Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rapid Technological Advancements

The global electronic materials market is experiencing significant growth, driven by rapid technological advancements. In today's digital age, technological innovations are constantly pushing the boundaries of what is possible in various industries. Electronic materials play a crucial role in enabling these advancements by providing the necessary components and materials for electronic devices and systems. From semiconductors and conductive materials to dielectric materials and substrates, electronic materials are essential for the development of cutting-edge technologies such as artificial intelligence, Internet of Things (IoT), 5G communication, and renewable energy systems. As these technologies continue to evolve and become more sophisticated, the demand for high-performance electronic materials is expected to grow significantly. Manufacturers are investing in research and development to create advanced electronic materials that offer improved conductivity, higher thermal stability, enhanced durability, and other desirable properties. The rapid pace of technological advancements is driving the growth of the global electronic materials market, as industries across the board seek materials that can meet the evolving demands of modern technology.Increasing Adoption of Electric Vehicles

The global electronic materials market is witnessing significant growth, driven by the increasing adoption of electric vehicles (EVs). As the world shifts towards a more sustainable future, EVs have emerged as a viable alternative to traditional internal combustion engine vehicles. Electronic materials are essential for the production of EV components such as batteries, power electronics, and charging infrastructure. The demand for electronic materials in the EV industry is driven by the need for high-performance batteries that offer longer range, faster charging, and improved safety. Advanced materials such as lithium-ion batteries, solid-state batteries, and graphene-based materials are being developed to meet these requirements. Additionally, electronic materials are used in power electronics, which control the flow of electricity in EVs, enabling efficient energy conversion and management. The growing infrastructure for EV charging stations also relies on electronic materials for the construction of charging points and the development of smart charging systems. As governments and consumers worldwide embrace the transition to electric mobility, the demand for electronic materials in the EV industry is expected to surge, driving the growth of the global electronic materials market.Emerging Applications in Healthcare

The global electronic materials market is experiencing significant growth, driven by emerging applications in the healthcare sector. Electronic materials are playing a crucial role in the development of advanced medical devices, diagnostics, and wearable technologies. These technologies are revolutionizing healthcare by enabling remote patient monitoring, personalized medicine, and improved treatment outcomes. Electronic materials are used in the production of sensors, electrodes, and flexible circuits that are integrated into medical devices such as pacemakers, glucose monitors, and drug delivery systems. These materials offer biocompatibility, flexibility, and durability, ensuring the safe and reliable operation of medical devices within the human body. Electronic materials are also used in diagnostic devices, such as DNA sequencing systems and biosensors, which enable rapid and accurate disease detection. Furthermore, wearable technologies that monitor vital signs, track fitness levels, and provide real-time health data rely on electronic materials for their functionality and comfort. As the healthcare industry continues to embrace digital transformation and the demand for advanced medical technologies grows, the global electronic materials market is expected to expand significantly.Growing Demand for Renewable Energy Systems

The global electronic materials market is witnessing significant growth, driven by the growing demand for renewable energy systems. As the world seeks to reduce its reliance on fossil fuels and mitigate the effects of climate change, renewable energy sources such as solar and wind power are gaining prominence. Electronic materials play a crucial role in the production of photovoltaic cells, which convert sunlight into electricity, and wind turbine components, which generate electricity from wind energy. These materials, including semiconductors, conductive materials, and encapsulation materials, are essential for the efficient and reliable operation of renewable energy systems. The demand for electronic materials in the renewable energy sector is driven by the need for higher energy conversion efficiency, improved durability, and reduced costs. Manufacturers are investing in research and development to develop advanced electronic materials that can enhance the performance and longevity of renewable energy systems. As governments worldwide implement policies to promote renewable energy adoption and the demand for clean energy continues to rise, the global electronic materials market is expected to experience significant growth.Integration in Smart Home and IoT Applications

The global electronic materials market is experiencing significant growth, driven by integration in smart home and Internet of Things (IoT) applications. Smart home systems and IoT devices are becoming increasingly prevalent, offering enhanced convenience, energy efficiency, and connectivity. Electronic materials are essential for the development of sensors, actuators, and communication modules that enable the seamless operation of these systems. These materials provide the necessary conductivity, insulation, and durability required for the reliable and efficient functioning of smart home devices and IoT applications. From smart thermostats and lighting systems to security cameras and voice assistants, electronic materials are at the core of these technologies. As consumers embrace the concept of a connected home and the IoT ecosystem expands, the demand for electronic materials in smart home and IoT applications is expected to grow significantly. Manufacturers are focusing on developing electronic materials that can meet the specific requirements of these applications, such as low power consumption, wireless connectivity, and miniaturization. The integration of electronic materials in smart home and IoT applications is driving the growth of the global electronic materials market, as industries strive to create smarter and more interconnected environments.Key Market Challenges

Quality Control and Counterfeit Products

The global electronic materials market faces challenges related to quality control and the proliferation of counterfeit products. As the demand for electronic materials continues to rise, there is an increased risk of substandard or counterfeit materials entering the market. These low-quality materials may not meet the required specifications, leading to performance issues, reliability concerns, and potential safety hazards. Manufacturers and industry stakeholders need to implement stringent quality control measures to ensure that only genuine and high-quality electronic materials are used in the production of electronic devices.Supply Chain Disruptions

The global electronic materials market is susceptible to supply chain disruptions, which can impact the availability and cost of materials. Factors such as natural disasters, geopolitical tensions, trade disputes, and pandemics can disrupt the supply chain, leading to material shortages, price fluctuations, and delays in production. These disruptions can have a significant impact on the electronics industry, affecting the timely delivery of electronic devices and potentially increasing costs for manufacturers. To mitigate these challenges, manufacturers need to diversify their supply chains, establish contingency plans, and collaborate closely with suppliers to ensure a stable and resilient supply of electronic materials.Environmental Sustainability

The electronic materials market faces increasing pressure to address environmental sustainability concerns. The production and disposal of electronic materials can have a significant environmental impact, including resource depletion, pollution, and electronic waste generation. Manufacturers need to adopt sustainable practices throughout the lifecycle of electronic materials, including the sourcing of raw materials, manufacturing processes, and end-of-life disposal. This includes reducing energy consumption, minimizing waste generation, promoting recycling and reuse, and exploring alternative materials with lower environmental footprints. Additionally, regulatory bodies and industry associations play a crucial role in setting and enforcing environmental standards to drive sustainable practices within the electronic materials market.Technological Obsolescence

The rapid pace of technological advancements poses a challenge for the electronic materials market. As new technologies emerge, older materials may become obsolete, requiring manufacturers to adapt and innovate to meet the changing demands of the industry. This challenge is particularly relevant in sectors such as semiconductors, where the development of smaller, faster, and more efficient materials is essential to keep up with the demands of the electronics market. Manufacturers need to invest in research and development to stay at the forefront of technological advancements and ensure that their electronic materials remain relevant and competitive in the market.Intellectual Property Protection

Intellectual property protection is a significant challenge in the global electronic materials market. The development of new and innovative electronic materials requires substantial investments in research, development, and intellectual property rights. However, the unauthorized use or infringement of intellectual property can undermine the competitiveness and profitability of manufacturers. Protecting intellectual property rights is crucial to incentivize innovation and ensure a fair and competitive market. Manufacturers need to implement robust strategies to safeguard their intellectual property, including patents, trademarks, and trade secrets, and collaborate with regulatory bodies and legal institutions to enforce intellectual property rights and combat infringement.Key Market Trends

Advancements in Semiconductor Materials

The global electronic materials market is undergoing notable progress, particularly in the realm of semiconductor materials, which serve as vital elements in a wide array of electronic devices. Materials like silicon, gallium nitride, and gallium arsenide play a pivotal role in the manufacturing of integrated circuits, transistors, and various other electronic components. These materials are fundamental to the functioning of modern gadgets, enabling the seamless operation of smartphones, computers, and a plethora of other electronic devices. What's noteworthy is the continuous evolution of semiconductor materials, marked by enhancements in performance, heightened efficiency, and a trend toward smaller form factors. This ongoing refinement is the driving force behind the market's growth, fueling innovations and enabling the development of increasingly sophisticated electronic devices. The relentless pursuit of improved materials not only ensures the seamless functioning of current electronics but also paves the way for future technological advancements. As the demand for smaller, faster, and more powerful electronic devices continues to surge, the research and development efforts in semiconductor materials are paramount. Industry leaders and researchers alike are investing substantial resources in this area, aiming to push the boundaries of what electronic devices can achieve. This momentum in semiconductor innovation signifies a paradigm shift in the electronic materials market, shaping the way for cutting-edge technologies that are set to redefine our digital landscape. With these advancements, electronic materials are not just components; they are the bedrock upon which the future of technology is being constructed, promising a world of possibilities for industries and consumers alike.Emerging Applications in Renewable Energy

The rising emphasis on renewable energy solutions, particularly solar and wind power, is fueling a substantial demand surge for electronic materials within the renewable energy sector. Key components like photovoltaic materials and conductive polymers are playing indispensable roles in the production of solar cells and energy storage devices. In the global shift toward a more sustainable future, these electronic materials are emerging as linchpins of innovation. Photovoltaic materials, essential for harnessing solar energy, are undergoing significant advancements, leading to increased efficiency and durability of solar cells. Likewise, conductive polymers, vital for energy storage technologies, are enabling the development of efficient batteries and supercapacitors, facilitating the seamless integration of renewable energy sources into the existing power infrastructure. As the world increasingly recognizes the importance of sustainable energy practices, the demand for these electronic materials within the renewable energy sector is poised for substantial growth. This transformative trend signifies not only a technological evolution but also a paradigm shift in energy production and consumption, underlining the pivotal role electronic materials play in creating a greener and more eco-conscious world. With ongoing research and development efforts focused on enhancing the efficiency and affordability of these materials, the renewable energy sector stands on the brink of a revolutionary era, where electronic materials are driving the transition toward cleaner and more sustainable energy sources.Rise of Internet of Things (IoT)

The surge in IoT devices is driving a substantial need for electronic materials, underpinning a technological revolution across various sectors. IoT gadgets, spanning from smart home appliances and wearable devices to industrial sensors, heavily rely on electronic materials for their core functionality. These materials are the linchpin, enabling pivotal aspects such as wireless communication, energy harvesting, and the crucial miniaturization of IoT devices. Through these electronic components, IoT devices can seamlessly communicate with one another and with broader networks, creating interconnected ecosystems that enhance efficiency and convenience in our daily lives. Moreover, electronic materials empower energy harvesting mechanisms within IoT devices, ensuring sustainable power sources by harnessing energy from the environment. This capability not only promotes longevity but also aligns with eco-conscious trends. Additionally, the miniaturization facilitated by these materials is pivotal, allowing IoT devices to become more discreet, portable, and integrated into various settings, from smart homes to industrial complexes. With the rapid expansion and integration of IoT into diverse industries, ranging from healthcare to manufacturing, the demand for electronic materials continues to soar. This escalating need underscores the fundamental role these materials play in the backbone of IoT technology, propelling innovations and shaping a future where seamless connectivity and smart functionalities define the way we interact with the world. As the IoT landscape evolves, electronic materials stand as the cornerstone, ensuring these smart devices operate efficiently, sustainably, and with the sophistication demanded by the modern era.

Increasing Emphasis on Miniaturization

The trend towards miniaturization of electronic devices is driving the demand for electronic materials with superior performance in smaller form factors. Manufacturers are focusing on developing materials that offer high conductivity, thermal stability, and mechanical flexibility to meet the requirements of compact electronic devices. The miniaturization trend is particularly prominent in sectors such as consumer electronics, healthcare devices, and automotive electronics.Expansion of Online Distribution Channels

The expansion of e-commerce and online retail channels is reshaping the electronic materials market. Consumers now have easy access to a wide range of electronic materials from various brands and suppliers through online platforms. This digital transformation has increased competition, allowing consumers to compare prices, read reviews, and make informed purchasing decisions. The convenience and accessibility of online shopping have become integral to the growth of the electronic materials market, enabling manufacturers to reach a global customer base.The global electronic materials market is undergoing a transformative shift, driven by technological advancements, sustainability concerns, and changing consumer behaviors. As the world becomes increasingly interconnected and reliant on electronic devices, the demand for high-performance, sustainable, and miniaturized electronic materials is expected to grow. The expansion of e-commerce and online retail channels further amplifies this growth, providing consumers with a convenient platform to access a wide range of electronic materials. In this digital age, the electronic materials market stands at the forefront of innovation, catering to the evolving needs of industries and consumers alike.

Segmental Insights

Application Insights

Based on the application, the market is segmented into silicon wafers, PCB laminates, specialty gases, wet chemicals, photoresist chemicals, and others. The silicon wafers segment is estimated to hold the largest share in this market in 2020. The growth of this segment is associated with a rise in demand for electronic devices such as PCs, laptops, mobiles, and air conditioners, globally. Silicon wafers are widely used in the microelectronic devices as an under layer and acts as the key component in the fabrication of integrated circuits. Thus, a higher use of silicon wafers in making such electronic devices will boost the growth of the segment. The PCB laminates form a key component of electronic circuitry in ensuring functionality and integrity of a wide range of electronics such as computers, communication and other consumer electronics. Moreover, increasing preference for types of PCBs such as miniaturized, multi-layered, and halogen free, has increased the consumption of electronic chemicals and materials.The growth of the specialty gases segment is associated with its wide use of electronic devices and components such as semiconductors, solar cells, liquid crystal panels, and LEDs. Additionally, they are used in several electrical equipment such as circuit breakers and transformers. The latest product developments includes wearable and technological advancements such as control systems, connected homes, and connected industrial systems in the electronic industry, are estimated to boost the demand for specialty gases. This will further positively impact the electronic chemicals & materials market. The wet chemicals segment is in a growing phase due to its rising use in semiconductors, integrated circuit manufacturing, display panels, televisions, LCDs, and LEDs. The growing adoption of these devices across the globe has contributed a high consumption of wet chemicals thereby boosting the electronic chemicals and materials demand.

Photoresist chemicals are primarily used in processes such as photoengraving and photolithography to create a pattern on the semiconductor material. Additionally, growing demand for LED displays and miniaturization of electronic goods is enhancing the use of photoresist chemicals thus leading to electronic chemicals and materials market growth. Others segment includes CMP slurries, Low K Dielectrics and conductive polymers. The growth of these segment is characterized by increasing demand for electronic products globally.

End-Use Insights

Based on the end-use, the market is segmented into semiconductors and others. The semiconductor segment held the dominant market share in 2020. This segment is bifurcated into integrated circuits and printed circuit boards. Electronic chemicals and materials are mainly used for etching of semiconductors for appropriate maintenance and improving functioning. Moreover, rising demand of semiconductors from electric & hybrid vehicles, and industrial machines will provide growth opportunities for the market.The growth of integrated circuit segment is attributed to the increasing adoption of IoT devices. In this, the integrated circuits sense and transmit intelligent data. Furthermore, the benefits associated with analog ICs across a vast range of real-time connected applications and devices will surge the chemicals and materials consumption. The consumption of electronic chemicals and materials in the printed circuit boards is rising owing to rising demand for digitalization from both developing and developed countries in the industrial and consumer sector. Further, the development of PCB designs, to maximize utilization and minimize cost, including replacement of base materials to BT-epoxy and polyamides, will drive the growth of the segment.

Regional Insights

The Asia-Pacific region emerged as the dominant force in the Global Electronic Materials Market and is anticipated to maintain its stronghold throughout the forecast period. This dominance can be attributed to several key factors. Firstly, countries like China, Japan, South Korea, and Taiwan are at the forefront of electronics manufacturing, with a significant number of leading semiconductor and electronics companies headquartered in these nations. Their robust manufacturing capabilities, coupled with a skilled workforce and advanced technological infrastructure, have positioned Asia-Pacific as the epicenter of electronic materials production and consumption. Additionally, the region's massive consumer base for electronic devices, including smartphones, laptops, and consumer electronics, has further driven the demand for electronic materials. Furthermore, supportive government policies, investments in research and development, and collaborations between industries and academic institutions have fostered innovation in electronic materials, giving companies in this region a competitive edge. As a result, Asia-Pacific is expected to continue its dominance in the Global Electronic Materials Market. The region's proactive approach toward technological advancements and its pivotal role in the global electronics supply chain are poised to sustain its leadership position, making it a focal point for businesses and investors in the electronic materials sector.Report Scope:

In this report, the Global Electronic Materials Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Electronic Materials Market, By Application:

- Silicon Wafers

- PCB Laminates

- Specialty Gases

- Wet Chemicals

- Photoresist Chemicals

- Others

Electronic Materials Market, By End-Use:

- Semiconductors {Integrated Circuits and Printed Circuit Boards}

- Others

Electronic Materials Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electronic Materials Market.Available Customizations:

Global Electronic Materials market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Dow Inc.

- BASF SE

- Samsung Electronics Co., Ltd.

- LG Chem Ltd.

- Sumitomo Chemical Co., Ltd.

- DuPont de Nemours, Inc.

- Hitachi Chemical Co., Ltd.

- Henkel AG & Co. KGaA

- Shin-Etsu Chemical Co., Ltd.

- JSR Corporation

- Tokyo Electron Limited

- Air Products and Chemicals, Inc.

- Covestro AG

- Mitsubishi Chemical Corporation

- Wacker Chemie AG

Table Information

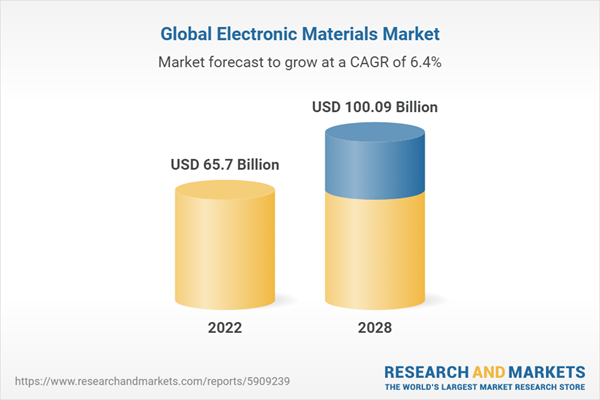

| Report Attribute | Details |

|---|---|

| No. of Pages | 171 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 65.7 Billion |

| Forecasted Market Value ( USD | $ 100.09 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |