Speak directly to the analyst to clarify any post sales queries you may have.

A clear and authoritative orientation to electrophoresis reagents that frames their technical role, operational importance, and evolving expectations across modern laboratory workflows

Electrophoresis reagents are foundational consumables that enable separation, visualization, and characterization of nucleic acids and proteins across research, clinical, and forensic contexts. These reagents encompass agarose and polyacrylamide matrices, buffer systems, stains, molecular weight ladders, and pre-formulated kits that together determine resolution, reproducibility, and throughput for laboratory assays. As laboratories pursue higher analytical fidelity and accelerated workflows, reagents increasingly influence downstream data quality, instrument utilization, and assay cost structures.Across academic, clinical, and industrial laboratories, reagent selection is driven by trade-offs between sensitivity, convenience, and compatibility with automated platforms. Recent advances have extended the functional capabilities of reagents, including enhanced staining chemistries for lower detection limits, stabilized buffer formulations for longer shelf life, and pre-cast formats that reduce hands-on preparation time. Consequently, procurement strategies and inventory management practices are evolving in parallel, as organizations balance just-in-time supply models with the need for validated, reproducible reagents that support regulatory and accreditation requirements.

In this report, emphasis is placed on understanding how reagent characteristics intersect with applications such as genomics and proteomics, the operational demands of high-throughput workflows, and the resilience of global supply chains. By situating reagent innovation within the broader laboratory ecosystem, readers will gain a pragmatic view of where incremental technical improvements translate into meaningful operational and clinical benefits.

A nuanced assessment of how automation, reagent chemistry advances, safety priorities, and supply diversification are redefining reagent selection and laboratory workflows

The electrophoresis reagent landscape is undergoing transformative shifts driven by technological integration, reagent chemistry innovations, and heightened demands from clinical and regulatory stakeholders. First, the integration of automation and digital analytics is reshaping reagent requirements; pre-cast gels and standardized buffer systems are increasingly optimized for robotic platforms and image analysis pipelines, which reduces variability and accelerates throughput. Second, chemistry-level innovations such as next-generation staining reagents and stabilized formulations are extending the functional lifespan of consumables and improving signal-to-noise ratios for low-abundance analytes.Third, there is a clear move toward modularization of assay components, with kits and combined reagent solutions simplifying workflow implementation for end users while facilitating quality control and traceability. At the same time, environmental and safety considerations are prompting the adoption of less hazardous alternatives to legacy reagents, influencing procurement policies in research institutions and clinical laboratories. Finally, strategic sourcing adaptations are emerging as manufacturers pursue regional manufacturing footprints and multi-supplier approaches to mitigate concentration risks in raw materials. Together, these trends are not isolated; rather, they compound to produce a market environment in which agility, compatibility with digital instruments, and demonstrable safety and performance characteristics are decisive factors for buyers.

A practical analysis of how recent United States tariff policies have reshaped sourcing strategies, inventory practices, and supplier relationships across the reagent value chain

In 2025 the United States implemented tariff measures and related trade policy adjustments that have had a cumulative impact on the electrophoresis reagents ecosystem, with implications for sourcing, cost structures, and strategic supply chain decisions. The immediate effect has been increased scrutiny of import-dependent inputs, prompting many buyers and suppliers to reassess supplier diversification and nearshore manufacturing options. For reagent producers that rely on specialty raw materials or polymer precursors sourced from affected regions, tariff-related cost pressures have amplified incentives to localize production or to negotiate supplier terms that insulate downstream customers from abrupt cost variability.Concurrently, laboratories that had operated under lean inventory models faced choices between absorbing higher per-unit costs or expanding stock holdings to buffer against future trade-induced volatility. This shift in inventory strategy has introduced capital and storage considerations into reagent procurement decisions, particularly for larger clinical and industrial users who must maintain validated lots for regulatory compliance. In response, some manufacturers have introduced extended-dated reagent solutions, bundled service offerings, and subscription procurement models to smooth ordering cycles and provide predictable access despite external trade pressures.

Policy-driven tariffs have also accelerated supplier consolidation in certain segments where scale economies provide bargaining power to absorb or mitigate duties. As a result, buyers are prioritizing suppliers that demonstrate transparent supply chains, local warehousing options, and proven quality systems. Importantly, the tariff environment has stimulated strategic dialogues between procurement teams and R&D organizations to evaluate alternative chemistries and formulations that reduce dependency on constrained raw materials while maintaining analytical performance.

Integrated segmentation analysis explaining how reagent type, application, technology, end user profile, and product form collectively determine procurement and development priorities

Segmentation-based insights reveal distinct performance and adoption dynamics across reagent types, applications, technologies, end users, and forms. When viewing the market through reagent type, agarose gels-differentiated between high-resolution and standard grades-remain essential for routine nucleic acid separations while high-resolution formulations are increasingly preferred for demanding fragment analysis. Buffers and stains show divergent demand where buffer systems, loading dyes, and staining solutions each carry unique formulation and stability requirements that align with laboratory preferences for convenience versus customization. DNA ladders and markers, split between high molecular weight and low molecular weight standards, are evaluated primarily on sizing accuracy and lot-to-lot consistency, whereas polyacrylamide gels, encompassing native PAGE and SDS-PAGE variants, are assessed on resolution for protein separations and compatibility with downstream staining or transfer workflows.From an application perspective, clinical diagnostics, forensic analysis, genomics, and proteomics shape reagent feature priorities. Clinical diagnostics, with sub-focus areas such as hemoglobin variants and protein electrophoresis, demand validated reagents that support accreditation and reproducibility. Forensic analysis, comprising fingerprinting and STR analysis, prioritizes chain-of-custody ready formats and reagents that deliver consistent sensitivity. Genomics users working on DNA fragment analysis and RNA analysis require reagents that integrate with high-throughput sequencing preparatory steps, while proteomics applications including 2D electrophoresis and Western blotting emphasize stain sensitivity and transfer compatibility.

In terms of technology, capillary electrophoresis, gel electrophoresis, and isoelectric focusing impose different reagent specifications. Capillary electrophoresis variants such as CE-MS and CZE call for low-viscosity, highly pure polymer matrices and buffers optimized for electroosmotic control, while isoelectric focusing methodologies, including 2D-IEF and IEF strips, depend on ampholyte stability and strip uniformity. End user segmentation highlights divergent procurement behaviors: academic institutes often prioritize price and flexibility, biopharmaceutical companies and their CRO partners focus on lot traceability and scale, forensic laboratories insist on validated chain-of-custody consumables, and hospitals and diagnostic centers emphasize regulatory-compliant reagent solutions. Finally, form-based segmentation-kits, powders, and reagent solutions-shows a trend toward complete kits and pre-cast gel kits for users seeking reduced setup time, commodities like acrylamide and agarose powders for labs that require formulation control, and ready-to-use reagent solutions for operational simplicity and reduced preparation errors.

A regional perspective on how distinct regulatory environments, manufacturing footprints, and procurement behaviors influence reagent accessibility and adoption across global territories

Regional dynamics shape reagent availability, regulatory interactions, and technology adoption patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, demand is propelled by a strong concentration of clinical testing centers, biotechnology hubs, and forensic laboratories that require rapid access to validated reagent supplies and responsive distributor networks. This region also exhibits a pronounced appetite for workflow automation and bundled reagent-instrument solutions that streamline laboratory operations.The Europe, Middle East & Africa region presents a heterogeneous picture where regulatory stringency and sustainability mandates in parts of Europe encourage reformulation toward less hazardous reagents, while other markets within the region emphasize cost-effective solutions and regional manufacturing partnerships to improve access. Cross-border regulatory harmonization efforts and accreditation programs materially influence procurement timelines and supplier qualification processes.

Asia-Pacific continues to demonstrate robust adoption across research and clinical segments driven by expanding academic capacity, growing biopharmaceutical manufacturing, and increased public investment in genomic and diagnostic infrastructures. Local manufacturing capabilities are expanding in this region, which affects global sourcing patterns and provides alternative supply avenues for reagents and ancillary supplies. Across all regions, logistics considerations, customs processes, and regional supplier ecosystems are critical determinants of reagent lead times and long-term supplier selection.

Evaluative insight into how manufacturers and specialty firms are differentiating through product innovation, partnerships, regional capacity expansion, and quality-focused services

Key companies in the electrophoresis reagent space are differentiating through a combination of product innovation, strategic partnerships, and expanded service offerings. Market leaders are investing in higher-performance chemistries, pre-cast and kit formats that reduce hands-on time, and compatible reagents designed for integration with automation and imaging platforms. These investments are complemented by expanded quality systems, such as enhanced lot documentation and extended stability testing, which support adoption in regulated environments.Strategic partnerships between reagent producers and instrument manufacturers underscore a growing preference for ecosystem solutions that optimize end-to-end workflows. In parallel, select companies are building regional production and distribution capabilities to shorten lead times and reduce tariff exposure. Mergers and acquisitions remain a tactical route for firms seeking to broaden their portfolios, gain access to niche chemistries, or secure raw material sources, while alliances with academic networks provide a pipeline for early validation of novel formulations.

Smaller specialized firms continue to play a meaningful role by focusing on niche segments-such as high-resolution matrices, novel staining chemistries, or forensic-grade consumables-where deep application expertise and customized support are differentiators. Across the competitive landscape, companies that combine robust quality assurance, transparent supply chains, and responsive technical support are best positioned to meet the increasingly specific needs of clinical, forensic, and industrial end users.

Actionable strategic recommendations for reagent manufacturers to enhance interoperability, fortify supply chains, and deliver regulatory and operational support that accelerates adoption

Industry leaders should prioritize three strategic imperatives to maintain competitive advantage in electrophoresis reagents: product interoperability, supply chain resilience, and customer-centered regulatory support. First, designing reagents and kits that are interoperable with leading automation and imaging platforms reduces barriers to adoption and increases the likelihood of inclusion in standardized laboratory protocols. Emphasizing compatibility and providing clear integration guides will accelerate procurement decisions among high-throughput users.Second, strengthening supply chain resilience through diversified sourcing, localized manufacturing footprints, and buffer inventory strategies will mitigate exposure to trade policy shifts and raw material disruptions. Suppliers should invest in supplier qualification programs, dual-sourcing strategies for critical precursors, and transparent traceability systems that reassure institutional buyers and regulators. Third, expanding customer-facing regulatory support services and validation documentation will enhance trust among clinical and forensic customers who must meet stringent accreditation standards. Providing validated lot histories, stability data, and methodological support reduces internal validation burdens for buyers and shortens time-to-implementation.

Operationally, firms should pursue modular commercial models that include comprehensive kits, subscription-based procurement, and application-specific training to deepen customer relationships. From an R&D perspective, prioritizing safer chemistries and sustainable packaging will respond to evolving institutional procurement policies and environmental commitments. Together, these actions will improve market access, reduce friction in adoption, and create durable customer partnerships.

A transparent explanation of research design combining primary laboratory interviews, technical literature synthesis, and supplier validation to ensure credible and actionable findings

This report synthesizes primary interviews with technical leaders across academic, clinical, forensic, and industrial laboratories, supplemented by secondary research drawing on peer-reviewed literature, industry white papers, regulatory guidances, and product technical notes. Primary engagements included method development scientists, procurement managers, and quality assurance professionals who provided detailed insight into operational needs, validation constraints, and purchase drivers. Secondary sources were selected for technical rigor and included comparative analyses of reagent chemistries, instrument integration case studies, and materials on regulatory compliance for diagnostic and forensic applications.Analytical approaches combined qualitative thematic analysis with product capability mapping to highlight performance differentiators and supply chain risk nodes. Company profiles were developed through a combination of public filings, product catalogs, and direct supplier communications, while regional dynamics were assessed using import/export documentation, trade policy reviews, and logistics performance indicators. Throughout the methodology, care was taken to corroborate vendor claims with independent technical literature and laboratory practitioner testimony to ensure reliability. Limitations of the research and assumptions underpinning certain comparative assessments are documented in the methodological appendix to preserve transparency and enable readers to align findings with their institutional contexts.

A concise and compelling synthesis that ties reagent innovation, operational preparedness, and collaborative strategies to long-term laboratory resilience and value delivery

In conclusion, electrophoresis reagents sit at the intersection of technical performance, operational efficiency, and supply chain resilience, and decisions made by manufacturers and end users today will shape laboratory capabilities for years to come. The evolving landscape is characterized by greater demand for automation-compatible formulations, safer chemistries, and supply continuity solutions that reconcile cost pressures with the need for validated, traceable consumables. Organizations that align product design with instrument ecosystems, enhance transparency in sourcing, and provide tangible regulatory and technical support will capture the broadest set of opportunities.Moving forward, collaboration between reagent manufacturers, instrument vendors, and end users will be instrumental in scaling solutions that both improve analytical outcomes and reduce operational complexity. Strategic investments in regional capacity, standardized kit offerings, and modular commercial models will help organizations adapt to policy shifts and logistical constraints while preserving assay integrity. Ultimately, the most successful companies will be those that balance innovation with operational rigor and who can translate technical superiority into demonstrable, reproducible value for their customers.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Electrophoresis Reagents Market

Companies Mentioned

The key companies profiled in this Electrophoresis Reagents market report include:- Agilent Technologies, Inc.

- Anamed Elektrophorese GmbH

- Avantor Inc.

- Bio-Rad Laboratories, Inc.

- Biophoretics

- Byahut Scientico

- Chemenu Inc.

- Cleaver Scientific Ltd.

- Elabscience Biotechnology Inc.

- Euroclone S.p.A.

- Geno Technology, Inc.

- Guangzhou Dongsheng Biotech Co., Ltd.

- Helena Laboratories Corporation

- IBI Scientific

- Illumina, Inc.

- Lonza Group Ltd.

- Merck KGaA

- OPRL Biosciences Pvt.,Ltd.

- PerkinElmer, Inc

- Polysciences, Inc. by Ott Scientific Inc.

- Promega Corporation

- Sebia

- Spectrum Chemical Mfg. Corp.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

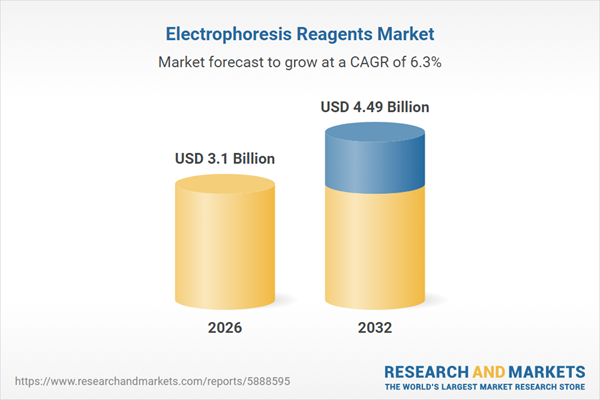

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 4.49 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |