Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

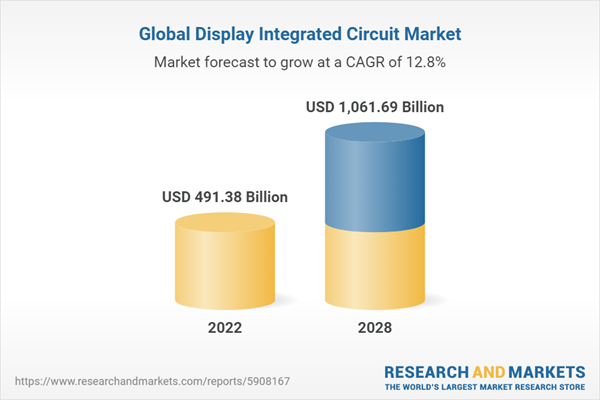

Global Display Integrated Circuit market has seen tremendous growth in recent years, fueled by digital transformation initiatives across various industries worldwide. Sectors like manufacturing, healthcare, transportation, and logistics have increasingly recognized the need for reliable and secure display integrated circuit solutions to support core operations.

This growth has been accelerated by continuous innovations from leading semiconductor companies. Vendors have introduced display ICs with enhanced processing power, advanced display technologies, and more robust connectivity options. For industries like automotive and industrial IoT, the ability to transmit real-time visual data through integrated displays is critical.

As industrial networks increasingly leverage technologies such as IoT, AI and analytics, display ICs are powering more intelligent interfaces. This allows organizations to gain valuable insights from data to improve decision making, streamline operations and enhance productivity. Emerging technologies promise support for advanced display types with higher resolutions.

With modernization of mission-critical systems a top priority, analysts remain optimistic about the long-term prospects of the display IC market. As capabilities continue enhancing to support industries' evolving needs, display, display, display ICs are poised to remain central to digital transformation initiatives across sectors. The market potential for supporting diverse applications through integrated intelligent displays remains vast.

Key Market Drivers

Growing Adoption of IoT and Industry 4.0

The increasing adoption of IoT and Industry 4.0 technologies across automotive, manufacturing, healthcare and other industries is driving the demand for display integrated circuits. IoT devices require intelligent interfaces with integrated displays to provide real-time data monitoring, analytics and control capabilities. Display ICs play a crucial role in powering IoT-enabled equipment, machines, medical devices and more by supporting advanced display technologies. They allow integration of larger, high-resolution color touch displays suitable for industrial environments. Vendors are developing specialized display ICs optimized for Industry 4.0 applications around predictive maintenance, quality inspection and asset management. The proliferation of connected devices and machinery in line with Industry 4.0 roadmaps will propel display IC consumption in the coming years.Advancing Automotive Electronics and ADAS Systems

The automotive industry is witnessing rapid adoption of advanced driver assistance systems (ADAS), connected car technologies, electric powertrains and autonomous capabilities. These innovations require sophisticated displays for applications like infotainment, navigation, telematics and rear seat entertainment. They also demand high-performance display solutions for instrument clusters, center consoles and ADAS/autonomous driving interfaces. Display ICs tailored for automotive needs are enabling larger, brighter and more durable displays. Leading semiconductor companies are investing in developing automotive-grade display ICs with enhanced reliability, thermal management and support for advanced display technologies. Tighter fuel efficiency and safety regulations will accelerate automotive electronics integration, driving display IC demand.Growth of Smart Wearables and Mobile Computing

The market for smart wearables, smartphones, tablets and other mobile computing devices continues expanding globally. These devices rely heavily on display ICs to power AMOLED, OLED and LCD panels of ever-increasing sizes, resolutions and refresh rates. Display driver ICs need to support higher pixel densities and color depths for vibrant visual experiences. They must also enable thinner and more energy-efficient form factors. Vendors continuously innovate display technologies and integrate new features in ICs like touch sensing, ambient light sensing and fingerprint recognition. The proliferation of mobile devices across consumer and enterprise segments along with demand for superior display experiences will propel display IC consumption over the coming years.Key Market Challenges

Increasing Complexity in Display Technologies

One of the prominent challenges facing the Global Display Integrated Circuit (IC) market is the ever-increasing complexity of display technologies. As consumers demand higher resolutions, larger screen sizes, and innovative features in their electronic devices, display technologies have evolved rapidly. Manufacturers are now incorporating advancements such as OLED, MicroLED, and flexible displays into smartphones, televisions, and wearable devices.This complexity poses several challenges for display IC manufacturers. First, they must develop specialized ICs tailored to the unique requirements of each display technology. For instance, OLED displays require different driving methods and power management compared to traditional LCDs. Developing and producing these specialized ICs can be resource-intensive and may require significant research and development investments.

Second, as new display technologies emerge, manufacturers must adapt quickly to stay competitive. The risk of investing in a technology that may become obsolete in a short period is a genuine concern. It necessitates a delicate balance between innovation and investment protection.

Third, the demand for higher resolution and pixel density places additional pressure on display ICs to deliver impeccable image quality and response times. Achieving this while managing power consumption is a persistent challenge.

To address these challenges, companies in the Display IC market must remain agile, investing in research and development to stay at the forefront of emerging display technologies. Additionally, they need to engage in collaborative partnerships with display panel manufacturers to ensure seamless integration of their ICs with the latest displays.

Intensified Global Supply Chain Disruptions

The Global Display Integrated Circuit market is grappling with the escalating challenge of supply chain disruptions. The industry relies on a complex global network of suppliers for raw materials, components, and semiconductor manufacturing, making it susceptible to a range of disruptions, including geopolitical tensions, natural disasters, and pandemics.Recent events, such as the COVID-19 pandemic and semiconductor chip shortages, have underscored the vulnerability of the supply chain. These disruptions have led to production delays, increased lead times, and rising costs. In particular, the shortage of semiconductor chips has had a cascading effect on the availability of display ICs, impacting various industries, from consumer electronics to automotive.

Managing supply chain resilience has become paramount for companies in the Display IC market. This involves diversifying sources of supply, increasing buffer inventories, and implementing robust risk mitigation strategies. Collaborative partnerships with suppliers and customers for better visibility and coordination across the supply chain are also critical.

Furthermore, investment in semiconductor fabrication facilities and advanced manufacturing technologies may help reduce dependence on external suppliers and enhance the ability to meet market demands even in the face of supply chain disruptions. Navigating these supply chain challenges will be essential for maintaining market competitiveness and meeting the growing demand for display ICs across industries.

Key Market Trends

Proliferation of 5G-Enabled Devices Driving Demand for Advanced Display ICs

The rollout of 5G networks worldwide is ushering in a significant trend in the Global Display Integrated Circuit (IC) market. The higher data speeds and lower latency offered by 5G technology are accelerating the adoption of bandwidth-intensive applications, particularly in the realm of mobile communication and IoT devices. As a result, there's a growing demand for advanced display ICs capable of delivering seamless visuals, faster response times, and energy-efficient performance in 5G-enabled smartphones, tablets, and IoT gadgets.This trend is compelling IC manufacturers to develop innovative solutions that can optimize display performance while minimizing power consumption. Features like adaptive refresh rates, dynamic color management, and enhanced image processing are becoming essential for providing a superior user experience on 5G devices. Additionally, display ICs with integrated AI capabilities are gaining traction as they enable real-time adjustments for improved video streaming, gaming, and augmented reality applications. As the 5G ecosystem continues to expand, the demand for cutting-edge display ICs is expected to surge, offering growth opportunities for companies that can meet these evolving requirements.

Augmented Reality (AR) and Virtual Reality (VR) Driving Display IC Advancements

The advent of augmented reality (AR) and virtual reality (VR) technologies is reshaping the landscape of the Global Display Integrated Circuit market. AR and VR applications are no longer confined to the gaming industry; they are gaining traction across various sectors, including education, healthcare, and design. These immersive technologies demand display ICs that can deliver high-resolution, low-latency visuals with minimal motion sickness effects.Display IC manufacturers are responding to this trend by developing specialized solutions tailored for AR and VR headsets. These ICs incorporate features like high refresh rates, low persistence displays, and advanced motion tracking capabilities to ensure a seamless and immersive experience for users. Furthermore, efforts are underway to reduce the form factor and power consumption of these ICs to make AR and VR devices more practical and comfortable for extended use.

The AR and VR trend extends beyond entertainment and gaming, with applications in training, simulation, and remote collaboration. As industries increasingly adopt these technologies, the demand for cutting-edge display ICs will continue to rise, presenting significant growth prospects for market players who can provide innovative solutions.

Emphasis on Energy Efficiency and Sustainability in Display ICs

Energy efficiency and sustainability have become paramount concerns in the Global Display Integrated Circuit market. With the growing awareness of environmental issues and the need for energy conservation, there is a significant trend toward developing energy-efficient display ICs that reduce power consumption without compromising performance.Manufacturers are incorporating advanced power management features, such as adaptive brightness control, dynamic refresh rates, and low-power standby modes, into their display IC designs. These innovations not only extend the battery life of portable devices like smartphones and laptops but also contribute to reducing carbon footprints.

Moreover, there is an increasing focus on the sustainability of materials used in display ICs. Manufacturers are exploring eco-friendly options and sustainable packaging to minimize the environmental impact of their products. This trend aligns with the broader global shift toward greener and more responsible business practices.

As sustainability and energy efficiency continue to be critical considerations for consumers and regulators, companies in the Display Integrated Circuit market are expected to prioritize these aspects in their product development strategies. Offering energy-efficient and environmentally responsible display IC solutions will likely be a key differentiator in the market and a driving force behind future growth.

Segmental Insights

Technology Insights

LCD driver ICs dominated the global display integrated circuit market in 2022, accounting for over 40% of the total share. LCD remains the most widely used display technology across industries due to its excellent picture quality, high brightness levels and relatively lower production costs compared to newer technologies. LCD driver ICs have continued witnessing strong demand with the proliferation of LCD displays in various consumer electronics such as smartphones, laptops, TVs, monitors, and other commercial applications such as digital signage and transportation systems.LCD driver ICs provide high-quality image rendering for LCD panels with consistent brightness and low power consumption. Leading semiconductor companies have further optimized LCD driver ICs with advanced functionalities such as local dimming, higher refresh rates and wider color gamuts to enhance the viewing experience. Additionally, established LCD supply chains and manufacturing infrastructure allow for mass production of LCD displays, driving consistent need for LCD driver ICs. With LCD still dominating various display applications, LCD driver ICs are expected to retain their dominant position during the forecast period in the global display integrated circuit market.

Display Type Insights

Small and medium-sized displays dominated the global display integrated circuit market in 2022, accounting for over 45% of the total share. This segment encompasses displays ranging from 1-inch to 40-inch diagonals used in various consumer electronics such as smartphones, tablets, laptops, wearables and automotive infotainment systems. The robust demand for premium smartphones, tablets and other consumer devices worldwide drove the demand for display ICs powering their high-resolution small-to-medium sized screens.Semiconductor companies extensively focus on developing optimized display driver ICs for this segment to deliver vivid visual experiences on compact screens. Advancements in manufacturing technologies are enabling the integration of more TFTs and higher resolution into constrained form factors. Additionally, the integration of advanced touchscreen, AMOLED and high refresh rate technologies into portable devices is propelling the need for sophisticated display ICs. Furthermore, the growing adoption of connected vehicles is augmenting the installation of small-to-medium sized displays in automotive cockpits, fueling additional demand. With consumer electronics remaining the major end-use industry, small and medium-sized displays and their corresponding display ICs are likely to stay dominant during the forecast period..

Regional Insights

The Asia Pacific region dominated the global display integrated circuit market in 2022, accounting for over 45% of the total share. This large share of the region can be attributed to the strong presence of leading display IC manufacturers as well as robust demand from the consumer electronics industry within Asia Pacific countries.China, Taiwan, South Korea and Japan are global manufacturing hubs for various consumer electronics such as smartphones, laptops, TVs, monitors and appliances-all of which heavily utilize display integrated circuits. Heavy investments by semiconductor players to ramp up display IC production capacities in these countries continued to meet the growing regional demand. Additionally, these nations also have a vast domestic market for consumer devices and are among the major exporters of devices globally.

Furthermore, Asia Pacific is a prominent automotive manufacturing base with OEMs rapidly increasing electronic content in vehicles. This is propelling the installation of advanced instrument clusters, infotainment systems and ADAS displays-augmenting regional display IC consumption. With well-established electronics supply chains, manufacturing ecosystems and economies of scale, the Asia Pacific region is expected to retain its dominant position during the forecast period.

Report Scope:

In this report, the Global Display Integrated Circuit Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Display Integrated Circuit Market, By Technology:

- LCD Driver ICs

- OLED Driver ICs

- LED Driver ICs

- MicroLED Driver ICs

- E-Paper Driver ICs

Display Integrated Circuit Market, By Display Type:

- Small and Medium-sized Displays

- Large Displays

- Flexible Displays

- Transparent Displays

Display Integrated Circuit Market, By End-User Industry:

- Industrial and Manufacturing

- Electronics and Semiconductor

- Telecommunications

- Healthcare

- Aerospace and Defense

- Retail and Hospitality

Display Integrated Circuit Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Display Integrated Circuit Market.Available Customizations:

Global Display Integrated Circuit Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Samsung Electronics

- Novatek Microelectronics

- Himax Technologies

- Silicon Works

- FocalTech Systems

- Synaptics

- Raydium Semiconductor

- Magnachip Semiconductor

- Solomon Systech

- Ultra Chip

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 491.38 Billion |

| Forecasted Market Value ( USD | $ 1061.69 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |