Speak directly to the analyst to clarify any post sales queries you may have.

A concise strategic orientation to elemental analysis that clarifies technological roles, operational trade-offs, and decision-making priorities for laboratory and corporate leaders

Elemental analysis underpins a wide range of scientific, regulatory, and commercial activities, and this executive summary synthesizes pivotal developments shaping laboratory practice and market priorities. The discipline spans analytical techniques that determine elemental composition across materials and matrices, supporting quality assurance, compliance, research, and product development. Advances in instrument sensitivity, data analytics, and sample preparation have elevated expectations for throughput and trace-level accuracy, while persistent operational pressures demand pragmatic trade-offs between destructive and non-destructive approaches.In practice, stakeholders from academic laboratories to regulatory bodies require clarity on technology capabilities, comparative strengths, and workflow implications. This summary contextualizes current shifts in regulatory regimes, supply chains, and application demand, with a focus on practical implications for procurement, method selection, and laboratory design. It offers an integrated viewpoint that balances technical nuance with strategic priorities, enabling decision-makers to reconcile short-term operational needs with long-term investments in capability and compliance.

Throughout, emphasis is placed on cross-cutting themes-data integrity, instrument interoperability, workforce competence, and reproducibility-that influence the adoption trajectory of both established and emerging elemental analysis approaches. By articulating these patterns, the introduction sets the stage for deeper sections addressing landscape transformations, trade policy impacts, segmentation intelligence, regional distinctions, company dynamics, and recommended actions for leaders.

How converging advances in instrumentation, digital integration, sustainability, and workforce capability are reshaping laboratory investment priorities and testing workflows

The landscape of elemental analysis is evolving through coordinated advances in instrumentation, digital integration, and regulatory expectation that collectively reshape how laboratories operate and invest. Instrument manufacturers are refining sensor sensitivity and automation, while software ecosystems increasingly enable cloud-enabled workflows, remote monitoring, and enhanced data governance. Concurrently, laboratory managers are recalibrating procurement criteria to value lifecycle support, software upgradability, and vendor partnerships that extend beyond hardware delivery.Technological convergence is another powerful force: non-destructive spectroscopies are benefiting from algorithmic improvements in spectral deconvolution, while destructive techniques such as inductively coupled plasma mass spectrometry derive greater utility from streamlined sample introduction systems and miniaturized consumables. These advances drive new use cases and expand the feasible applications for elemental testing across complex matrices. Moreover, sustainability and safety considerations are prompting the adoption of lower-waste sample preparation methods and energy-efficient instrumentation, influencing total cost of ownership calculus.

Finally, the talent and training landscape is changing in parallel, with an increasing premium on multidisciplinary expertise that combines analytical chemistry with data science. Organizations that integrate instrument capability with data workflows and personnel development are positioned to capture the most value from technological shifts, turning capability upgrades into measurable improvements in throughput, reproducibility, and regulatory confidence.

Implications of 2025 tariff shifts that compel procurement teams to prioritize total landed cost, service continuity, and geographically diversified sourcing strategies

Tariff policy changes in 2025 have introduced a new set of considerations for procurement, vendor selection, and supply chain resilience in elemental analysis equipment and consumables. Increased duties on certain classes of imported instruments, components, and accessories can alter the relative cost advantage of competing suppliers, prompting procurement teams to reassess total landed cost rather than list price alone. This shift elevates the importance of geographically diversified sourcing and long-term service agreements that include predictable parts and consumable pricing.In response, many organizations are revisiting procurement timelines and inventory strategies to mitigate near-term exposure to price volatility. Capital expenditure plans have been adjusted to factor in extended lead times and potential duty-related surcharges, with a growing emphasis on modular systems and upgradeable architectures that defer full replacements. Service and maintenance contracts are gaining salience as instruments age and replacement becomes costlier under new tariff regimes.

Moreover, the tariffs accelerate regional supply chain strategies, encouraging partnerships with local distributors and certified service providers to ensure continuity and compliance. For laboratories with mission-critical throughput, the focus has shifted toward contractual guarantees for uptime and parts availability. Collectively, these dynamics are reshaping commercial conversations around value, trust, and long-term vendor relationships rather than purely transactional equipment pricing.

Segment-driven clarity that aligns element type, analytical category, and technology choices with application demands and user expectations to optimize laboratory capability selection

Insight into segmentation helps organizations align technology choices and operational design with analytical needs across differing material types and use cases. When considering element type, analytical pathways diverge: inorganic analyses typically prioritize metals and mineral matrices requiring high-throughput digestion and plasma-based detection, whereas organic element determinations demand methods that accommodate complex carbon-based matrices and potential interferences, informing sample prep and detector selection.Category distinctions between qualitative analysis and quantitative analysis frame how laboratories structure workflows and validation protocols. Qualitative approaches are frequently used for screening and identification, guiding initial decision gates, while quantitative approaches underpin regulatory compliance and product specifications that require rigorous calibration, uncertainty assessment, and inter-laboratory comparability. These categories influence instrumentation choice, method validation burden, and documentation practices.

Technology segmentation further clarifies capability trade-offs. Destructive technologies, including combustion analysis, ICP-MS, and ICP-OES, offer deep sensitivity and elemental coverage suited for trace-level quantitation and complex matrices, though they require consumables and sample preparation workflows that increase per-sample cost. Non-destructive technologies, such as Fourier transform infrared spectroscopy and X-ray fluorescence, preserve samples and speed throughput, making them attractive for screening, in-field testing, and quality control where rapid feedback is paramount.

Application-focused segmentation emphasizes end-use constraints and performance criteria. Environmental testing requires robust detection limits and regulatory traceability, food and beverage testing prioritizes matrix-specific extraction and contamination control, geology demands ruggedized sample handling and mineral identification capabilities, and life sciences places a premium on trace purity, biocompatibility assessment, and documentation for clinical or research contexts. End-users span academic and research institutions, government laboratories, manufacturers, and pharmaceutical and biotech companies, each bringing distinctive procurement cycles, validation needs, and support expectations that shape long-term vendor relationships. Distribution channels range from offline, where hands-on demonstrations and local service create competitive advantage, to online channels that accelerate procurement but necessitate enhanced digital documentation and remote onboarding services.

Regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific that dictate differentiated adoption patterns, validation needs, and commercial models

Regional dynamics exert a pronounced influence on technology adoption, regulatory priorities, and commercial models in elemental analysis, requiring differentiated strategies across geographies. In the Americas, demand is anchored by a mix of industrial testing, environmental monitoring, and advanced research, with strong emphasis on compliance frameworks and a mature service ecosystem that supports instrument uptime and method validation. Market participants in this region often prioritize robust support networks and certifications that align with national and state-level regulatory regimes.Europe, Middle East & Africa presents a diverse palette of regulatory regimes and investment climates. Western Europe emphasizes sustainability, energy efficiency, and harmonized standards, which inform procurement criteria and lifecycle assessments. The Middle East shows increasing investment in resource characterization and petrochemical testing, driving demand for ruggedized analytical platforms and high-throughput workflows. In Africa, testing needs are expanding alongside infrastructural investment, and opportunities exist for portable, cost-effective solutions that address mineral exploration and environmental monitoring.

Asia-Pacific is characterized by rapid industrialization, significant investment in manufacturing quality control, and expanding research capacity. This region demonstrates a heightened appetite for automation, digital integration, and localized service offerings to support high-volume production testing. Across all regions, successful vendors tailor commercial models to local validation requirements, provide accessible training, and build regional spare-parts networks to minimize downtime and foster long-term customer relationships.

Competitive differentiation driven by integrated instrumentation, software-enabled service models, regional support infrastructures, and sustainability commitments that influence purchasing decisions

Competitive dynamics in elemental analysis are shaped by a combination of product breadth, application-specific expertise, global service reach, and digital capability. Leading suppliers differentiate themselves through integrated solutions that combine high-performance instrumentation with robust software toolsets for data integrity, audit trails, and remote diagnostics. Partnerships with academic institutions and regulatory bodies also reinforce credibility, enabling vendors to co-develop methods that anticipate compliance requirements.Service excellence has emerged as a major differentiator. Organizations increasingly evaluate vendors on their ability to provide rapid parts replacement, certified training, and method-transfer support that reduces validation time. Companies that invest in regional service centers and spare parts inventories gain advantage in markets where uptime is mission-critical. Additionally, firms that offer modular, upgradeable platforms allow laboratories to extend asset life and adapt to evolving analytical needs without wholesale equipment replacement.

Strategic alliances and channel strategies further influence competitive positioning. Vendors leveraging well-established distribution networks alongside digital sales channels can reach a broader customer base while providing localized technical support. Forward-looking companies are also embedding sustainability credentials and lifecycle assessments into their value propositions, reflecting buyer interest in energy efficiency, waste reduction, and lower environmental impact of analytical operations.

Actionable priorities for industry leaders that align capital planning, vendor evaluation, workforce development, supply chain resilience, and sustainability into a cohesive operational strategy

Leaders in industry must adopt a holistic approach to align capability upgrades with operational priorities and regulatory obligations. First, investments should prioritize systems that balance analytical performance with flexible lifecycle pathways, enabling incremental upgrades rather than full replacements. This approach reduces capital strain and preserves institutional knowledge tied to existing workflows. Second, companies should formalize vendor evaluation criteria that weight service responsiveness, spare-parts availability, and software support as heavily as initial equipment pricing, thereby protecting throughput and reducing validation burden.Workforce development is equally important; organizations should invest in cross-disciplinary training that combines analytical technique mastery with data literacy and quality systems understanding. By fostering internal capability to manage both instrumentation and data workflows, laboratories can accelerate method development and enhance reproducibility. Moreover, leaders should engage in proactive supply chain planning, diversifying sourcing and negotiating service-level agreements that secure parts and consumables under changing trade conditions.

Finally, executives should embed sustainability and risk management into procurement decisions by assessing energy consumption, waste generation, and end-of-life options alongside analytical performance. By integrating these elements into capital planning, organizations can advance both operational resilience and environmental stewardship, creating measurable benefits for stakeholders and customers.

A methodological summary detailing how expert interviews, technical literature, and practical validation informed action-oriented insights and clarified evidence limitations

The research approach underpinning this summary combined qualitative expert engagement with systematic review of technical literature, product specifications, regulatory guidance, and observable commercial practices to derive insights that are operationally relevant. Primary inputs included structured interviews with laboratory directors, procurement specialists, and application scientists, which provided perspective on instrument performance in real-world workflows and the practical constraints of method validation and maintenance.Secondary sources were used to triangulate vendor positioning, technology capability, and service model trends. These included technical white papers, regulatory documents, and publicly available specifications that inform the comparative assessment of destructive and non-destructive technologies. Attention was paid to consistency of claims across multiple independent sources and to field reports that highlight operational variability in different application domains.

Analytical synthesis emphasized transparency in assumptions and limitations, clarifying where inference was based on observable practices versus where it relied on expert judgment. The methodology prioritized actionable interpretation over speculative projection, delivering guidance that supports procurement decisions, laboratory optimization, and strategic planning while acknowledging areas where further primary study would add precision.

Concluding synthesis emphasizing the need to reconcile technological capability, operational resilience, regional nuance, and policy impacts to sustain reliable analytical outcomes

In conclusion, elemental analysis is at an inflection point where technological refinement, digital integration, and external policy pressures combine to reshape laboratory strategy and vendor relationships. Decision-makers must balance analytical performance with operational realities-serviceability, data governance, and sustainability-to ensure that investments translate into reliable, reproducible outputs. The interplay between destructive and non-destructive approaches, coupled with segmentation by element type, application, and end-user expectations, underscores the need for nuanced procurement frameworks and lifecycle thinking.Regional nuance and trade policy developments add further complexity, compelling organizations to adopt diversified sourcing strategies and to prioritize vendors with strong regional support networks. Competitive advantage accrues to suppliers and laboratories that can operationalize software-enabled workflows, offer modular upgrade paths, and provide demonstrable service commitments. Ultimately, the ability to convert technical capability into consistent, auditable outcomes will distinguish resilient laboratories from those that struggle with scalability and regulatory compliance.

These conclusions are intended to guide leaders in allocating resources, shaping procurement practices, and enhancing operational resilience so that elemental analysis continues to deliver scientific rigor and commercial value across a spectrum of applications.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Elemental Analysis Market

Companies Mentioned

The key companies profiled in this Elemental Analysis market report include:- Agilent Technologies Inc.

- Analytik Jena by Endress+Hauser Group

- Applied Spectra, Inc.

- Bruker Corporation

- CatSci Ltd.

- Changsha Kaiyuan Instruments Co., Ltd.

- Clariant AG

- Elemental Microanalysis

- Elementar

- ELTRA GmbH

- Eurofins Scientific SE

- Hitachi, Ltd.

- HORIBA, Ltd.

- Intertek Group PLC

- Jordi Labs

- Malvern Panalytical Ltd by Spectris PLC

- Merck KGaA

- Metrohm AG

- Mettler Toledo

- PerkinElmer, Inc.

- Rigaku Holdings Corporation

- Shimadzu Corporation

- SPECTRO Analytical Instruments

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | January 2026 |

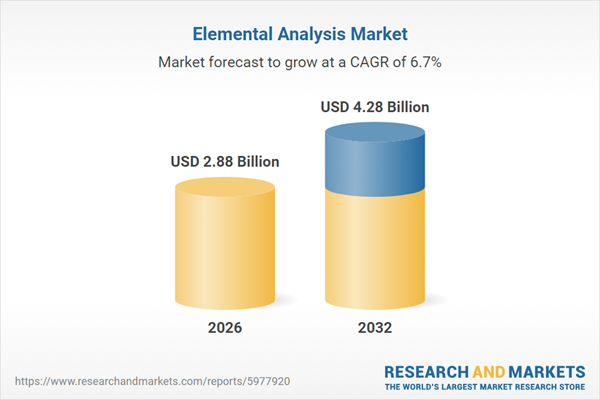

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 2.88 Billion |

| Forecasted Market Value ( USD | $ 4.28 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |