Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This blend yields a versatile glass-ceramic material suitable for various dental applications. This material is esteemed for its notable flexural strength and resistance to fractures, making it a favored option for dental restorations. It exhibits robustness sufficient to endure the pressures of normal mastication. Also, An eminent advantage of dental lithium disilicate lies in its capacity to closely emulate the natural appearance of teeth. It can be meticulously matched in shade to seamlessly harmonize with a patient's existing dentition.

Furthermore, Lithium disilicate, prized for its lifelike visual appeal due to its inherent translucency, allows light to pass through much like natural tooth enamel. This property makes it a favored choice in various dental applications. Dental crowns crafted from lithium disilicate offer robust fortification for compromised teeth, while thin veneers enhance the appearance of teeth's anterior surface. For moderate damage, partial coverage restorations like inlays and onlays prove effective. Additionally, lithium disilicate is employed in the construction of dental bridges to replace missing teeth.

The fabrication process involves taking a precise impression of the patient's teeth, followed by CAD-assisted design and CAM milling from a lithium disilicate block. Noteworthy advancements and a variety of brands in the market have led to heightened strength and aesthetics. Post-fabrication, the restoration is firmly affixed to the prepared tooth using dental cement, ensuring a secure bond.

To maintain these restorations, patients should adopt a routine dental care regimen, including regular brushing, flossing, and timely check-ups. It is crucial to recognize that while dental lithium disilicate exhibits exceptional durability and aesthetic appeal, the suitability of a specific material for a dental restoration hinge on diverse factors, including the unique needs of the patient, the location of the restoration, and the professional judgment of the dentist. Patients are advised to consult their dentist to ascertain the optimal material for their case.

Key Market Drivers

Increasing Demand for Aesthetic and Minimally Invasive Dentistry

The global Dental Lithium Disilicate Market is witnessing substantial growth, largely driven by the increasing demand for aesthetic and minimally invasive dentistry. As patients prioritize natural-looking smiles and less invasive procedures, the adoption of lithium disilicate restorations has surged. This trend is reshaping the dental industry and creating new opportunities for manufacturers, dental laboratories, and practitioners.Patients today are more conscious of their dental aesthetics than ever before, influenced by factors such as: The rise of digital media has amplified awareness of cosmetic dentistry, making natural and perfect smiles a desirable feature. According the British Academy of Cosmetic Dentistry, demand for cosmetic dental treatments among adults in the UK has surged by 40%. This growth is primarily attributed to the influence of social media, heightened awareness of dental health, and a growing emphasis on achieving a confident, polished appearance. These factors highlight shifting consumer priorities and present significant opportunities for dental practices and related industries to expand their offerings and meet evolving market demands.

Key Market Challenges

High Cost

The high cost associated with advanced dental materials, such as dental lithium disilicate, is a significant factor influencing the market dynamics in the field of dentistry. While these materials offer superior properties in terms of strength, aesthetics, and durability, their elevated price tags can present challenges for both dental practitioners and patients. For dental practices, the procurement of high-cost materials can strain financial resources, particularly for smaller or independent practitioners. The initial investment in acquiring advanced materials, along with the necessary equipment and technology for their utilization, can be substantial.This expense may deter some practices from adopting these materials, especially those operating on tighter budgets or in regions with limited financial resources. Moreover, the high cost of advanced dental materials can potentially be passed on to patients in the form of higher treatment fees. This can lead to affordability concerns for certain patient demographics, potentially limiting their access to the benefits of these cutting-edge materials. Patients without comprehensive dental insurance coverage or those seeking elective cosmetic procedures may find it challenging to justify the additional expense associated with these materials. Additionally, the cost factor may influence the decision-making process for both practitioners and patients when selecting dental materials. While advanced materials like dental lithium disilicate offer exceptional benefits, the financial implications may prompt some to opt for more cost-effective alternatives, even if they may not provide the same level of performance or aesthetics.

Key Market Trends

Growing Focus on Minimally Invasive Dentistry

The focus on Minimally Invasive Dentistry (MID) is exerting a notable positive impact on the dental lithium disilicate market. This approach emphasizes the preservation of natural tooth structure while still achieving effective restorations. Dental lithium disilicate aligns seamlessly with the principles of MID, as it can be utilized in a range of minimally invasive procedures, such as veneers and inlays/onlays. By opting for dental lithium disilicate, dentists can perform procedures with minimal tooth preparation, ensuring that healthy tooth structure remains intact. This not only reduces the invasiveness of the treatment but also contributes to faster patient recovery times and a lower risk of post-operative complications. Patients benefit from the conservation of their natural teeth, leading to enhanced overall oral health.Key Market Players

- Ivoclar Vivadent Inc

- DENTSPLY SIRONA Inc

- Shofu Dental Corp

- Shenzhen Upcera Dental Technology Co., Ltd.

- Cendres + Metaux SA

- Vita Zahnfabrik H Rauter GmbH & Co KG

- HASSBIO America, Inc.

Report Scope:

In this report, the Global Dental Lithium Disilicate Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Dental Lithium Disilicate Market, By Type:

- Crown

- Veneering

- Bridge

Dental Lithium Disilicate Market, By Application:

- Hospitals

- Dental Clinics

- Others

Dental Lithium Disilicate Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Dental Lithium Disilicate Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ivoclar Vivadent Inc

- DENTSPLY SIRONA Inc

- Shofu Dental Corp

- Shenzhen Upcera Dental Technology Co., Ltd.

- Cendres + Metaux SA

- Vita Zahnfabrik H Rauter GmbH & Co KG

- HASSBIO America, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | March 2025 |

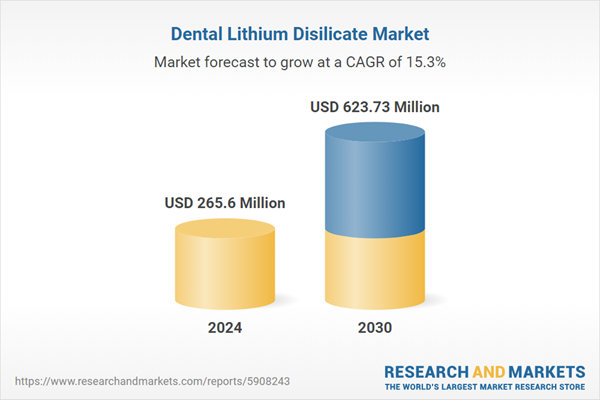

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 265.6 Million |

| Forecasted Market Value ( USD | $ 623.73 Million |

| Compound Annual Growth Rate | 15.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |