Global Automotive Connecting Rods Market - Key Trends & Drivers Summarized

Why Are Connecting Rods Vital to Automotive Engine Performance?

Connecting rods are a critical component in internal combustion engines, playing a pivotal role in transferring motion between the piston and the crankshaft. These rods are responsible for converting the linear motion of the piston into the rotational motion required to power the vehicle. Given their essential function, the performance and durability of connecting rods directly impact engine efficiency, power output, and fuel economy. As the automotive industry moves towards more efficient and compact engines, the demand for high-performance connecting rods continues to grow. Additionally, the shift towards turbocharged and downsized engines has further highlighted the importance of robust connecting rods. These engines operate at higher pressures and temperatures, necessitating the use of advanced materials and designs to withstand the stress. Innovations in forged and powdered metal connecting rods have enhanced their strength-to-weight ratios, contributing to improved engine reliability and reduced vibrations. As a result, manufacturers are increasingly focusing on developing lightweight yet durable connecting rods to meet the evolving demands of modern engines.How Are Technological Advancements Transforming Connecting Rod Designs?

The automotive connecting rods market is experiencing significant technological advancements aimed at enhancing performance and reducing environmental impact. One of the key trends is the adoption of lightweight materials such as aluminum alloys, carbon composites, and titanium. These materials reduce the overall weight of the connecting rods without compromising their strength, resulting in better fuel efficiency and reduced emissions. Additionally, advancements in manufacturing techniques, such as precision forging and powder metallurgy, have enabled the production of connecting rods with superior mechanical properties and tighter tolerances. Hybrid engines and electric vehicles (EVs) are also influencing connecting rod design. While EVs do not require traditional connecting rods, the rise of hybrid powertrains has created a niche demand for customized solutions. These powertrains require connecting rods that can handle the unique load and stress conditions of hybrid engines. Furthermore, digital tools such as computer-aided design (CAD) and finite element analysis (FEA) are being extensively used to optimize connecting rod geometry, enhancing their performance and durability while reducing production costs.What Regional Trends Are Shaping the Connecting Rod Market?

The demand for automotive connecting rods varies significantly across regions due to differences in automotive production, fuel efficiency standards, and consumer preferences. Asia-Pacific dominates the market, driven by the rapid growth of the automotive industry in countries like China, India, and Japan. The region is home to some of the largest automotive manufacturers and benefits from a robust supply chain for raw materials and components. Additionally, rising disposable incomes and urbanization are fueling vehicle ownership in these countries, creating a strong demand for connecting rods. North America and Europe are also key markets, primarily due to their focus on high-performance vehicles and stringent emission norms. These regions emphasize the adoption of lightweight and advanced materials in engine components to comply with regulatory standards. Meanwhile, Latin America and the Middle East are witnessing steady growth due to increasing automotive production and rising investments in manufacturing facilities. The global push towards green mobility and the adoption of hybrid vehicles are further influencing the dynamics of the connecting rod market in these regions.What Is Driving Growth in the Automotive Connecting Rods Market?

The growth in the automotive connecting rods market is driven by several factors, including advancements in engine technologies, the increasing demand for lightweight and durable components, and rising automotive production. Manufacturers are focusing on developing high-performance connecting rods that can withstand the higher pressures and temperatures of turbocharged and downsized engines. The adoption of lightweight materials such as aluminum alloys and titanium is further driving market growth by enabling better fuel efficiency and compliance with emission standards. The shift towards hybrid powertrains has also created a demand for specialized connecting rods capable of meeting the unique requirements of these systems. Additionally, consumer preferences for fuel-efficient and high-performance vehicles are pushing automakers to invest in innovative connecting rod designs. Regional factors, such as the growth of the automotive industry in Asia-Pacific and the adoption of stringent emission norms in North America and Europe, are further contributing to market expansion. These trends collectively position automotive connecting rods as a critical component in shaping the future of engine technologies.Report Scope

The report analyzes the Automotive Connecting Rods market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Steel Material, Aluminum Material, Titanium Material, Composite Materials, Other Materials); Sales Channel (OEM Sales Channel, Aftermarket Sales Channel); Vehicle Type (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Steel Material segment, which is expected to reach US$24.0 Billion by 2030 with a CAGR of a 3.9%. The Aluminum Material segment is also set to grow at 3.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.8 Billion in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $9.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Connecting Rods Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Connecting Rods Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Connecting Rods Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bosch Mobility Solutions, Continental Engineering Services GmbH, Forvia SE, Foryou Corporation, FPT Software Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Automotive Connecting Rods market report include:

- AECO Engineering LLP (AGRA Engineering Co.)

- Albon Engineering & Manufacturing Plc

- Arrow Precision Engineering Ltd.

- Boostline

- CP-Carrillo

- Lion Engineering

- MAHLE GmbH

- Pauter Machine Co.

- Revent Precision Engineering Limited

- Wiseco

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AECO Engineering LLP (AGRA Engineering Co.)

- Albon Engineering & Manufacturing Plc

- Arrow Precision Engineering Ltd.

- Boostline

- CP-Carrillo

- Lion Engineering

- MAHLE GmbH

- Pauter Machine Co.

- Revent Precision Engineering Limited

- Wiseco

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

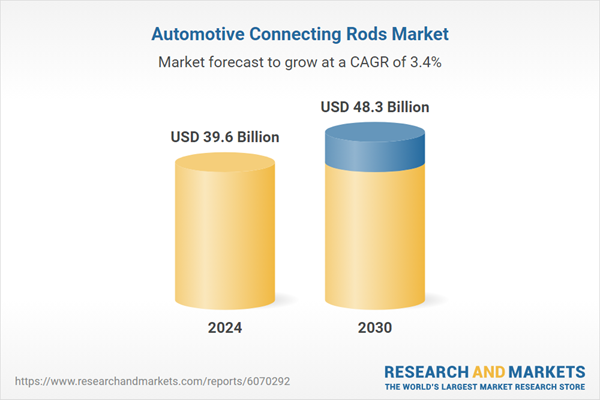

| Estimated Market Value ( USD | $ 39.6 Billion |

| Forecasted Market Value ( USD | $ 48.3 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |