Speak directly to the analyst to clarify any post sales queries you may have.

An integrative overview of energy logistics strategic context highlighting operational pressures and pathways for resilient network modernization

The global energy logistics landscape sits at the intersection of accelerating decarbonization, evolving trade patterns, and infrastructure modernization. This introduction synthesizes the strategic context that shapes provider and shipper decisions across fossil fuels, natural gas, refined products, and emerging low-carbon carriers. It situates operational challenges-such as throughput constraints, regulatory complexity, and modal integration-within the broader trajectory of supply chain resilience and commercial competitiveness.In recent years, network operators and commodity handlers have balanced legacy asset utilization with investments in flexibility and safety. At the same time, demand-side transformation and policy shifts are altering flows and asset lifecycles, requiring a recalibration of asset deployment and contractual arrangements. The intent of this executive summary is to present an integrated view of these dynamics, highlight pivotal structural shifts, and translate insights into pragmatic actions for executives responsible for network planning, commercial strategy, and capital allocation.

By foregrounding operational friction points alongside emerging opportunities, this section prepares leaders to interpret the deeper analyses that follow and to prioritize interventions that preserve continuity of supply while enabling strategic transitions. The following pages frame the immediate imperatives and long-run strategic considerations that should guide board-level and operational planning.

How technological adoption, policy shifts, and changing trade dynamics are jointly reshaping energy logistics networks and competitive business models

Energy logistics is undergoing transformative shifts driven by converging technological, regulatory, and market forces that reconfigure how energy is produced, moved, stored, and consumed. Electrification and the rise of low-carbon carriers are changing demand patterns for traditional fuels even as natural gas remains a flexible bridge fuel; concurrently, digitalization and remote monitoring are improving operational visibility and lowering the marginal cost of coordination across multimodal networks.Policy and geopolitical developments are reshaping trade corridors and influencing investment signals, prompting a re-evaluation of onshore and offshore pipeline priorities, as well as modal substitution between marine, rail, and road transport. Infrastructure resilience considerations-storm hardening, cyber protections, and redundancy planning-have become central to capital allocation decisions, while new business models such as asset-as-a-service and logistics aggregation platforms are emerging to capture value from fragmented supply chains.

Taken together, these transformative shifts require logistics leaders to adopt flexible asset strategies, integrate advanced analytics into planning cycles, and deepen partnerships across the value chain to manage transition risks and commercial volatility. The net effect is a landscape in which adaptability, interoperability, and strategic foresight determine competitive advantage.

Assessing how new U.S. tariff measures in 2025 compel strategic rerouting, contractual recalibration, and accelerated nearshoring in energy supply chains

The introduction of tariffs and trade measures by the United States in 2025 has created material implications for routing decisions, modal economics, and contract structures across energy logistics ecosystems. Tighter trade barriers influence the relative attractiveness of import-dependent supply chains and prompt shippers and operators to reassess long-haul maritime routes versus regional sourcing and processing, thereby altering throughput patterns at hubs and terminals.Tariff-driven cost differentials incentivize nearshoring and the development of inland logistics capacity, particularly for refined products and intermediate feedstocks where cost-to-serve becomes a decisive factor. In response, operators are reallocating capacity toward markets with more predictable trade terms and are renegotiating long-term logistics contracts to incorporate tariff contingencies and force majeure clauses that specifically address trade policy volatility.

Moreover, tariff policy interacts with regulatory standards and environmental compliance in ways that can accelerate supply chain reconfiguration. This has led to increased capital discipline around cross-border assets, renewed focus on customs and compliance capabilities, and a proliferation of scenario-based planning to preserve continuity under alternative trade regimes. Ultimately, the 2025 tariff landscape has underscored the need for operational flexibility, strategic buffer capacity, and contractual sophistication to manage persistent policy uncertainty.

A detailed segmentation framework revealing distinct operational requirements and value levers across energy sources, modes, services, and end-use industries

Segmentation provides a structured lens to evaluate where value, risk, and friction are concentrated across the energy logistics continuum. Based on Energy Source the analysis differentiates Coal, which is examined across Metallurgical Coal and Thermal Coal; Natural Gas, studied through Dry Gas, LNG, and NGL; Petroleum, assessed across Crude Oil and Refined Products; and Renewables, considered through Biofuels and Hydrogen. These distinctions are crucial because handling, storage, regulatory requirements, and modal preferences vary substantially between metallurgical coal shipments and hydrogen carriers, for example, affecting terminal design and safety protocols.Based on Transportation Mode the study contrasts Air with its Air Cargo use cases, Marine with Barges and Tankers, Pipeline with Offshore and Onshore configurations, Rail with Rail Tank Cars and Unit Trains, and Road with ISO Containers and Tanker Trucks, recognizing that modal choice drives lead times, unit economics, and risk exposure. Based on Service Type the research examines Handling with Loading/Unloading and Transshipment activities, Storage with Tank Storage and Underground Caverns, Transportation as an end-to-end function, and Value Added Services with Blending and Quality Analysis to understand how margins are captured beyond pure transport.

Based on End Use Industry the segmentation tracks Commercial, Industrial, Power Generation, Residential, and Transportation demand centers to identify differences in contract tenor, reliability expectations, and regulatory exposure. By integrating these segmentation lenses, stakeholders can pinpoint which asset classes and service offerings will need targeted innovation to meet evolving customer needs and regulatory constraints.

Comparative regional dynamics and infrastructure imperatives that drive differentiated logistics strategies across Americas, EMEA, and Asia-Pacific geographies

Regional dynamics create differentiated operational challenges and investment priorities that influence how logistics networks are configured and governed. In the Americas, energy corridors are shaped by continental pipeline networks, extensive inland barge systems, and a growing emphasis on export capacity for natural gas and refined products, which in turn affects terminal throughput patterns and intermodal connectivity priorities. Policymaking in the region frequently emphasizes energy security and export facilitation, leading to an emphasis on cross-border interoperability and regulatory harmonization.Europe, Middle East & Africa present a mosaic of legacy pipeline infrastructure, strategic maritime chokepoints, and diverse regulatory regimes. In this region, capacity management and geopolitical sensitivity are paramount, with a premium on flexibility and insurance-backed risk mitigation for long-distance maritime shipments. Infrastructure modernization and decarbonization goals coexist with aging assets that require selective renewal, so public-private partnerships and coordination across national jurisdictions often determine project viability.

Asia-Pacific is characterized by rapid demand growth in industrial and power generation sectors, major seaborne trade flows for crude and LNG, and accelerated deployment of storage and port capacity. Supply chain integration, digitalized operations, and investments in large-scale terminal infrastructure are primary responses to density-driven economies of scale. Across all regions, cross-border trade dynamics, climate resilience, and local regulatory regimes shape capital allocation and operational priorities, but the common thread is the need for adaptive, regionally informed strategies.

Competitive maneuvers and capability builds by major operators and innovative providers that are reshaping service offerings and strategic positioning

Key companies in the energy logistics space are deploying varied strategies to preserve operational continuity while pursuing growth in adjacent low-carbon markets. Large integrated operators and terminal owners are investing in multimodal connectivity, digital asset management, and strategic partnerships with carriers and shippers to secure long-term throughput. These firms focus on optimizing utilization of onshore and offshore pipelines, expanding tank storage capabilities, and retrofitting terminals to handle a broader slate of products, including biofuels and hydrogen-ready infrastructure.Emerging logistics platforms and niche service providers are capitalizing on demand for value-added services such as blending, quality analysis, and just-in-time delivery models, thereby increasing the margin potential of traditionally commodity-based operations. Rail and road carriers are enhancing fleet safety and compliance programs to meet stricter regulatory regimes, while marine operators are investing in fleet efficiency and port-call optimization to reduce turnaround times.

Across owners, operators, and service specialists, strategic themes include bundling of services to create stickier customer relationships, selective asset divestiture to concentrate on core capabilities, and proactive engagement with regulators to shape practical safety and environmental standards. Competitive differentiation is increasingly tied to digital capability, contract flexibility, and the ability to execute complex cross-border logistics under evolving trade and climate policies.

Practical strategic imperatives and capital allocation priorities to strengthen resilience, capture service margin, and enable transition-readiness within logistics operations

Industry leaders should prioritize a set of actionable initiatives that strengthen resilience, unlock value, and position organizations for the low-carbon transition. First, invest in modular infrastructure and flexible storage solutions that allow rapid repurposing across product types and enable faster responses to demand shifts. Complement these physical investments with digital twins and advanced analytics to reduce downtime, improve scheduling, and enhance predictive maintenance, thereby increasing throughput efficiency and reducing operational risk.Second, renegotiate commercial contracts to incorporate tariff and regulatory contingencies, adopt dynamic pricing where feasible, and expand service bundles that capture end-to-end customer needs. Third, accelerate collaboration across the value chain through joint ventures, shared terminal access agreements, and standardized interoperability protocols for data and safety, which reduce duplication and create scale efficiencies. Fourth, implement robust scenario planning and stress testing to evaluate exposure to policy shocks, trade disruptions, and extreme weather events, and allocate capital with an eye toward optionality and staged commitments.

Finally, embed decarbonization pathways into capital planning by piloting hydrogen-ready facilities, low-emission modal corridors, and sustainable fuel handling capabilities, while ensuring that workforce development and safety programs evolve in parallel to support new operational requirements. These actions will enable organizations to navigate near-term disruption and capture structural advantages as the industry evolves.

A rigorous mixed-methods approach combining stakeholder interviews, operational validation, and scenario analysis to produce actionable insights for energy logistics decision-makers

The research methodology underpinning this executive summary blends primary engagement with industry stakeholders, rigorous secondary-source synthesis, and scenario-driven analysis to ensure robustness and relevance. Primary inputs include structured interviews with network operators, terminal managers, logistics service providers, and regulatory officials to capture operational realities, pain points, and near-term investment priorities. These qualitative engagements are complemented by site visits and operational audits where feasible to validate assumptions about throughput constraints and asset condition.Secondary analysis leverages publicly available regulatory filings, shipping and customs data, modal performance statistics, and technology adoption indicators to contextualize primary findings and identify emerging patterns. Scenario analysis explores alternative trade policy pathways, demand elasticity shifts across end-use segments, and technology adoption rates to stress-test strategies and reveal contingencies. Cross-validation techniques ensure that thematic conclusions are consistent across independent data sources and stakeholder perspectives.

Finally, findings are synthesized into actionable insights through iterative review with practitioner advisors, refining recommendations for operational, commercial, and investment audiences. This transparent methodological approach ensures that conclusions are both empirically grounded and operationally implementable.

A synthesized strategic mandate emphasizing flexibility, interoperability, and staged investment to preserve continuity and capture transition opportunities

The conclusion synthesizes the imperative that energy logistics stakeholders must act decisively to balance near-term reliability with long-term transformation. Operational flexibility, digital capability, and contractual sophistication emerge as recurring themes that determine whether firms can absorb policy shocks, shifting demand patterns, and modal disruptions. Investments in adaptable infrastructure and enhanced interoperability pay dividends by enabling rapid reallocation of flows and by reducing the friction of modal substitution.Regulatory and tariff volatility underline the need for scenario-based capital planning and an emphasis on modular, stage-gated investments that preserve optionality. At the same time, decarbonization objectives present both risks to incumbent business models and opportunities for differentiated service offerings, such as hydrogen handling and biofuel blending services. Companies that integrate environmental pathways into core logistics planning will be better positioned to win longer-term contracts and to access emerging markets.

Ultimately, the strategic priority is to develop cohesive roadmaps that align physical assets, digital platforms, and commercial models to navigate a period of sustained change. By doing so, organizations can secure operational continuity, protect margins, and create the foundations for growth in a lower-carbon energy system.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Energy Logistics Market

Companies Mentioned

The key companies profiled in this Energy Logistics market report include:- AET

- Agility Logistics

- Bolloré Logistics

- BP PLC

- Buckeye Partners L.P.

- C.H. Robinson

- CEVA Logistics

- Cheniere Energy, Inc.

- Chevron Corporation

- COSCO Shipping Lines

- DB Schenker

- DHL Global Forwarding

- Enbridge Inc.

- Energy Transfer LP

- Enterprise Products Partners L.P.

- Essar Shipping Ports & Logistics Ltd.

- Expeditors International

- ExxonMobil Corporation

- GAC Group

- Kinder Morgan, Inc.

- Kuehne + Nagel

- Maersk

- Mediterranean Shipping Company

- Mitsubishi Logistics

- MPLX LP

- Nakilat

- Plains All American Pipeline, L.P.

- Royal Dutch Shell plc

- TC Energy Corporation

- The Williams Companies, Inc.

- Tidewater Inc.

- Vitol

- XPO Logistics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | January 2026 |

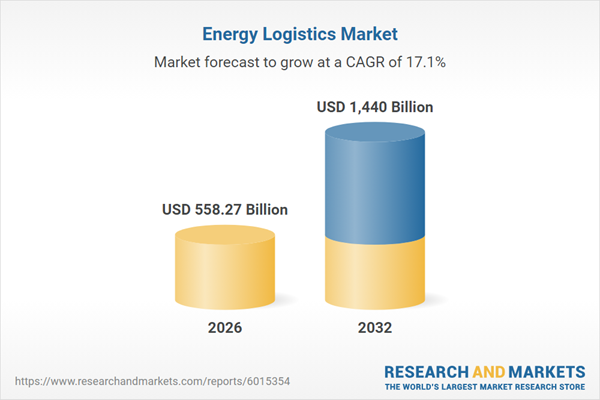

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 558.27 Billion |

| Forecasted Market Value ( USD | $ 1440 Billion |

| Compound Annual Growth Rate | 17.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 34 |