Increase in Livestock Production Drives Europe Feed Premix Market

Industrial livestock production has undergone a significant transformation owing to increasing demand for meat-based products and dairy products. Animal protein account for 16% of energy and 34% of the protein in human diets. Livestock production also accounts for ~19% of the value of food production and 30% of the global value of agriculture. The demand for livestock products is driven by changing lifestyles and food preferences, increasing urbanization, growing income, and the rapidly rising world population. With burgeoning livestock demand, the consumption of protein-rich meat products is surging. According to the Food and Agriculture Organization (FAO), worldwide meat protein consumption is predicted to increase by 14% by 2030. Additionally, world milk production is expected to rise by 1.6% annually between 2020 and 2029 and reach 997 million metric tons in 2029, according to a report by the Organization for Economic Co-operation and Development (OECD) and FAO. Thus, the increasing consumption of livestock products such as meat and increasing milk production has encouraged manufacturers to focus on providing good quality and nutrient rich feed for livestock. This drives the demand for feed premix as an additive among the feed manufacturers. The growth in livestock production is likely to create a demand for feed premixes to enhance the nutritional quality of feed, as people are highly concerned about the quality of meat they consume. Nutrient deficiencies in livestock can be resolved by providing them with nutritional feed that maintains the growth rate of livestock, their health, and well-being. Thus, with the surging demand, the production of healthy livestock is increasing across the region, further driving the Europe feed premix market.Europe Feed Premix Market Overview

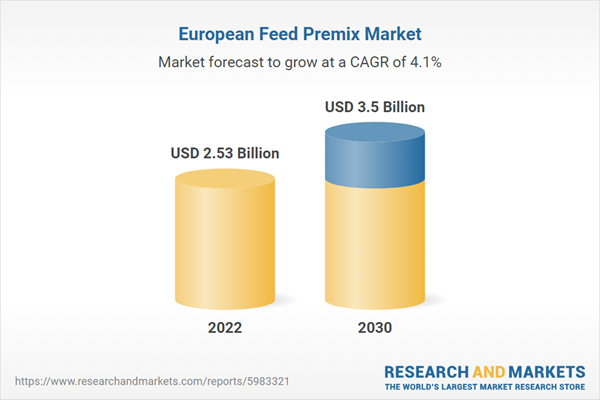

The Europe feed premix market in Europe is witnessing strong growth due to the surging industrialization of meat production and the increasing demand for nutritional animal feed. Livestock owners are adopting healthy feed ingredients to produce healthy, quality, and nutritious animal meat products. Furthermore, Europe is known for its large variety of animal stocks and high demand for meat. As per the Eurostat (European Union), in 2020, Europe had nearly 146 million pigs, 76 million bovine animals, and 75 million sheep and goat stock. Such a huge stock of livestock animals requires enough animal feed, which is increasing the demand for feed premix.The region witnessed its highest poultry meat production in 2020, recording ~13.6 million poultry meat production. Additionally, according to the European Feed Manufacturers' Federation (FEFAC), pig feed production rose by 2.9% in 2020 despite the continued spread of African Swine Fever (ASF) in the region and its impact on pig farming. The high livestock production and the rise in animal stock are creating a favorable business environment for the Europe feed premix market in Europe. Thus, the mass production of animal feed and its consumption due to growing livestock are boosting the demand for nutritious feed additives such as feed premix. Thus, owing to all the factors mentioned above, the Europe feed premix market is expected to grow significantly in Europe during 2022-2030. However, Europe has stringent policies for some feed ingredients and limits the ratios of feed contents in animal food. For instance, European Food Safety Authority (EFSA), the European Medicines Agency (EMA), and the European Centre for Disease Prevention and Control (ECDC) have issued guidelines to decrease the use of antibiotics in animal feed. Such policies impede the Europe feed premix market growth in the region.

Europe Feed Premix Market Segmentation

The Europe feed premix market is segmented based on type, form, livestock, and country.Based on type, the Europe feed premix market is segmented into vitamins, minerals, amino acids, antibiotics, antioxidants, blends, and others. The blends segment held the largest share in 2022.

By form, the Europe feed premix market is bifurcated into dry and liquid. The dry segment held a larger share in 2022.

By livestock, the Europe feed premix market is categorized into research poultry, ruminants, swine, aquaculture, and others. The poultry segment held the largest share in 2022.

Based on country, the Europe feed premix market is segmented into Germany, France, Italy, the UK, Spain, and the Rest of Europe. The Rest of Europe dominated the Europe feed premix market in 2022.

Agrifirm Group BV, Archer-Daniels-Midland Co, Cargill Inc, Danish Agro AMBA, Dansk Landbrugs Grovvareselskab amba, De Heus Voeders BV, Kemin Industries Inc, Koninklijke DSM NV, NuSana BV, and Nutreco NV are some of the leading companies operating in the Europe feed premix market.

Table of Contents

Companies Mentioned

- Agrifirm Group BV

- Archer-Daniels-Midland Co

- Cargill Inc

- Danish Agro AMBA

- Dansk Landbrugs Grovvareselskab amba

- De Heus Voeders BV

- Kemin Industries Inc

- Koninklijke DSM NV

- NuSana BV

- Nutreco NV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 113 |

| Published | May 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 2.53 Billion |

| Forecasted Market Value ( USD | $ 3.5 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |