesis, and a rigorous triangulation approach to ensure that findings reflect current industry realities and practitioner perspectives. Primary inputs included in-depth discussions with procurement leaders, R&D heads, supply chain managers, and commercial executives across manufacturers, retailers, and ingredient suppliers, as well as interviews with selected regional distributors and foodservice buyers to capture demand-side nuance. Secondary research encompassed regulatory publications, trade policy analyses, industry white papers, and company disclosures to contextualize tariffs, certification requirements, and sustainability commitments. These diverse inputs were cross-validated to reconcile differences in reporting and to surface consistent patterns and emerging signals.Analytical techniques involved segmentation mapping to identify differentiated consumer and channel behaviors, scenario analysis to explore the operational impacts of tariff shifts and supply disruptions, and sensitivity testing to understand the implications of packaging and formulation changes on cost-to-serve. Quality controls included methodological audits, respondent validation of key themes, and iterative reviews by subject-matter experts to ensure clarity and practical relevance. The approach prioritizes actionable intelligence for decision-makers while maintaining transparency about data sources and the interpretive steps taken to derive strategic recommendations.

Concluding perspective on how agility, sustainability, targeted innovation, and disciplined portfolio management will determine long-term competitive advantage in dairy spreads

The dairy spreads sector stands at a strategic crossroads where the interplay of consumer expectations, regulatory shifts, and supply chain realities will determine which players capture sustainable advantage. Companies that invest in differentiated product experiences, pursue credible sustainability narratives, and build resilient procurement and manufacturing footprints will be better positioned to navigate tariff-related friction and shifting retail dynamics. Equally important is the capacity to execute channel-specific strategies that align assortment, pricing, and promotional tactics with the unique economics of convenience stores, hypermarkets & supermarkets, and online retail.Looking ahead, the winners will be those that blend operational rigor with market-led innovation, leveraging data-driven insights to optimize portfolios and accelerate formats and flavors that resonate with targeted consumer segments. By focusing on agility, transparency, and disciplined portfolio management, stakeholders can convert current disruptions into strategic opportunities and secure stronger long-term positioning within the dairy spreads category.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

20. China Dairy Spreads Market

Companies Mentioned

The key companies profiled in this Dairy Spreads market report include:- Agropur Cooperative

- Amul

- Arla Foods amba

- Bunge Limited

- Conagra Brands

- Dairy Farmers of America, Inc.

- Danone SA

- DMK Deutsches Milchkontor

- Flora Food Group

- Fonterra Co-operative Group Limited

- Groupe Lactalis

- Koninklijke FrieslandCampina N.V.

- Kraft Heinz Company

- Land O'Lakes, Inc.

- Meggle GmbH

- Meiji Holdings Co., Ltd.

- Mengniu Dairy

- Nestlé

- Ornua Co-operative Limited

- Saputo Inc.

- Savencia Fromage & Dairy

- Schreiber Foods, Inc.

- Unternehmensgruppe Theo Müller GmbH & Co. KG

- Valio Ltd.

- Wilmar International

- Yili Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

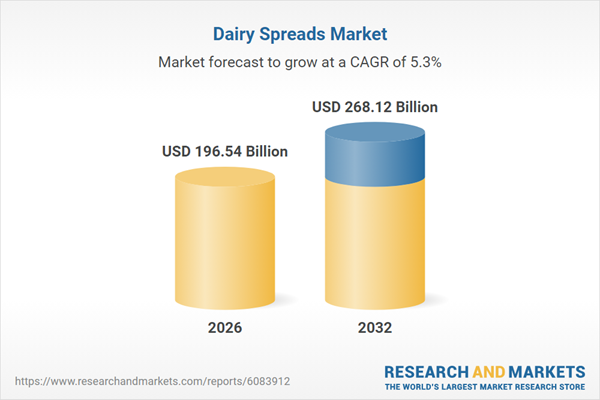

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 196.54 Billion |

| Forecasted Market Value ( USD | $ 268.12 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |