Speak directly to the analyst to clarify any post sales queries you may have.

A tightly focused introduction to the technical, commercial, and organizational forces shaping the next wave of deployable edge AI hardware solutions

Edge AI hardware is reshaping how data is processed, analyzed, and acted upon beyond centralized cloud environments. Advances in efficient processors, specialized accelerators, sensor integration, and power management technologies are driving compute closer to physical processes, enabling lower latency, improved privacy, and autonomous decisioning across a growing set of use cases. As organizations prioritize real-time inference, the confluence of device miniaturization, optimized silicon, and modular deployment architectures is creating new vectors for innovation and competitive differentiation.

In parallel, enterprise adoption patterns are evolving: pilot deployments are graduating to production, and requirements for deterministic performance, security, and lifecycle manageability are becoming non-negotiable. Stakeholders must balance hardware selection with software frameworks and lifecycle services to ensure sustained value. Consequently, hardware vendors, system integrators, and platform providers are turning to tighter co-design practices and deeper vertical integration to meet domain-specific needs.

This introduction frames the central themes that follow, offering a compact lens on the technical imperatives, commercial pressures, and organizational choices that will determine winners in the next wave of edge AI hardware deployments. The emphasis is on pragmatic pathways that align technical feasibility with measurable business outcomes, setting the stage for more detailed analysis of market dynamics and strategic recommendations.

How technical innovation, geopolitical shifts, and evolving commercial models are converging to redefine competitive advantage in edge AI hardware markets

The landscape for edge AI hardware is undergoing transformative shifts driven by technology maturation, supply chain realignment, and changing enterprise expectations. Hardware advancements, including domain-specific accelerators and power-efficient processors, are enabling new classes of on-device intelligence that were previously impractical due to thermal and energy constraints. These technical improvements are coinciding with software ecosystem growth, where optimized runtimes and model compression techniques extend the value of existing models to constrained environments.

At the same time, geopolitical pressures and policy incentives are prompting firms to reassess supplier concentration and manufacturing geography. This dynamic is accelerating investment in regional fabs, modular supply chains, and collaborative ecosystems that combine silicon, firmware, and systems integration. As a result, differentiation is shifting from raw compute benchmarks toward holistic capabilities such as secure update mechanisms, explainability for local models, and energy-aware inference orchestration.

Consequently, commercial models are shifting as well. Device OEMs and solution providers are experimenting with subscription-based services and hardware-as-a-service arrangements to lower adoption friction and create recurring value streams. The net effect is a market where technical innovation, regulatory strategy, and commercial design converge to favor partners that can deliver validated, end-to-end solutions rather than stand-alone components.

Assessing how tariff measures and export controls through 2025 are reshaping supplier strategy, sourcing resilience, and architecture decisions across edge AI hardware ecosystems

United States tariff actions and related trade measures announced or implemented through 2025 are producing layered effects across the edge AI hardware ecosystem, influencing supplier selection, component costs, and strategic investment decisions. Tariff-related cost inflation on imported components has prompted many firms to revisit bill-of-materials optimization and prioritize components that offer superior performance-per-watt to offset higher unit costs. In response, some organizations are accelerating plans to qualify alternative suppliers or to bring key stages of manufacturing closer geographically to their primary markets to reduce exposure to trade policy volatility.

Moreover, export controls and restrictions on advanced semiconductor technologies have led to more complex compliance regimes for companies operating across borders. This has increased the burden on procurement and legal teams to ensure that hardware designs and sourcing strategies align with evolving regulations. As firms adapt, there is a noticeable shift toward diversified supply chains that combine trusted regional suppliers with strategic long-term partnerships for specialized processors and sensors. Investment patterns are also adjusting: incentives and grants aimed at strengthening domestic manufacturing capability encourage greater capital deployment into localized fabrication and advanced packaging, while firms simultaneously hedge by maintaining multi-sourcing strategies.

Finally, the combined effect of tariffs and export restrictions is accelerating architectural shifts. Device designers are placing greater emphasis on modularity and upgradability to extend device lifespans and reduce the frequency of full hardware refreshes. Firms that can demonstrate resilient sourcing, regulatory compliance, and cost-effective performance will mitigate tariff-driven headwinds and preserve competitive margins in an uncertain policy environment.

A detailed segmentation-driven synthesis revealing how component choices, device types, processing modes, deployment patterns, applications, and industry verticals define differentiated value propositions

A nuanced segmentation framework clarifies where value and risk concentrate across the edge AI hardware landscape. Based on Component, market participants must weigh trade-offs among Memory, Power Modules, Processors, and Sensors; within Processors, choices among ASIC, CPU, FPGA, and GPU architectures determine performance, programmability, and unit cost implications. Component-level choices drive downstream design and influence system-level power profiles and thermal envelopes, making integration strategy critical for deployment success.

Based on Device Type, differentiation emerges between Cameras, Robots, Smart Speakers, and Smartphones, each presenting distinct sensor suites, form factor constraints, and interaction models. Cameras emphasize image pipelines and bandwidth-efficient processing, robots require tight integration of motion control and perception stacks, smart speakers prioritize low-power voice processing and wake-word robustness, and smartphones blend high-performance compute with strict energy budgets and user-experience considerations. Based on Processing Mode, the split between Inference and Training guides architecture selection: inference-focused deployments favor low-latency, deterministic accelerators while training scenarios emphasize memory bandwidth and sustained throughput.

Based on Deployment Type, the contrast between Edge Gateway and On Device influences network architecture and security boundaries, with gateways aggregating data and sometimes performing heavier pre-processing while on-device deployments prioritize autonomy and privacy. Based on Application, use cases across Computer Vision, NLP, Predictive Maintenance, Robotics, and Speech Recognition impose different latency, accuracy, and reliability constraints that must be matched to hardware capabilities and software tooling. Finally, based on Industry Vertical, the context of Agriculture, Automotive, Consumer Electronics, Energy & Utilities, Healthcare, and Telecom informs regulatory requirements, environmental conditions, and integration pathways that materially affect productization and commercialization timelines.

How divergent regional dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific are shaping adoption priorities, sourcing strategies, and commercialization pathways

Regional dynamics materially influence technology adoption, supply chain decisions, and regulatory compliance strategies for edge AI hardware. In the Americas, demand is driven by enterprise modernization, automotive innovation, and defense-related requirements that prioritize secure, locally sourced solutions and strong integration with cloud and edge orchestration platforms. The Americas ecosystem benefits from robust venture capital flows and an expanding domestic semiconductor capacity, which together accelerate prototype-to-production cycles and favor companies that can align product roadmaps with stringent security and lifecycle management expectations.

In Europe, Middle East & Africa, customers emphasize regulatory compliance, environmental sustainability, and interoperability across diverse legacy systems. Firms operating in Europe, Middle East & Africa must navigate a mosaic of standards and data-protection requirements while capitalizing on industrial automation and telecom modernization projects. Investment incentives and regional partnerships are encouraging localized manufacturing and certification pathways that reduce cross-border friction.

In the Asia-Pacific region, scale and manufacturing density remain decisive advantages. Asia-Pacific is a center for component supply, contract manufacturing, and rapid iteration for consumer electronics and telecom hardware. However, regional geopolitical dynamics and trade policy shifts require nimble sourcing strategies and accelerated supplier qualification processes. Across all regions, successful vendors tailor product, service, and pricing models to local procurement norms, regulatory regimes, and adoption velocity to maximize market traction.

Insights into how leading vendors combine silicon specialization, software integration, strategic partnerships, and lifecycle services to capture long-term enterprise value

Leading companies in the edge AI hardware ecosystem are adopting differentiated strategies that combine silicon innovation, software integration, and ecosystem partnerships. Some vendors are concentrating on domain-specific accelerators and custom ASIC development to deliver compelling performance and energy efficiency for targeted use cases, while others prioritize programmability through FPGA and heterogeneous CPU/GPU combinations to support rapid feature evolution. Firms that integrate hardware with middleware and model optimization toolchains create stickier value propositions by reducing customers’ integration burden and shortening time-to-first-value.

Strategic partnerships between component suppliers, ODMs, and systems integrators are increasingly common, enabling end-to-end solutions that meet verticalized requirements. Mergers and acquisitions continue to be a vehicle for acquiring IP and accelerating time-to-market, and companies are balancing organic R&D with targeted acquisition to fill capability gaps. Additionally, growing emphasis on lifecycle services - including secure update frameworks, remote management, and model retraining pipelines - differentiates players that can offer operational continuity beyond initial deployment.

Finally, corporate strategies that emphasize transparent roadmaps, compliance-ready designs, and clear support commitments are winning enterprise trust. Companies that invest in reproducible performance benchmarks, third-party validation, and open collaboration with standards bodies are better positioned to capture long-term enterprise contracts where risk mitigation and predictable total cost of ownership are paramount.

Actionable and prioritized strategic initiatives for hardware vendors and solution providers to accelerate adoption, reduce risk, and build defensible positions in edge AI deployments

Industry leaders should pursue a coordinated set of actions to capitalize on edge AI hardware opportunities while mitigating supply chain, regulatory, and operational risks. First, prioritize supplier diversification and multi-sourcing strategies for critical components to reduce single-point dependencies and sustain production continuity. Concurrently, invest in strategic partnerships with contract manufacturers and packaging specialists to optimize for localized demand and accelerate compliance with regional regulatory regimes.

Second, adopt a hardware-software co-design discipline that aligns processor selection, model optimization, and power management early in the product cycle; this reduces late-stage rework and ensures that delivered solutions meet both performance and energy targets. Third, establish a robust lifecycle management approach that includes secure firmware updates, remote diagnostics, and model governance practices to extend device longevity and protect operational integrity. Fourth, evaluate opportunities to leverage domain-specific accelerators or custom silicon for high-volume, latency-sensitive applications while using more programmable architectures for product lines requiring frequent feature updates.

Fifth, build engagement models with customers that combine pilot-to-scale playbooks, clear metrics for success, and flexible commercial structures such as subscription or outcome-based contracts to lower adoption friction. Lastly, maintain active monitoring of trade policy and regulatory developments and engage in cross-industry consortia to influence standards and certification frameworks, thereby reducing compliance friction and opening channels for collaboration on interoperability and security best practices.

A transparent mixed-methods research methodology combining primary interviews, technical validation, policy review, and scenario analysis to ensure robust practitioner-relevant insights

The findings presented in this report are grounded in a mixed-methods research approach designed for rigor, transparency, and practitioner relevance. Primary research included structured interviews with hardware engineers, procurement leads, systems integrators, and enterprise buyers to capture practical constraints and decision criteria encountered during pilot and production rollouts. These qualitative inputs were complemented by technical validations that examined performance benchmarks, power envelopes, and integration complexity across representative devices and processor classes.

Secondary research encompassed a comprehensive review of public regulatory filings, policy announcements, technology white papers, and patent landscapes to contextualize supply chain and innovation trends. Scenario analysis was applied to assess the implications of tariff shifts and export controls, and sensitivity testing explored how supplier concentration, component availability, and energy constraints would influence architecture choices. Triangulation between primary interviews, independent technical testing, and publicly available documentation ensured that conclusions are robust and reflect multiple vantage points.

Finally, peer validation workshops with domain experts and end users provided reality checks on practical deployability, maintenance burdens, and business model acceptability. The methodology emphasizes reproducibility and seeks to surface actionable insights rather than speculative projections, enabling decision-makers to translate findings into prioritized strategic initiatives and implementation plans.

A conclusive synthesis highlighting how co-design, modularity, lifecycle services, and resilient sourcing form the foundation for durable competitive advantage in edge AI hardware

Edge AI hardware is no longer an experimental frontier; it is a practical enabler of real-time decisioning, privacy-preserving analytics, and autonomous operation across multiple industries. Successful deployment hinges on aligning silicon choices, power and thermal management, software optimization, and supply chain resilience with clearly defined use-case economics. Vendors that place equal emphasis on integration, lifecycle services, and compliance will outperform those focused solely on component-level performance metrics.

Sustained competitive advantage will accrue to organizations that can rapidly validate domain-specific solutions, maintain flexible manufacturing arrangements, and offer contractual models that reduce adoption friction. Geopolitical shifts and tariff actions underscore the need for multi-regional sourcing and greater transparency in procurement practices, while ongoing improvements in model compression and on-device inference frameworks continue to expand the feasible envelope of edge applications.

In sum, the intersection of hardware innovation, pragmatic commercial models, and resilient operational practices creates a window of opportunity for firms that act decisively. By focusing on co-design, modularity, and lifecycle continuity, market participants can convert technical advances into durable business outcomes and lead the next phase of intelligent, distributed computing.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Edge AI Hardware Market

Companies Mentioned

The key companies profiled in this Edge AI Hardware market report include:- Advanced Micro Devices, Inc.

- Apple Inc.

- Arm Holdings plc

- Axelera AI

- BrainChip Holdings Ltd

- Ceva Inc.

- Hailo Technologies Ltd.

- Huawei Technologies Co., Ltd.

- Imagination Technologies

- Innodisk Group

- Intel Corporation

- International Business Machines Corporation

- MediaTek Inc.

- Microsoft Corporation

- Murata Manufacturing Co., Ltd.

- NVIDIA Corporation

- Premier Farnell Limited

- Qualcomm Technologies, Inc.

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- Sony Group Corporation

- STMicroelectronics N.V.

- Super Micro Computer, Inc.

- Texas Instruments Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

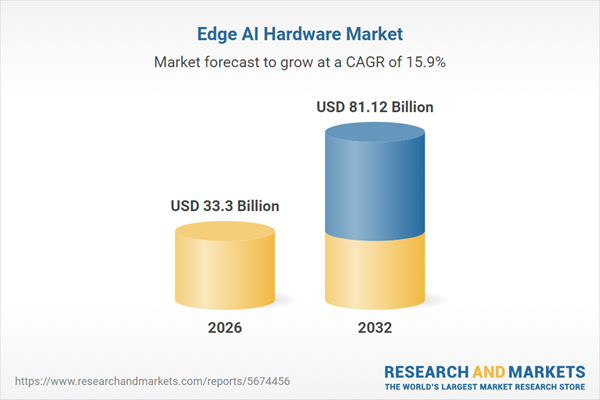

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 33.3 Billion |

| Forecasted Market Value ( USD | $ 81.12 Billion |

| Compound Annual Growth Rate | 15.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |