Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive orientation to ethyl formate covering its chemical attributes, multi-industry relevance, supply chain inflection points, and sustainability implications

Ethyl formate occupies a distinct position as a versatile solvent, flavoring agent, and chemical intermediate, and its role in contemporary industrial and consumer applications warrants focused examination. The compound’s physicochemical properties and relative biodegradability have increased its appeal across multiple end-use sectors, prompting stakeholders to reassess supply chains, sourcing strategies, and regulatory compliance measures.This introduction frames key considerations for procurement teams, regulatory affairs professionals, and product development groups by outlining the compound’s primary types, grades, manufacturing routes, and application pathways. By synthesizing recent shifts in raw material availability and production technology, the section sets a foundation for deeper analysis that follows. Moreover, it highlights the importance of integrating sustainability criteria, occupational safety protocols, and traceability mechanisms into commercial decisions to enhance resilience and market acceptance.

Evolving regulatory pressures, technological advancements, and shifting end-user preferences that are reshaping production approaches, sustainability priorities, and supply chain relationships

Recent years have seen transformative shifts in the ethyl formate landscape driven by converging regulatory, technological, and demand-side forces. Regulatory frameworks have tightened around solvent emissions and product labeling, nudging manufacturers toward cleaner production practices and more transparent supply chains. Concurrently, manufacturers are differentiating product portfolios by emphasizing provenance and environmental attributes, which influences procurement preferences and fosters closer collaboration between suppliers and end users.On the technology front, advances in catalytic processes and process intensification have improved selectivity and energy efficiency, enabling some producers to lower operational footprints while maintaining output quality. At the same time, downstream end users are innovating in formulation design; flavor houses and fragrance developers are leveraging ethyl formate’s sensory profile while adapting concentrations and delivery formats to meet evolving consumer safety expectations. Finally, sustainability narratives and circularity considerations are reshaping commercial conversations, prompting value chain actors to evaluate lifecycle impacts and adopt measurable sustainability goals.

Assessment of the cumulative operational and procurement impacts resulting from the United States tariffs introduced in 2025 and the resulting strategic adaptations across value chains

The tariffs introduced by the United States in 2025 have had a notable cumulative effect on procurement strategies, cost structures, and trade flows across ethyl formate supply chains. Importers and domestic manufacturers have had to reassess sourcing geographies to mitigate elevated landed costs, while contract terms and lead-time buffers have been adjusted to absorb customs-related variability. As a result, purchasing teams have increased emphasis on supplier diversification, dual-sourcing arrangements, and localized inventories to manage exposure to tariff volatility.In parallel, some downstream formulators responded by reformulating products or shifting towards domestically produced inputs when feasible, while others absorbed incremental costs temporarily to maintain shelf pricing. Financial and operational planning horizons expanded as companies re-evaluated supplier contracts and logistics networks. Overall, the tariff environment catalyzed a strategic pivot toward greater supply chain resilience, tighter supplier qualification processes, and more rigorous scenario planning that considers policy-driven trade disruptions.

Granular segmentation analysis linking product types, grades, manufacturing routes, applications, and sales channels to strategic commercial and regulatory implications across supply chains

A nuanced segmentation analysis reveals meaningful differences in demand drivers, value propositions, and regulatory considerations across product types, grades, manufacturing processes, end-use applications, and sales channels. Based on Type, the market is studied across Natural Ethyl Formate and Synthetic Ethyl Formate, where natural variants often carry premium positioning for certain food and fragrance applications while synthetic routes remain dominant for large-scale industrial use. Based on Grade, the market is studied across Food Grade, Industrial Grade, and Pharmaceutical Grade, each of which requires distinct quality assurance frameworks, documentation, and handling protocols to satisfy end-user specifications and certifications. Based on Manufacturing Process, the market is studied across Carbon Monoxide Reaction and Esterification, with each route delivering different impurity profiles, raw material dependencies, and opportunities for process optimization.Based on Application, the market is studied across Agriculture, Flavoring Agent, Fragrances, and Pharmaceuticals. The Agriculture is further studied across Fungicides & Herbicides and Pesticide, reflecting the differentiated formulation chemistry and regulatory oversight in crop protection. The Flavoring Agent is further studied across Beverages and Confectionery, where sensory consistency and food-safety compliance are paramount. The Fragrances is further studied across Cosmetics and Personal Care, which emphasizes dermatological safety and regulatory labeling. The Pharmaceuticals is further studied across Chemical Intermediates and Solvent, highlighting stringent purity and documentation requirements for active pharmaceutical ingredient pathways. Based on Sales Channel, the market is studied across Offline Sales and Online Sales. The Offline Sales is further studied across Direct Sales and Distributors & Wholesalers, illustrating the coexistence of strategic direct partnerships for large-volume consumers and intermediary networks that serve smaller formulators and regional markets.

Taken together, these segmentation layers illustrate how product specification, certification demands, and go-to-market dynamics intersect to create differentiated commercial approaches. Consequently, companies must design quality systems, certification roadmaps, and channel strategies that align with the precise needs of each segment to optimize positioning and operational efficiency.

Comparative regional dynamics that explain how supply structures, regulatory regimes, and end-use demand differ across the Americas, Europe, Middle East & Africa, and Asia-Pacific and what that means for strategic planning

Regional dynamics shape supply availability, regulatory landscapes, and end-use demand patterns in distinct ways across the Americas, Europe, Middle East & Africa, and Asia-Pacific, necessitating tailored market approaches. In the Americas, proximity to key agricultural and beverage manufacturing hubs creates demand for both Food Grade and Industrial Grade ethyl formate, while evolving regulatory expectations require robust documentation and traceability. The region’s logistics infrastructure and established distributor networks support both direct sales and intermediary channels, enabling diverse procurement models.In Europe, Middle East & Africa, sustainability and safety regulations exert strong influence on product development and sourcing decisions, which encourages investment in cleaner manufacturing processes and certification schemes. Consumers in this combined region place a premium on provenance and regulatory compliance, driving manufacturers to prioritize higher-grade specifications for cosmetics and pharmaceuticals. Conversely, Asia-Pacific displays a complex mix of high-volume industrial demand and rapidly growing consumer applications in flavors and fragrances. Manufacturing capacity in Asia-Pacific benefits from integrated chemical value chains and cost-competitive feedstocks, yet buyers often require tight quality control and supply security assurances. Across these regions, transitional dynamics such as trade policy shifts, logistic chokepoints, and localized regulatory updates prompt continuous reassessment of regional strategies and reinforce the need for flexible sourcing and manufacturing footprints.

Corporate strategies and competitive behaviors that highlight investments in process excellence, quality assurance, channel management, and collaborative partnerships shaping the ethyl formate value chain

Leading chemical manufacturers, specialty solvent producers, and formulation houses play differentiated roles in the ethyl formate ecosystem, and competitive positioning increasingly hinges on operational reliability, quality systems, and value-added services. Key players are investing in process upgrades to improve energy efficiency and impurity control, while others focus on niche differentiation through certified natural sourcing or by targeting pharmaceutical-grade supply chains with enhanced documentation.Beyond production, distributors and logistics specialists contribute by providing inventory management, regulatory support, and rapid response capabilities that matter to formulators with tight production schedules. Strategic partnerships between producers and large end users have also become more common, fostering co-investment in capacity optimization and collaborative quality assurance programs. Together, these company-level behaviors emphasize the interplay between manufacturing excellence, channel management, and customer-centric service models as the core determinants of competitive advantage within the ethyl formate sector.

Actionable strategic recommendations for industry leaders to enhance supply chain resilience, optimize production practices, and align product portfolios with evolving regulatory and sustainability requirements

Industry leaders should adopt a pragmatic set of actions to strengthen resilience, capture differentiated value, and respond to regulatory and sustainability pressures. First, prioritize supplier diversification and structured qualification processes to mitigate trade disruption risk and ensure continuity of supply. Next, accelerate investments in process optimization and impurity control to meet stringent grade requirements and lower operational footprints, thereby improving compliance and cost predictability.Simultaneously, align product portfolios with end-user needs by developing certified Food Grade and Pharmaceutical Grade offerings and by exploring natural variants where appropriate. Enhance commercial agility by refining channel strategies that combine direct sales for large accounts with distributor-driven coverage for fragmented demand. Finally, embed lifecycle assessment and transparent sustainability reporting into corporate narratives to meet procurement-driven environmental criteria and to support long-term customer trust. Taken together, these measures will strengthen market positioning and enable organizations to capture strategic opportunities while navigating ongoing regulatory and trade complexities.

Transparent and reproducible research methodology combining stakeholder interviews, technical literature review, and cross-functional analysis to map production routes, quality systems, and channel dynamics

The research methodology integrates primary interviews, technical literature review, and cross-functional synthesis to produce an evidence-based perspective on ethyl formate market dynamics. Primary inputs included consultations with procurement managers, quality assurance professionals, process engineers, and formulation scientists to capture operational realities, certification requirements, and evolving application use-cases. These qualitative engagements were complemented by a systematic review of peer-reviewed chemical engineering literature, regulatory guidance documents, and industry white papers to validate technical pathways and impurity considerations.Analytical steps included comparative process mapping of Carbon Monoxide Reaction and Esterification routes, evaluation of grade-specific quality systems, and assessment of channel structures from direct sales to distributor networks. Wherever applicable, triangulation across multiple data sources ensured internal consistency and enhanced confidence in observed trends. The methodology emphasizes transparency, reproducibility, and a cross-disciplinary approach to reflect both the technical and commercial dimensions of the ethyl formate ecosystem.

Concluding synthesis that connects regulatory, technological, and commercial trends to practical strategic priorities for stakeholders engaged with ethyl formate across multiple end-use sectors

In conclusion, ethyl formate’s role across agriculture, flavoring, fragrances, and pharmaceutical applications underscores the compound’s strategic importance as both a functional ingredient and a manufacturing intermediate. Industry dynamics are currently shaped by tighter regulatory expectations, trade policy adjustments, and technological improvements that collectively push producers and end users toward greater resilience and higher quality standards. These forces, together with evolving sustainability preferences, create both operational challenges and commercial opportunities for incumbents and new entrants alike.Consequently, organizations that proactively strengthen supplier networks, invest in cleaner and more selective production processes, and align product portfolios with application-specific requirements will be better positioned to navigate complexity and to capture differentiated value. Ongoing attention to regulatory shifts, regional dynamics, and customer-driven specification changes will remain essential for sustained competitiveness and trusted market participation.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Ethyl formate Market

Companies Mentioned

- Advanced Biotech. Inc.

- Alpha Chemika

- Astrra Chemicals

- Aurochemicals

- Beetachem Industries by Rao A Group of Companies

- Berje Inc.

- ChemUniverse, Inc.

- Ernesto Ventós S.A.

- Fleurchem, Inc.

- Glentham Life Sciences Limited

- Intreso Group by Draslovka Holding A.S.

- Junsei Chemical Co.,Ltd.

- KANTO CHEMICAL CO.,INC.

- Linshu Huasheng Chemical Co.,Ltd.

- Loba Chemie Pvt. Ltd.

- M&U International LLC

- Merck KGaA

- NATIONAL ANALYTICAL CORPORATION

- Otto Chemie Pvt. Ltd.

- Riverside Aromatics Ltd.

- Santa Cruz Biotechnology, Inc.

- Spectrum Chemical

- SRS Aromatics Limited

- Sunaux International

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Treatt Plc

- Vigon International, Inc. by Azelis Group

- Zhengzhou Yibang Industrial Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

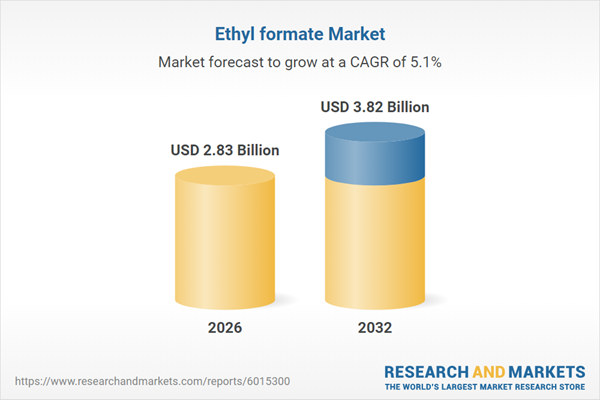

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 2.83 Billion |

| Forecasted Market Value ( USD | $ 3.82 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |