Speak directly to the analyst to clarify any post sales queries you may have.

The Digital Diagnostics Market is positioned as a transformative force reshaping healthcare workflows and patient outcomes. With rapid advances in technology and increased cross-industry collaborations, senior executives face new opportunities and challenges in strategic decision-making and market growth.

Market Snapshot: Digital Diagnostics Market Growth and Dynamics

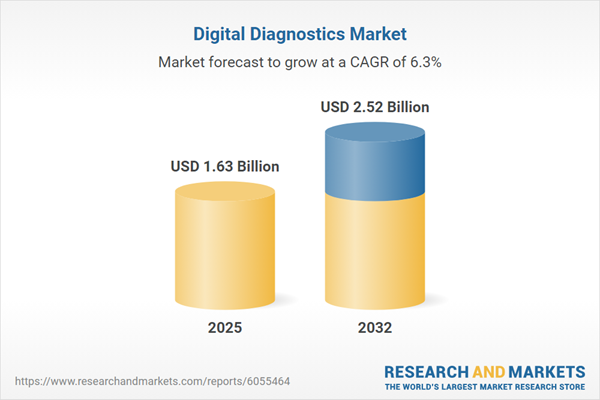

The digital diagnostics market grew from USD 1.54 billion in 2024 to USD 1.63 billion in 2025, and is forecasted to reach USD 2.52 billion by 2032 at a CAGR of 6.33%. This substantial growth is fuelled by advancements in computational imaging, artificial intelligence, and growing adoption of data-driven approaches within clinical and consumer health sectors. As payers, providers, and manufacturers align their strategies to leverage these technologies, the sector is entering a phase marked by increased innovation, operational efficiency, and high competition.

Scope & Segmentation

This report delivers an in-depth analysis of industry segments, key applications, and regional nuances, providing stakeholders with actionable visibility into the digital diagnostics market landscape.

- Type: Digital Dermatology, Digital Pathology, Digital Radiology, Mobile Health (mHealth) Diagnostics, Molecular & Genetic Diagnostics, Wearable & Remote Monitoring

- Industry Applications: Cardiology, Infectious Diseases, Neurology, Oncology

- End-User: Diagnostic Laboratories & Imaging Centers, Hospitals & Clinics, Research Institutes & Academic Medical Centers

- Geographic Coverage: Americas, Europe, Middle East, Africa, Asia-Pacific

- Main Companies Profiled: Abbott Laboratories, Agilent Technologies, Aidoc, Becton Dickinson and Company, Bio-Rad Laboratories, Butterfly Network, CANON MEDICAL SYSTEMS CORPORATION, Carestream Health, Danaher Corporation, FUJIFILM Holdings America Corporation, GE Healthcare Technologies, Google, Guardant Health, Hologic, IBM, Invitae Corporation, Koninklijke Philips, Microsoft, NVIDIA, PathAI, Qiagen, Roche Diagnostics, Siemens Healthineers, Tempus AI, Thermo Fisher Scientific

Key Takeaways for Decision-Makers

- Digital diagnostics is reshaping disease detection and treatment with real-time data, remote monitoring, and integrated AI solutions across care settings.

- Technology-driven collaborations between device manufacturers, software providers, and research institutes accelerate product development cycles and market access.

- Evolving reimbursement and regulatory models are incentivizing the adoption of digital health tools and early detection platforms in both developed and emerging markets.

- Segmented adoption rates depend on end-user readiness, infrastructure quality, and changing payer models, highlighting the need for tailored go-to-market strategies.

- Regional differences in regulatory environments and healthcare investment underscore the strategic importance of localization for sustainable growth.

Tariff Impact: Navigating US Policy Shifts in 2025

The introduction of new US tariff measures in 2025 affects the global supply chain for digital diagnostics. These policies prompt stakeholders to reconsider production locations, diversify sourcing, and develop software-centric offerings to insulate operations from hardware cost volatility. Such shifts are actively redefining competitive dynamics, increasing the urgency for supply chain resilience and strategic partnerships to enable uninterrupted market participation.

Methodology & Data Sources

This report applies a thorough methodology combining primary interviews with senior industry practitioners, clinicians, regulatory leaders, and payers, alongside comprehensive secondary research including regulatory documentation, clinical trial analysis, and corporate reports. A data triangulation approach ensures reliability, with additional market intelligence drawn from acquisition and partnership trends.

Why This Report Matters

- Enables senior leaders to benchmark market entry and expansion strategies in a rapidly evolving digital diagnostics environment.

- Delivers evidence-based guidance for technology adoption, partnership evaluation, and operational risk assessment.

- Supports stakeholders with insights to align product pipelines, adapt to regulatory shifts, and foster cross-sector collaborations for growth.

Conclusion

As digital diagnostics continues to evolve, senior decision-makers equipped with actionable insights will be well positioned to navigate disruption and drive sustainable growth. This report offers the critical foundation required for robust strategy development in an increasingly complex healthcare technology landscape.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Digital Diagnostics market report include:- Abbott Laboratories

- Agilent Technologies

- Aidoc

- Becton, Dickinson, and Company

- Bio-Rad Laboratories

- Butterfly Network, inc

- CANON MEDICAL SYSTEMS CORPORATION

- Carestream Health, Inc.

- Danaher Corporation

- FUJIFILM Holdings America Corporation

- GE Healthcare Technologies, Inc.

- Google LLC

- Guardant Health, Inc.

- Hologic, Inc.

- International Business Machines Corp.

- Invitae Corporation

- Koninklijke Philips N.V.

- Microsoft Corporation

- NVIDIA Corporation

- PathAI, Inc.

- Qiagen N.V.

- Roche Diagnostics Corporation

- Siemens Healthineers

- Tempus AI, Inc.

- Thermo Fisher Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.63 Billion |

| Forecasted Market Value ( USD | $ 2.52 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |