The key drivers in the data analytics outsourcing market are the rising demand for data-driven decision-making, cost efficiency, and access to advanced analytics expertise. Organizations are seeking to outsource solutions for processing large volumes of unstructured data and extracting actionable insights without heavy investment in in-house infrastructure. The widespread application of artificial intelligence (AI) and machine learning (ML) technologies further drives the data analytics outsourcing market demand. The healthcare sector, along with BFSI and retail, are increasingly relying on this outsourcing to get customer experience as well as seamless operations. In December 2024, for example, One Point One Solutions Ltd. announced its partnership with a global data analytics firm to boost customer experience solutions in India. The alliance is looking to increase omnichannel engagement, using sophisticated contact center services and an automated complaint management system that will position the company at the forefront of customer engagement innovations.

The main drivers for the data analytics outsourcing market growth in the United States include an increased need for cost-effective solutions to process and analyze large data sets, allowing firms to make data-driven decisions in numerous industries. The adoption of advanced technologies such as AI, machine learning, and big data tools has further amplified the growing demand for specialized analytics expertise. Industries that include healthcare, retail, and finance depend on outsourcing to boost the efficiency of their operations, optimize the customer experience, and maintain competitiveness in an ever-changing digital environment. In line with this, in January 2025, Health Catalyst announced its partnership with Databricks to further enhance healthcare data sharing and analytics. Utilizing Databricks' Delta Sharing and Health Catalyst's Ignite™ platform the collaboration focuses on securely integrating healthcare data across platforms, bringing about not only faster insights but better operational efficiency for organizations while addressing unique healthcare challenges. Focus on regulatory compliance fuels market growth as well.

Data Analytics Outsourcing Market Trends:

Rising Need for Enhanced Decision-Making

Accenture and Salesforce made investments on November 6, 2023, to develop the Salesforce Life Sciences Cloud, which includes new features, resources, and accelerators driven by AI and data. The companies leveraged their joint generative AI acceleration hub to develop new solutions and use cases for Salesforce Life Sciences Cloud. Industry reports indicate that 60% of respondents state their organizations now regularly utilize generative AI in at least one business function, up from one-third in 2023. This assists in accelerating the deployment of data and analytics capabilities and support decision-making and operations. Moreover, companies face complex challenges that require quick and accurate decision-making. The insights provided by data analytics help firms overcome these obstacles. Relying on specialized suppliers for outsourcing guarantees access to superior analytics that facilitate improved decision-making. Organizations require real time insights to stay competitive. Outsourced data analytics services include real time data processing and analysis that are beneficial in providing timely insights that help businesses react quickly to market changes and emerging trends.Thriving Finance Sector

The thriving finance sector represents one of the key data analytics outsourcing market trends. In line with this, on 29 June 2023, Moody's Corporation and Microsoft established a new strategic alliance on June 29, 2023, to provide financial services and global knowledge workers with next-generation data, analytics, research, collaboration, and risk solutions. According to industry reports, globally, banks generated USD 7 Trillion in revenue and USD 1.1 Trillion in net income. Microsoft Azure OpenAI Service in partnership with Moody's extensive data and analytical skills produces cutting-edge solutions that improve risk assessment and corporate intelligence. In addition, the banking industry is highly regulated, necessitating that companies adhere to a wide range of rules and regulations. Financial organizations can manage compliance and ensure conformity to several laws and standards by outsourcing data analytics. Apart from this, these organizations use predictive analytics and sophisticated risk management models to improve their ability to recognize and manage risks.Collaborations Between Key Companies

On 18 October 2023, Infosys, a leader in next-generation digital services and consulting worldwide, announced that it is expanding its partnership with Google Cloud to support businesses in creating AI-powered experiences by utilizing Google Cloud's generative AI solutions and Infosys Topaz offerings. Infosys can expand on its current knowledge of data, analytics, and AI on Google Cloud. Infosys and Google Cloud collaborated to provide a suite of industry solutions and revolutionary AI platforms for a variety of business scenarios. Additionally, partnerships enable companies to pool their resources and specialties and improve their data analytics offerings. A partnership between a data analytics firm and a cloud service provider can offer integrated solutions that include advanced analytics capabilities hosted on a robust cloud infrastructure. Collaborations also facilitate access to cutting-edge technologies, thereby enhancing the data analytics outsourcing market outlook.Our research scope embraces the services provided by Fractal Analytics, Inc., Helmes, Flatworld Solutions, Inc., Future Processing, Course5 Intelligence, Qsutra, Genpact, Accenture, ZS Associates, Inc., WNS (Holdings) Ltd., and additional firms. Companies use data analytics outsourcing by engaging service providers who analyze information provided by the outsourcing company. The practice of handing data analysis tasks to outside vendors along with their analytical applications constitutes data analytics outsourcing. Market expansion occurs thanks to the rising demand for robotic process automation (RPA) alongside artificial intelligence (AI) and big data and connected device repositories.

Data Analytics Outsourcing Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global Data Analytics Outsourcing market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, component, and vertical.Analysis by Type:

- Descriptive

- Predictive

- Prescriptive

Analysis by Application:

- Sales Analytics

- Marketing Analytics

- Finance and Risk Analytics

- Supply Chain Analytics

- Others

Analysis by Component:

- Solutions

- Services

The services segment includes consulting, implementation and support services for data analytics outsourcing. Businesses outsource analytics services to leverage domain expertise, technical capabilities and continuous support from external providers. Services are essential for ensuring successful integration of analytics tools, optimizing data strategies and aligning analytics outcomes with business objectives. The growing complexity in data management and analysis is driving the demand for customized services including real-time insights and predictive modeling making this segment a significant growth driver for the market.

Analysis by Vertical:

- Retail

- Automotive

- Manufacturing

- BFSI

- IT and Telecom

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Data Analytics Outsourcing Market Analysis

In 2024, the United States captured 78.90% of revenue in the North American market. The growing adoption of data analytics outsourcing in the United States is largely attributed to the expanding IT sector where cloud services have become an integral part of business strategies. According to survey over 51% of businesses now leverage cloud services. As organizations continue to embrace cloud computing for scalability, flexibility and cost efficiency the need for advanced data analytics to leverage the vast amounts of data generated by these services becomes more pronounced. This trend is further amplified by the increasing reliance on cloud platforms which offer the infrastructure necessary for businesses to process and analyze large datasets. The cloud’s ability to store and manage data more efficiently has led businesses to seek external analytics expertise driving demand for outsourcing. With cloud-based solutions enabling seamless access to data businesses are increasingly looking to specialized service providers to handle complex data analysis tasks fostering growth in outsourcing engagements. As cloud technologies continue to evolve organizations are increasingly adopting data-driven decision-making leading to the expanded outsourcing of analytics functions.Asia Pacific Data Analytics Outsourcing Market Analysis

In Asia-Pacific the growing investment on infrastructure around cloud and artificial intelligence (AI) is fuelling the surge in data analytics outsourcing. For example, Microsoft announced a USD 3 Billion investment plan aimed at enhancing cloud and AI infrastructure in India over the next two years with the goal of promoting AI adoption, skill development and innovation. The region has witnessed rapid advancements in both cloud computing and AI technologies offering businesses the ability to analyze large datasets quickly and accurately. As companies adopt these technologies the need for skilled professionals to manage, interpret and analyze data is increasing. Outsourcing analytics to third-party service providers allows businesses to focus on core operations while leveraging specialized expertise in handling data. This is particularly true as industries ranging from manufacturing to retail embrace automation and data-driven insights to optimize operations. The availability of highly skilled labor in the region makes outsourcing analytics a cost-effective solution further driving the demand. With the proliferation of cloud and AI platforms businesses in Asia-Pacific are increasingly looking to external partners to meet their data analysis needs.Europe Data Analytics Outsourcing Market Analysis

In Europe the surge in data analytics outsourcing adoption can be attributed to the growing demand for finance and risk analytics within the banking, financial services, and insurance (BFSI) sector. According to the European Banking Federation, there were 784 foreign bank branches in the EU in 2021 of which 619 were from other EU Member States and 165 from third countries. As financial institutions face increasing pressure to comply with regulatory requirements, manage risks and gain deeper insights into their operations the need for specialized analytics solutions has risen. Outsourcing data analytics services helps financial organizations access advanced capabilities and improve decision-making from fraud detection to customer behavior analysis. By partnering with third-party experts in data analytics companies in the BFSI sector can efficiently manage financial data, minimize risks and improve regulatory compliance ensuring business continuity in a dynamic environment.Latin America Data Analytics Outsourcing Market Analysis

In Latin America the rise of online ecommerce platforms is driving the increased adoption of data analytics outsourcing particularly in sales analytics. According to reports, the Latin America market currently boasts over 300 Million digital buyers. As the ecommerce market continues to expand companies face a pressing need to gain actionable insights into consumer behaviors, sales trends, and marketing effectiveness. Outsourcing sales analytics allows ecommerce businesses to optimize their strategies, enhance customer engagement and improve conversion rates. By leveraging external expertise companies can utilize advanced analytics tools and techniques to stay competitive in a rapidly changing digital marketplace. This growing reliance on outsourced analytics solutions highlights the pivotal role of data in shaping business success.Middle East and Africa Data Analytics Outsourcing Market Analysis

The Middle East and Africa are witnessing an uptick in data analytics outsourcing primarily due to the growing IT and telecom sectors. For example, total expenditure on information and communications technology (ICT) in the Middle East, Türkiye and Africa (META) is expected to exceed USD 238 billion this year representing a 4.5% increase compared to 2023. As telecommunications companies expand their digital services the need for actionable data insights to enhance customer experiences, network optimization and operational efficiency grows. Outsourcing data analytics enables telecom operators to tap into specialized knowledge and technology providing insights into consumer patterns, service usage and predictive maintenance. This shift toward outsourcing not only helps reduce operational costs but also empowers companies to leverage advanced analytics without overburdening internal resources. As the IT and telecom sectors continue to evolve so too will the demand for outsourced data analytics services.Competitive Landscape:

The data analytics outsourcing market is highly competitive characterized by a mix of established providers and emerging players offering tailored solutions to diverse industries. Companies differentiate themselves through advanced technologies such as AI, machine learning and big data integration enhancing analytics capabilities and decision-making efficiency. Cloud-based analytics outsourcing is gaining traction due to scalability and cost benefits while providers emphasize real-time insights, predictive analytics, and customized dashboards. Strategic partnerships, acquisitions and regional expansions are common strategies to capture market share. Vendors also focus on domain-specific expertise to address industry-specific needs such as healthcare, retail and finance. The growing demand for data-driven decision-making and specialized services drives continuous innovation is shaping the dynamic landscape of this market.The report provides a comprehensive analysis of the competitive landscape in the data analytics outsourcing market with detailed profiles of all major companies, including:

- Accenture PLC

- Capgemini Services SAS

- Fractal Analytics Inc.

- Genpact Limited

- Infosys Limited

- International Business Machines (IBM) Corporation

- Mu Sigma Inc.

- ElectrifAi LLC

- Tata Consultancy Services Limited

- Trianz Incorporated

- Wipro Limited

- ZS Associates Inc.

Key Questions Answered in This Report

1. What is outsourcing data analytics?2. How big is the data analytics outsourcing market?

3. What is the forecast for the data analytics outsourcing market?

4. What are the key factors driving the data analytics outsourcing market?

5. Which region accounts for the largest data analytics outsourcing market share?

6. Which are the leading companies in the global data analytics outsourcing market?

Table of Contents

Companies Mentioned

- Accenture PLC

- Capgemini Services SAS

- Fractal Analytics Inc.

- Genpact Limited

- Infosys Limited

- International Business Machines (IBM) Corporation

- Mu Sigma Inc.

- ElectrifAi LLC

- Tata Consultancy Services Limited

- Trianz Incorporated

- Wipro Limited

- ZS Associates Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | August 2025 |

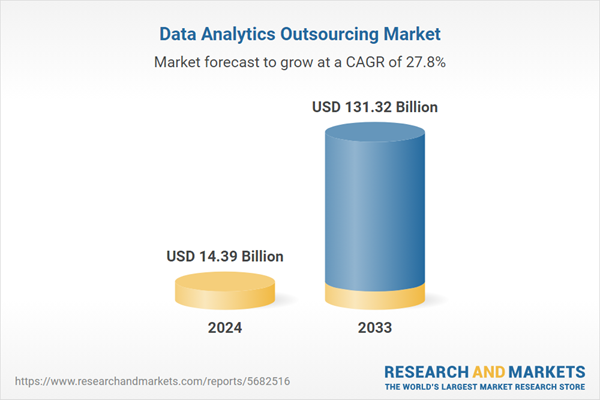

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 14.39 Billion |

| Forecasted Market Value ( USD | $ 131.32 Billion |

| Compound Annual Growth Rate | 27.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |